Reports

-

Manually entry - STP

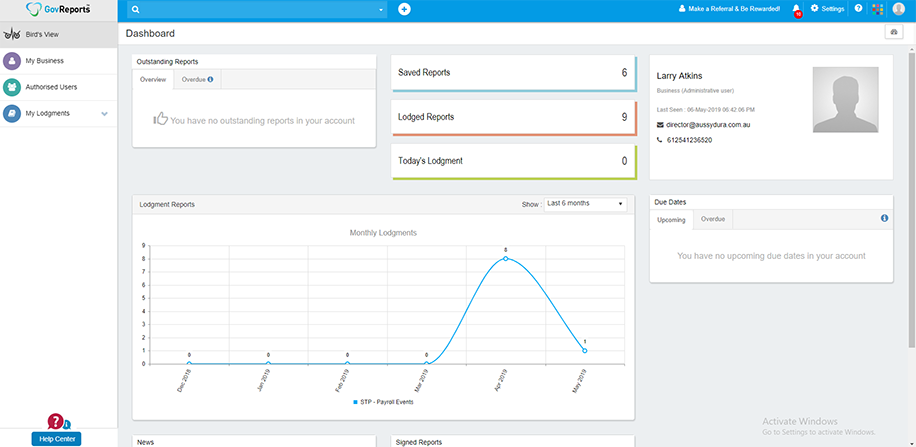

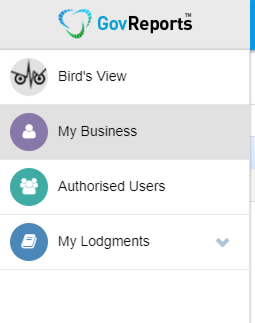

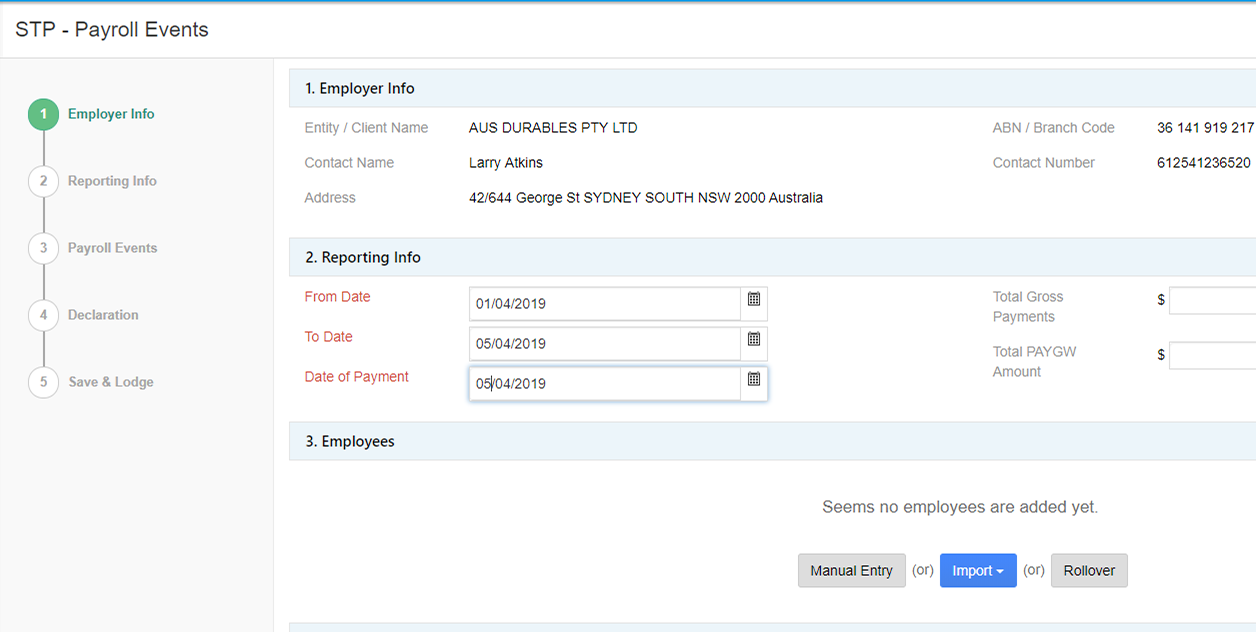

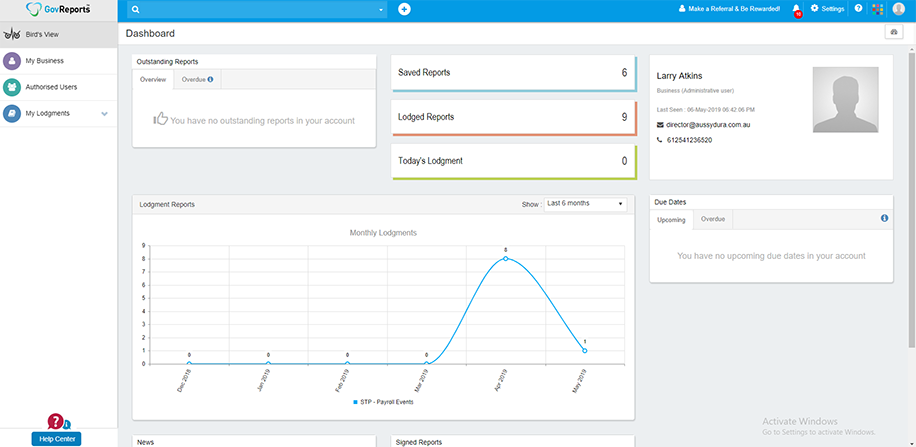

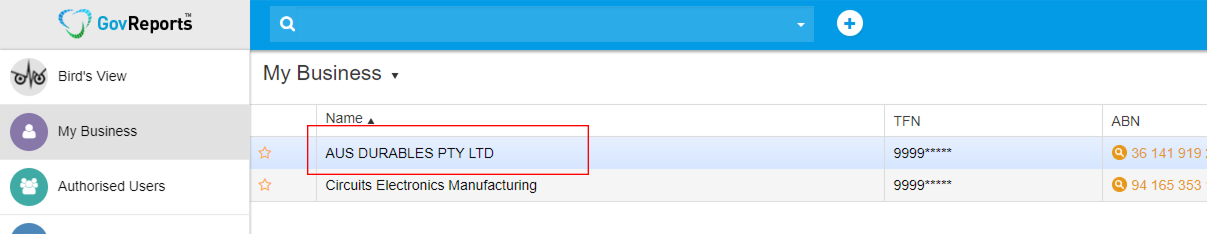

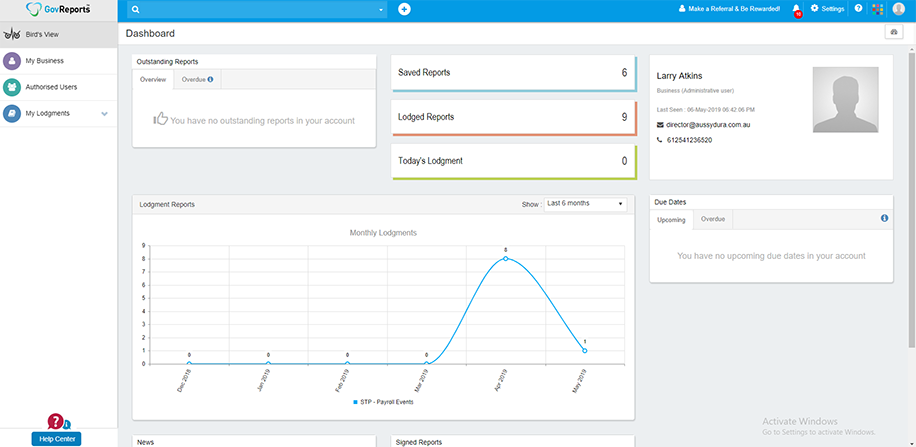

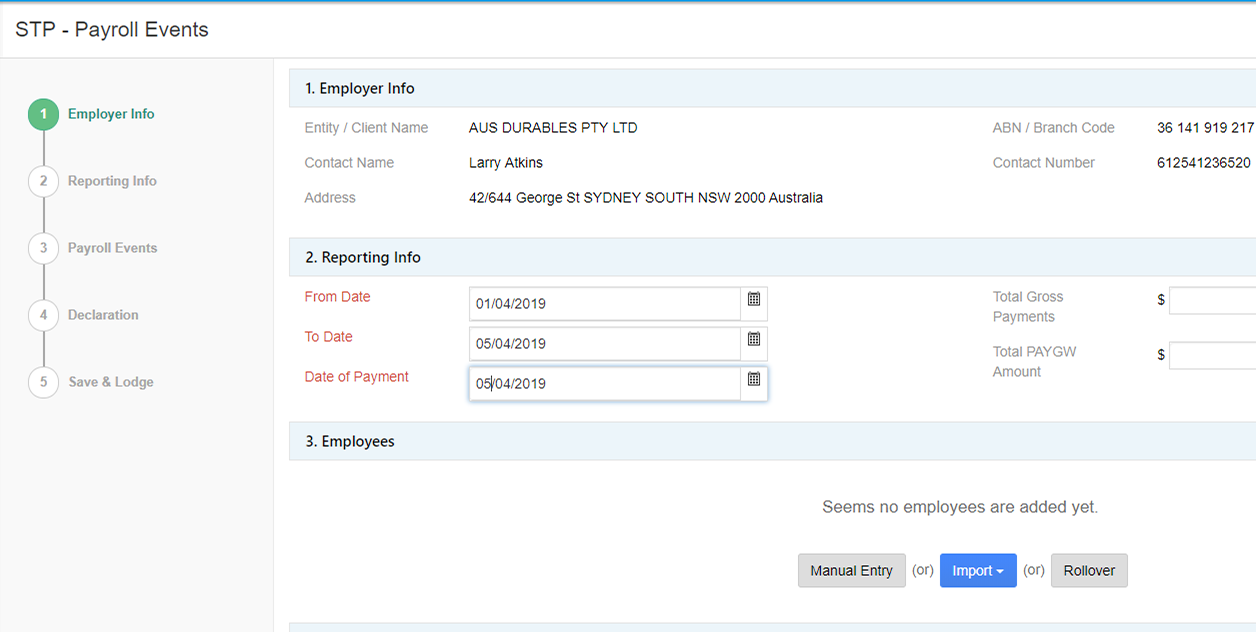

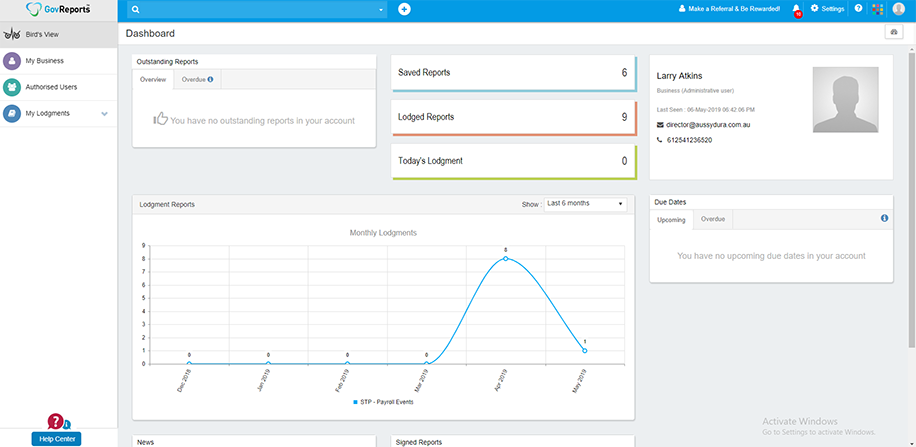

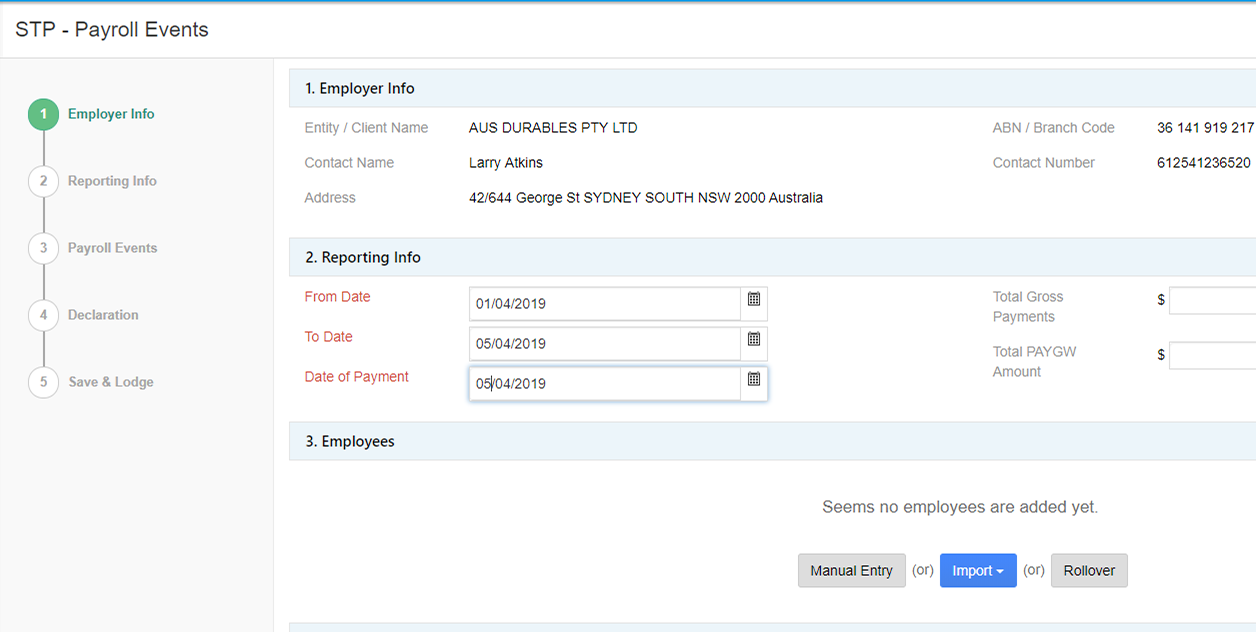

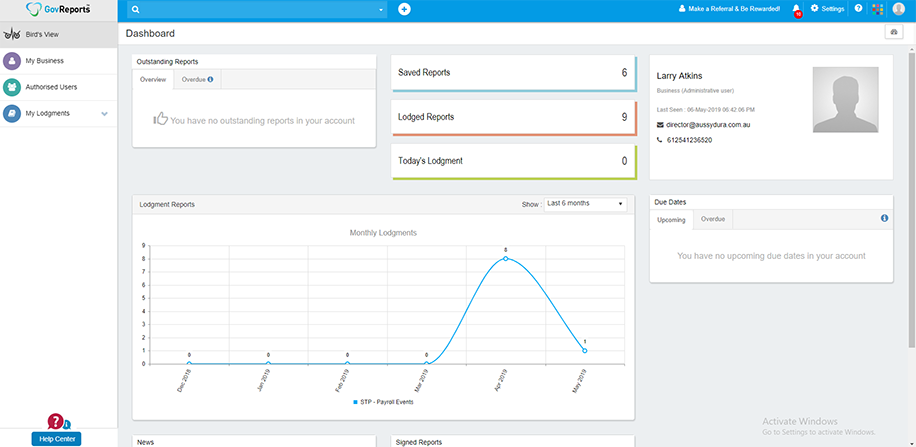

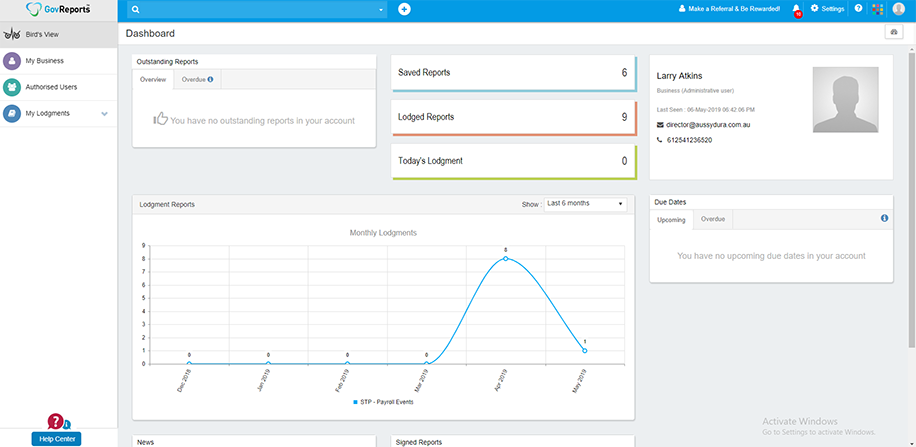

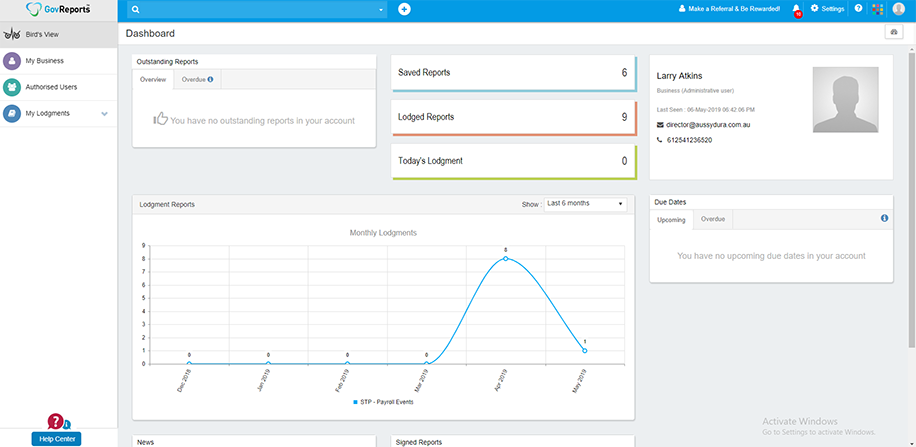

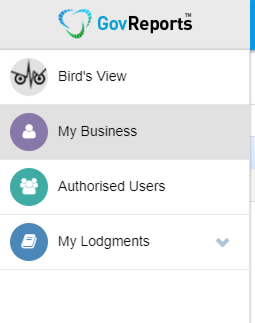

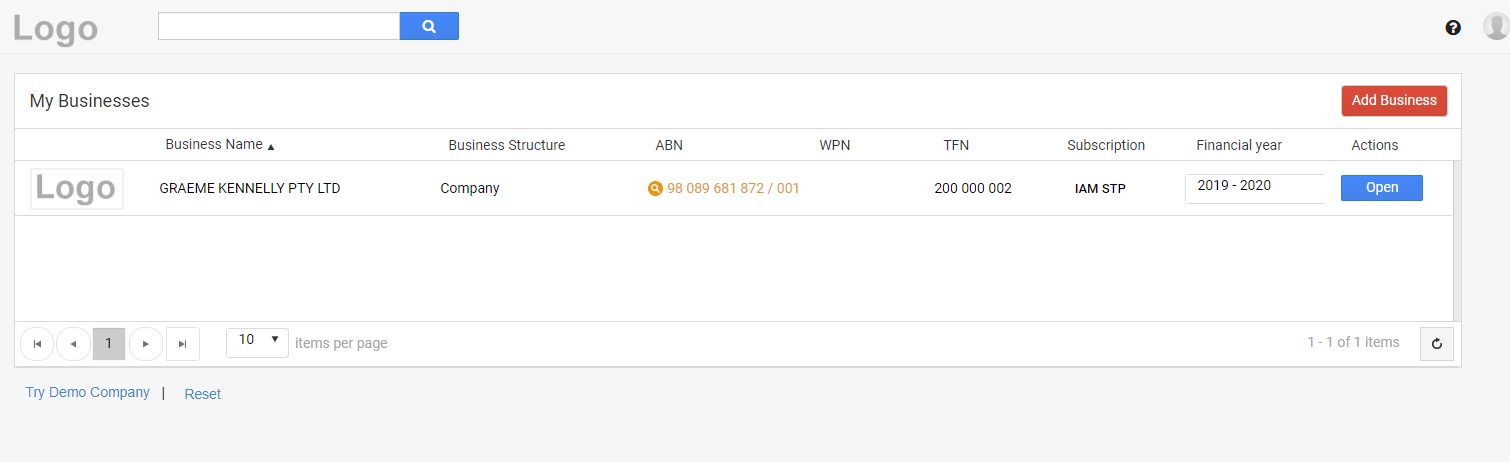

Login to GovReports account. This is a Business account. In case of Tax or BAS Agent account, Client is used synonymously instead of Business.

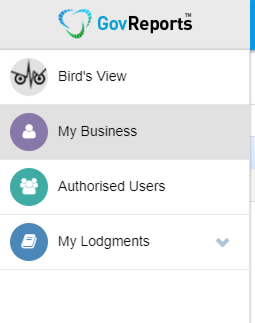

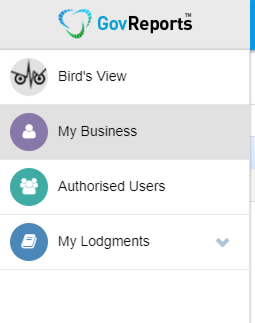

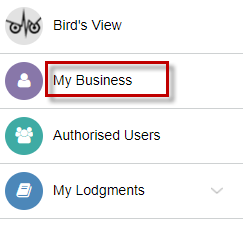

From the menubar on the left, click on "My Business"."My Clients" in case of Agent's account.

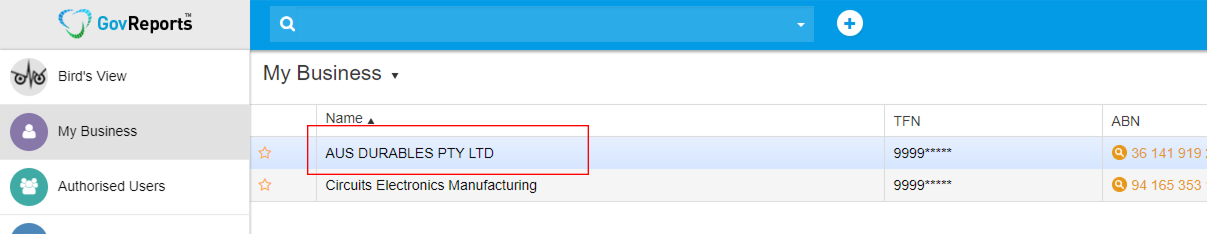

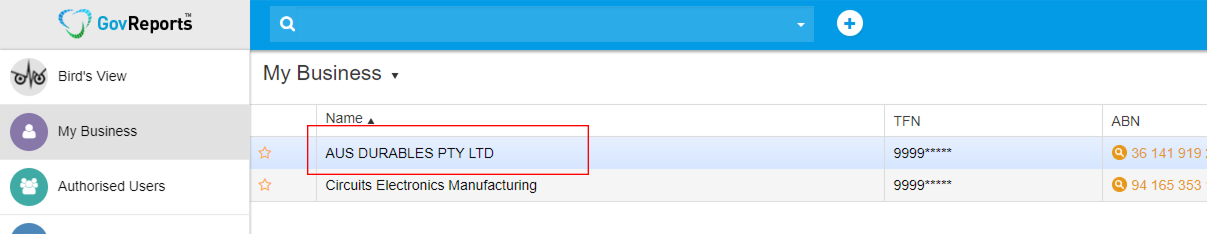

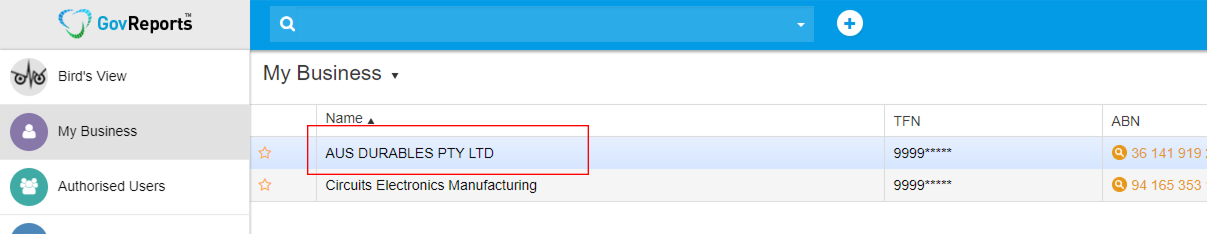

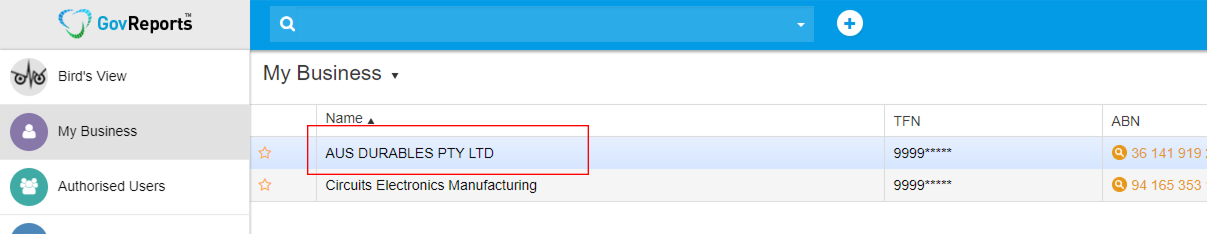

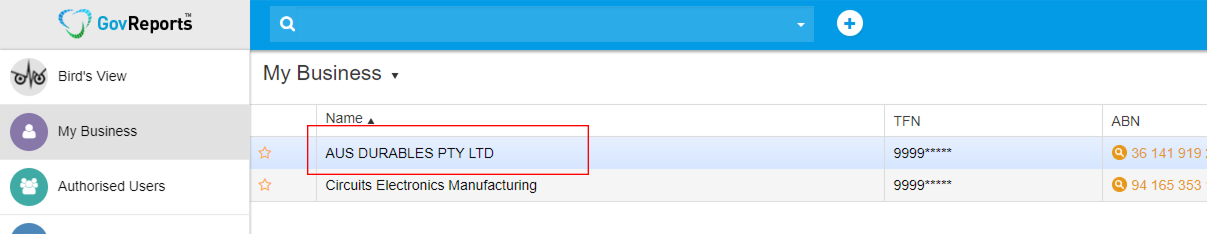

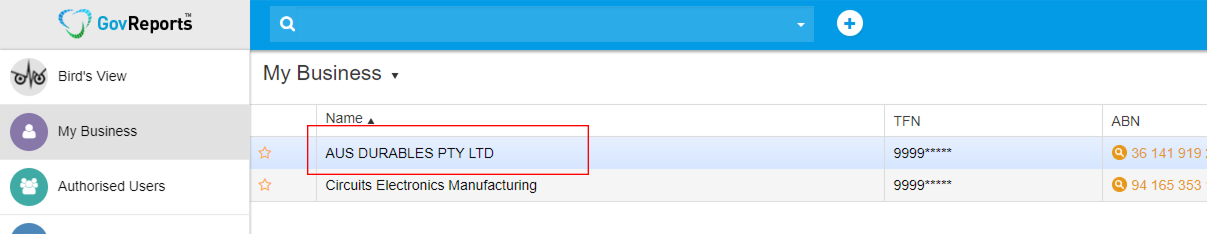

Select a business or client where employee information is to be added.

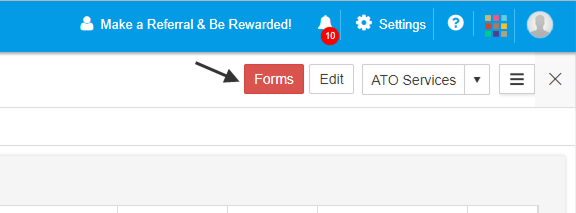

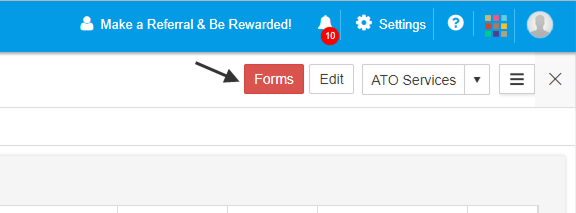

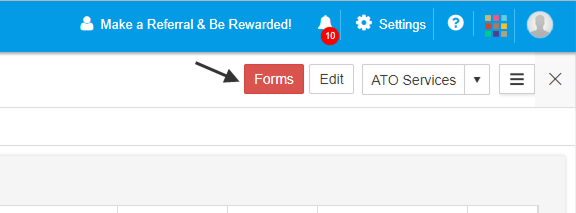

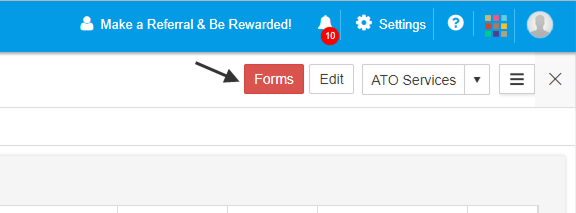

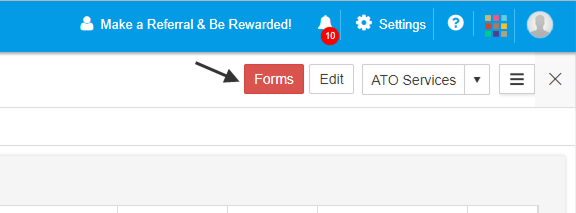

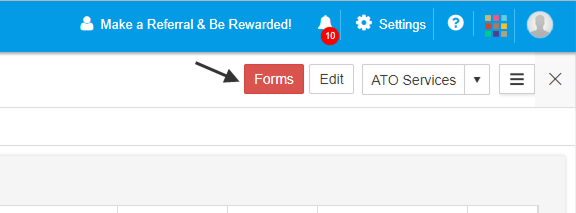

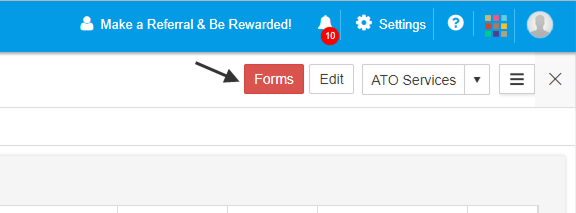

On the business or client screen, click on "Forms" on the top right corner.

