JobKeeper Payment (JK)- GovReports

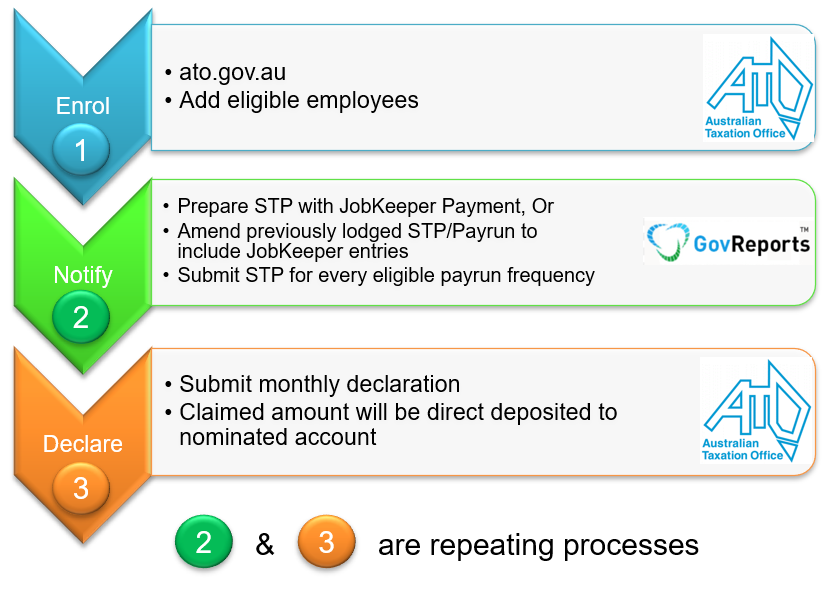

Process

-

To prepare STP payroll events with JobKeeper payment entries

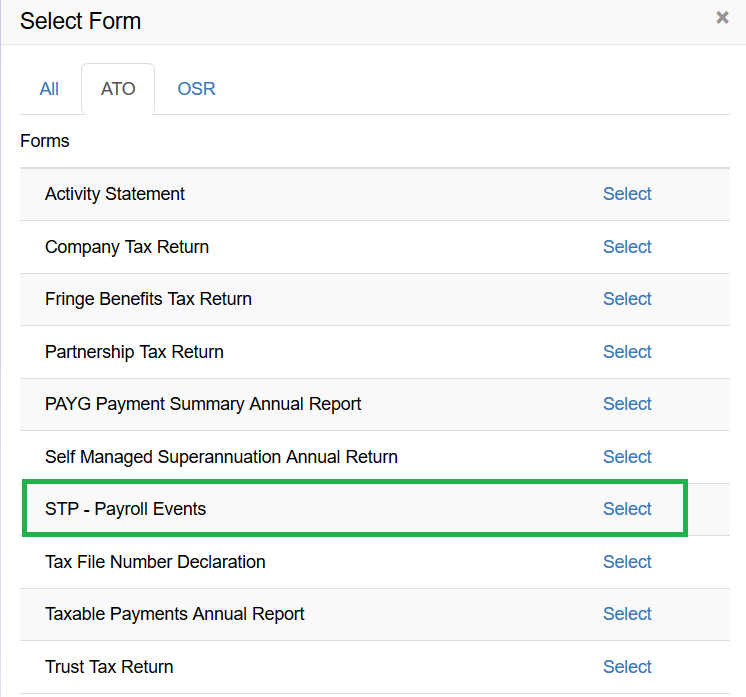

1. Select business/ Clients

2. Select STP Payroll Event form

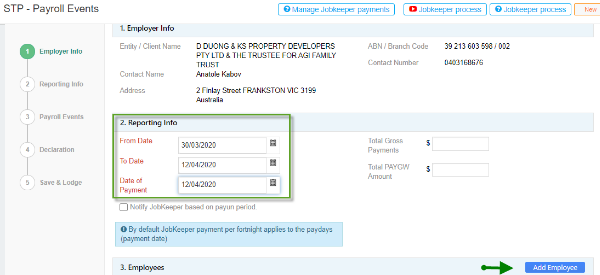

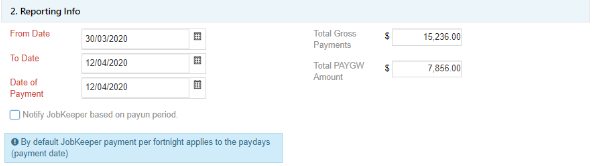

3. Complete the Reporting information in section2:

Reporting period details with total wages for all employees and total PAYGW amount.

Now you need to update the Total gross wages paid for the reporting period to include the additional top up for the

employees and the total PAYG withholding.

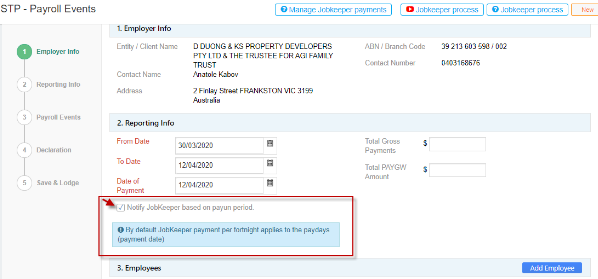

By default, Jobkeeper payment per fortnight is taken automatically by the system based on the payment date.

However, if you want the system to consider the Jobkeeper payment based on the pay period instead of the payment date, you can tick “Notify Job Keeper based on the payrun period.

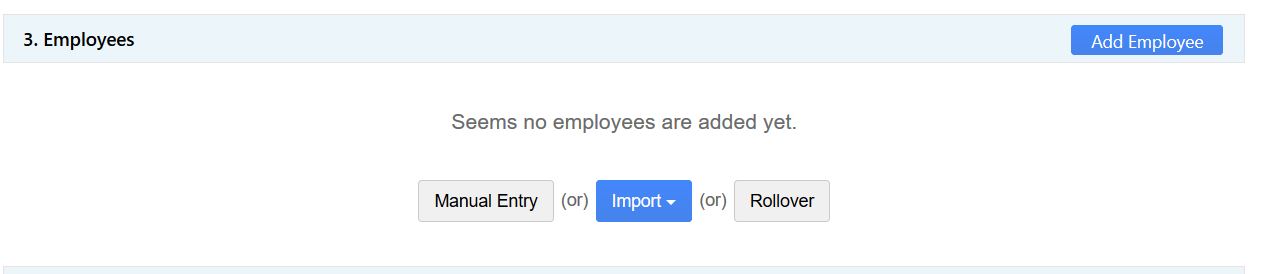

4. Complete Employee’s section

-

Rollover or Manually enter employee’s payment details.

-

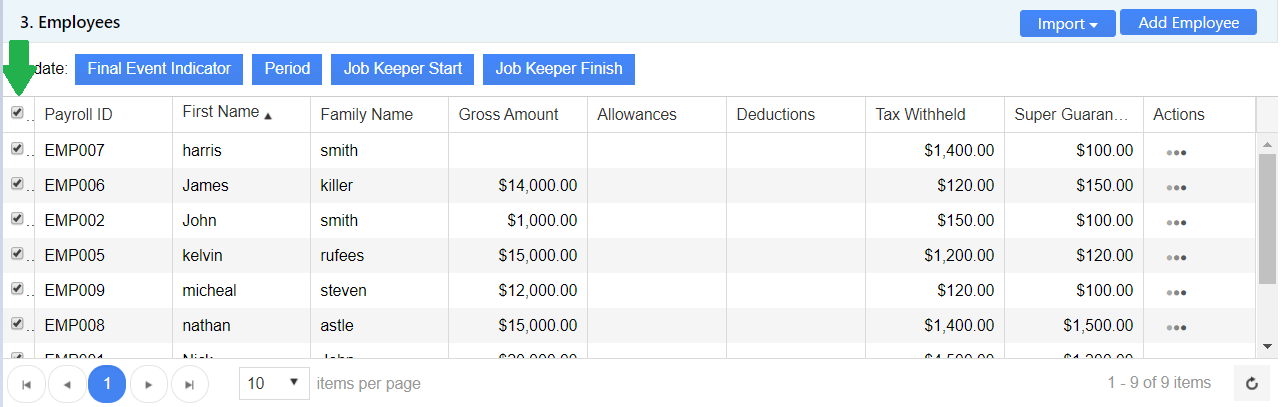

After adding employees choose either bulk update or select employee to add JobKeeper payment-

Bulk update - it is used to update JobKeeper Start & JobKeeper Finish

-

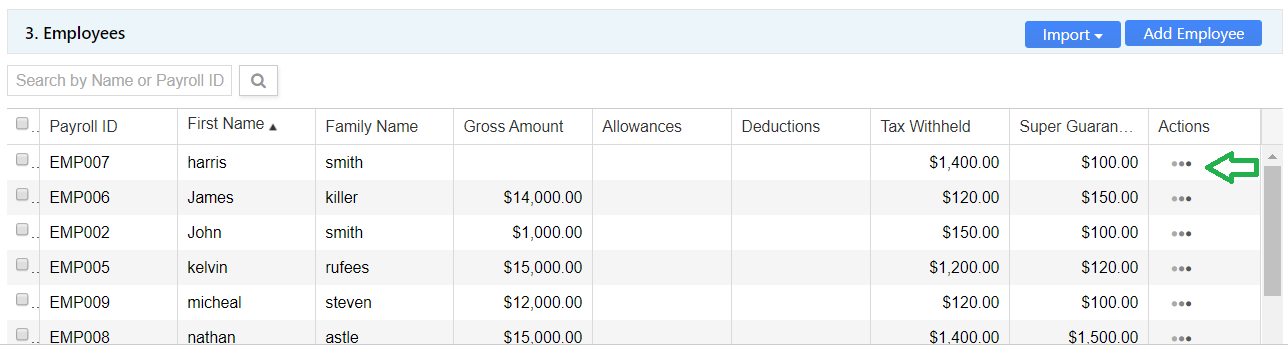

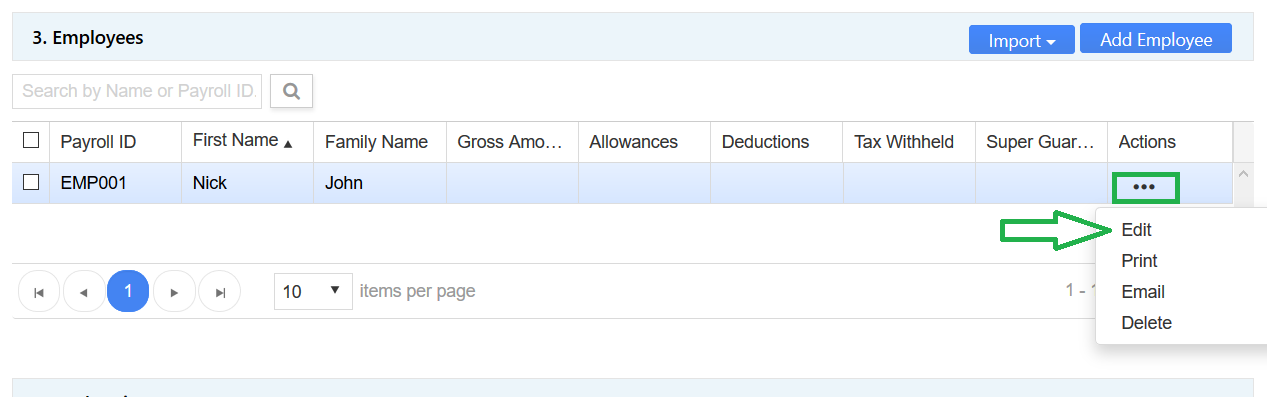

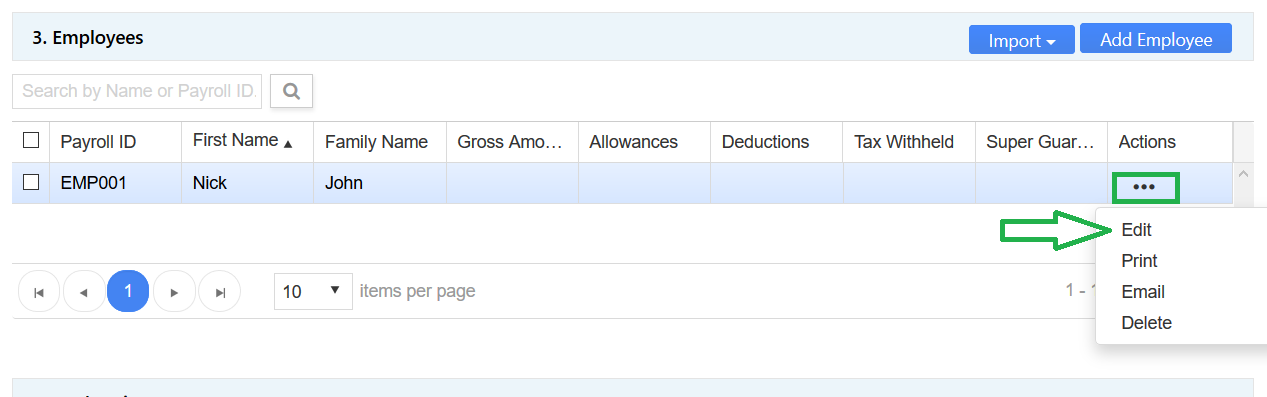

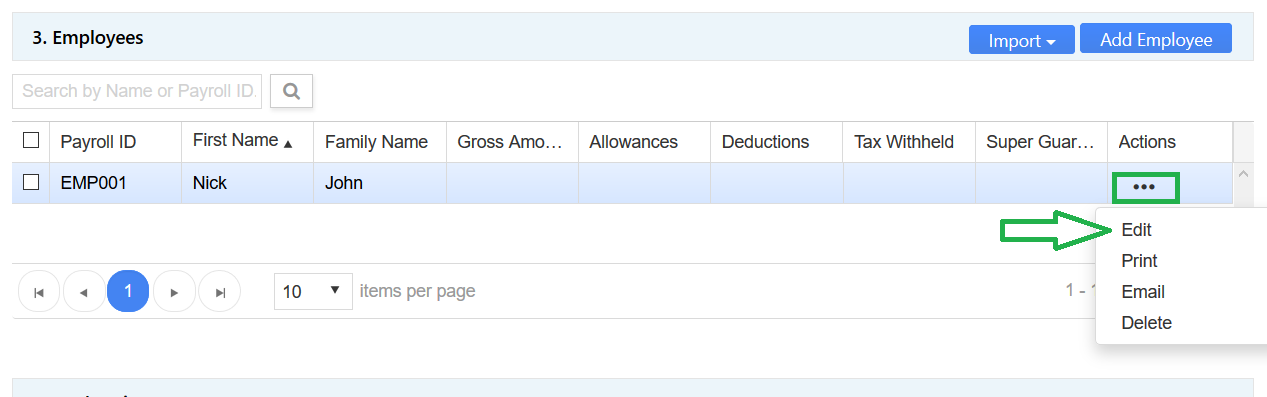

Employee edit- Edit individual employee to update JobKeeper Start, JobKeeper Top Up & JobKeeper Finish