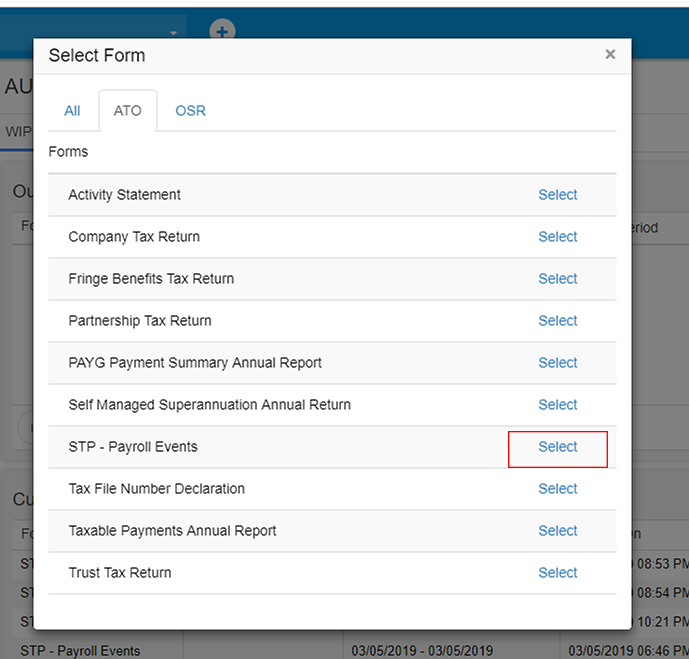

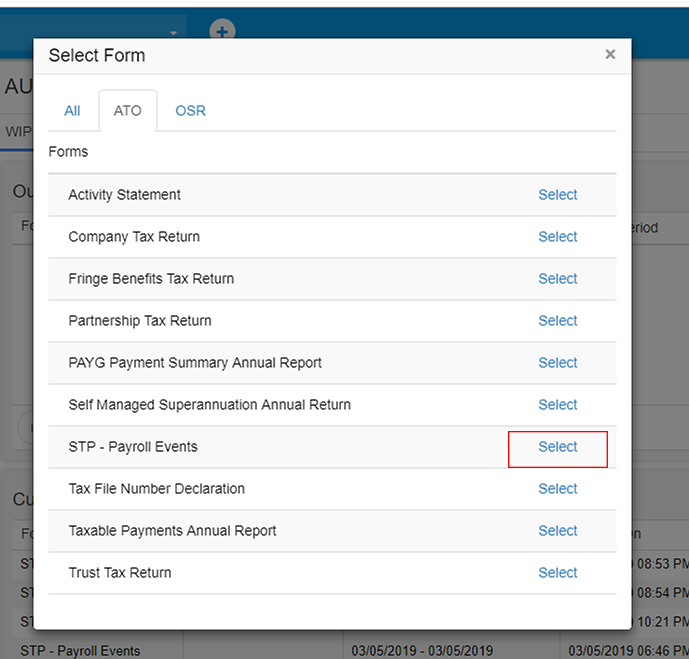

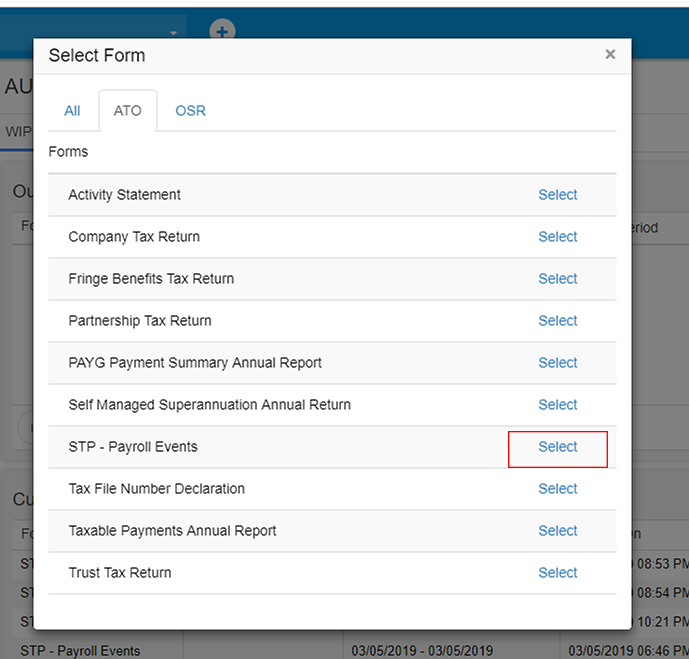

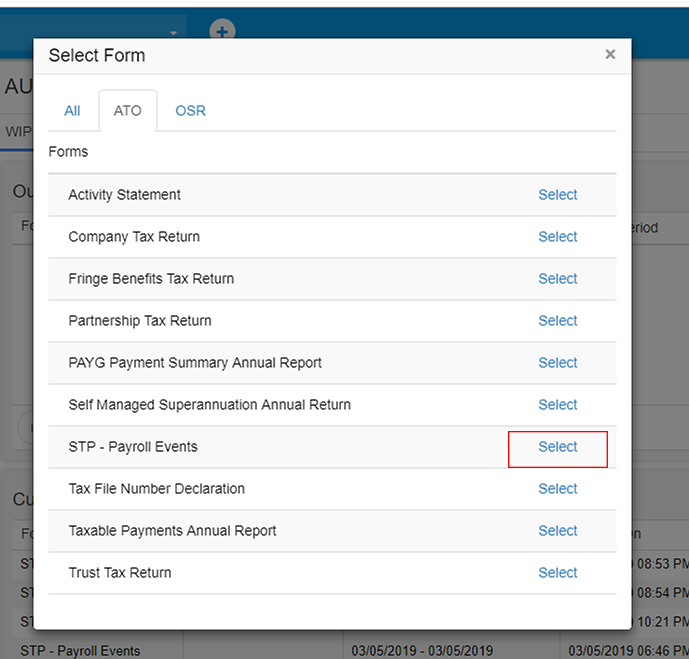

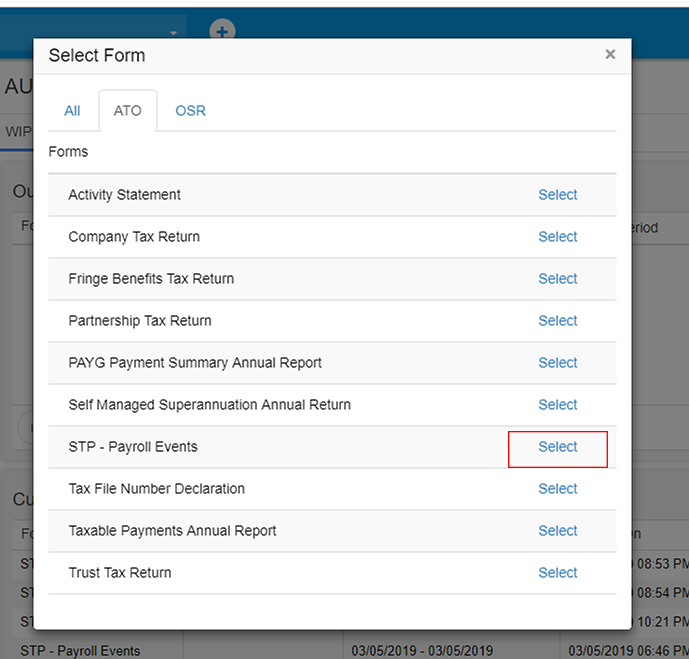

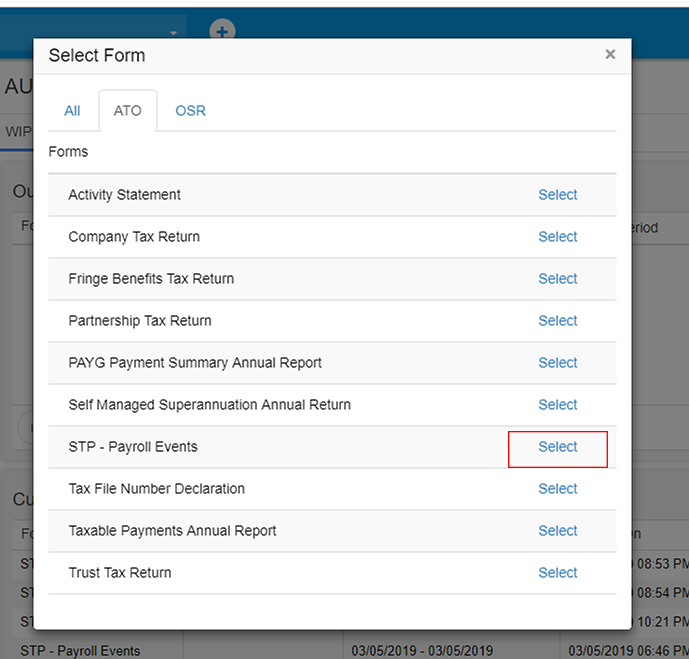

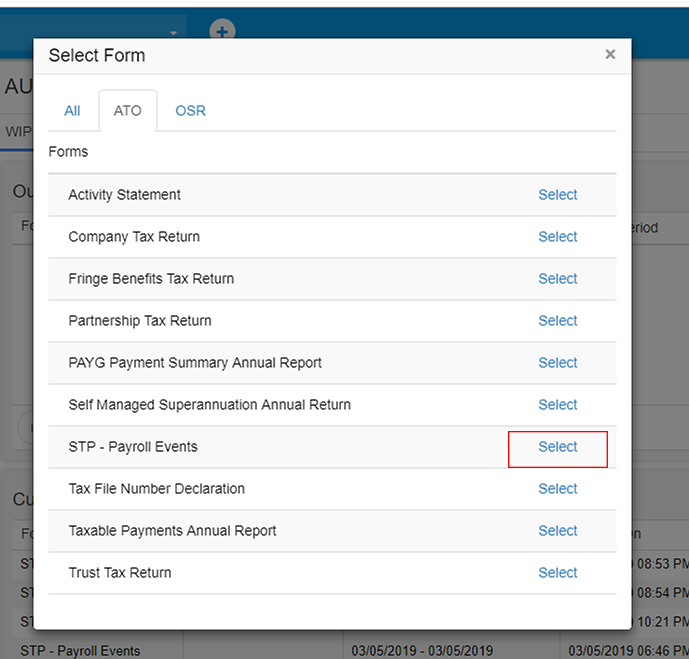

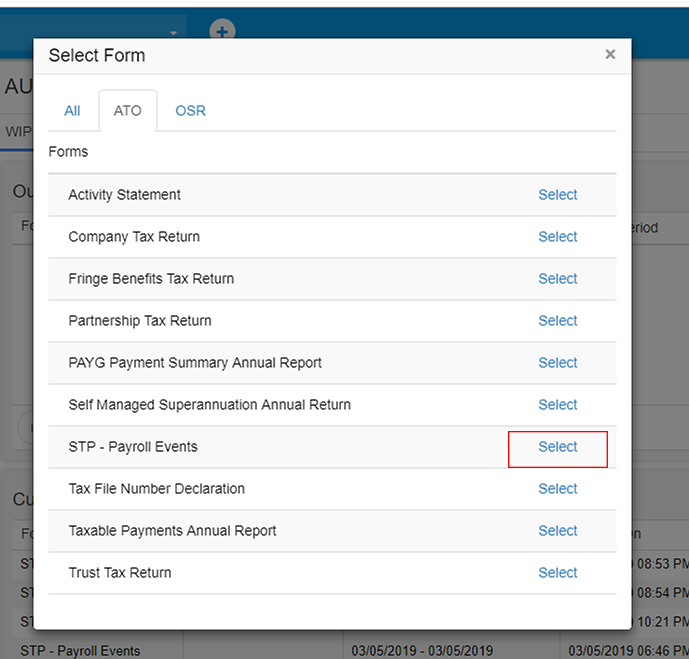

From the list of forms in the tab "ATO", click on "Select" next to "STP Payroll Events".

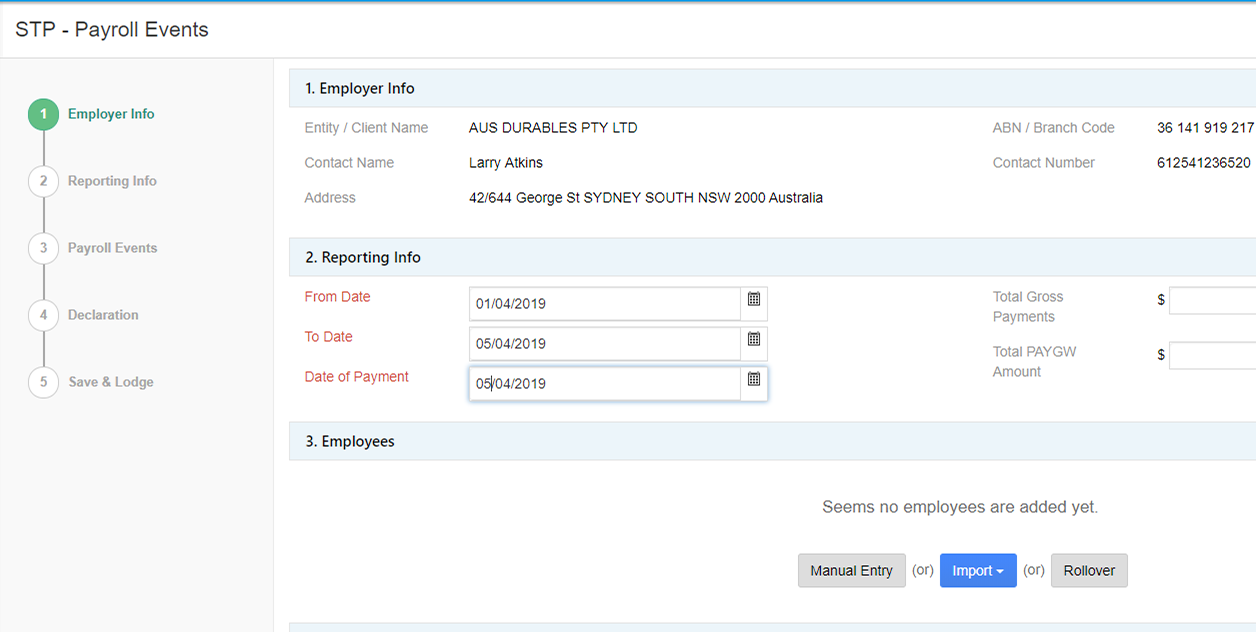

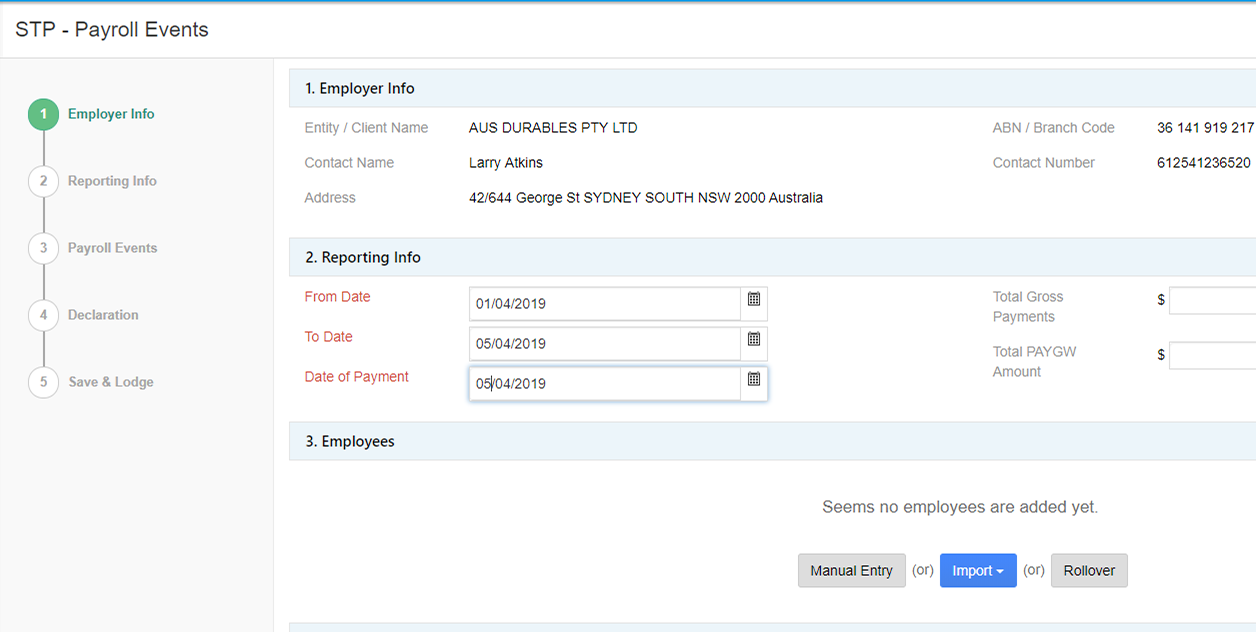

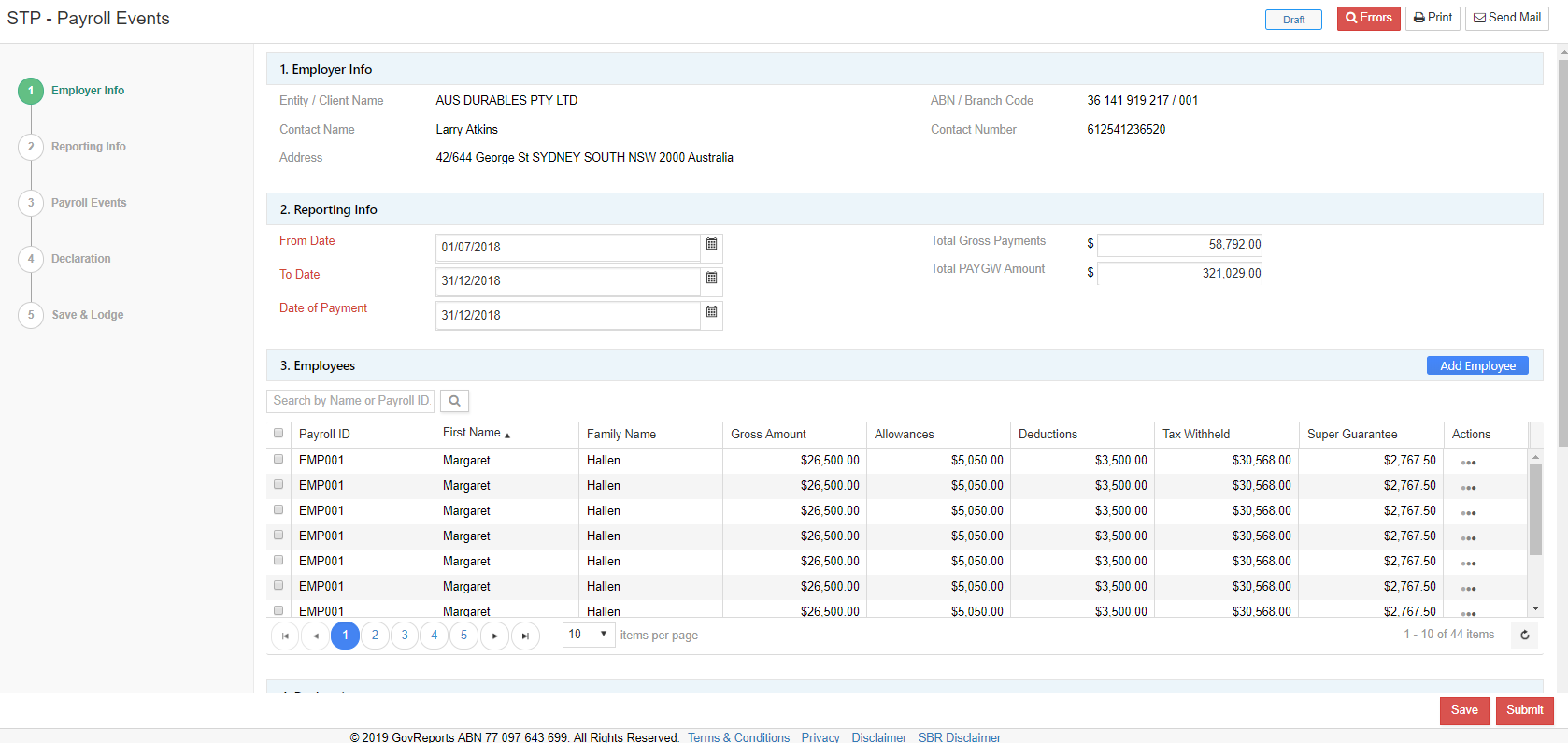

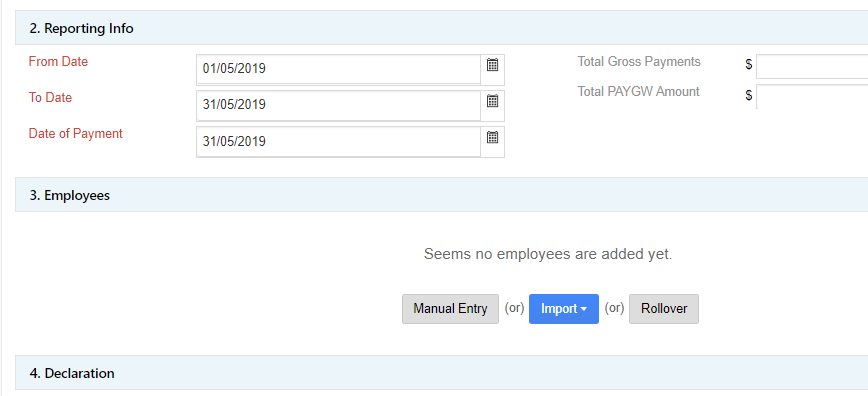

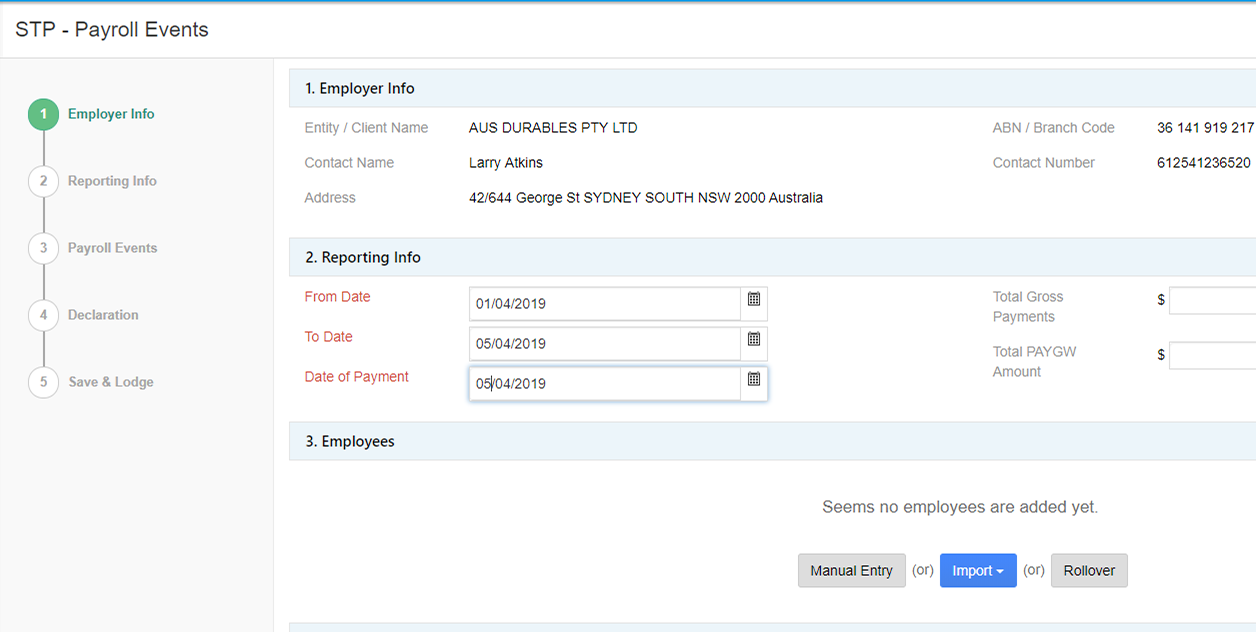

In the "Reporting Info" section, enter From date, To date and Date of Payment.

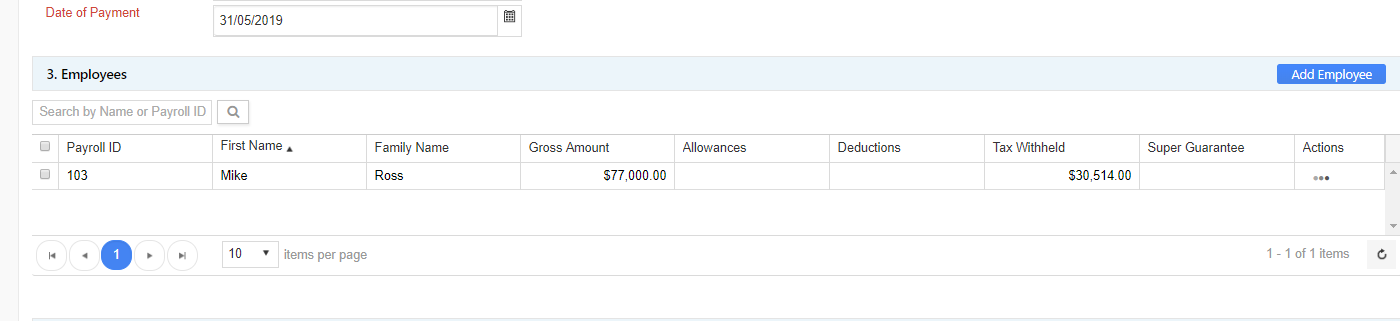

In the "Employees" section, click on "Manual Entry" button or click on "Add Employee" button.