-

Bulk update - it is used to update JobKeeper Start & JobKeeper Finish

-

JobKeeper Start

-

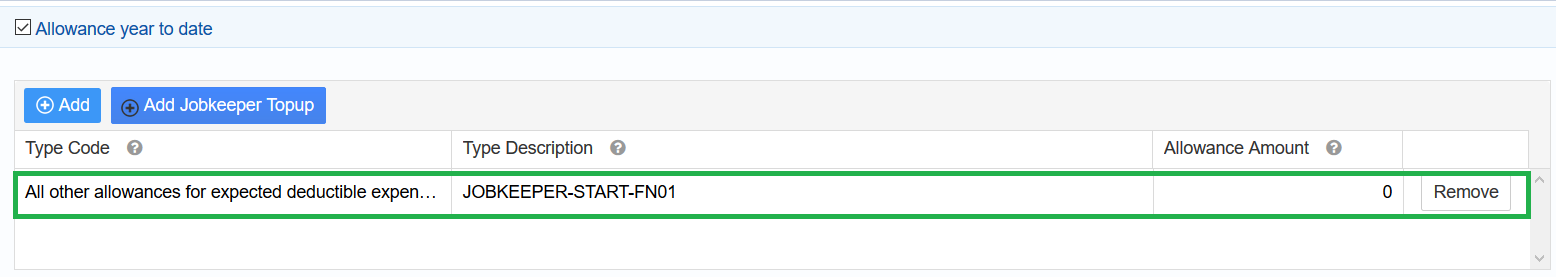

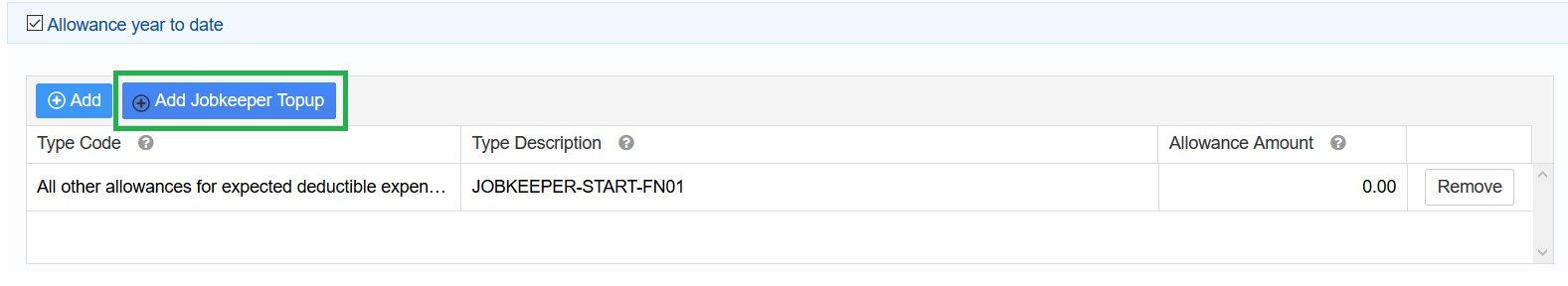

JOBKEEPER-START allowance is used to notify the ATO that this is the first JobKeeper reporting start period for the employee. The "JOBKEEPER-START-FNXX" allowance

item is only used once to notify ATO that this is the first JobKeeper reporting start period for the employee.

Edit employee’s pay run to add JobKeeper payment

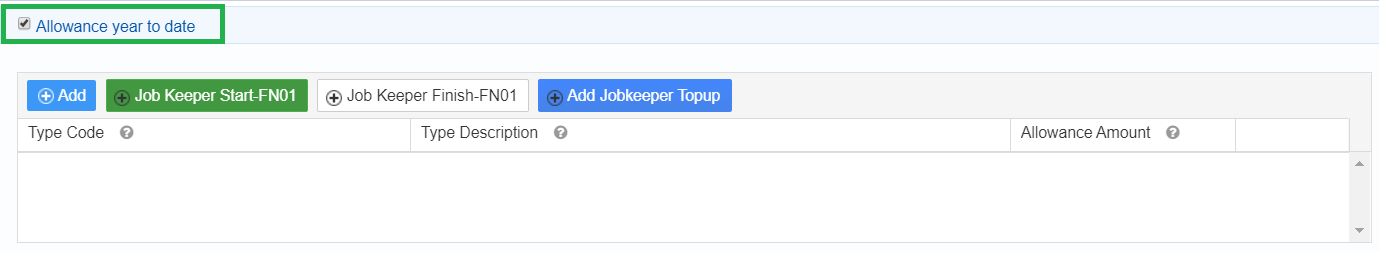

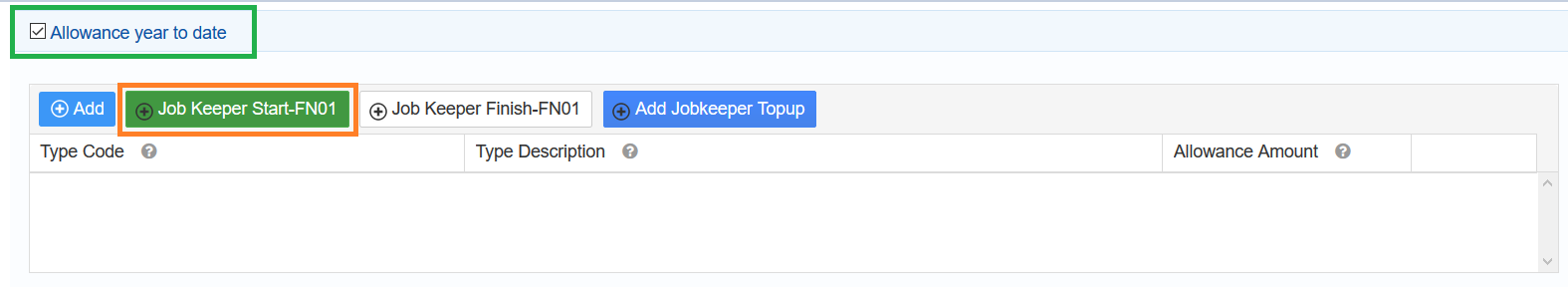

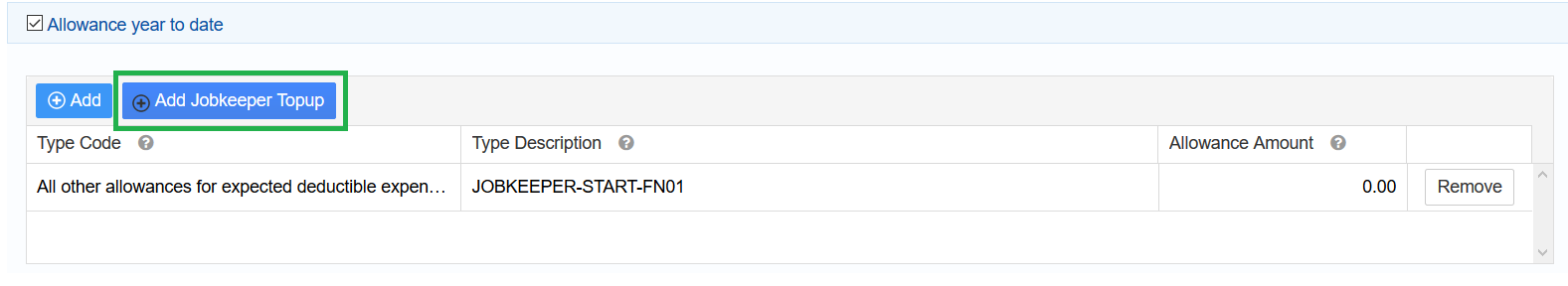

Go to Allowance Section and tick the checkbox

Click on JobKeeperStart to start

JobKeeper Start allowance will automatically added with nil amount (zero)

JobKeeper Topup

-

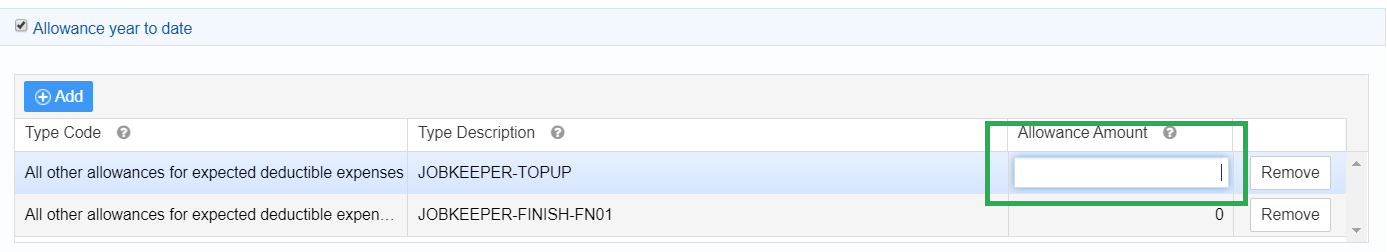

For eligible employees who are paid less than $1,500 per fortnight must be paid a “top-up” amount to bring their taxable gross to $1,500 per fortnight for paydays within

the JobKeeper fortnightly periods.

Edit employee’s pay run to add JobKeeper payment

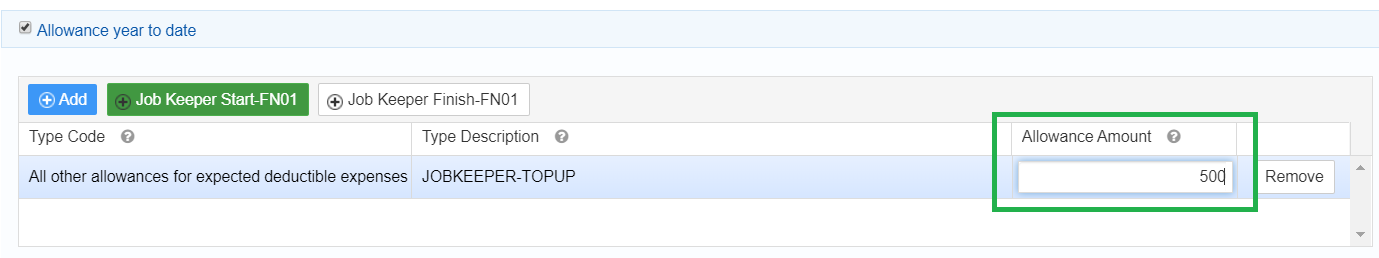

Go to Allowance Section and Click on ‘Add JobKeeper Top-up’ button, then a row will be added with zero amount.

Click on Allowance amount field to add top up amount ( Add YTD figure)

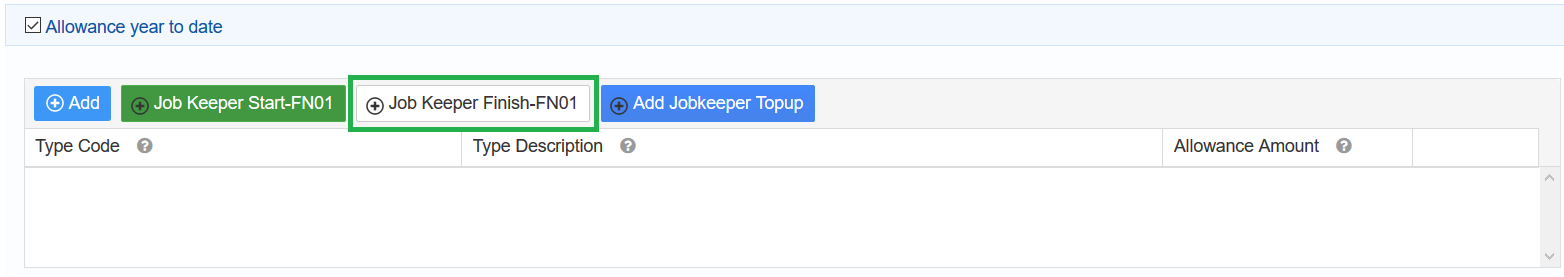

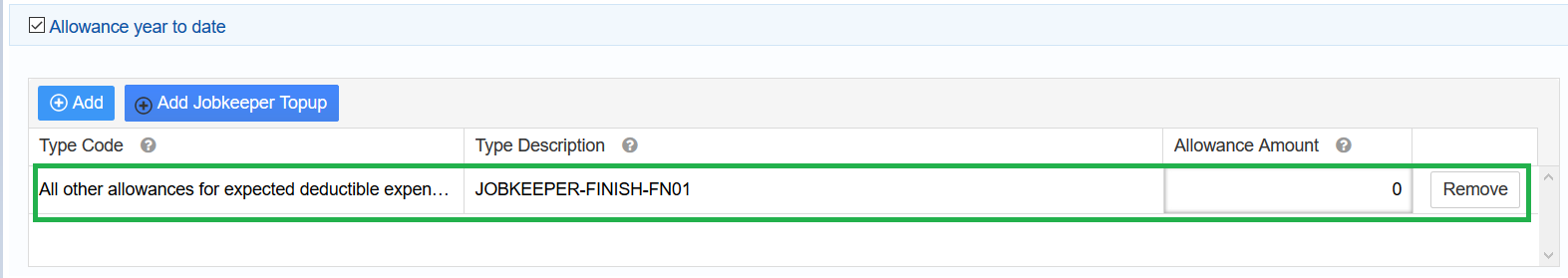

JobKeeper Finish

-

JOBKEEPER-Finish allowance is used to notify the ATO that employee’s JobKeeper reporting ends.

Edit an employee

Go to allowance section => click on JobKeeper Finish button

JobKeeper finish will be added automatically with nil amount (zero).

Employees JobKeeper payment can be finished and started any time during 13 fortnights.

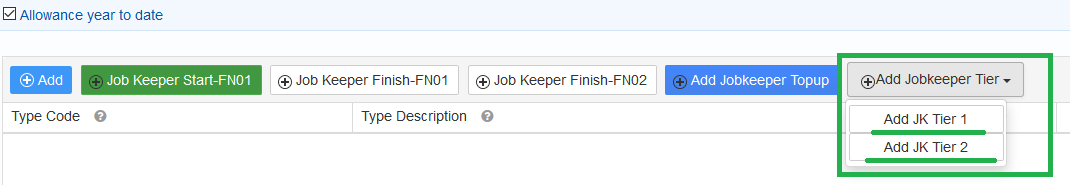

JobKeeper Tier

-

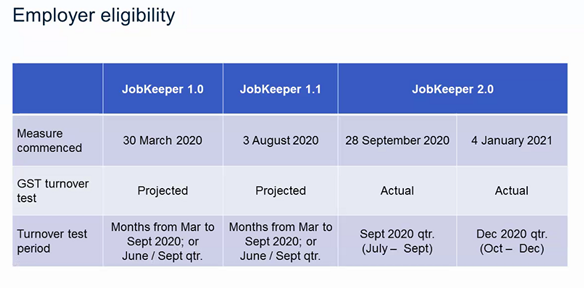

ATO has introduced tier rates for eligible employees

- Tier 1- eligible employees and eligible business participants who worked for 80 hours or more in the four weeks of pay periods

- Tier 2- eligible employees and eligible business participants work less than 80 hours per fortnight.

https://www.ato.gov.au/General/JobKeeper-Payment/payment-rates/

Add Jobkeeper tier for all eligible employees and eligible business participants under allowances section

What you need to do?