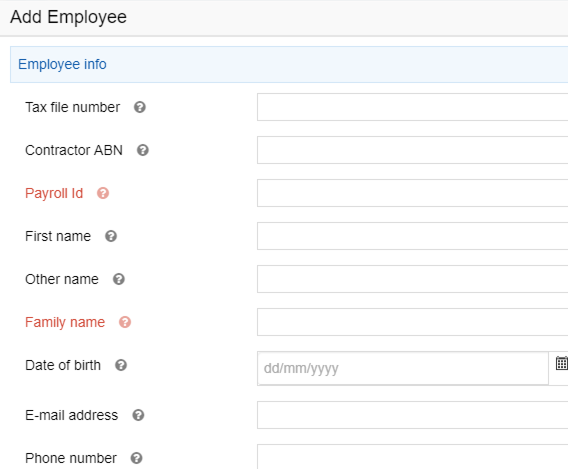

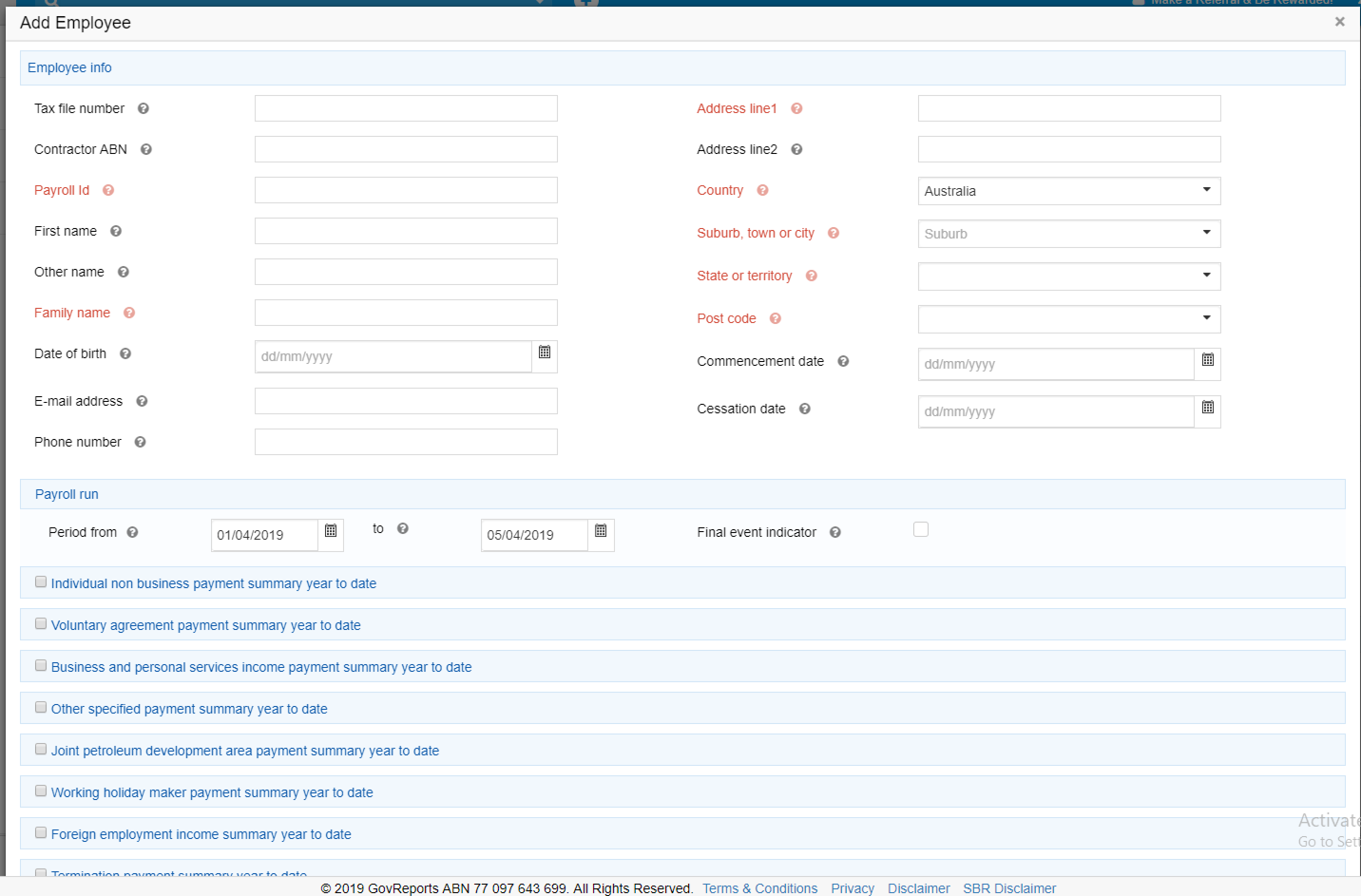

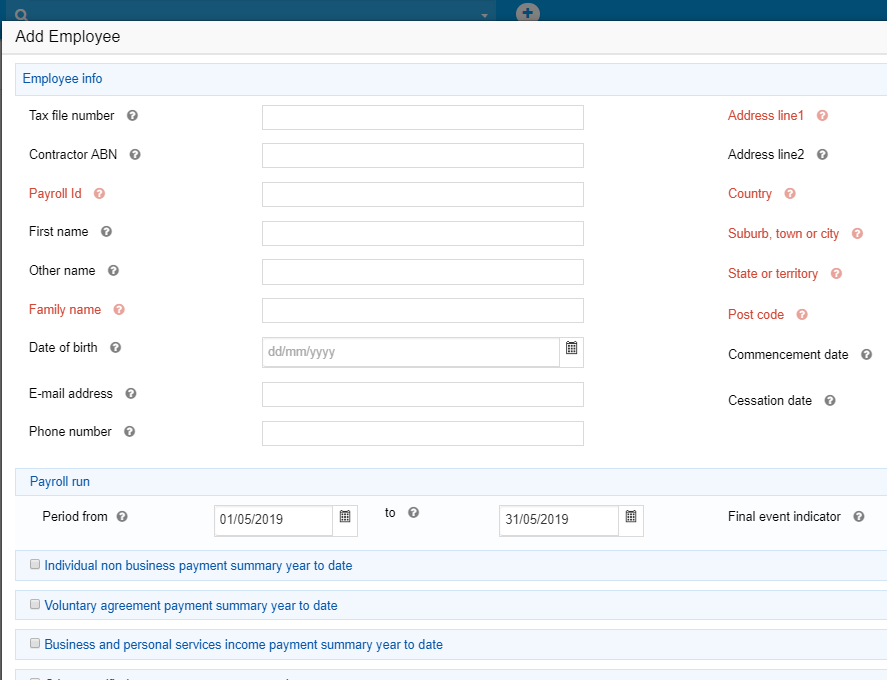

The "Add Employee" screen appears.

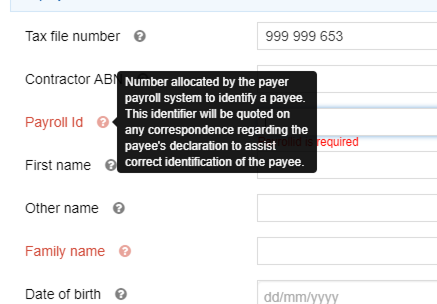

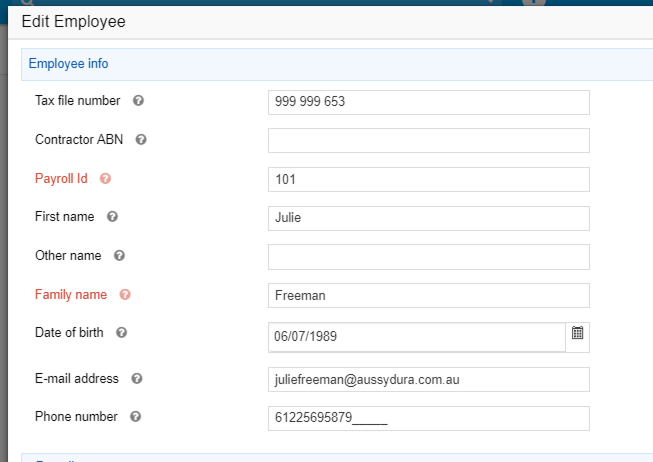

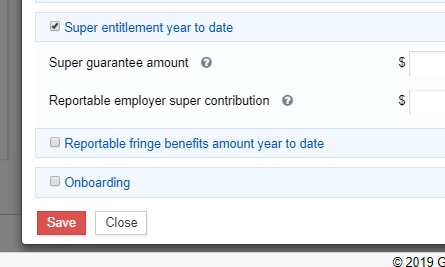

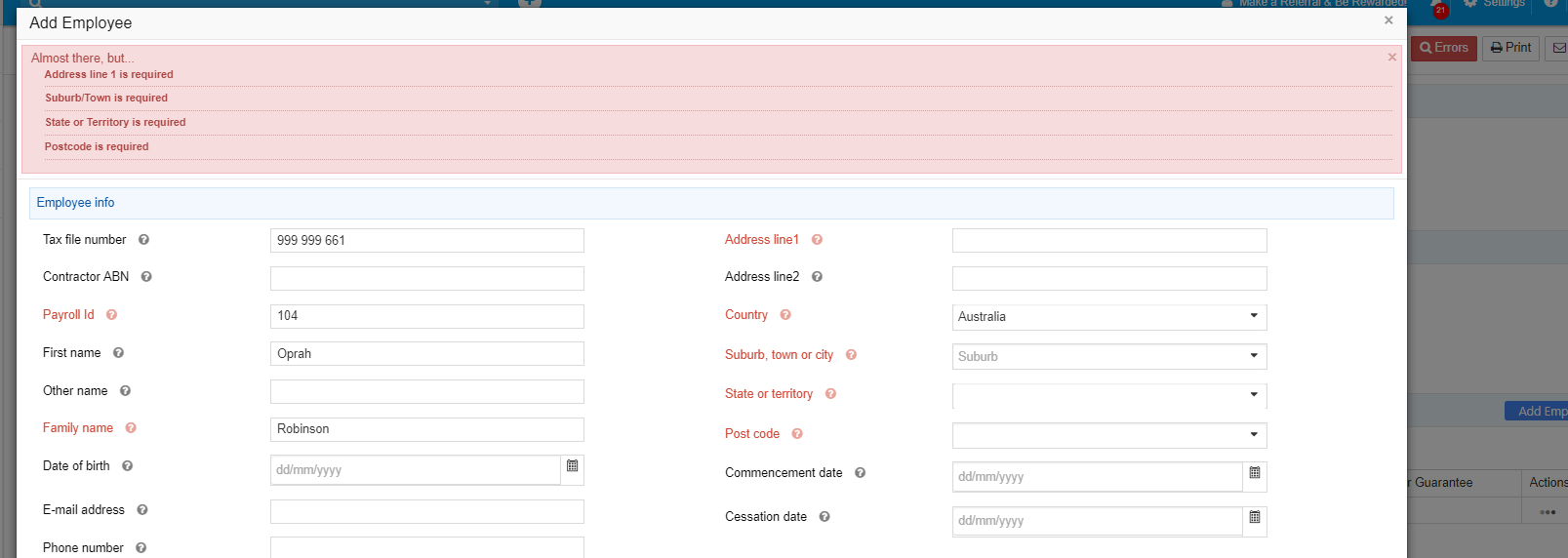

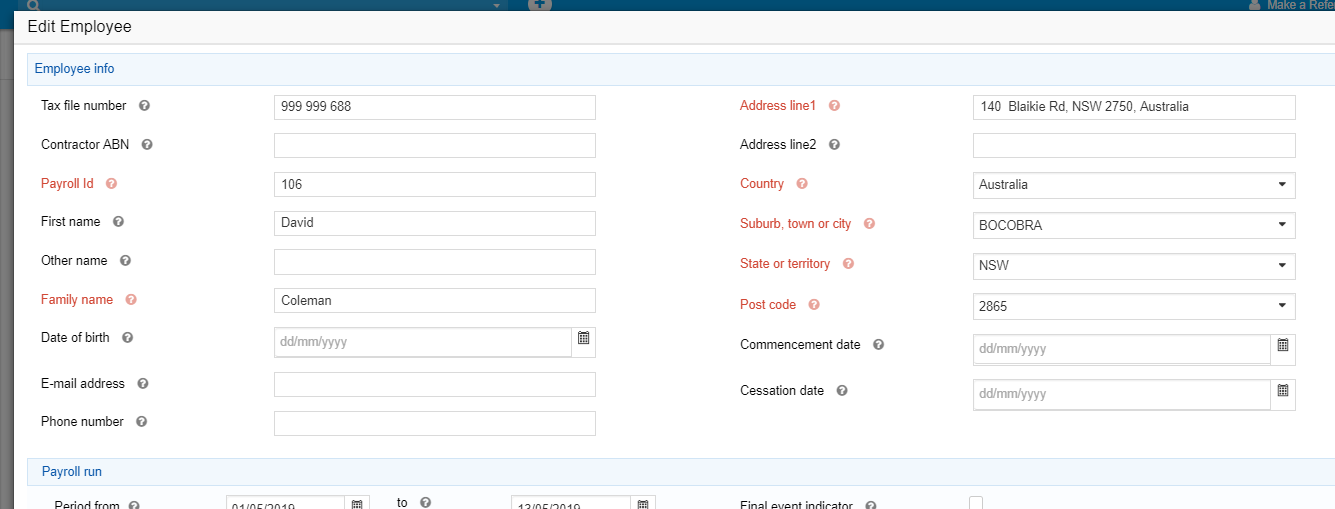

Enter the TFN, First Name, Family Name, Address details, etc. Remember that the fields in red are mandatory.

In case, if you are not sure of the purpose of a particular field, you hover on the question mark next to the field name. This acts as a tool tip.

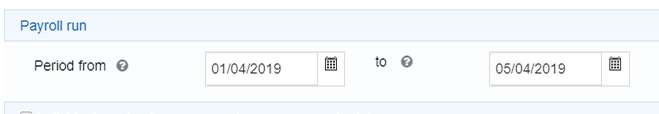

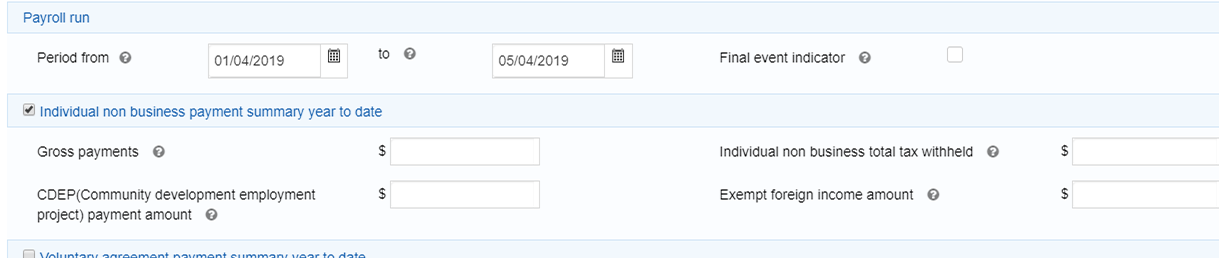

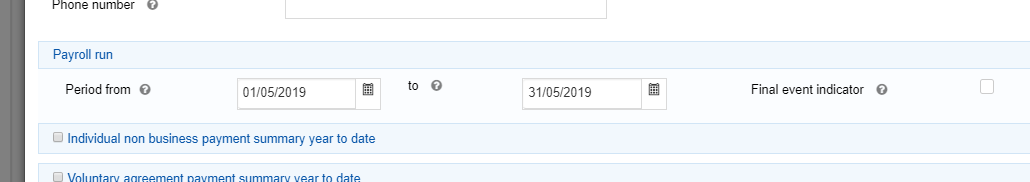

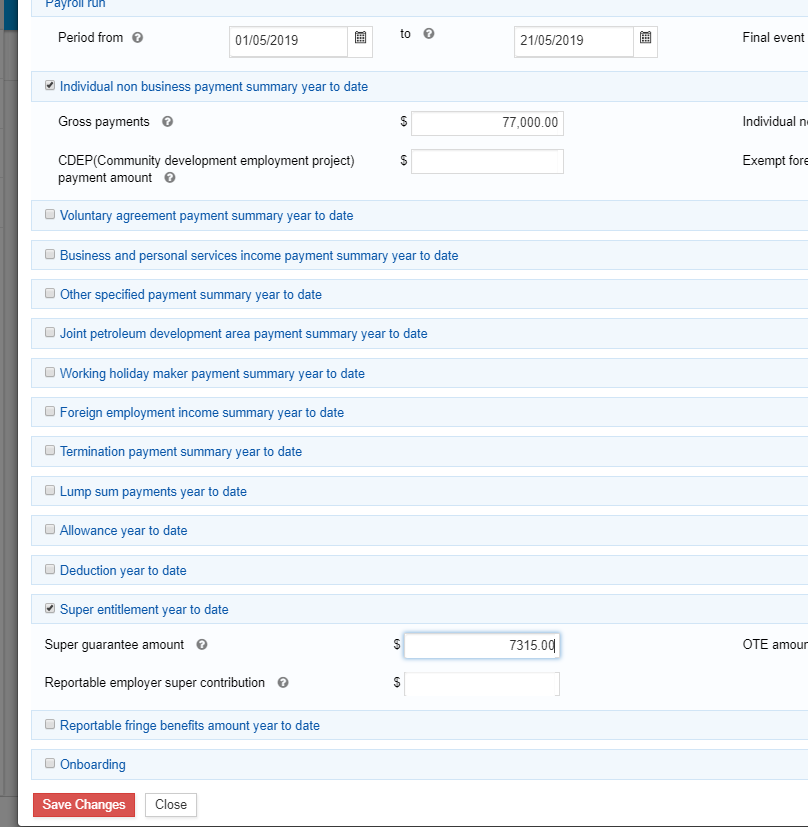

The Payroll From and To Date will be prefilled based on STP Payroll Events form.

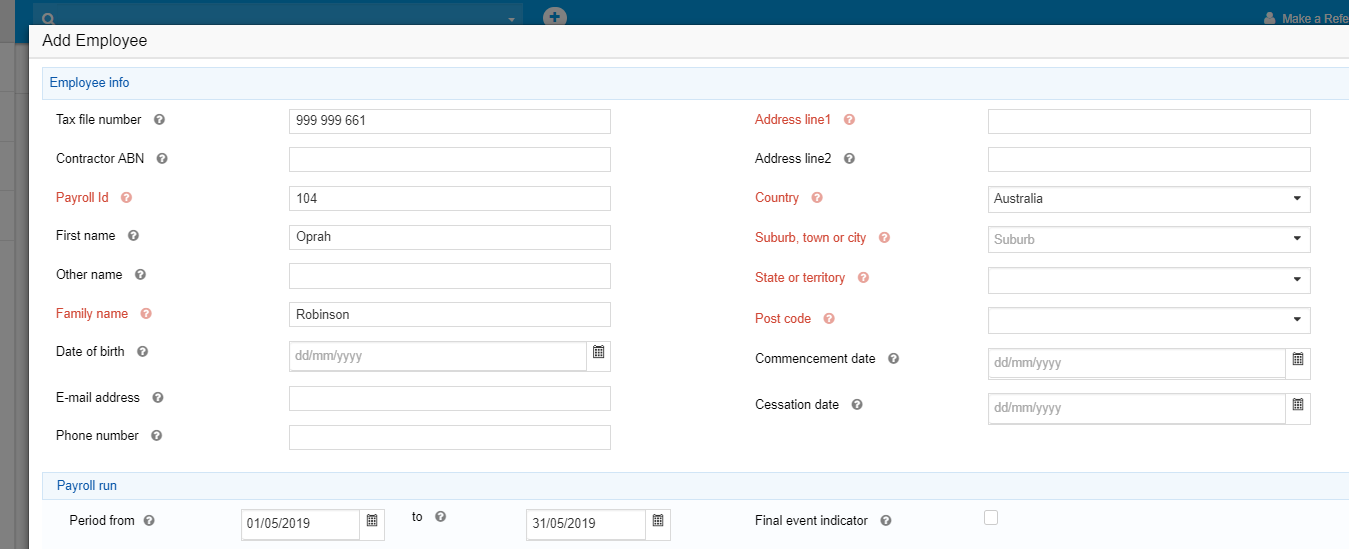

Based on the income type, enter the related income fields.

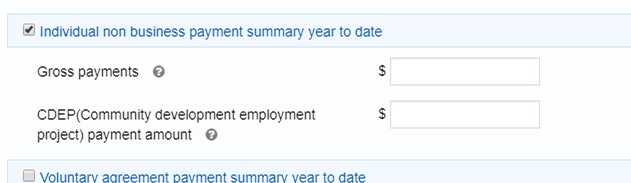

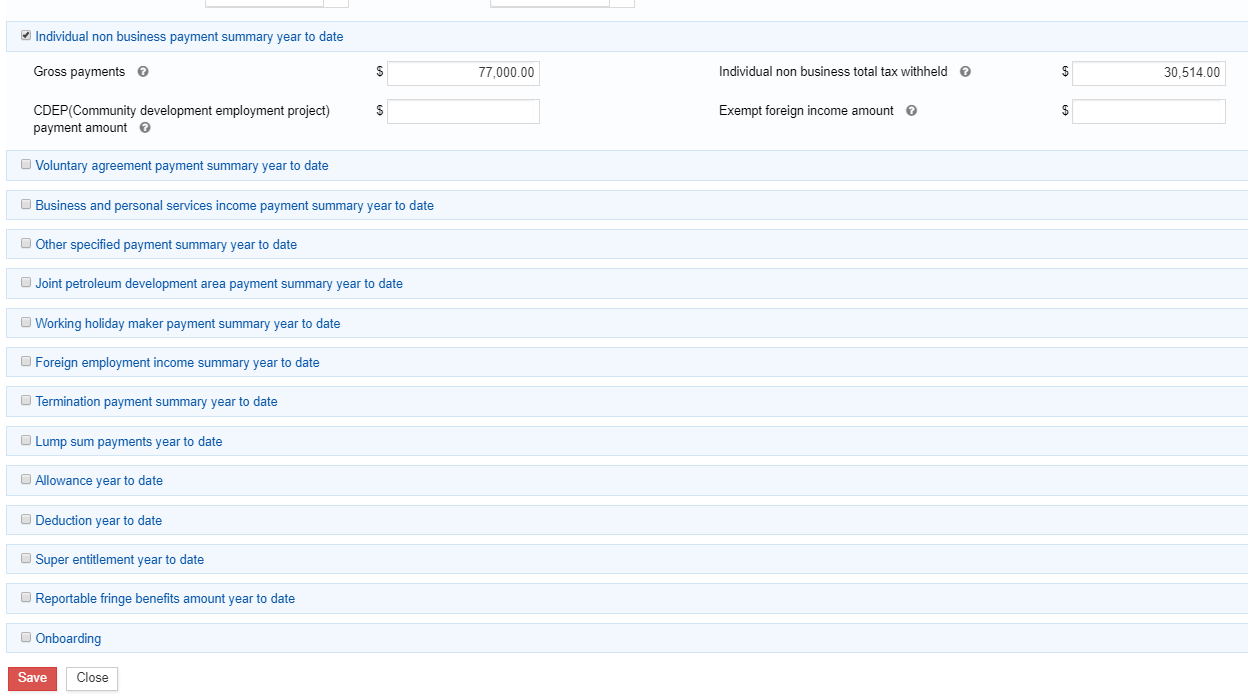

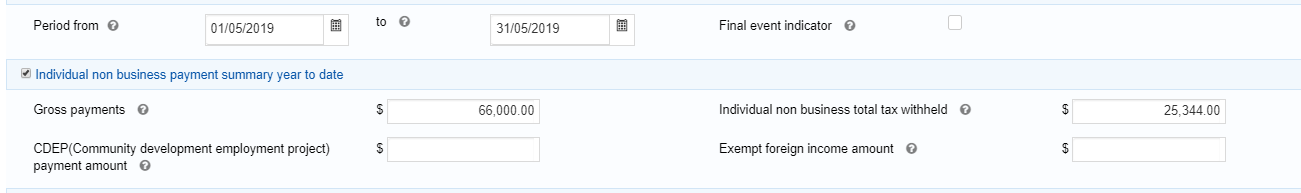

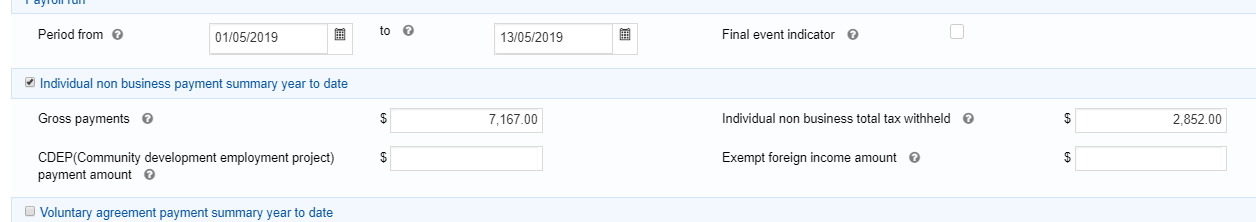

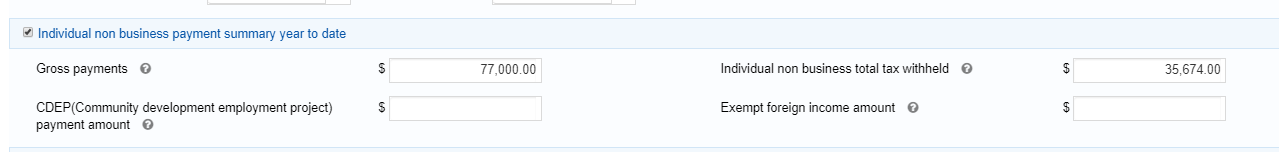

For example, Click on the checkbox next to "Individual Non-business payment summary year to date". The related columns open. Enter the Gross payments and Individual non-business total tax withheld.

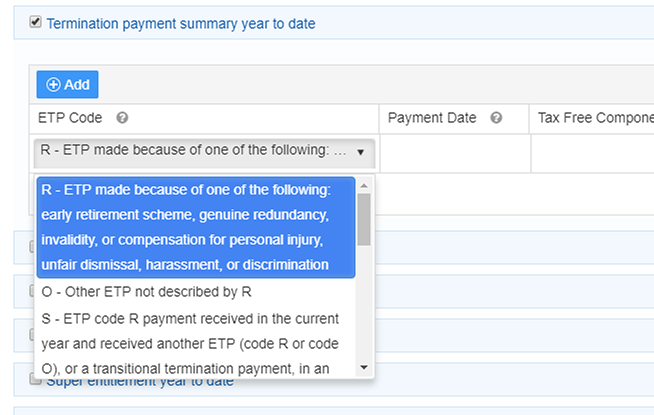

If the particular employee has any termination payment, it can be put in "Termination payment summary year to date". Click on "Add" button, select an option from the list, enter the date and other fields.

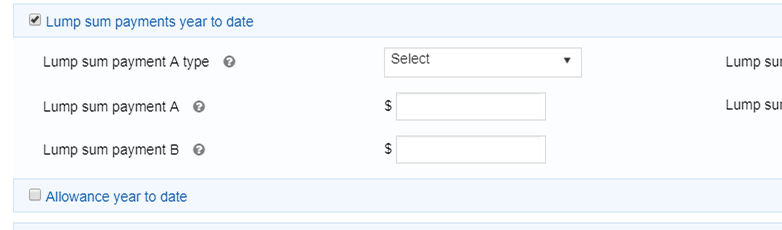

If the employee has any lump sum payment, it can be entered in "Lump sum payments year to date" section. Enter the relevant fields.

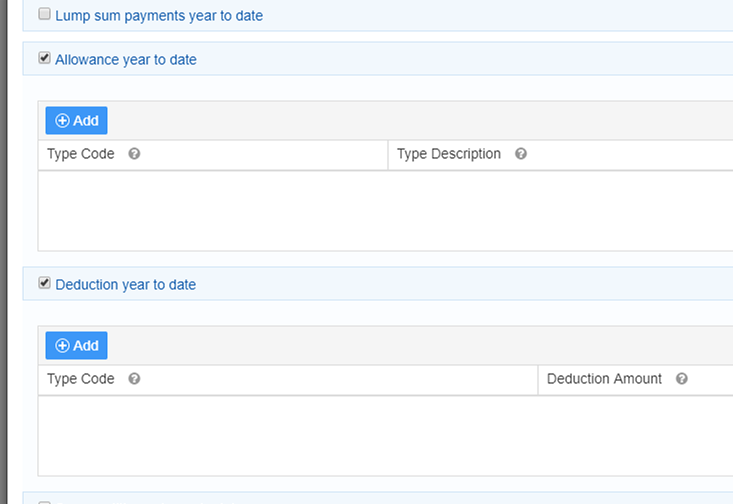

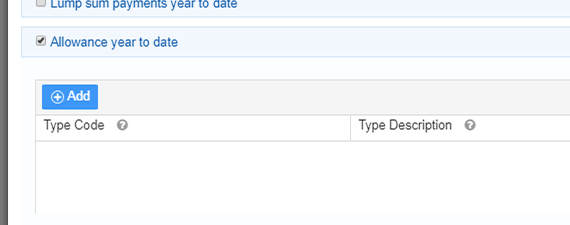

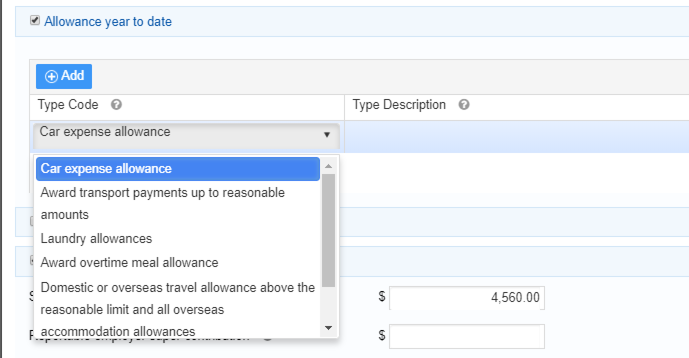

If the employees have any allowances or deductions, it can be entered in "Allowances" and "Deductions" section respectively. Click on "Add" button, select the type of allowances or deductions from the drop-down list and enter the appropriate amount.

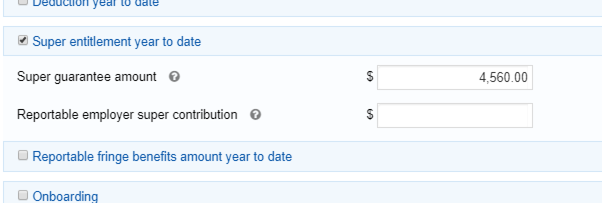

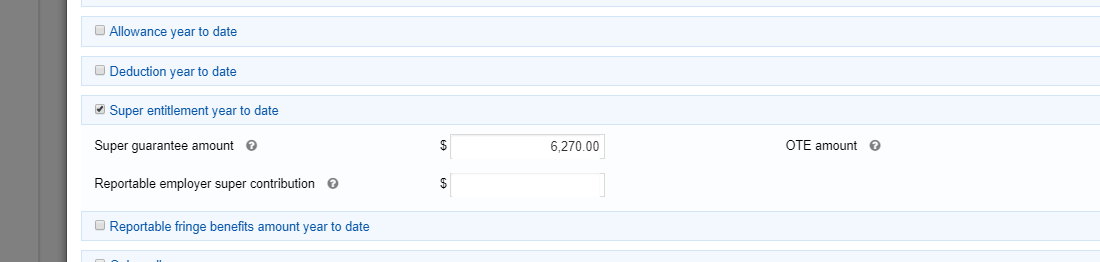

Click on the checkbox next to "Super entitlement year to date". Enter the value in the field, Super guarantee amount.

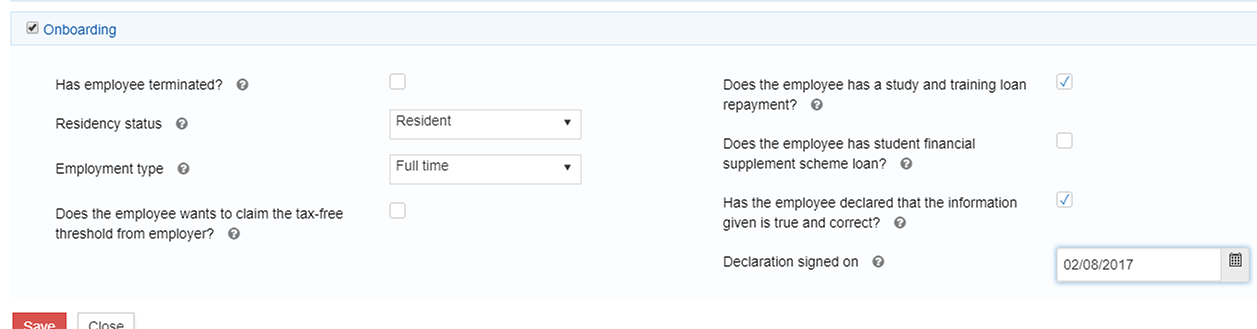

The onboarding section can be used to enter onboarding information of an employee like "Resident status", "Employment Type" and any other declarations of that employee with date.