From 28 September 2020, you must do all of the following:- work out if the tier 1 or tier 2 rate applies to each of your eligible employees and/or eligible business participants and/or eligible religious practitioners

- notify ATO and your eligible employees and/or eligible business participants and/or eligible religious practitioners what payment rate applies to them

-

during 28 September 2020 to 3 January 2021 – ensure your eligible employees are paid at least

- $1,200 per fortnight for tier 1 employees

- $750 per fortnight for tier 2 employees

-

during 4 January 2021 to 28 March 2021 – ensure your eligible employees are paid at least

- $1,000 per fortnight for tier 1 employees

- $650 per fortnight for tier 2 employees

What doesn't change

To claim for fortnights in the JobKeeper extension:- You don't need to re-enrol for the JobKeeper extension if you are already enrolled for JobKeeper for fortnights before 28 September.

- You don’t need to reassess employee eligibility or ask employees to agree to be nominated by you as their eligible employer if you are already claiming for them before 28 September.

-

You don't need to meet any further requirements if you are claiming for an eligible business participant, other than those that applied from the start of JobKeeper relating to

- holding an ABN, and

- declaring assessable income and supplies.

- holding an ABN, and

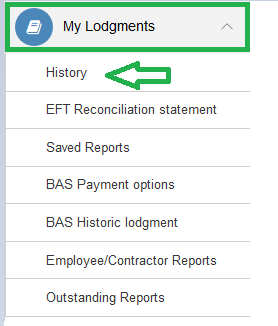

STP report previously submitted without JobKeeper payment

JobKeeper reporting periods

All STP reports lodged/reported earlier can be revised using Full-File replacement

-

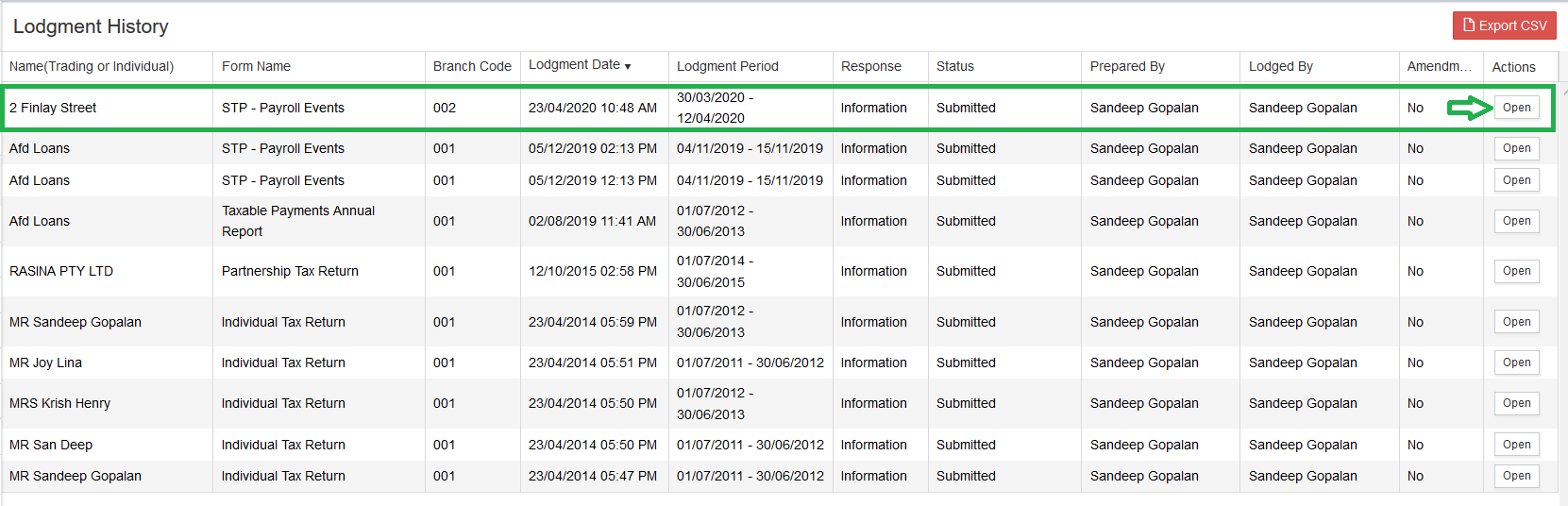

1. Go to My Lodgments =>History

2. Select the report

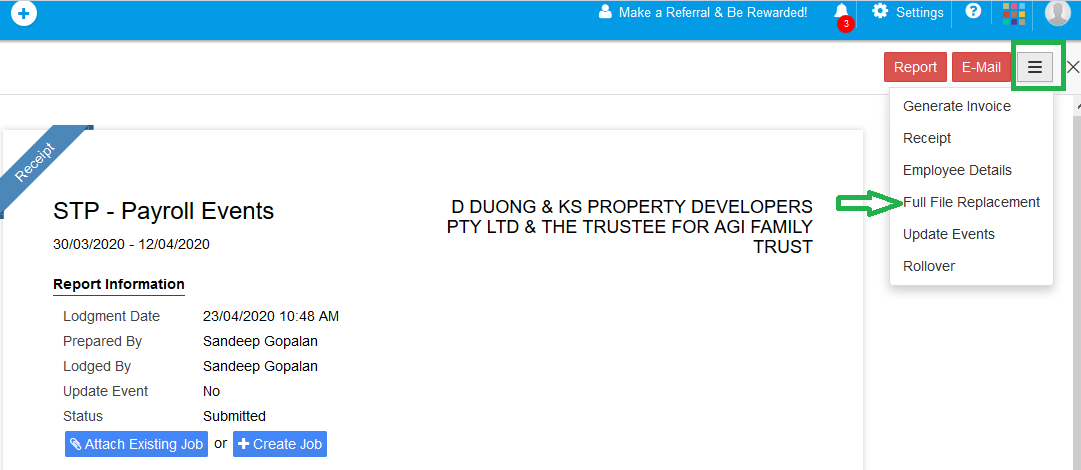

3. Go to More section (three lines with a box)=> Full file replacement

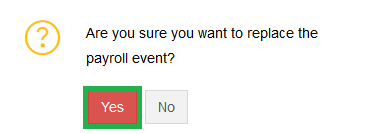

4. Click on Agree to Confirm

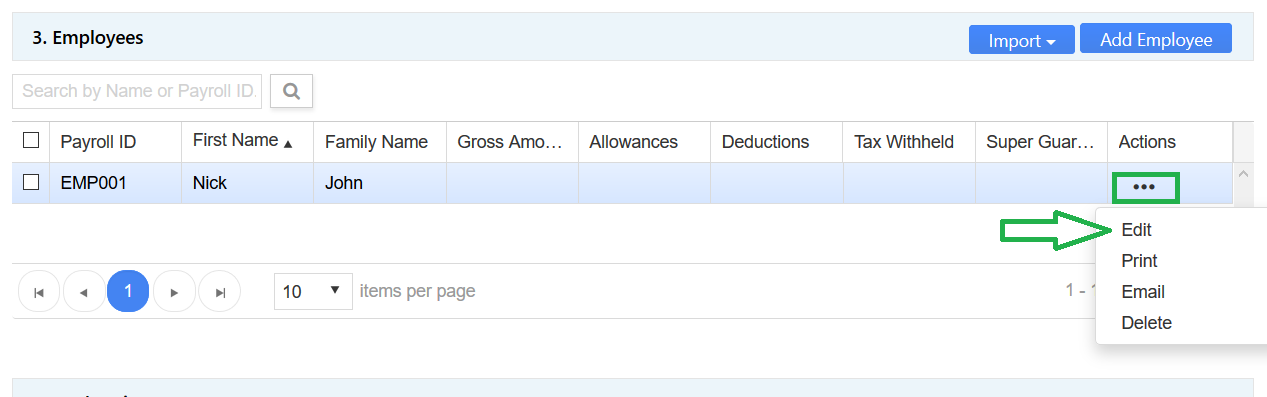

5. Select all eligible employees to add bulk jobkeeper start or manually update on each employee’s section

6. For JobKeeper Top up - Edit employee and add top up under Allowance

7. Save employee - Do it for all eligible employees

8. Now you need to update the Total gross wages paid for the reporting period to include the additional

top up and the total PAYG withholding.

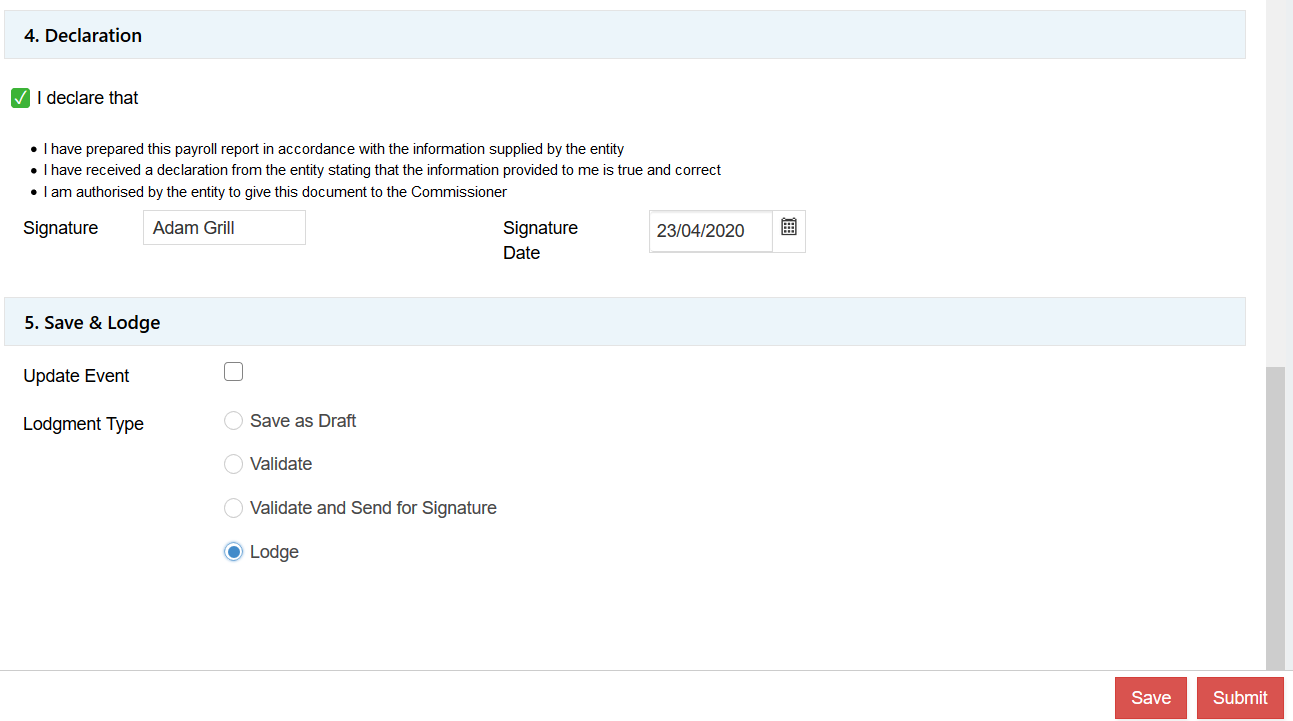

9.Proceed to lodgment.