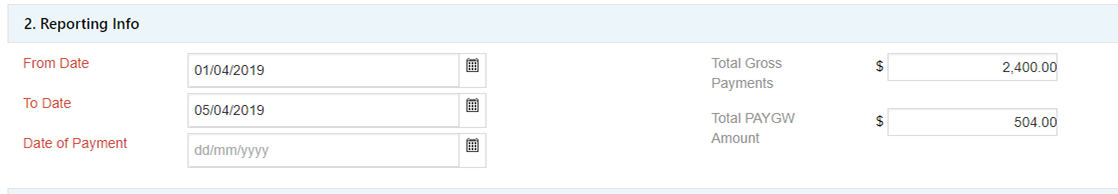

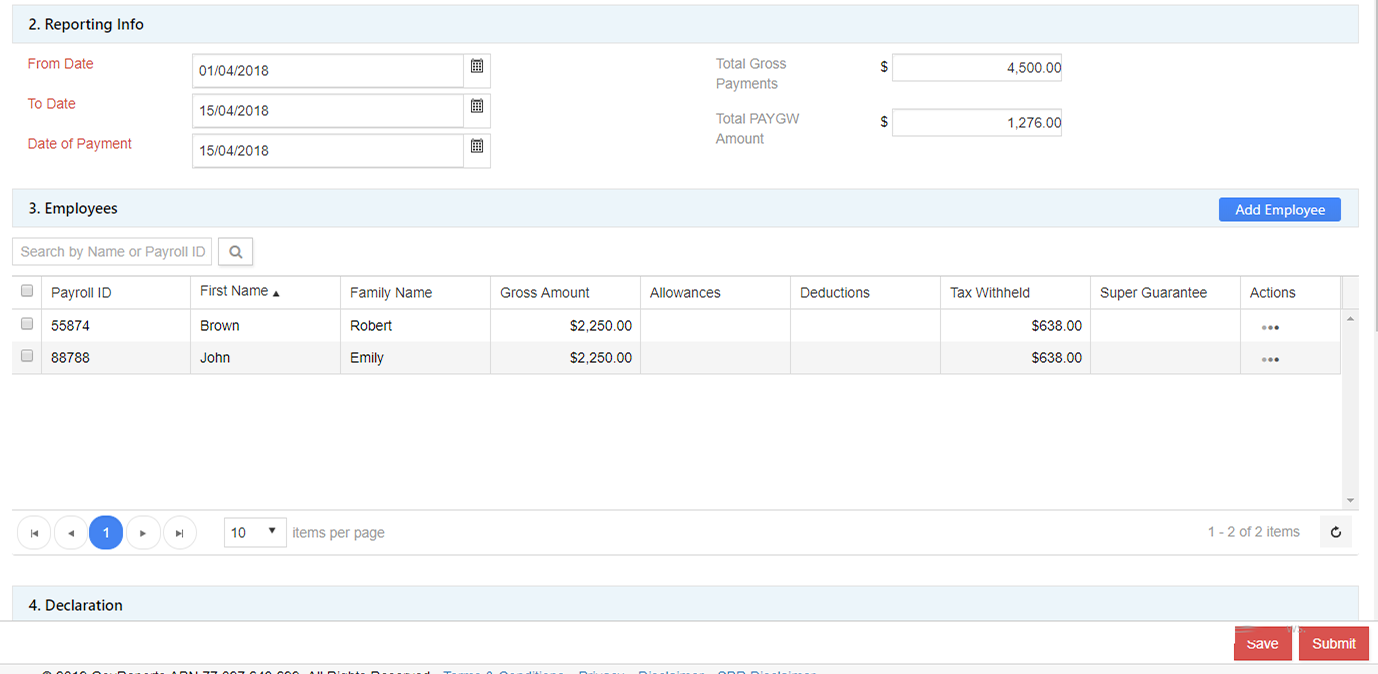

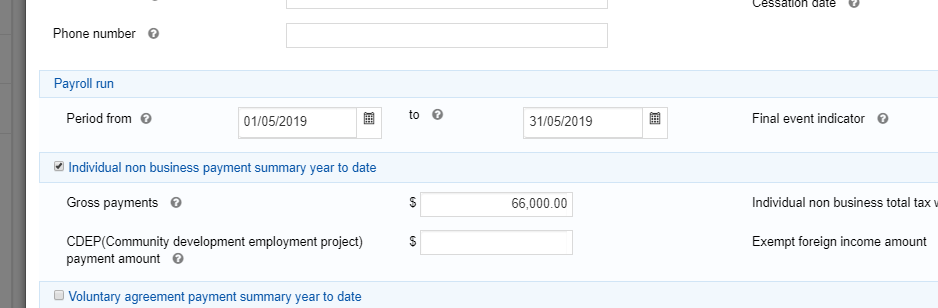

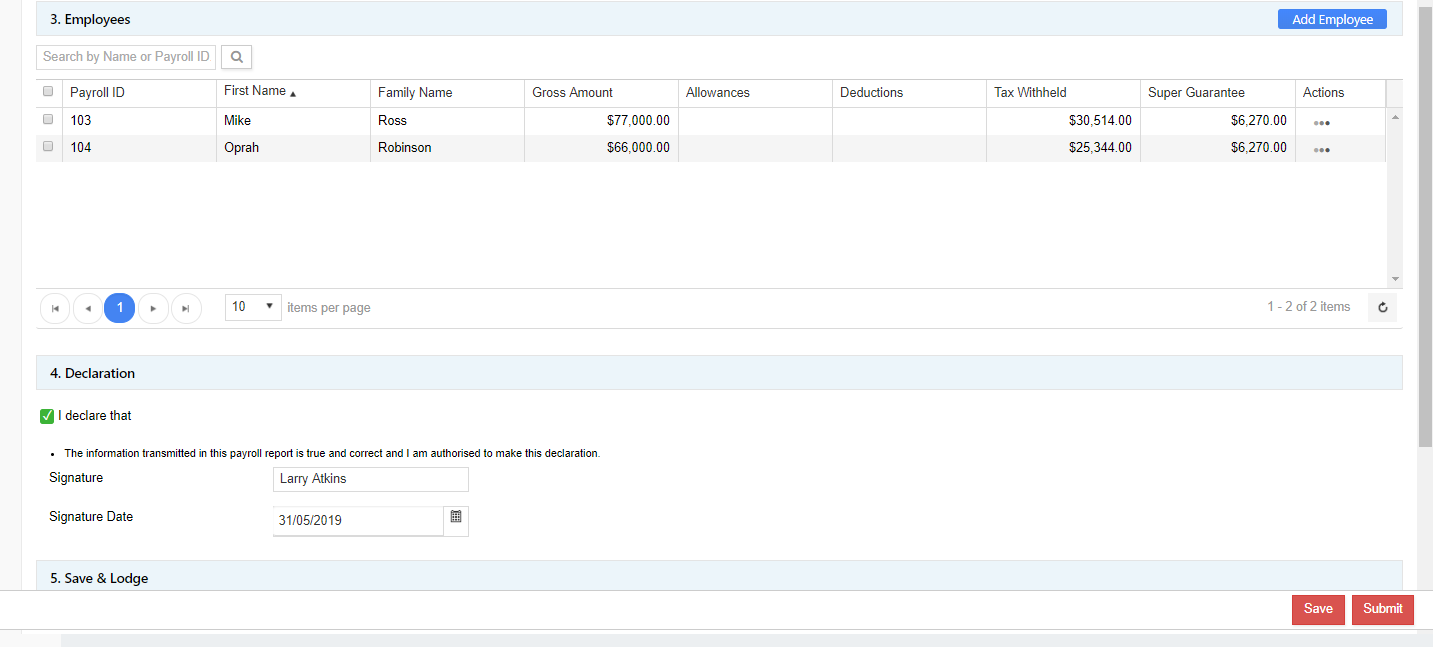

In the "Reporting Info" section, enter the amount in Total gross payments and Total PAYGW amount. Incase of multiple employees entered, the sum of gross payments and the sum of PAYGW amount of all the employees is added and entered in the appropriate fields. This amount represents the figures for the selected period.

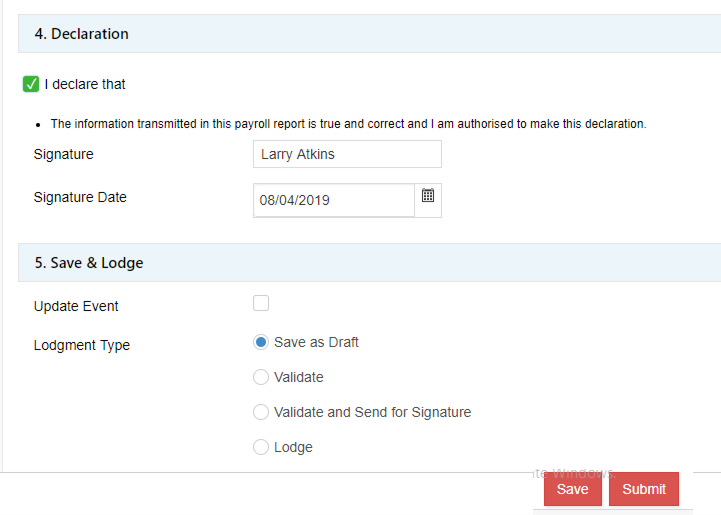

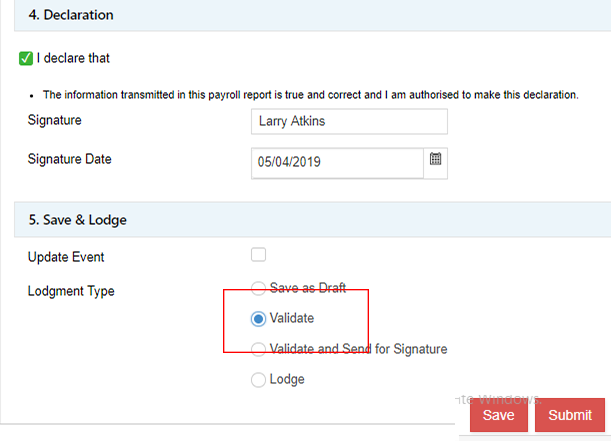

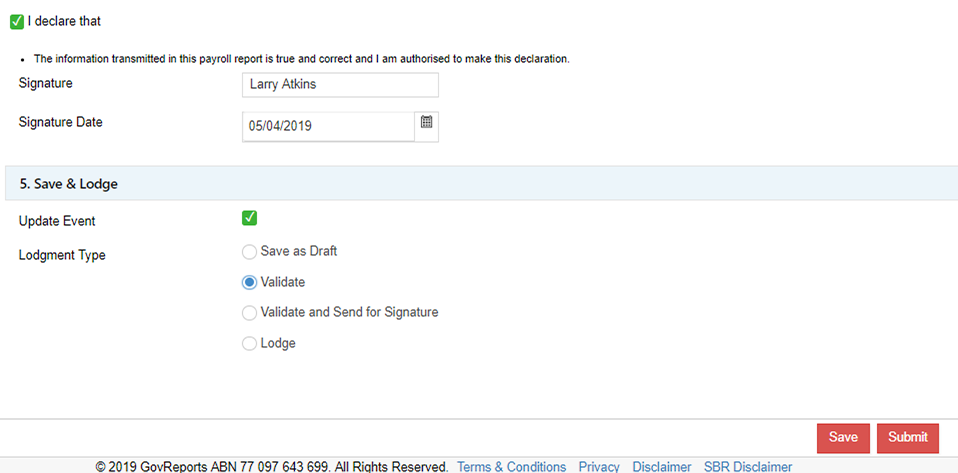

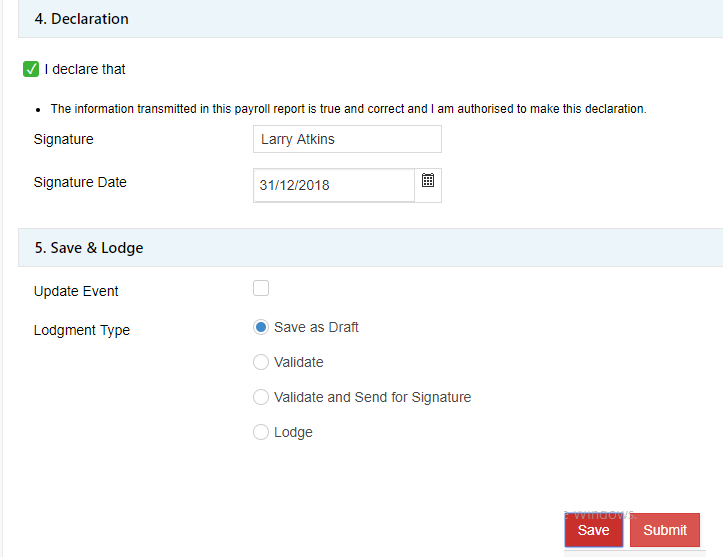

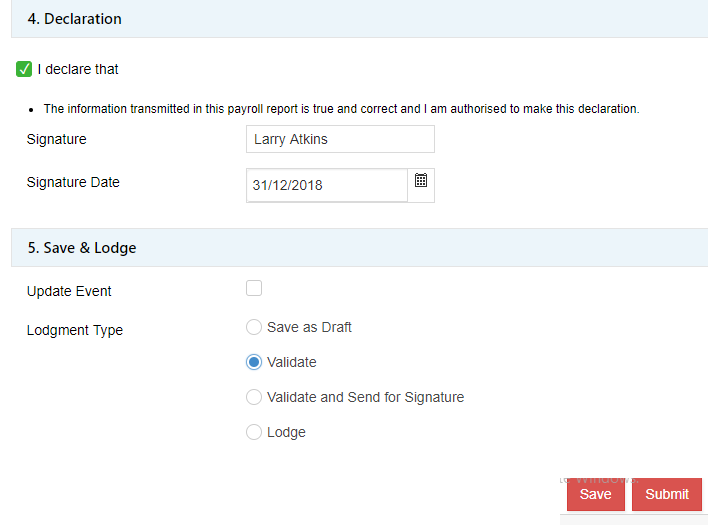

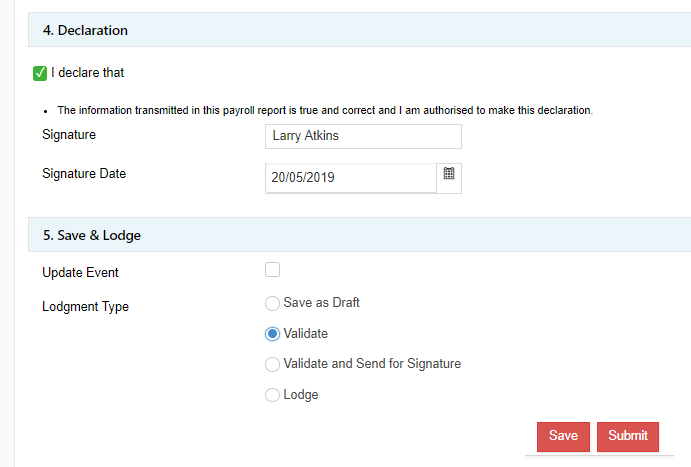

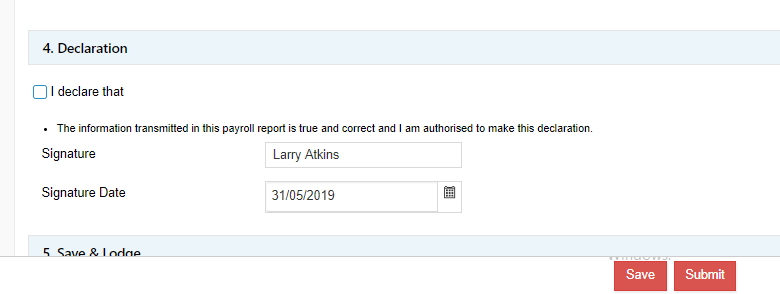

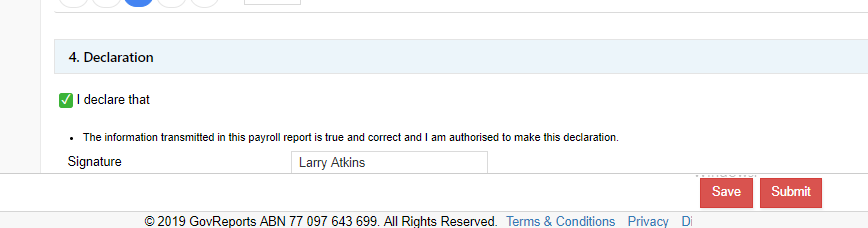

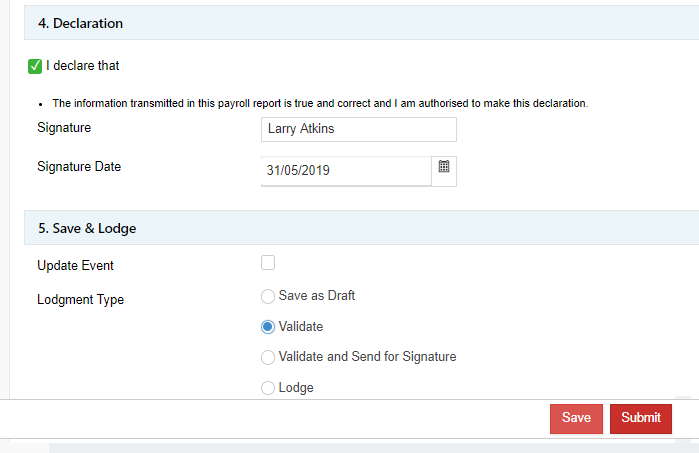

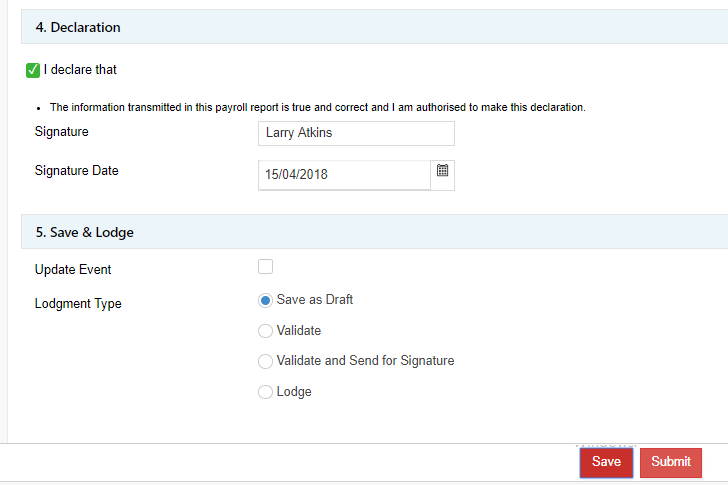

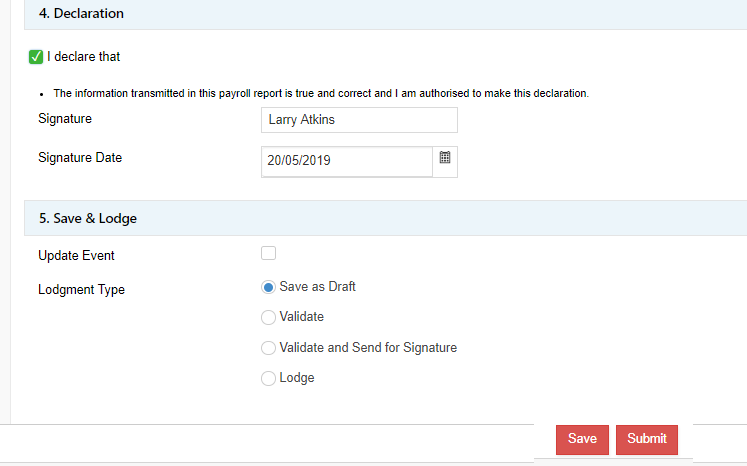

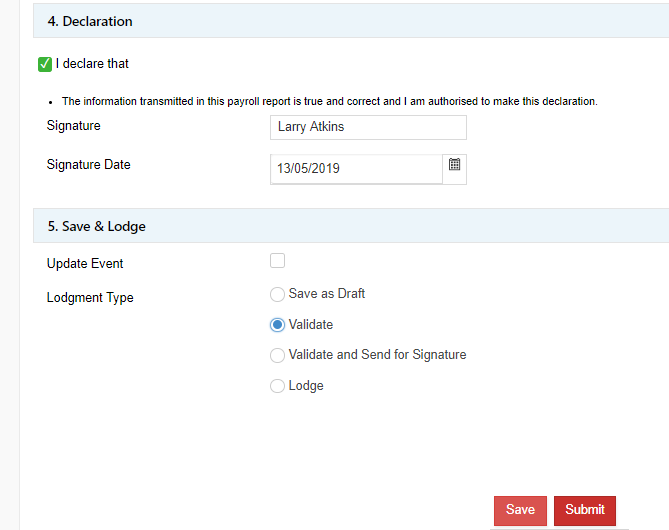

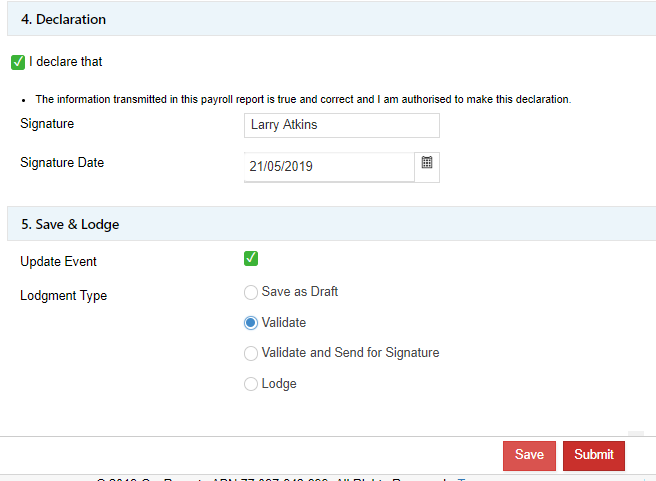

Make a declaration and click on "Save" button in the end.

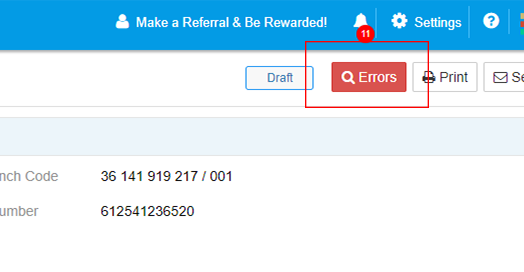

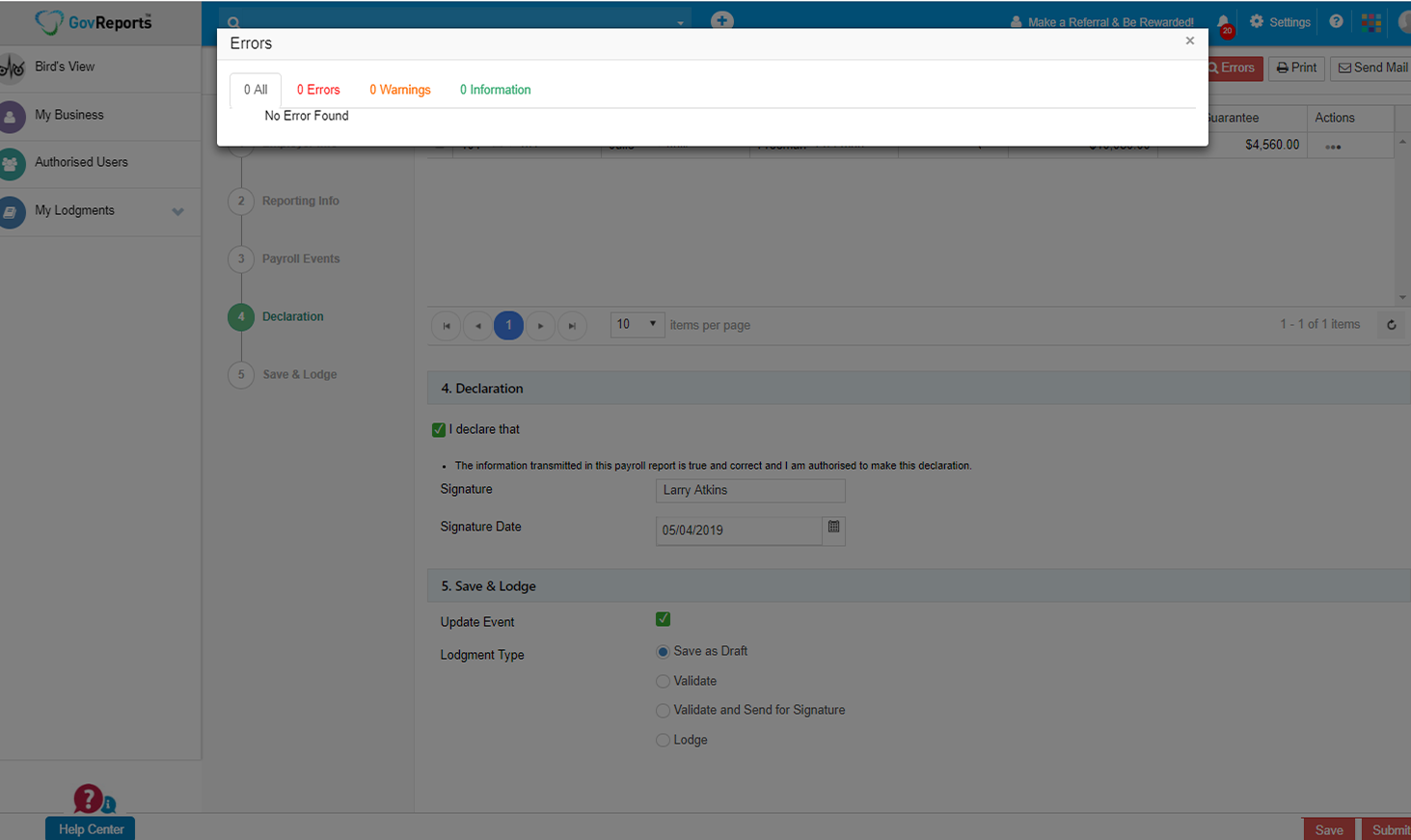

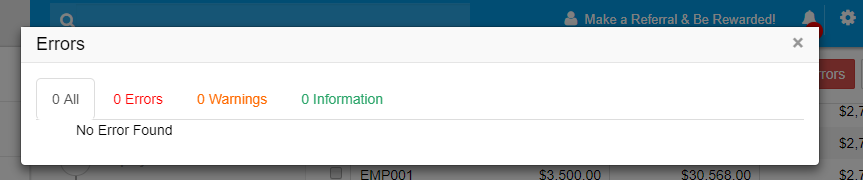

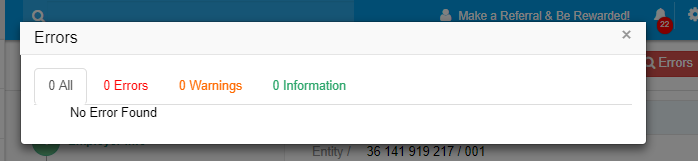

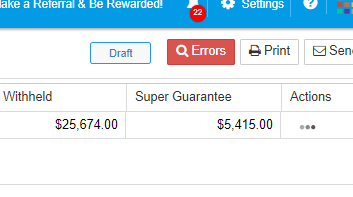

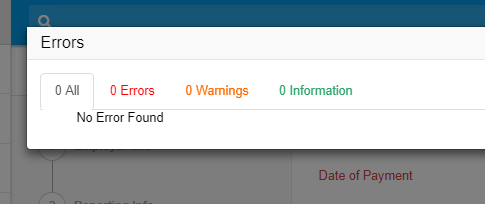

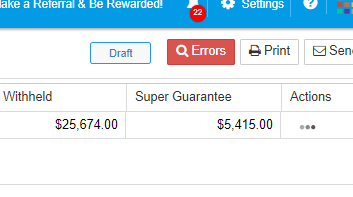

After the payroll details are saved, click on "Errors" on the top right corner.

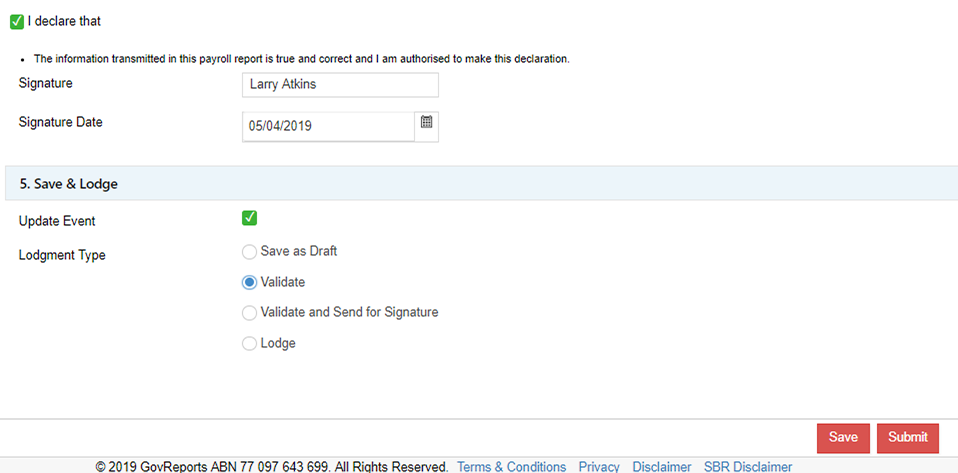

If there are no errors, click on "Validate" and Submit. Remember that you can only lodge forms that are in "Valid" status.

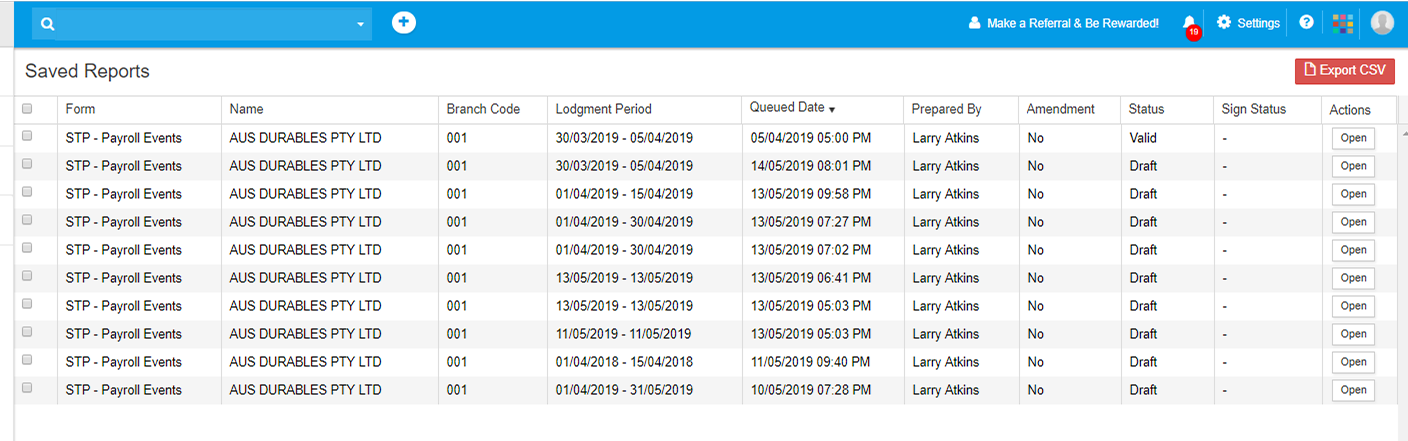

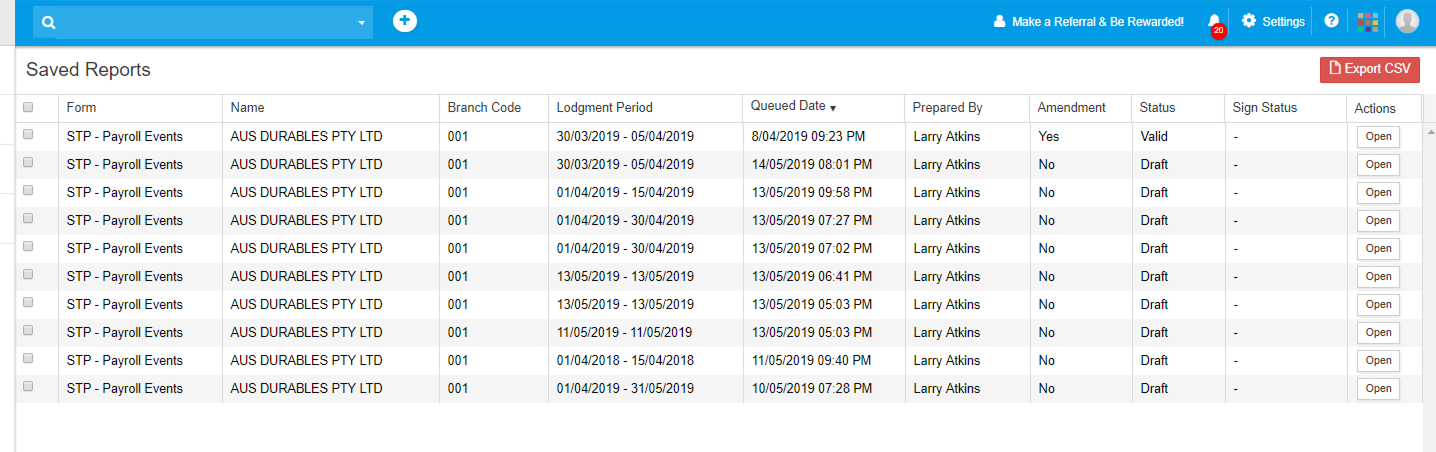

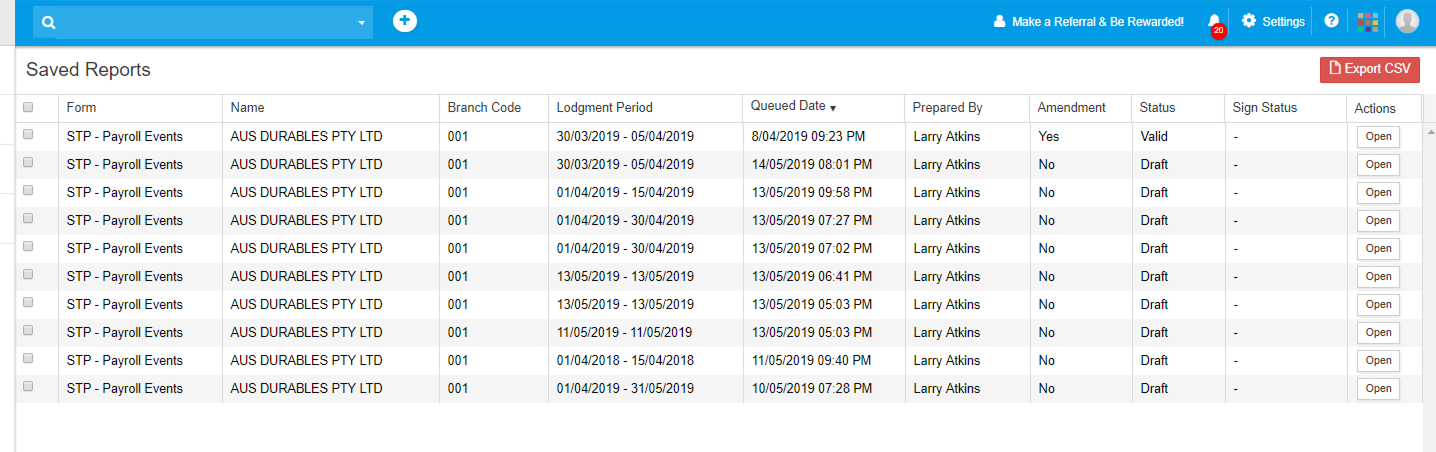

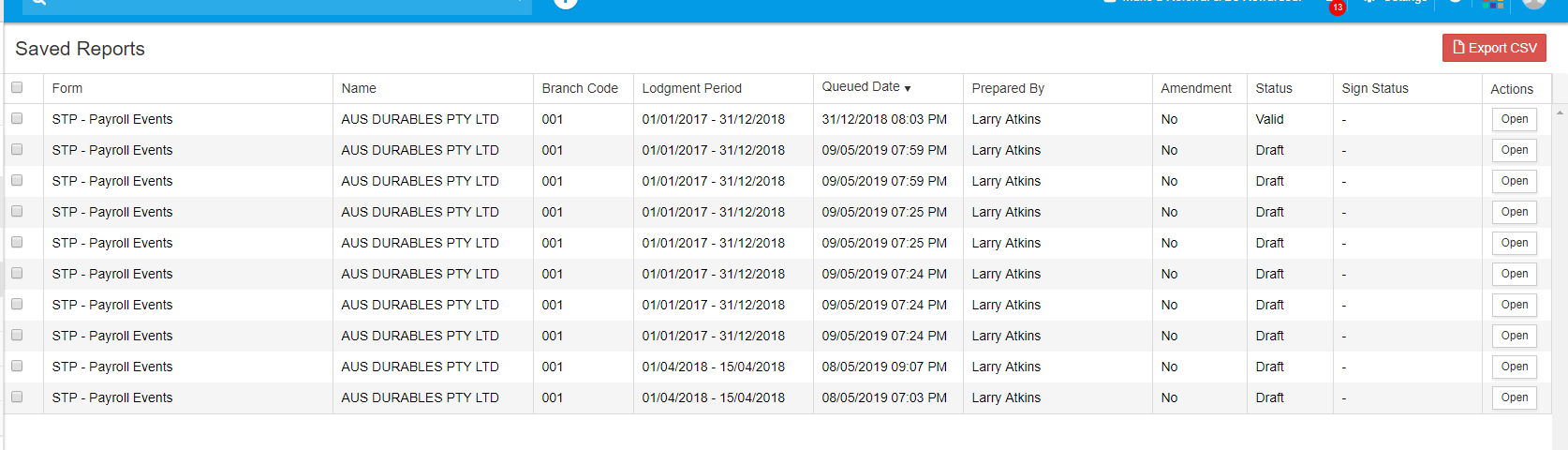

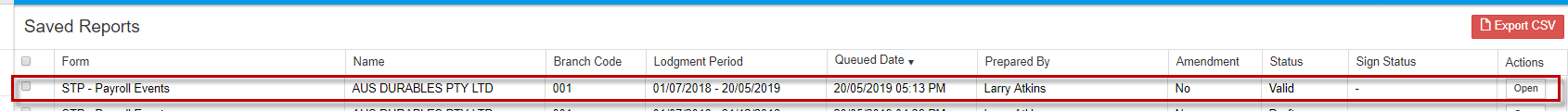

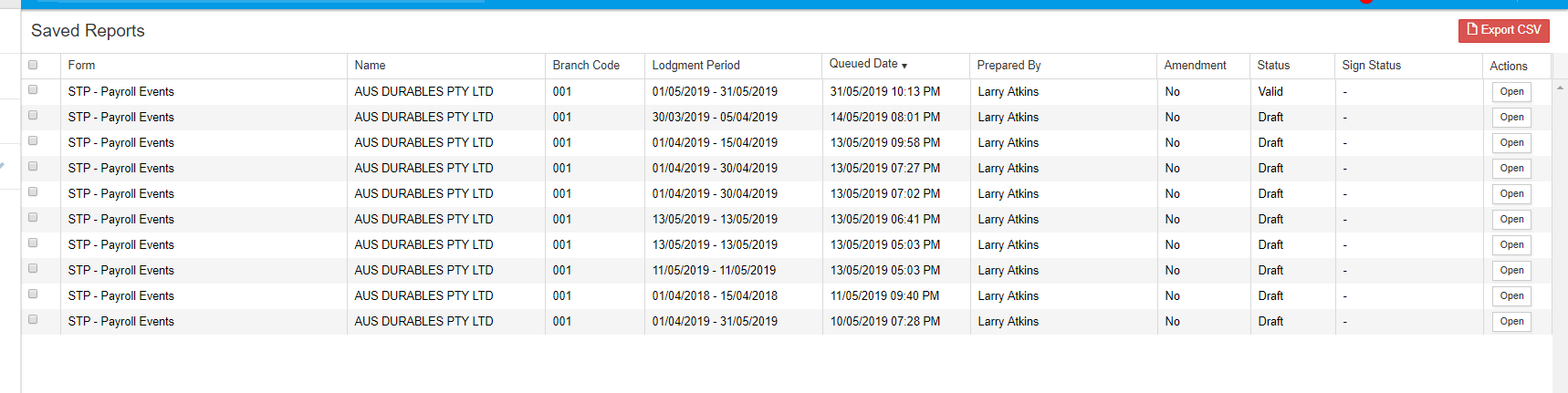

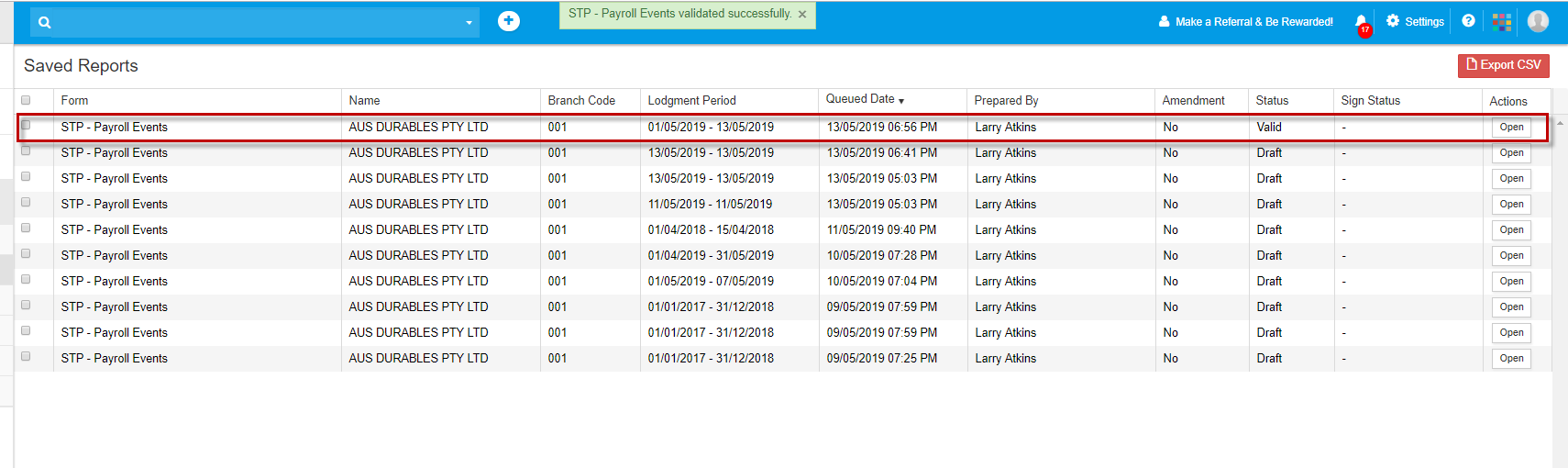

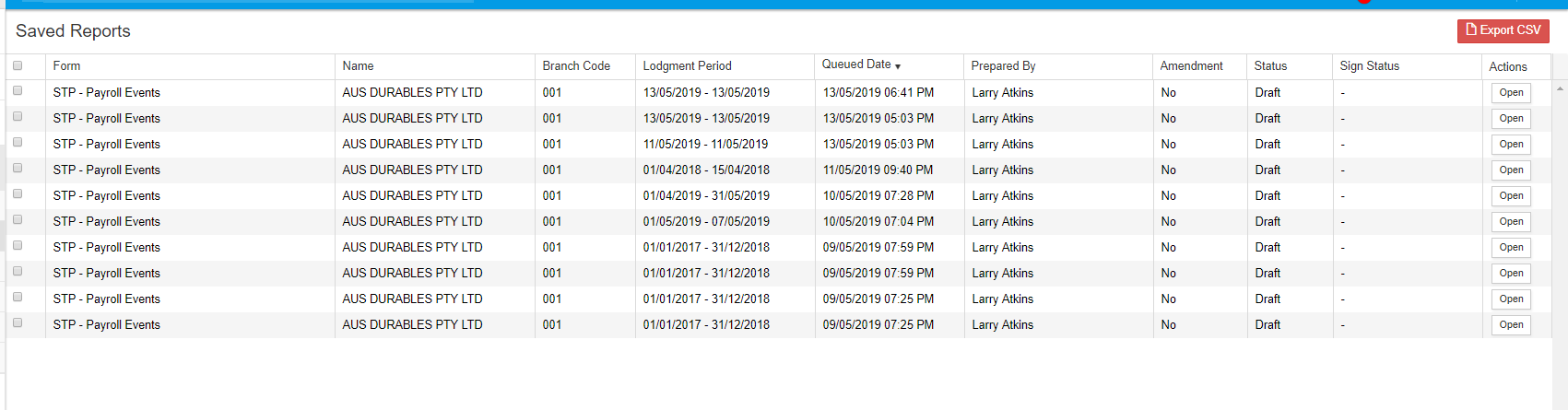

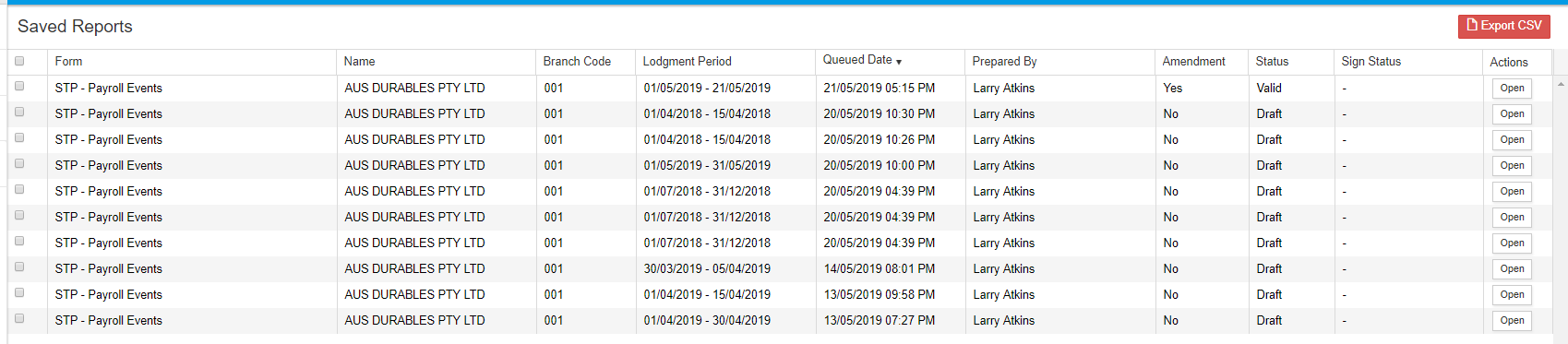

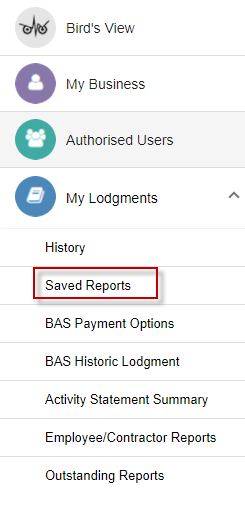

The validated payroll information will be under "Saved Reports" and redirected to "Saved Reports" screen automatically. You can see the column status shows "Valid".

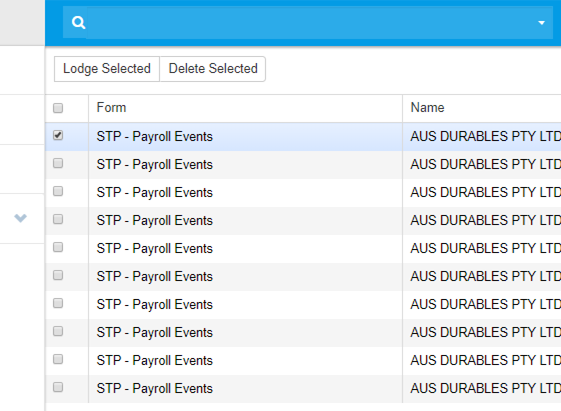

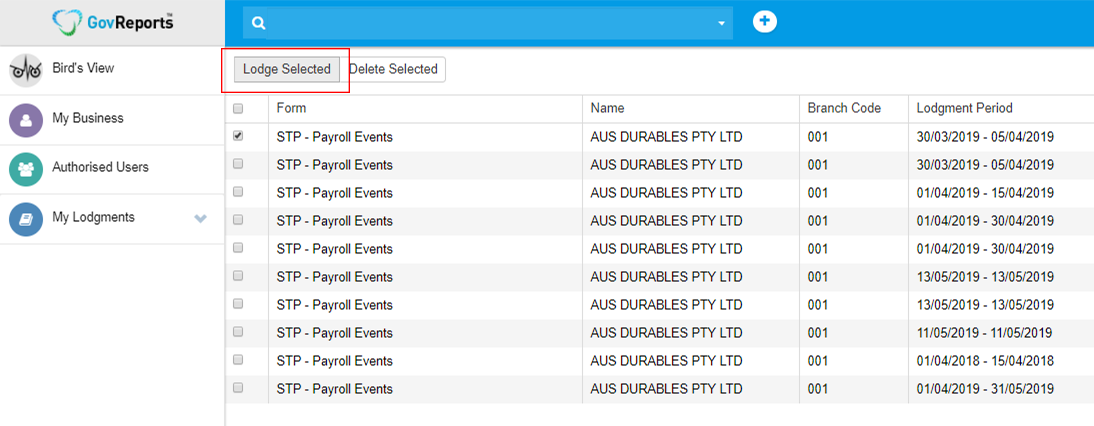

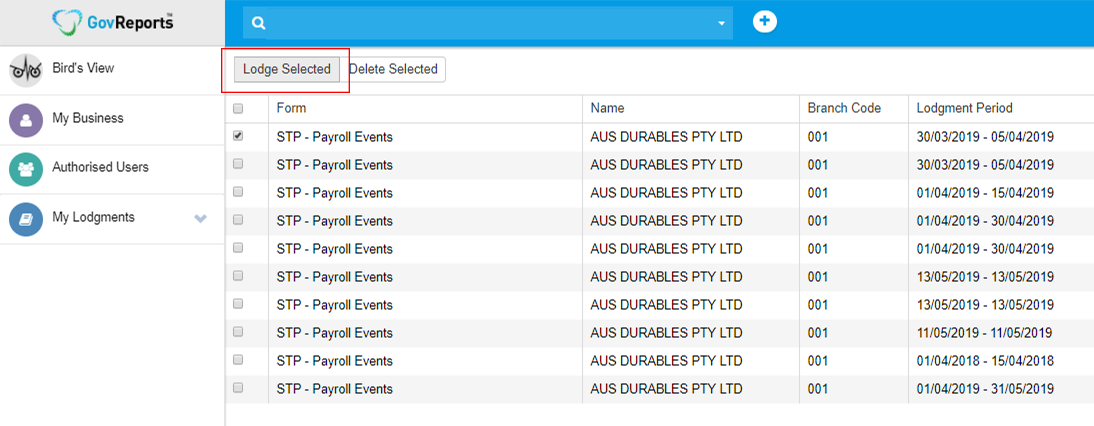

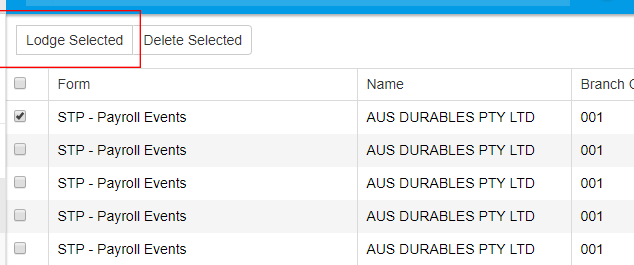

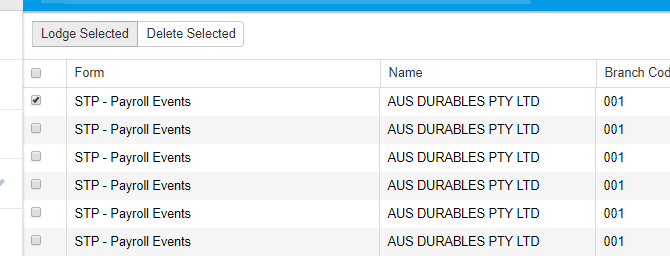

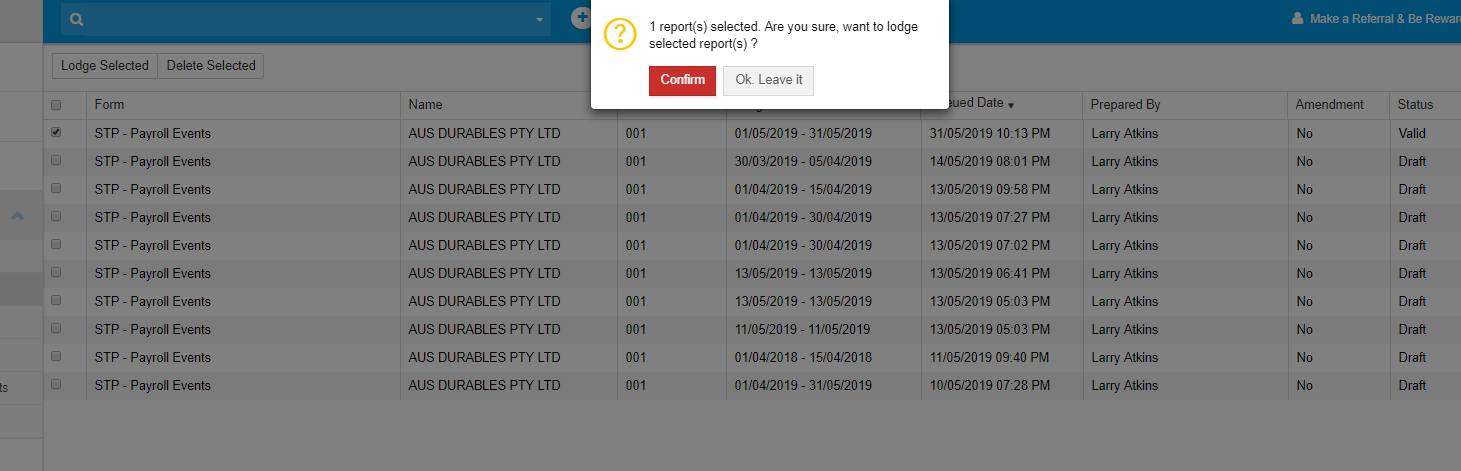

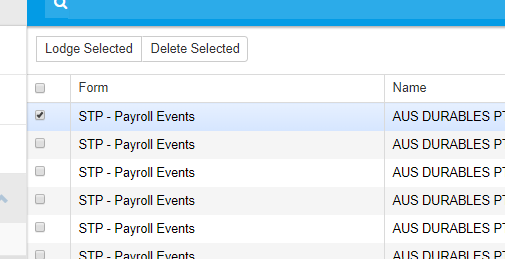

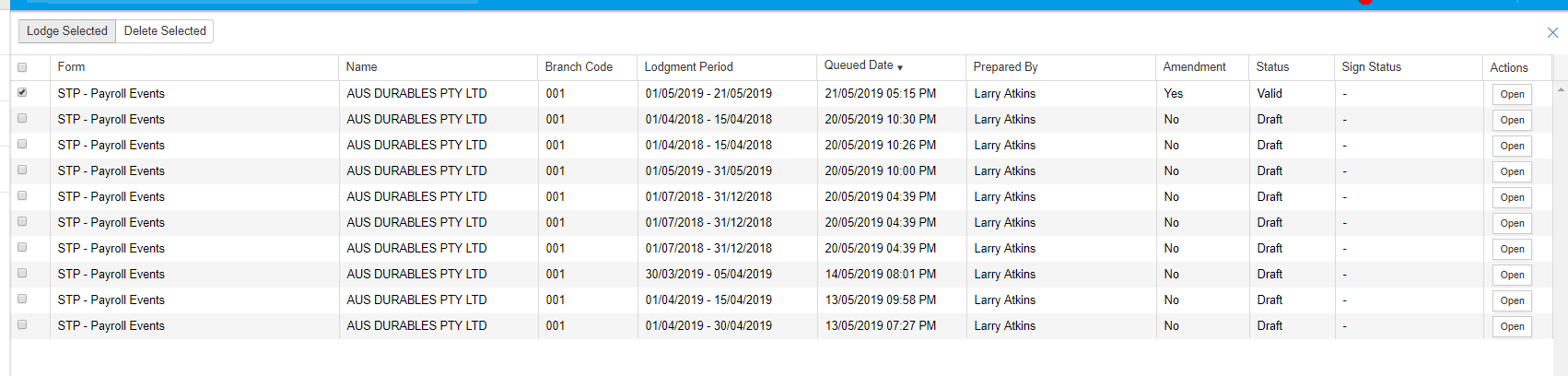

Click on the checkbox next to this report and click on "Lodge Selected" button.

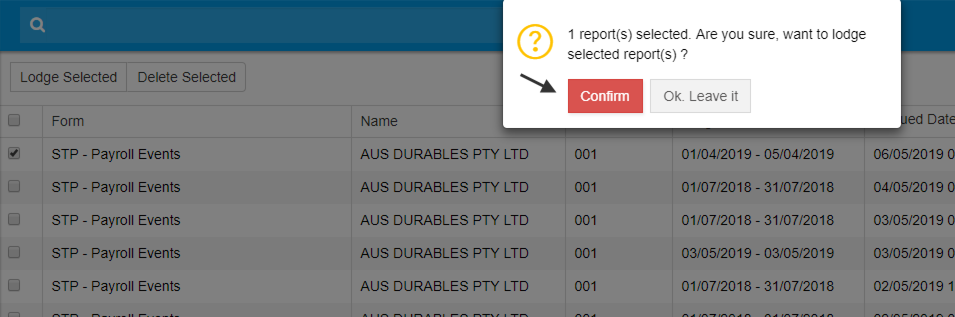

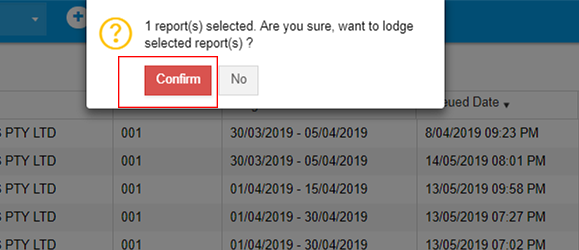

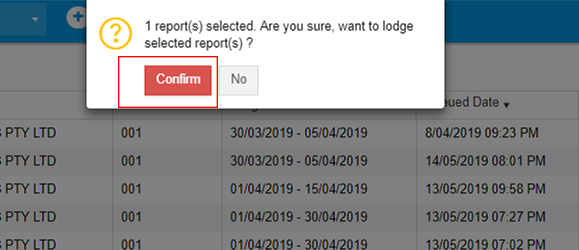

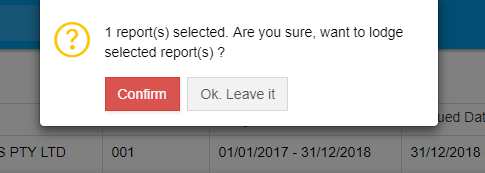

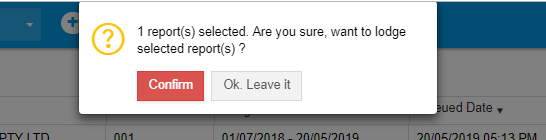

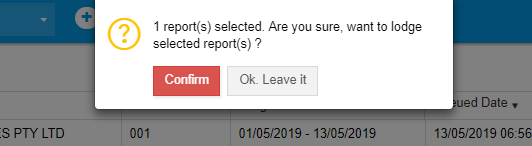

Confirm to lodge the report.