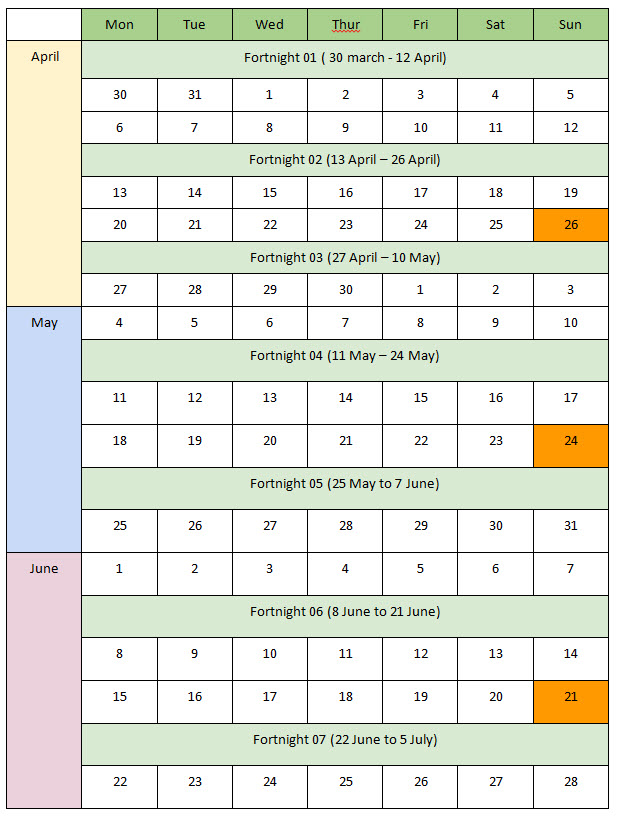

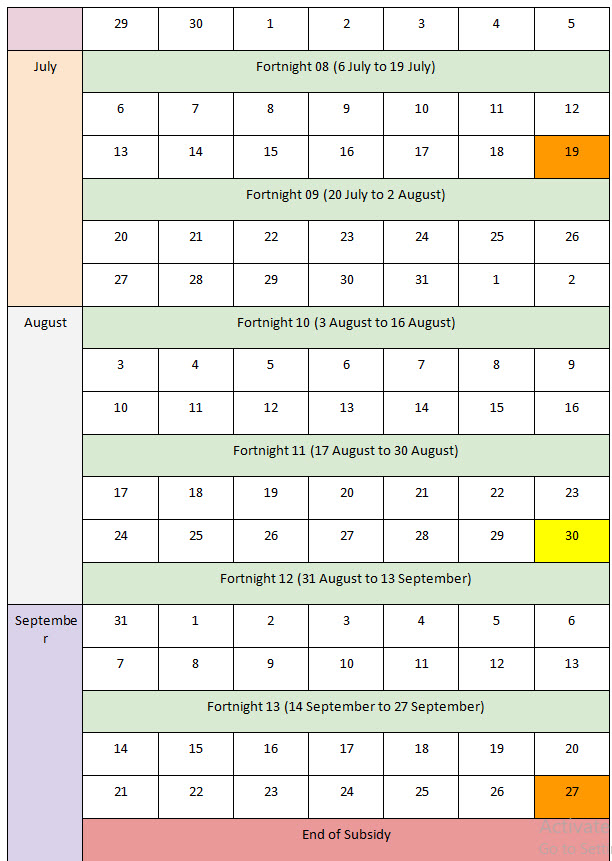

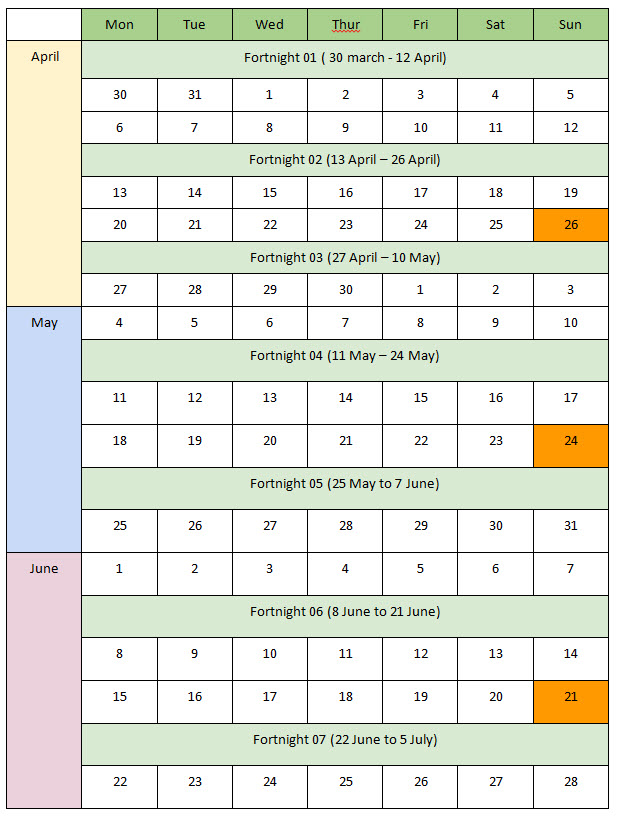

JobKeeper reporting periods

| FN | Dates | Start allowance | Finish Allowance |

|---|---|---|---|

| 01 | 30/03/2020 - 12/04/2020 | JOBKEEPER-START-FN01 | JOBKEEPER-FINISH-FN01 |

| 02 | 13/04/2020 - 26/04/2020 | JOBKEEPER-START-FN02 | JOBKEEPER-FINISH-FN02 |

| 03 | 27/04/2020 - 10/05/2020 | JOBKEEPER-START-FN03 | JOBKEEPER-FINISH-FN03 |

| 04 | 11/05/2020 - 24/05/2020 | JOBKEEPER-START-FN04 | JOBKEEPER-FINISH-FN04 |

| 05 | 25/05/2020 - 07/06/2020 | JOBKEEPER-START-FN05 | JOBKEEPER-FINISH-FN05 |

| 06 | 08/06/2020 - 21/06/2020 | JOBKEEPER-START-FN06 | JOBKEEPER-FINISH-FN06 |

| 07 | 22/06/2020 - 05/07/2020 | JOBKEEPER-START-FN07 | JOBKEEPER-FINISH-FN07 |

| 08 | 06/07/2020 - 19/07/2020 | JOBKEEPER-START-FN08 | JOBKEEPER-FINISH-FN08 |

| 09 | 20/07/2020 - 02/08/2020 | JOBKEEPER-START-FN09 | JOBKEEPER-FINISH-FN09 |

| 10 | 03/08/2020 - 16/08/2020 | JOBKEEPER-START-FN10 | JOBKEEPER-FINISH-FN10 |

| 11 | 17/08/2020 - 30/08/2020 | JOBKEEPER-START-FN11 | JOBKEEPER-FINISH-FN11 |

| 12 | 31/08/2020 - 13/09/2020 | JOBKEEPER-START-FN12 | JOBKEEPER-FINISH-FN12 |

| 13 | 14/09/2020 - 27/09/2020 | JOBKEEPER-START-FN13 | JOBKEEPER-FINISH-FN13 |

| 14 | 28/09/2020 - 11/10/2020 | JOBKEEPER-START-FN14 | JOBKEEPER-FINISH-FN14 |

| 15 | 12/10/2020 - 25/10/2020 | JOBKEEPER-START-FN15 | JOBKEEPER-FINISH-FN15 |

| 16 | 26/10/2020 - 08/11/2020 | JOBKEEPER-START-FN16 | JOBKEEPER-FINISH-FN16 |

| 17 | 09/11/2020 - 22/11/2020 | JOBKEEPER-START-FN17 | JOBKEEPER-FINISH-FN17 |

| 18 | 23/11/2020 - 06/12/2020 | JOBKEEPER-START-FN18 | JOBKEEPER-FINISH-FN18 |

| 19 | 07/12/2020 - 20/12/2020 | JOBKEEPER-START-FN19 | JOBKEEPER-FINISH-FN19 |

| 20 | 21/12/2020 - 03/01/2021 | JOBKEEPER-START-FN20 | JOBKEEPER-FINISH-FN20 |

| 21 | 04/01/2021 - 17/01/2021 | JOBKEEPER-START-FN21 | JOBKEEPER-FINISH-FN21 |

| 22 | 18/01/2021 - 31/01/2021 | JOBKEEPER-START-FN22 | JOBKEEPER-FINISH-FN22 |

| 23 | 01/02/2021 - 14/02/2021 | JOBKEEPER-START-FN23 | JOBKEEPER-FINISH-FN23 |

| 24 | 15/02/2021 - 28/02/2021 | JOBKEEPER-START-FN24 | JOBKEEPER-FINISH-FN24 |

| 25 | 01/03/2021 - 14/03/2021 | JOBKEEPER-START-FN25 | JOBKEEPER-FINISH-FN25 |

| 26 | 15/03/2021 - 28/03/2021 | JOBKEEPER-START-FN26 | JOBKEEPER-FINISH-FN26 |

Payroll cycles

- Regardless of the frequency of regular pay cycles or out of cycle pay periods, or the pay period start and end dates, the $1,500 per fortnight applies to the paydays (payrun period) within the defined fortnights and from which fixed fortnight the payment applies. Special rules apply for payments within the month of April and for employees receiving monthly pay.

| Pay frequency | JK Payment | Calculation |

|---|---|---|

| Weekly | 750 | 1500 / 2 |

| Fortnightly | 1500 | 1500 X 1 |

| Twice a month | 1625 | 1500 X 26 / 24 |

| Monthly (average) | 3250 | 1500 X 26 /12 |

Subsidy duration and periods

-

The JobKeeper payment period commenced from Monday 30 March 2020 and will apply for 13 full fortnights until Sunday 27 September 2020. The ATO will reimburse

participating employers monthly in arrears $1,500 for each full fortnight per eligible employee paid by the employer.

Manage Employees for JobKeeper payment

Employees are being paid less than the JobKeeper payment

Scenario:

Reporting for fortnight 01

Reporting for fortnight 02

Reporting for fortnight 03

Employees are being paid less than the JobKeeper payment

-

Pay full JobKeeper payment to all eligible employees. You'll pay them their current pay plus top-up amount to bring their taxable gross up to the JobKeeper payment amount.

JobKeeper payment is before tax and you can choose whether or not to pay superannuation on the top-up amount.