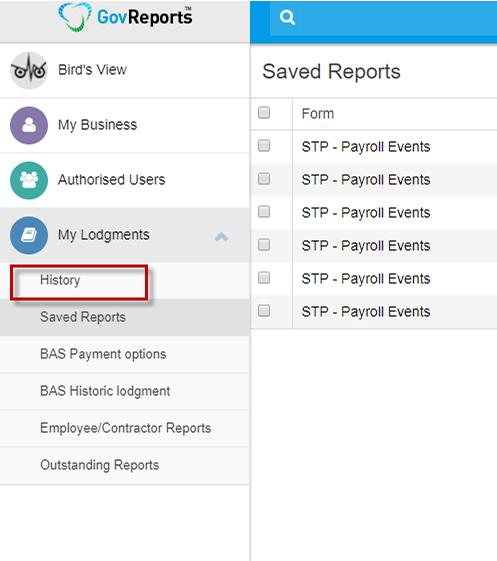

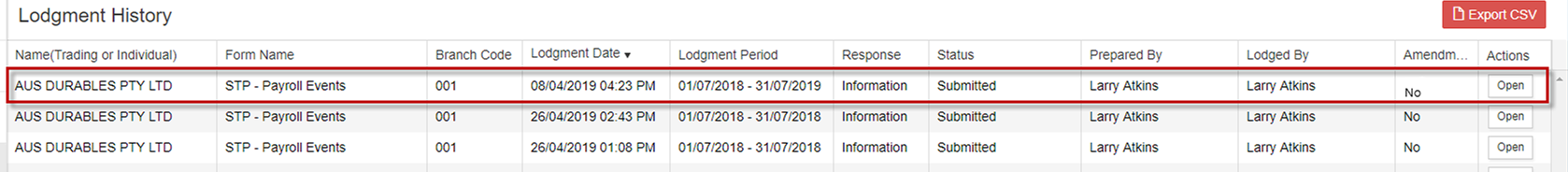

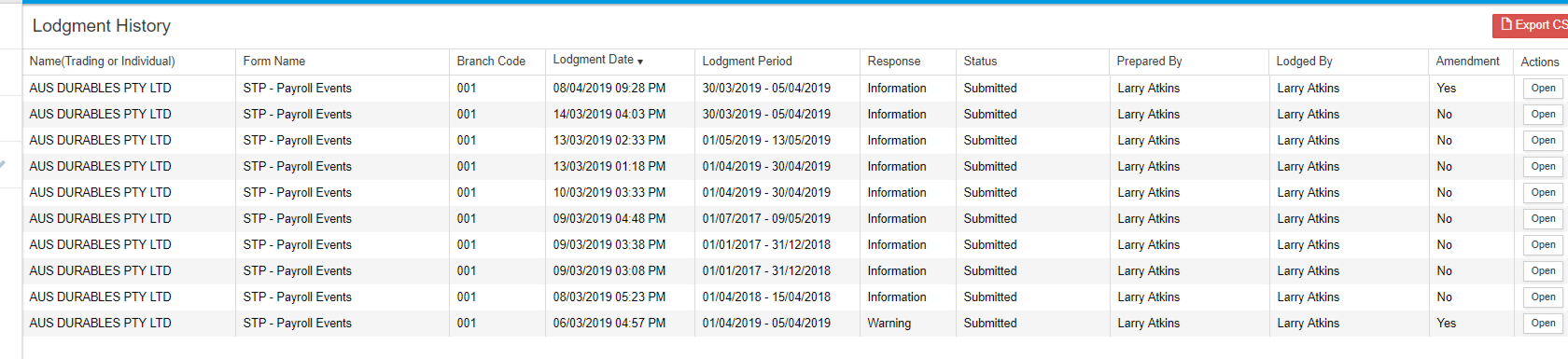

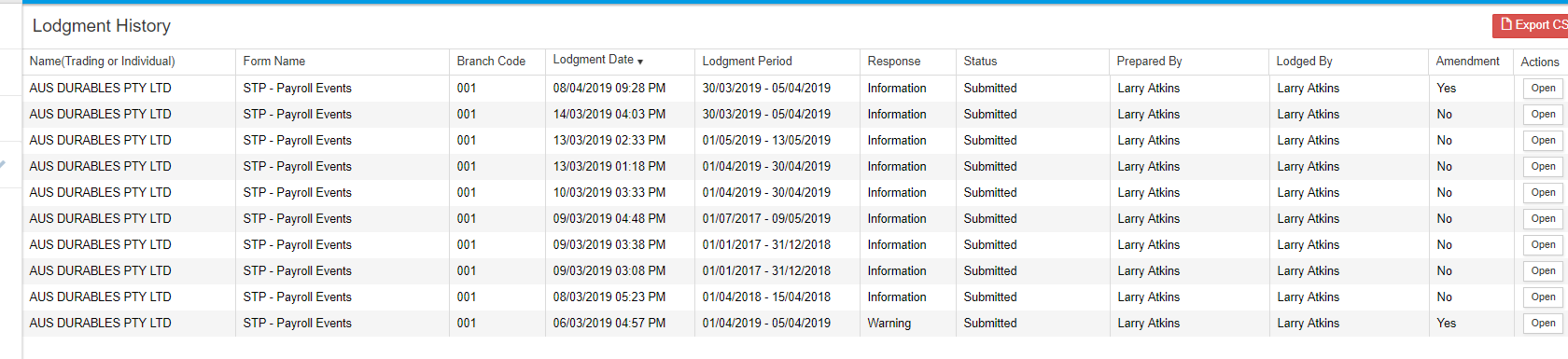

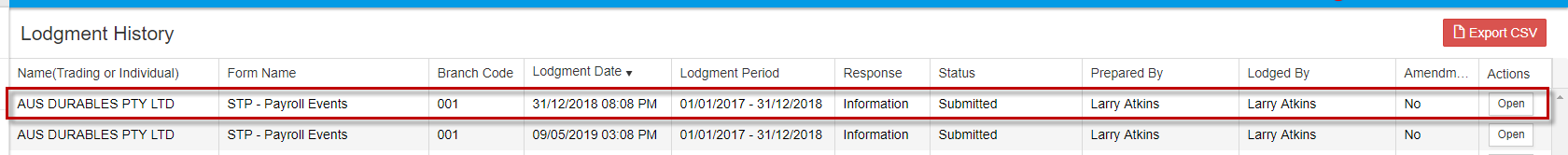

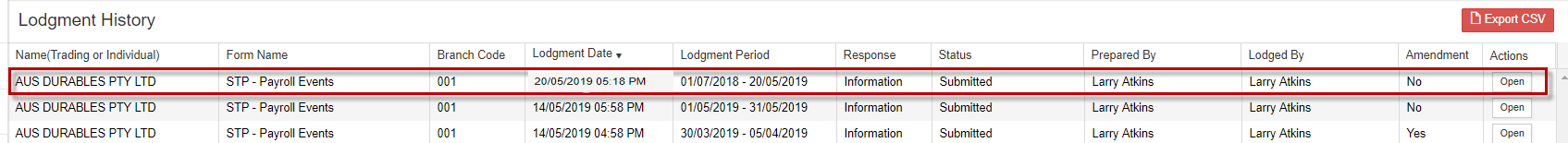

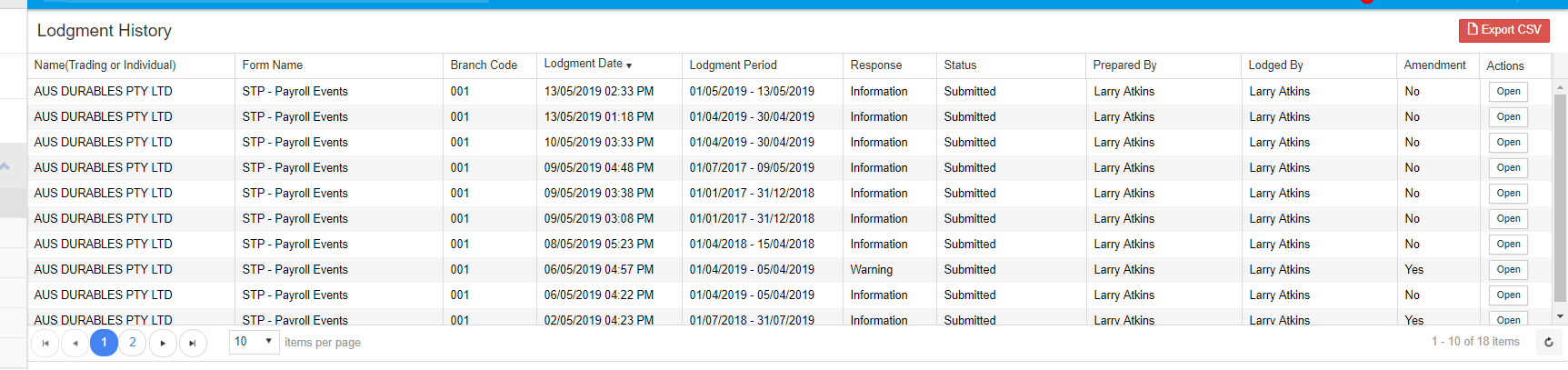

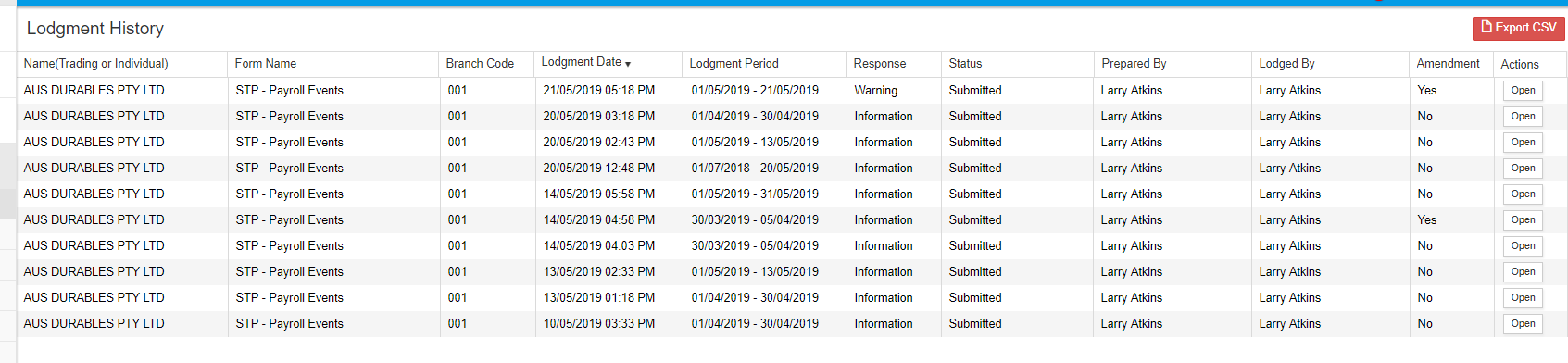

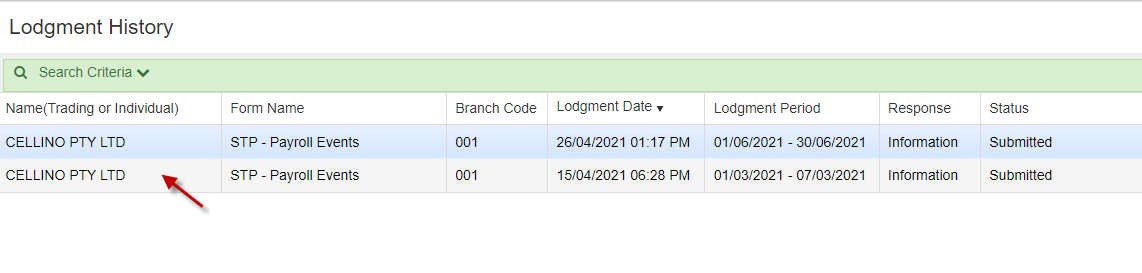

The lodgment request will be in queue. After some time, it can be found in "History" under "My Lodgments".