Scenario:

- Nick is permanent part time employee on a salary $1,000 per fortnight before tax and who continues working for the employer

Reporting for fortnight 01

- Add other allowance as description as ‘JOBKEEPER-START-FN01’ and amount as 0 (zero)

- Add another allowance with other type, description as ‘JOBKEEPER-TOPUP’ and payment as $500 (as a cumulative YTD amount)

Reporting for fortnight 02

- Add another allowance with other type, description as ‘jobkeeper-topup’ and payment as $1000 (as a cumulative ytd amount)

Reporting for fortnight 03

- Add another allowance with other type, description as ‘JOBKEEPER-TOPUP’ and payment as $1500 (as a cumulative YTD amount)

.

..

.

Reporting for fortnight 13

..

.

- Add another allowance with other type, description as ‘JOBKEEPER-TOPUP’ and payment as $6500 (as a cumulative YTD amount)

Employees are being paid more than the JobKeeper payment

Scenario:

Reporting for fortnight 01

Reporting for fortnight 02

Reporting for fortnight 13

Claim cycle

JobKeeper Extension

Update to reporting JobKeeper eligibility through STP

- Pay them as normal and report to ATO via STP.

Scenario:

- Adam is permanent full-time employee on a salary $3,000 per fortnight before tax and who continues working for the employer

Reporting for fortnight 01

- Add other allowance as description as ‘JOBKEEPER-START-FN01’ and amount as 0 (zero)

- Report $3000 as normal

Reporting for fortnight 02

- Report $3000 as normal

Reporting for fortnight 13

- Add other allowance as description as ‘JOBKEEPER-FINISH-FN13’ and amount as 0 (zero)

- report $3000 as normal

Claim cycle

- Employers will be required to notify the ATO of all eligible employees for which they wish to claim the JobKeeper payment after the last day of the last full fortnight in the calendar month. Employers will also be required to complete a monthly declaration online.

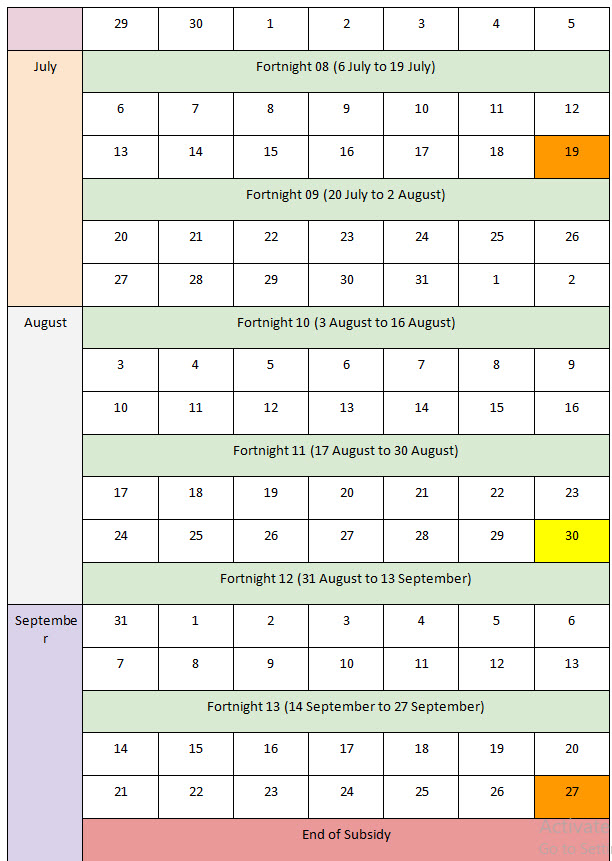

| Mon | Tue | Wed | Thur | Fri | Sat | Sun | |

|---|---|---|---|---|---|---|---|

| October | Fortnight 14 (28 September to 11 October) | ||||||

| 28 | 29 | 30 | 1 | 2 | 3 | 4 | |

| 5 | 6 | 7 | 8 | 9 | 10 | 11 | |

| Fortnight 15 (12 October to 25 October) | |||||||

| 12 | 13 | 14 | 15 | 16 | 17 | 18 | |

| 19 | 20 | 21 | 22 | 23 | 24 | 25 | |

| Fortnight 16 (26 October to 8 November) | |||||||

| 26 | 27 | 28 | 29 | 30 | 31 | 1 | |

| November | |||||||

| 2 | 3 | 4 | 5 | 6 | 7 | 8 | |

| Fortnight 17 (9 November to 22 November) | |||||||

| 9 | 10 | 11 | 12 | 13 | 14 | 15 | |

| 16 | 17 | 18 | 19 | 20 | 21 | 22 | |

| Fortnight 18 (23 November to 6 December) | |||||||

| 23 | 24 | 25 | 26 | 27 | 28 | 29 | |

| December | |||||||

| 30 | 1 | 2 | 3 | 4 | 5 | 6 | |

| Fortnight 19 (7 December to 20 December) | |||||||

| 7 | 8 | 9 | 10 | 11 | 12 | 13 | |

| 14 | 15 | 16 | 17 | 18 | 19 | 20 | |

| Fortnight 20 (21 December to 3 January) | |||||||

| 21 | 22 | 23 | 24 | 25 | 26 | 27 | |

| 28 | 29 | 30 | 31 | 1 | 2 | 3 | |

| January | Fortnight 21 (4 January to 17 January) | ||||||

| 4 | 5 | 6 | 7 | 8 | 9 | 10 | |

| 11 | 12 | 13 | 14 | 15 | 16 | 17 | |

| Fortnight 22 (18 January to 31 January) | |||||||

| 18 | 19 | 20 | 21 | 22 | 23 | 24 | |

| 25 | 26 | 27 | 28 | 29 | 30 | 31 | |

| February | Fortnight 23 (1 February to 14 February) | ||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | |

| 8 | 9 | 10 | 11 | 12 | 13 | 14 | |

| Fortnight 24 (15 February to 28 February) | |||||||

| 15 | 16 | 17 | 18 | 19 | 20 | 21 | |

| 22 | 23 | 24 | 25 | 26 | 27 | 28 | |

| March | Fortnight 25 (01 March to 14 March) | ||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | |

| 8 | 9 | 10 | 11 | 12 | 13 | 14 | |

| Fortnight 26 (15 March to 28 March) | |||||||

| 15 | 16 | 17 | 18 | 19 | 20 | 21 | |

| 22 | 23 | 24 | 25 | 26 | 27 | 28 | |

| End of Subsidy Fortnights | |||||||

JobKeeper Extension

-

The JobKeeper scheme has been extended from 28 September 2020 until 28 March 2021.

The extension periods are:- Extension 1: from 28 September 2020 to 3 January 2021

- Extension 2: from 4 January 2021 to 28 March 2021

Update to reporting JobKeeper eligibility through STP

We have identified occurrences of employers who have incorrectly reported JOBKEEPER-FINISH-FN13 for their employees. Reporting this will end date employees for JobKeeper from 13 September.

What you need to do:

For employers eligible for the JobKeeper Extension and wishing to maintain employee eligibility, a relevant Tier will need to be provided for each employee.

No further action is required if JOBKEEPER-FINISH-FN14 has been reported by employers that are not eligible for the JobKeeper Extension.

Note: For employers that are not eligible for the JobKeeper Extension, no finish code is required for their employees.

What you need to do:

- If JOBKEEPER-FINISH-FN13 has been reported incorrectly, this can be corrected by reporting JOBKEEPER-START-FN13 through STP.

For employers eligible for the JobKeeper Extension and wishing to maintain employee eligibility, a relevant Tier will need to be provided for each employee.

No further action is required if JOBKEEPER-FINISH-FN14 has been reported by employers that are not eligible for the JobKeeper Extension.

Note: For employers that are not eligible for the JobKeeper Extension, no finish code is required for their employees.