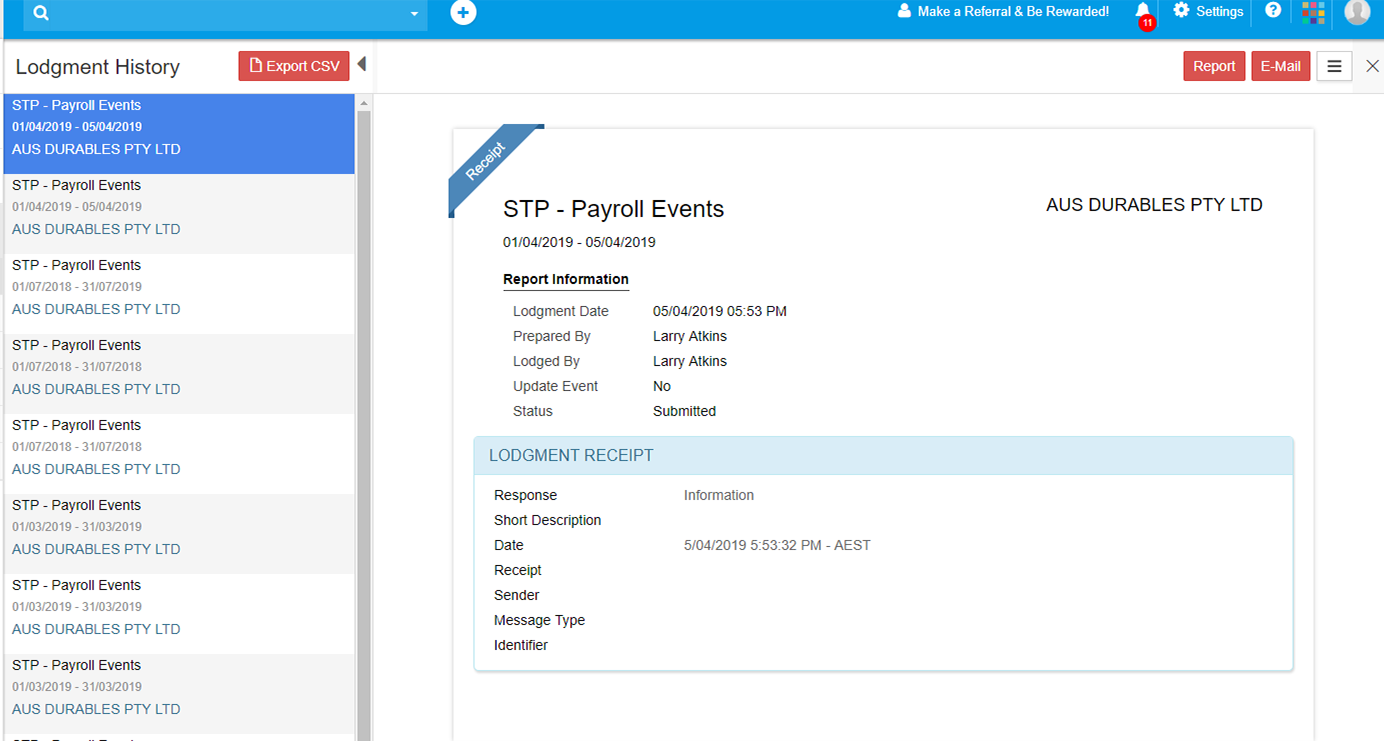

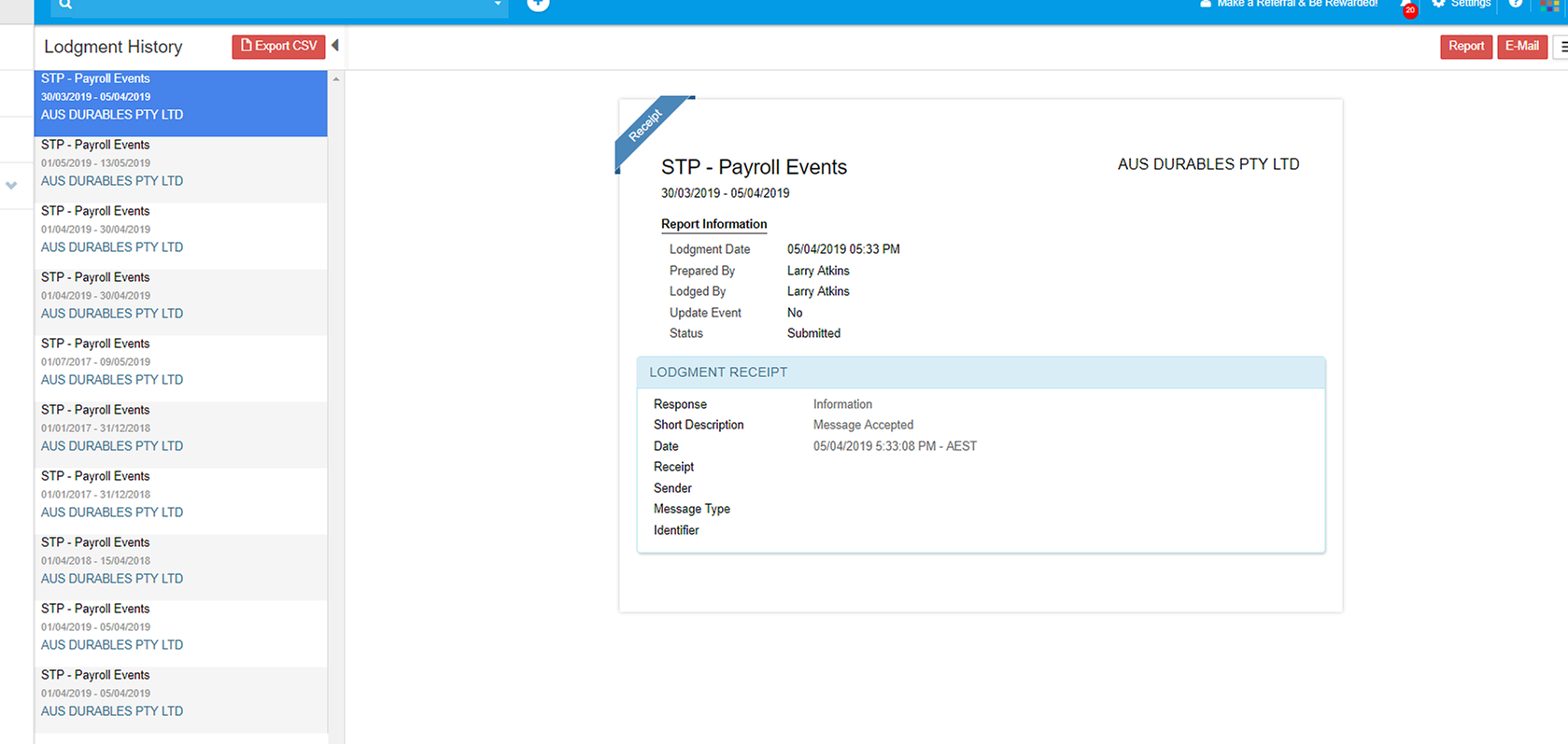

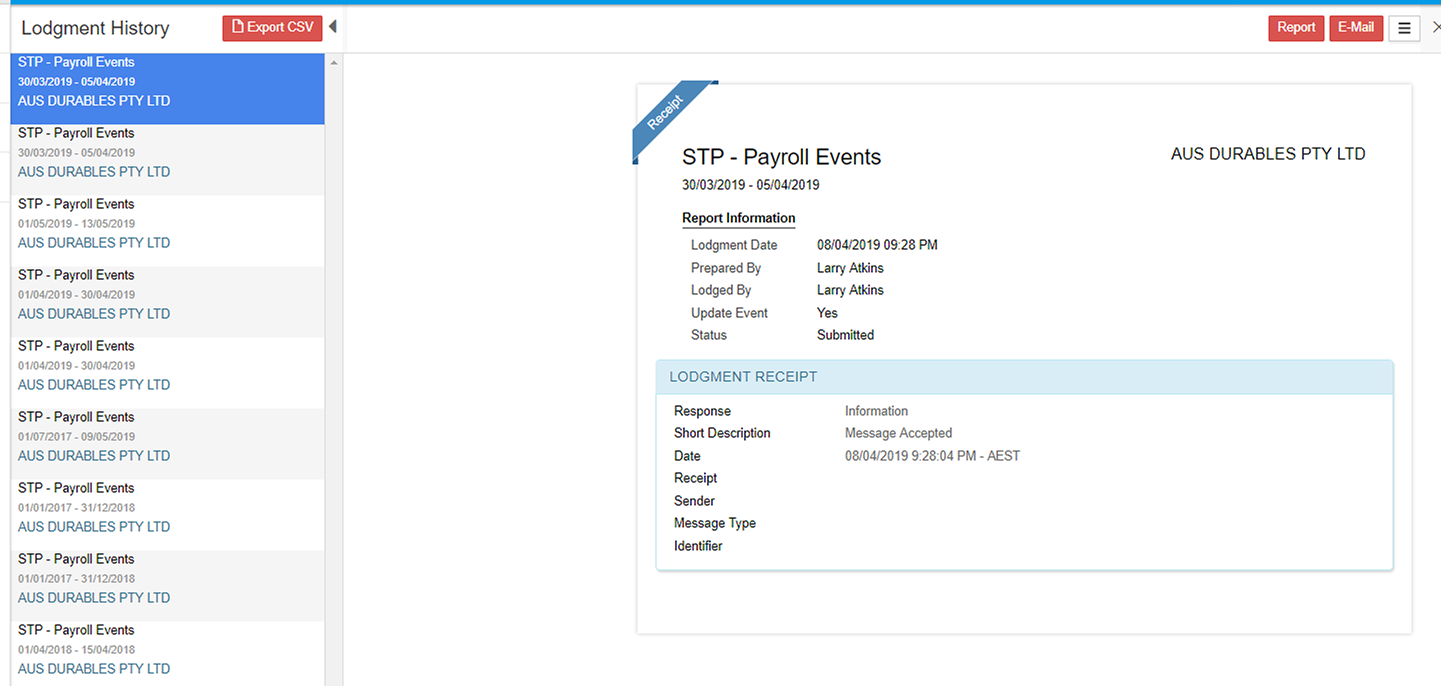

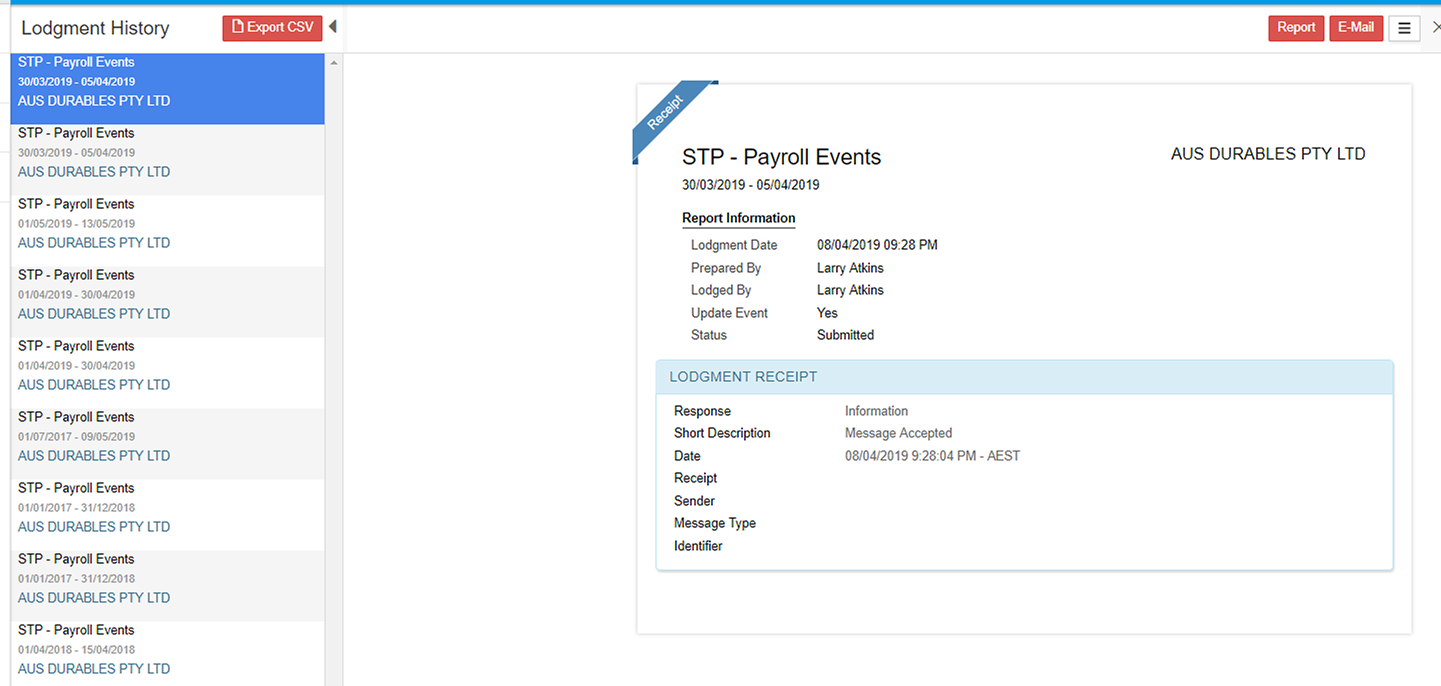

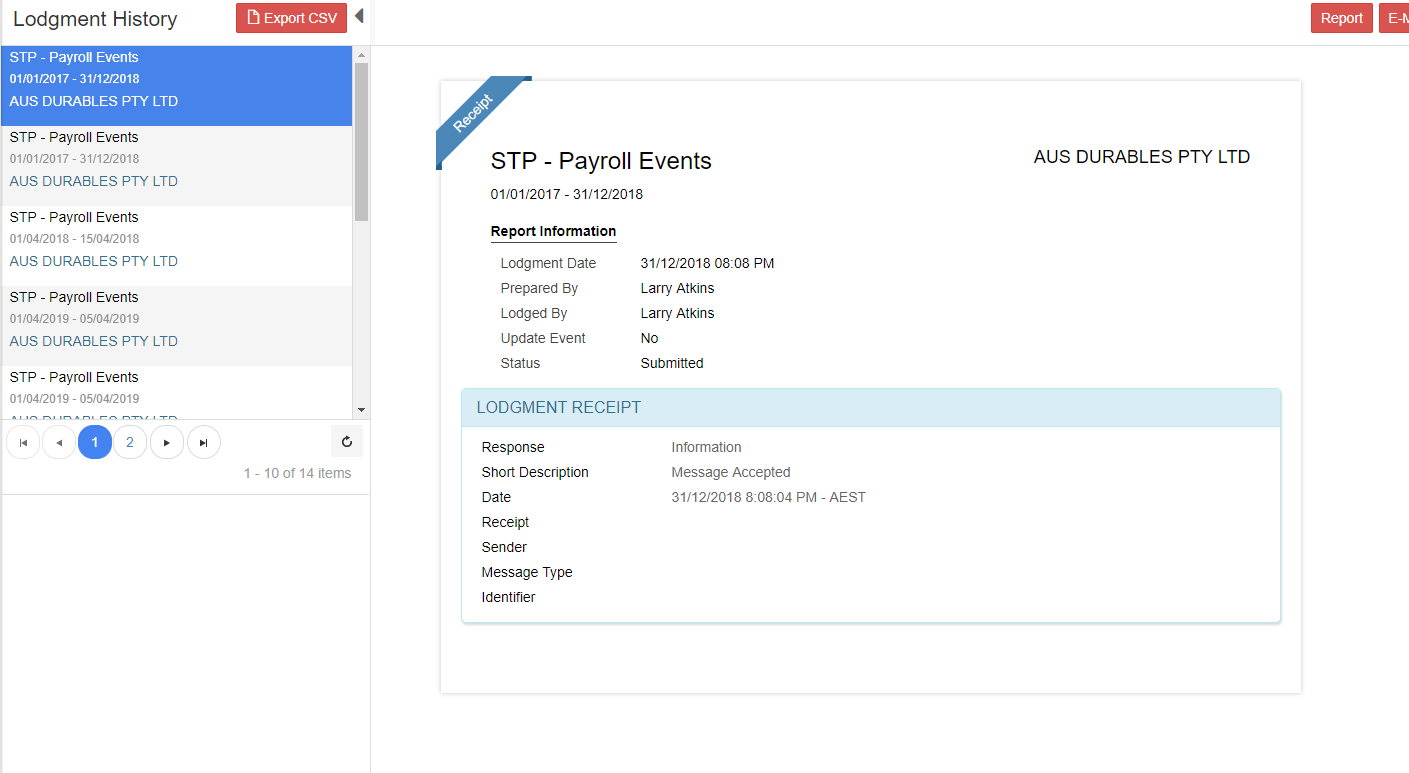

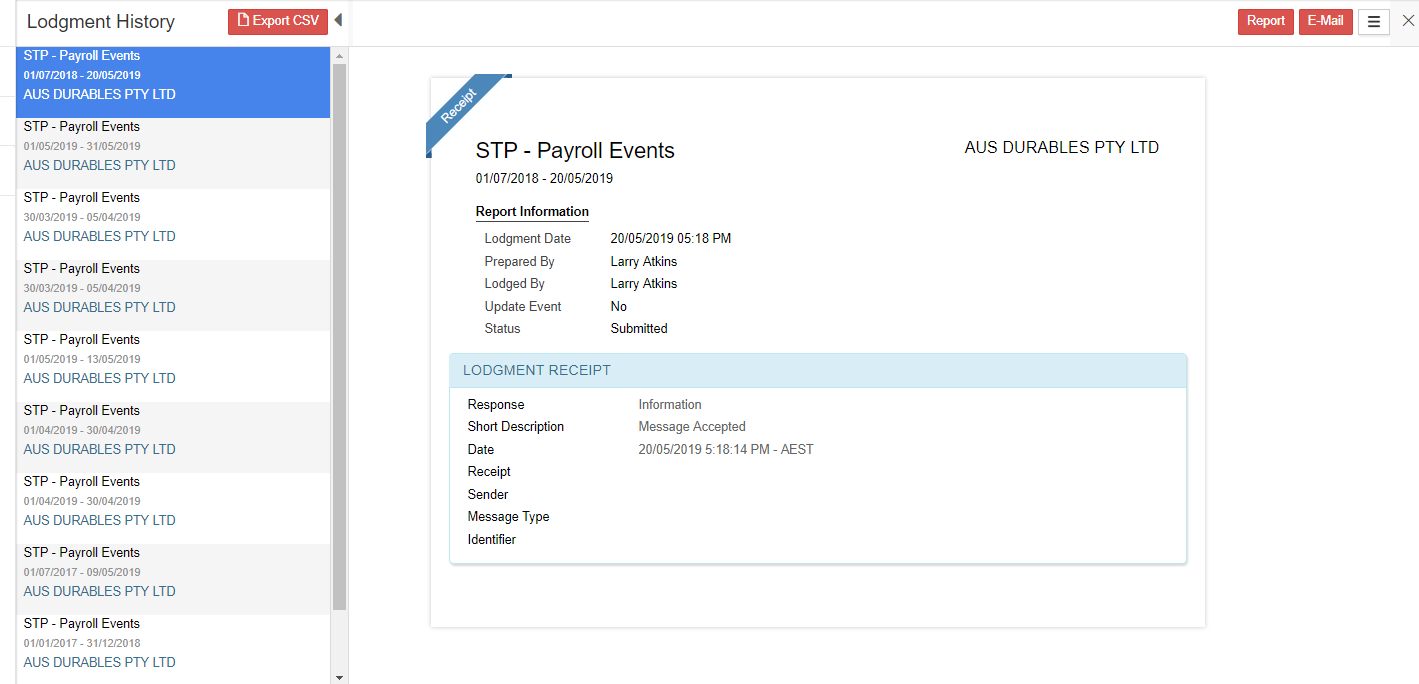

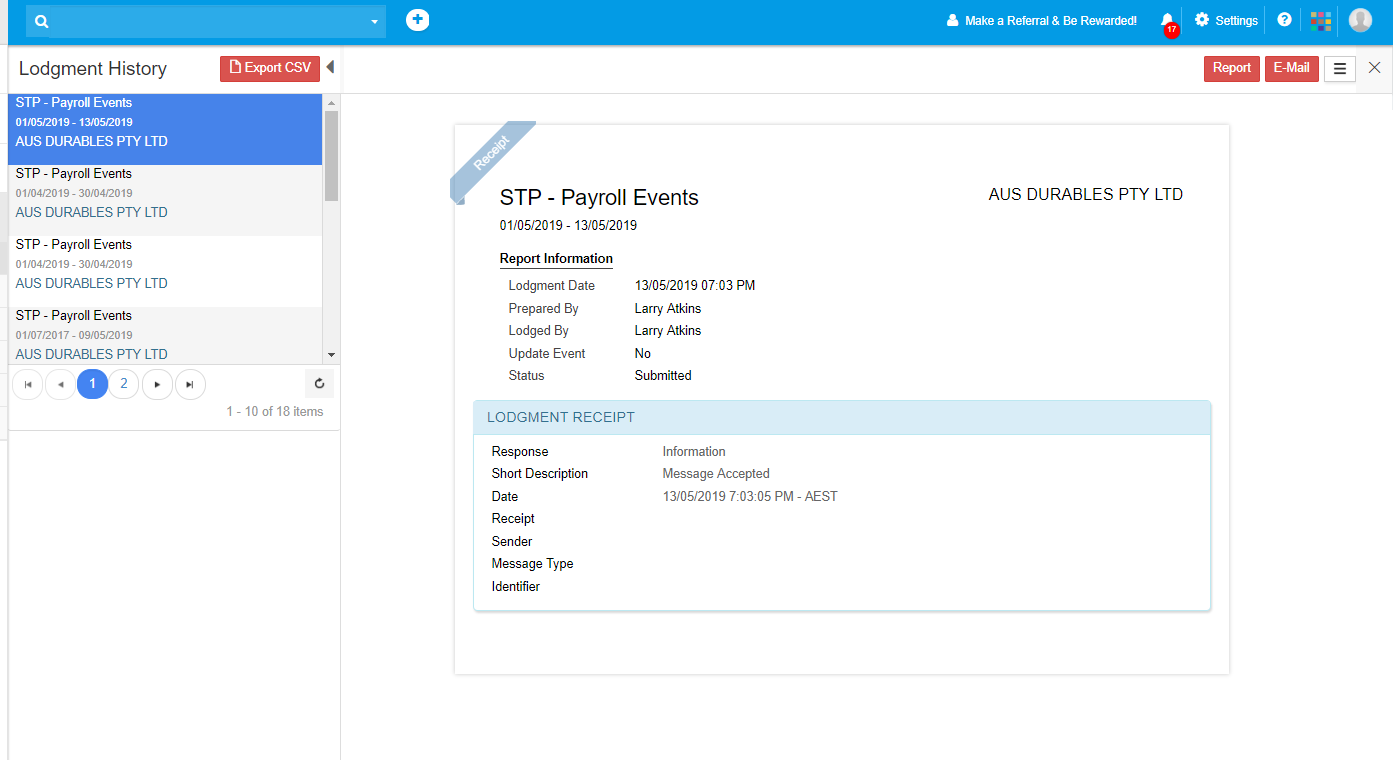

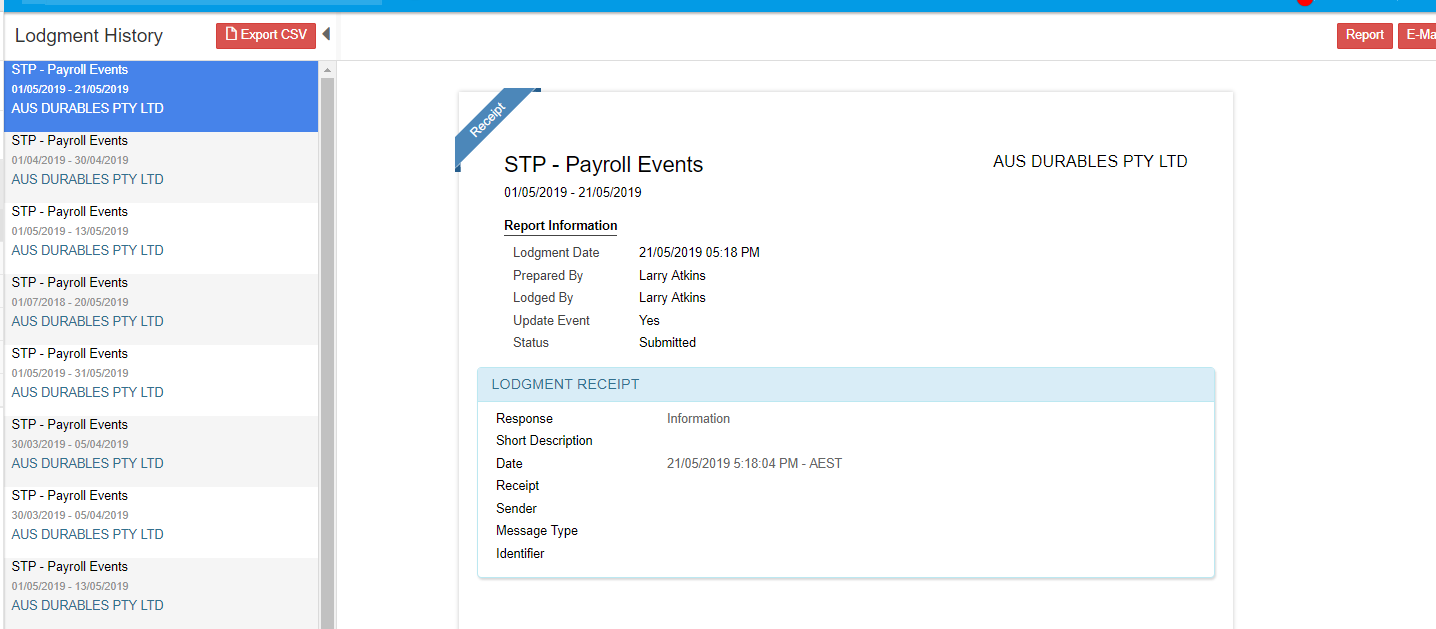

You can click on that lodgment and view the receipt.

-

Update Event

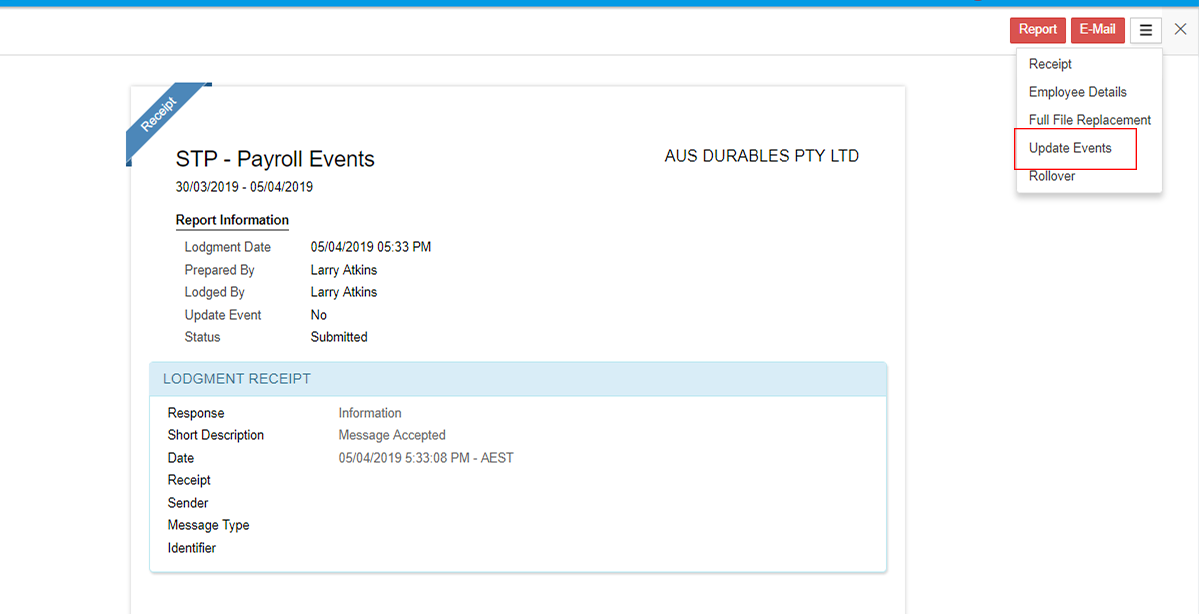

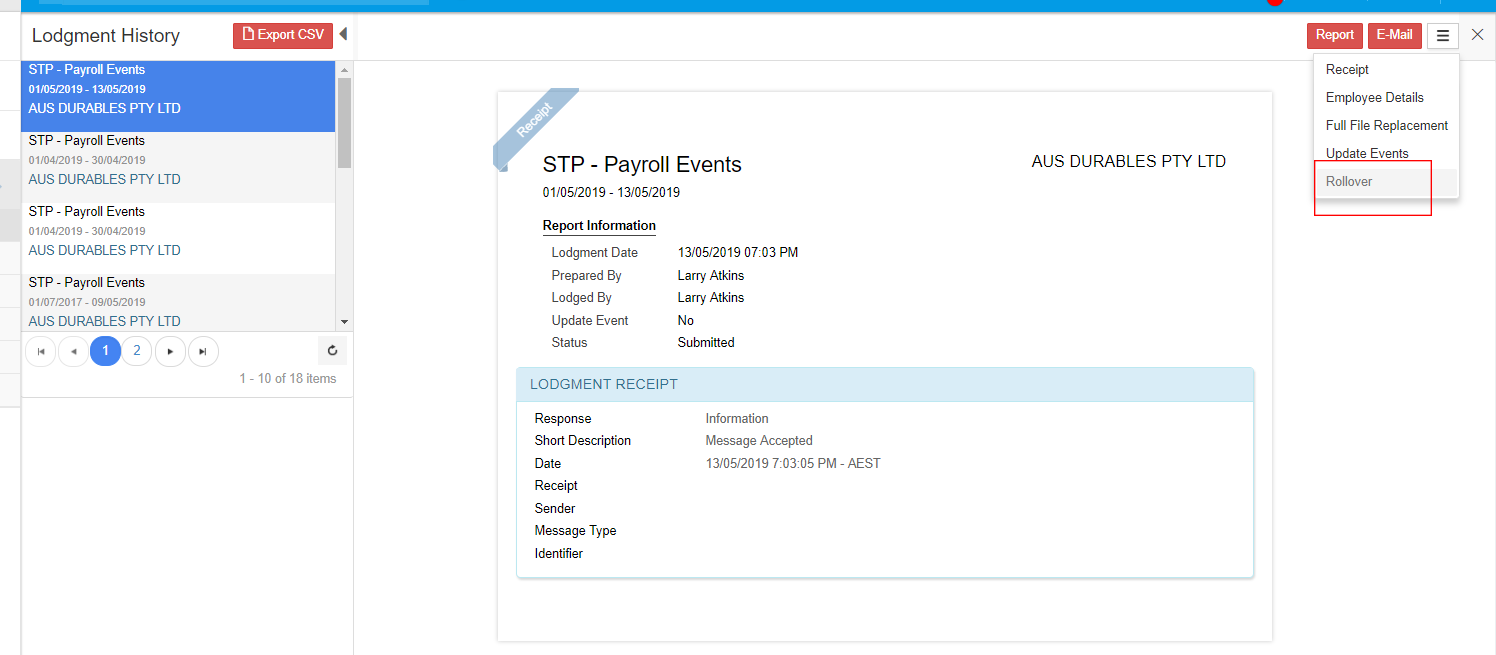

From the lodgment history, select the lodged receipt.

From the receipt screen, click on "More options" and click on "Update Event".

An update event is used to report changes to already lodged reports to the ATO.

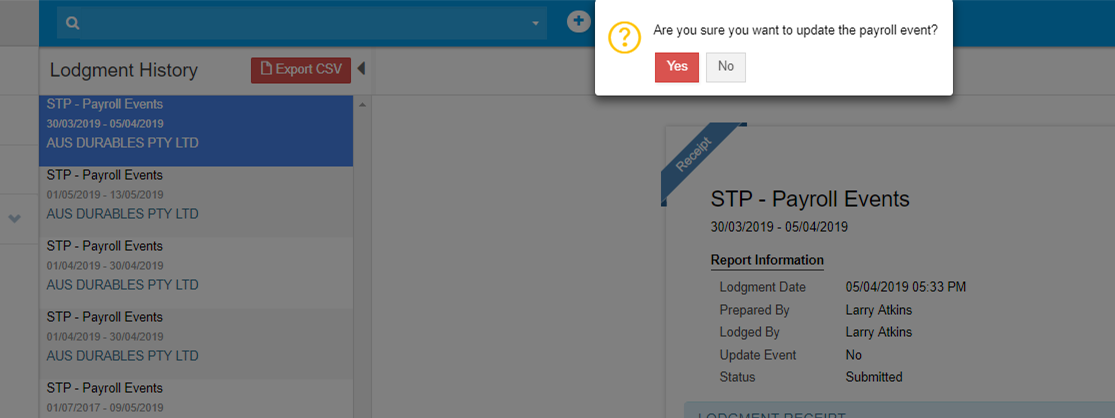

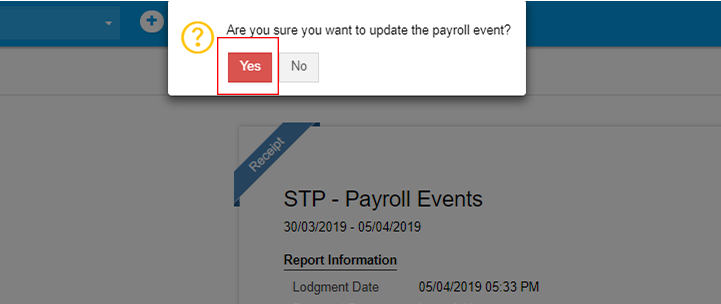

Click Yes to confirm.

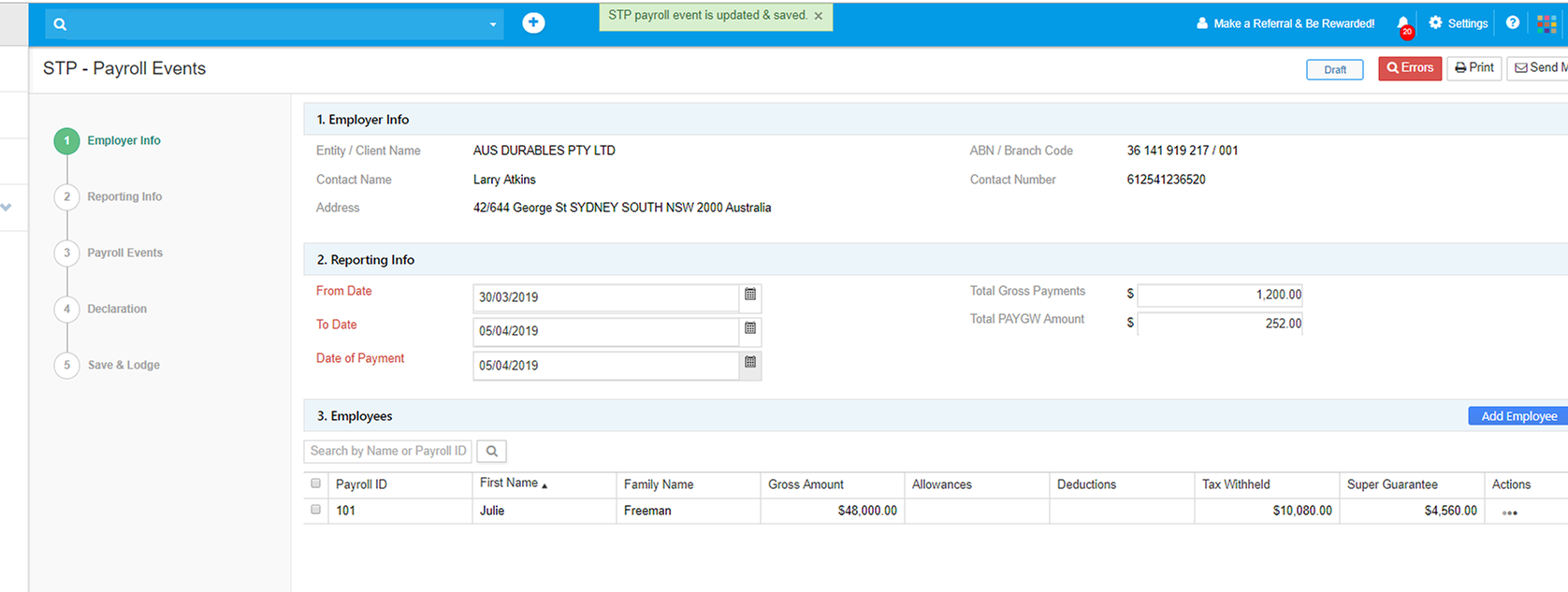

The Reporting Info fields will be pre-filled.

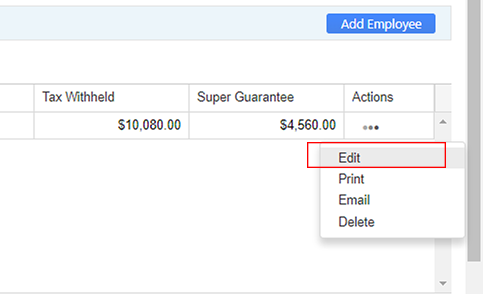

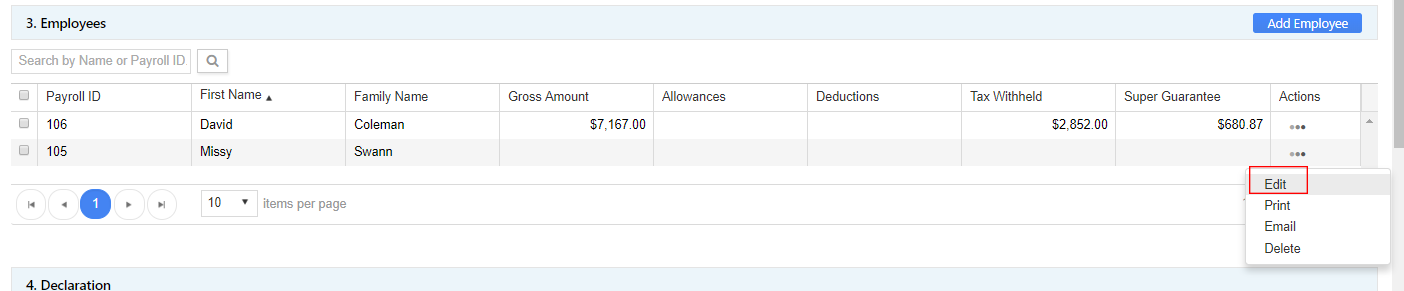

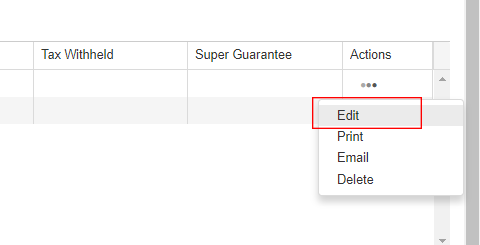

In the Employees section, locate an employee entry, under the field Actions, click on Edit.

The change for this particular employee is that "Allowances" amount has not been added in the previous lodgment.

The "Edit Employee" screen appears.

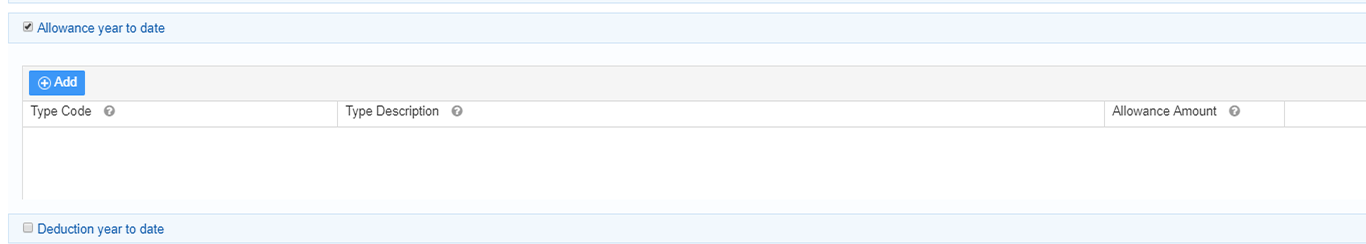

Click on the checkbox next to "Allowances". The fields related to Allowances pop-up.

Click on "Add" button to add allowance.

From the drop-down list, select the appropriate allowance and enter the allowance amount.

Click on "Save changes".

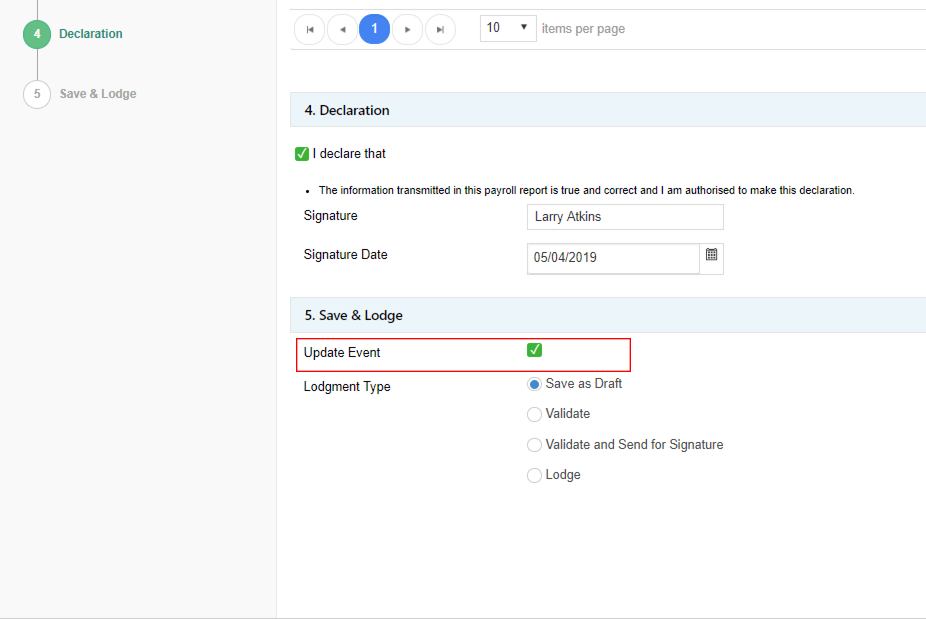

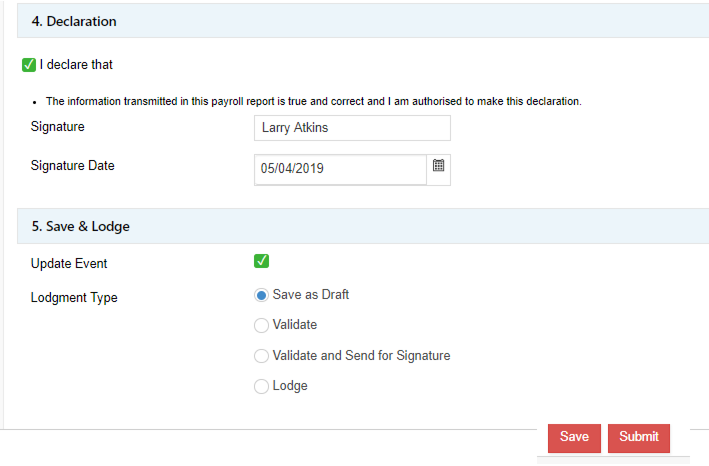

The payroll information is updated and hence the checkbox next to Update Event will be automatically checked.

Make a declaration and Save the payroll information.

Check for errors. If there are no errors, click on "Validate" radio button under "Save and Lodge" section and click on "Submit". Remember that you can only lodge forms that are in "Valid" status.

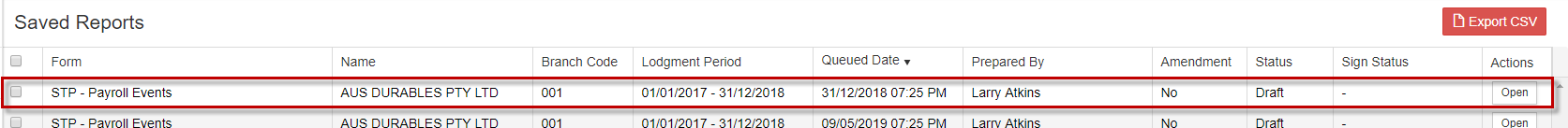

This is now redirected to "Saved Reports" screen. Please note that the Amendment column has "Yes". This means it is an "Update Event". You can see the column status shows "Valid".

Click on the checkbox next to the report and click on "Lodge Selected".

Confirm the lodgment. The lodgment request will be in queue and after sometime, it can be found in "History" under "My Lodgments".

Click on the lodgment to view the receipt. You can note that the receipt says it is an update event along with the date and time of lodgment.

-

Import from CSV file

Login to GovReports account. This is a Business account. In case of Tax or BAS Agent account, Client is used synonymously instead of Business.

From the menubar on the left, click on "My Business". "My Clients" in case of Agent's account.

Select a business/client where employee information is to be added.

On the business/client screen, click on "Forms" on the top right corner.

From the list of forms in the tab "ATO", click on "Select" next to "STP Payroll Events".

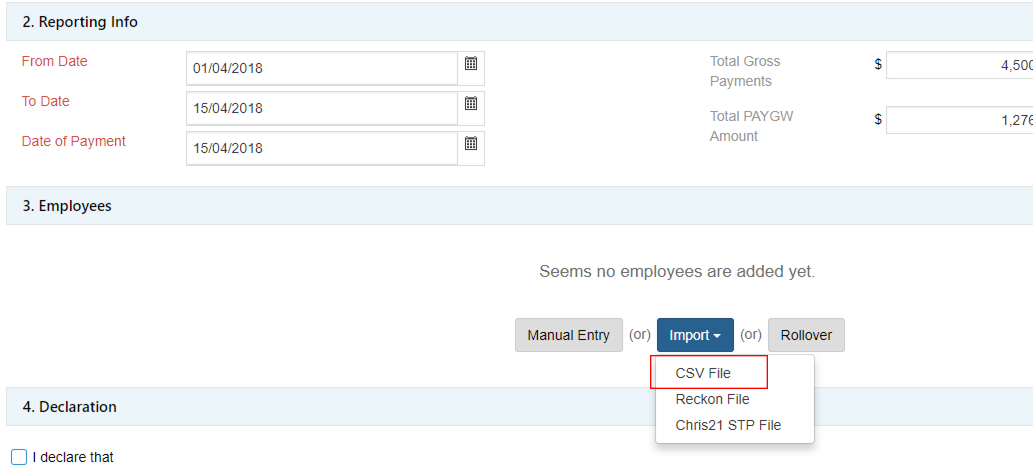

In the "Reporting Info" section, enter From date, To date and the Date of Payment.

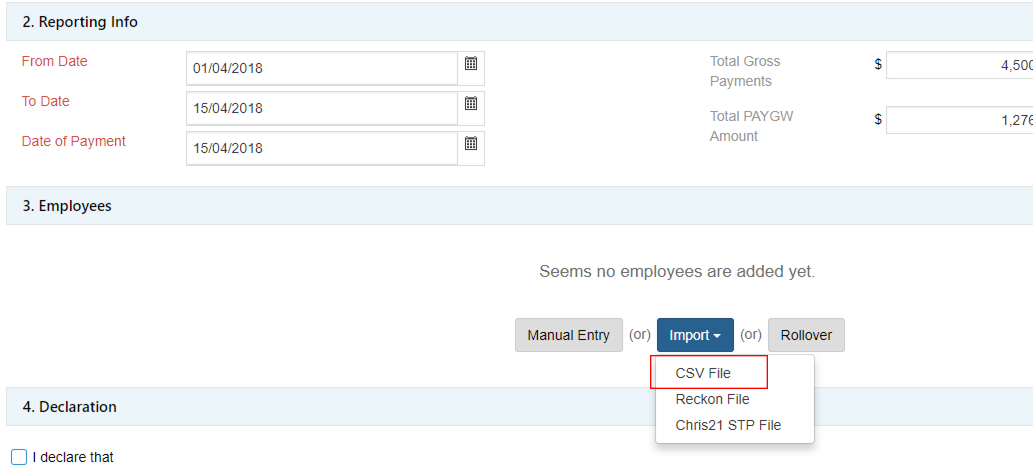

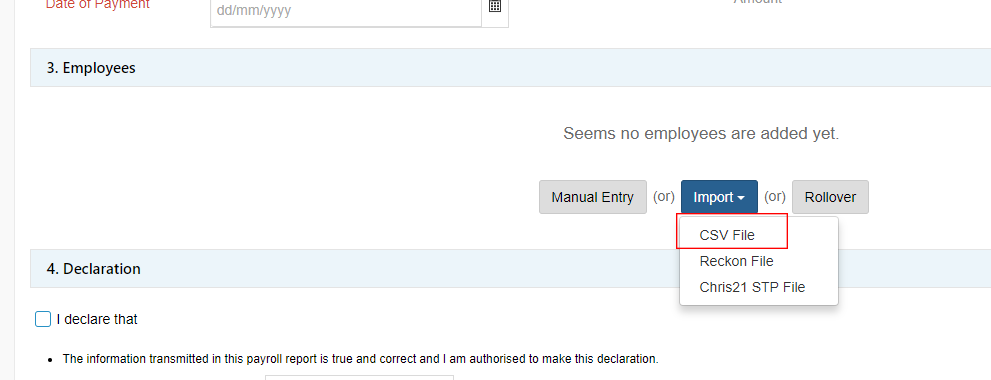

In the "Employees" section, click on Import-> CSV file.

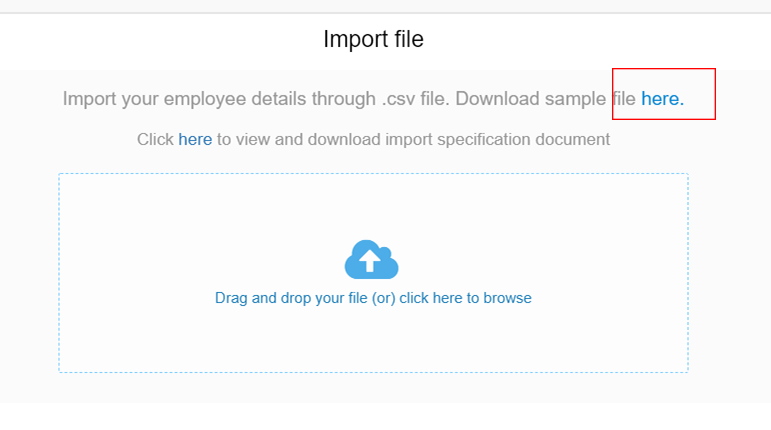

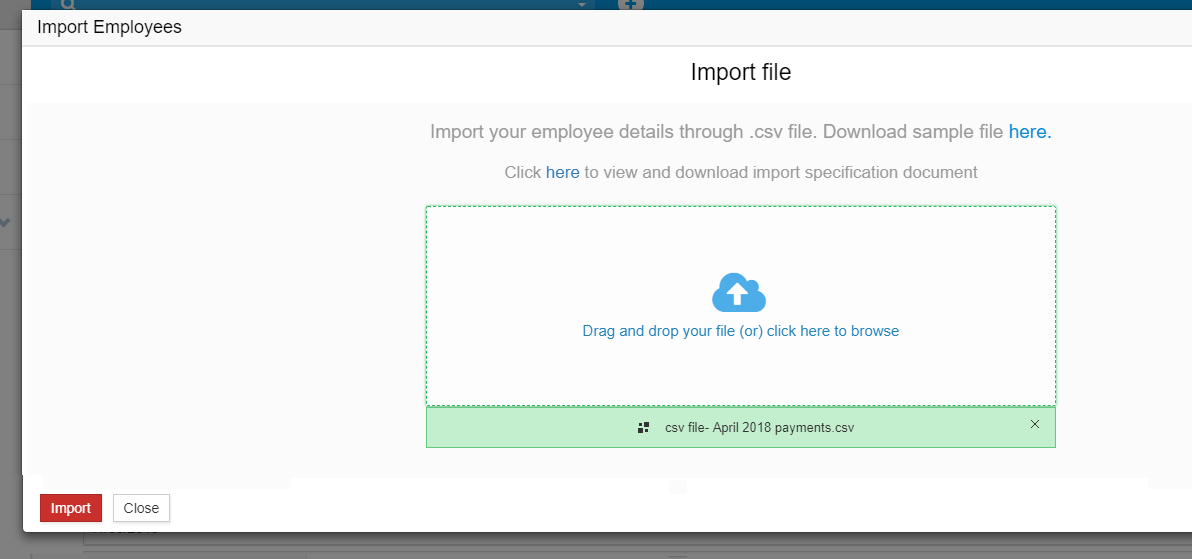

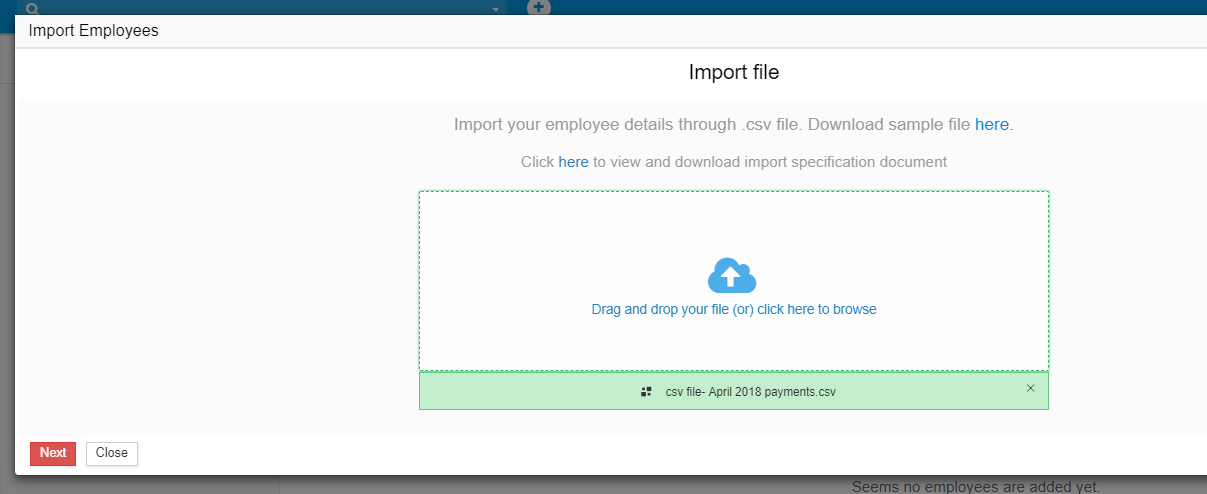

The Import Employees screen appears. Click on the "Sample file".

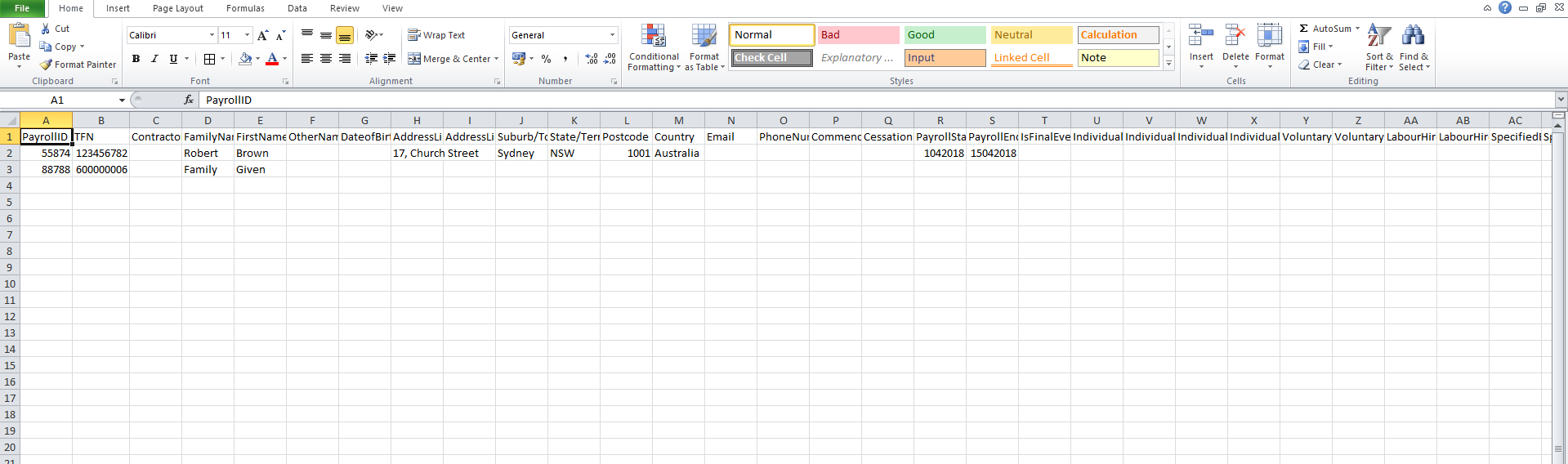

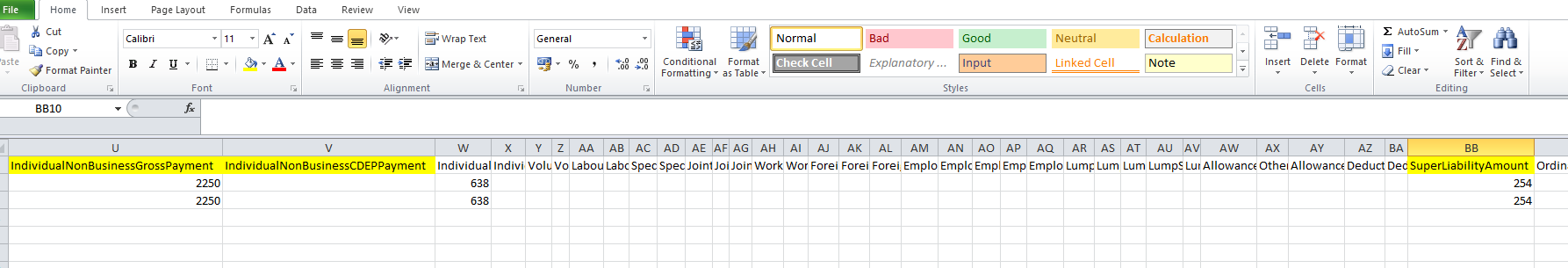

The Sample CSV file has employee entries. The employees entries to be imported as CSV file must be in the this format.

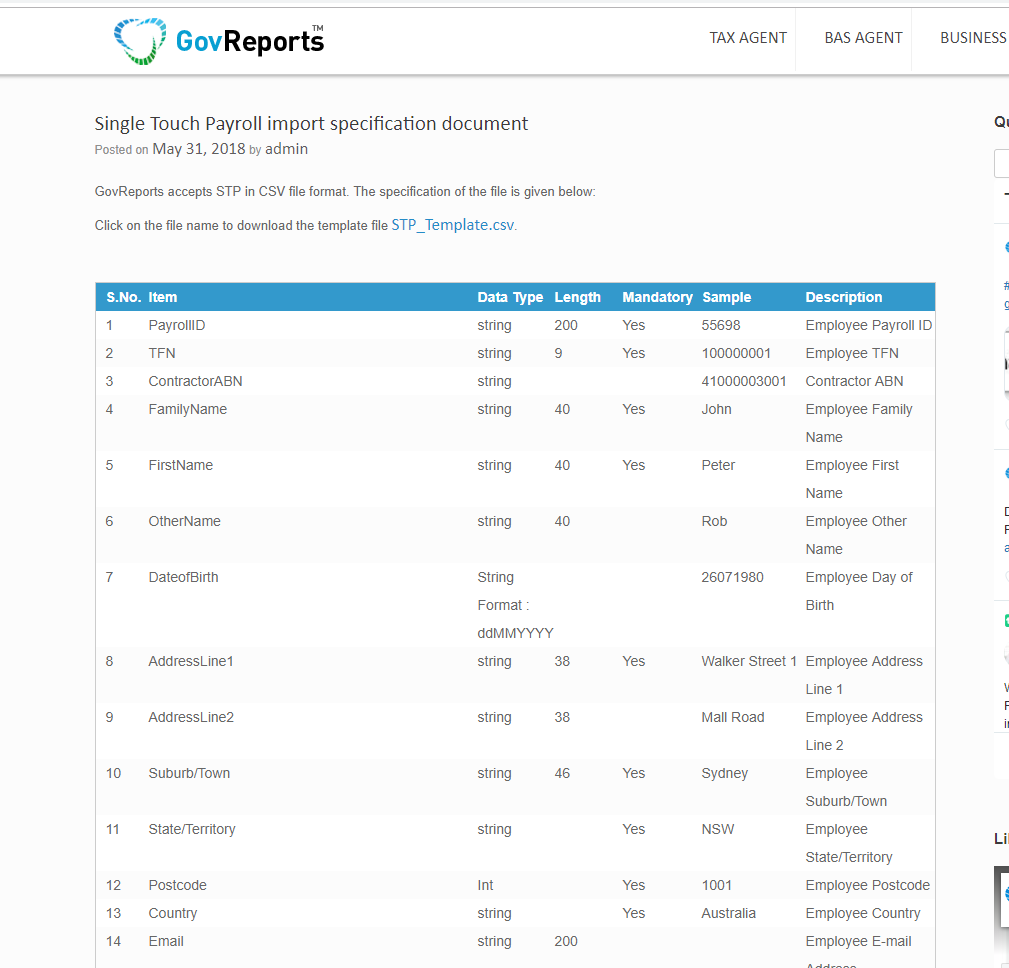

You can view the the Import Specification document. This gives the field names, the data type, whether it is mandatory and its description. An overview of the fields helps to determine the importance of each field.

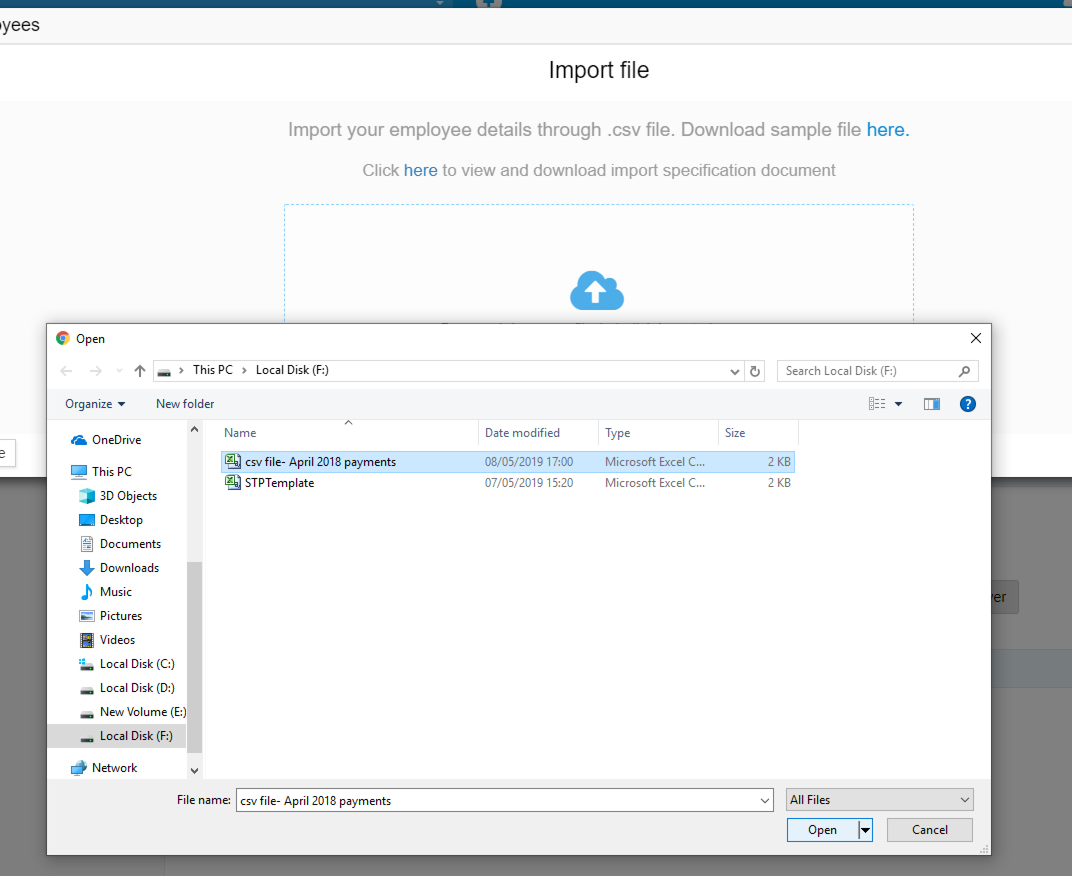

Click on "Drag and drop your file (or) click here to browse".

Select the CSV to be imported. Make sure that the Year To Date values of gross pay, tax withheld and Super Liablility amount is entered for all the employee entries in the CSV file. Please note that Year to Date values must be entered for all the applicable fields in the CSV file.

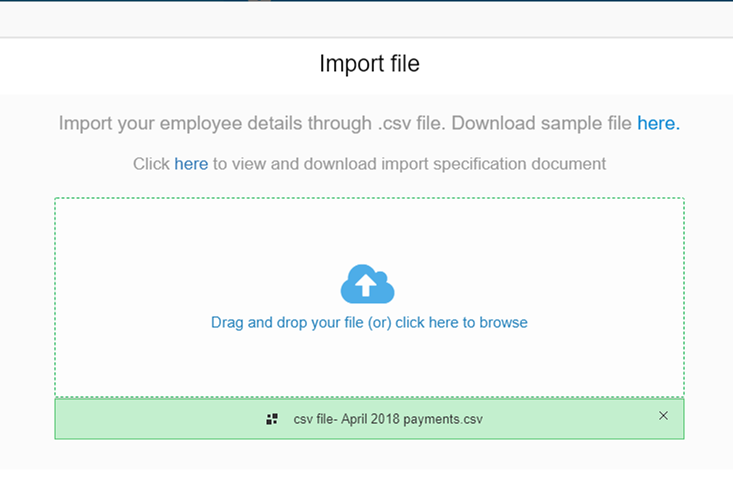

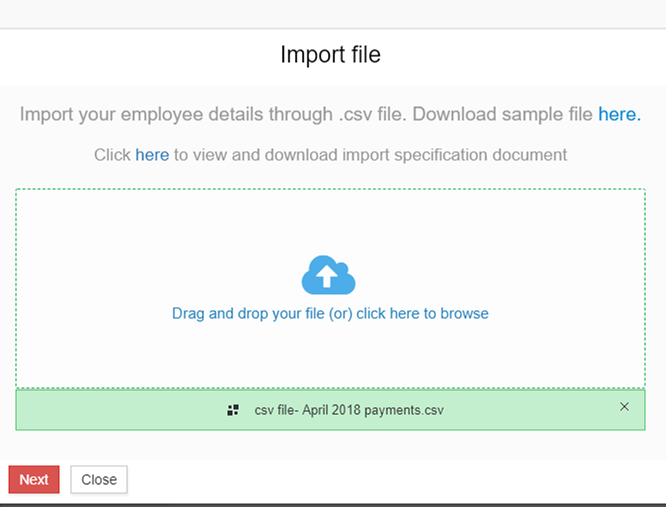

The CSV file will be uploaded. Click on "Next".

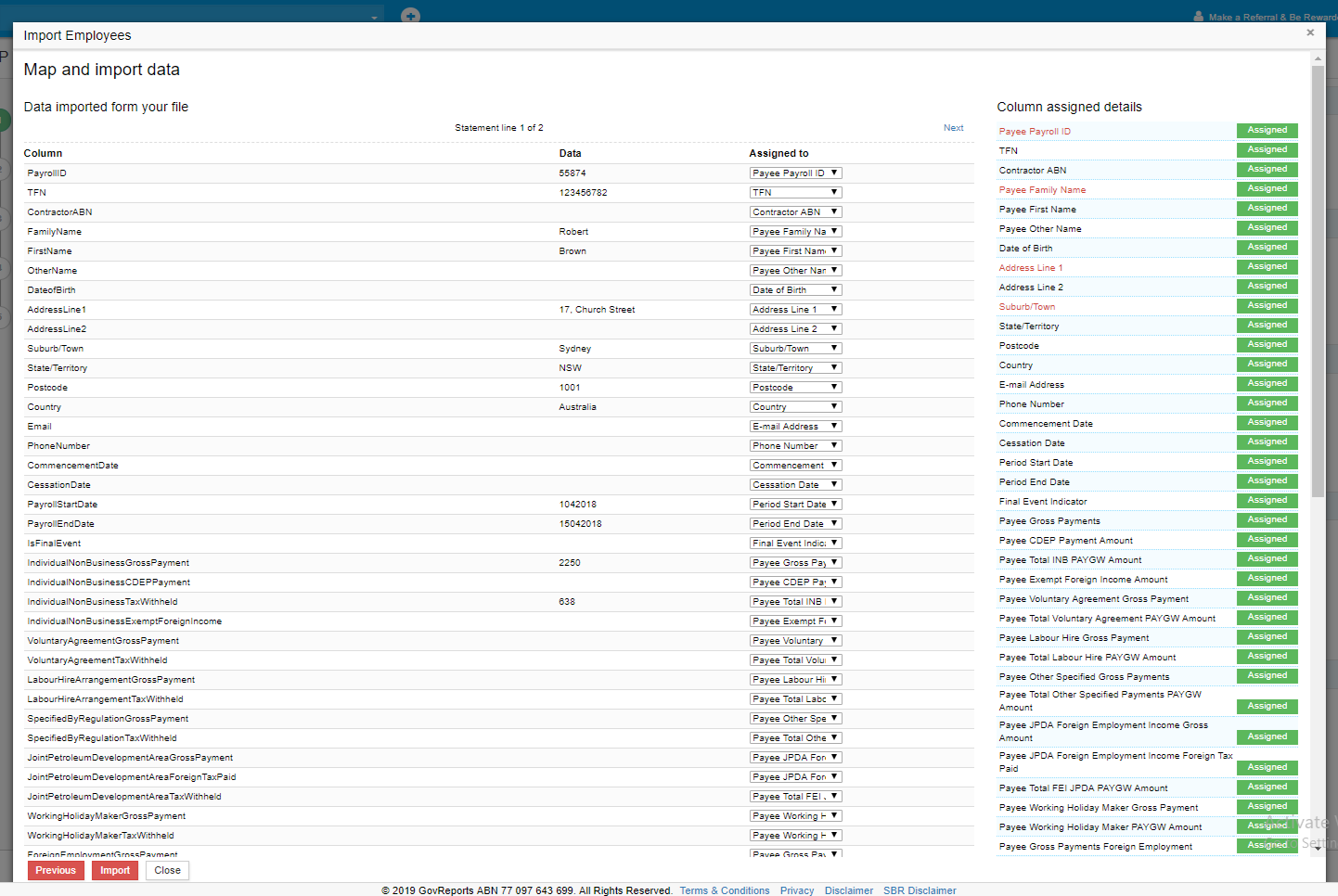

Review the fields and the mapping. Click on "Import".

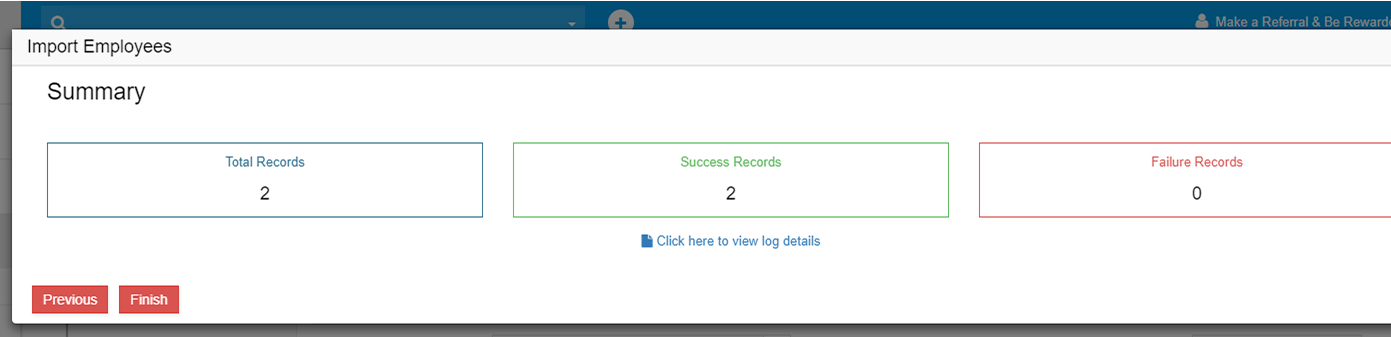

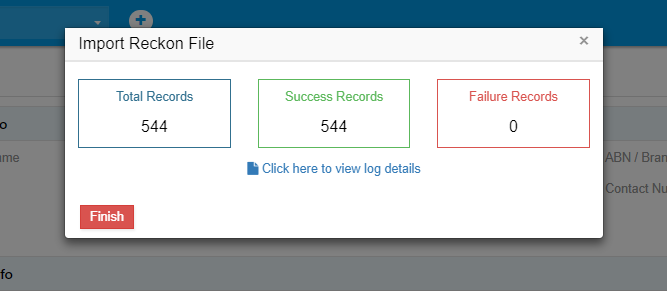

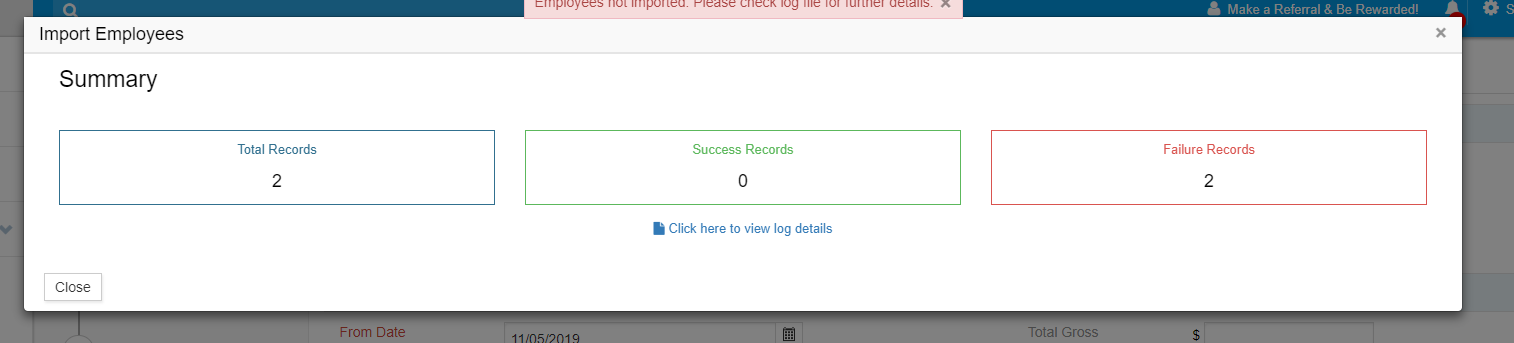

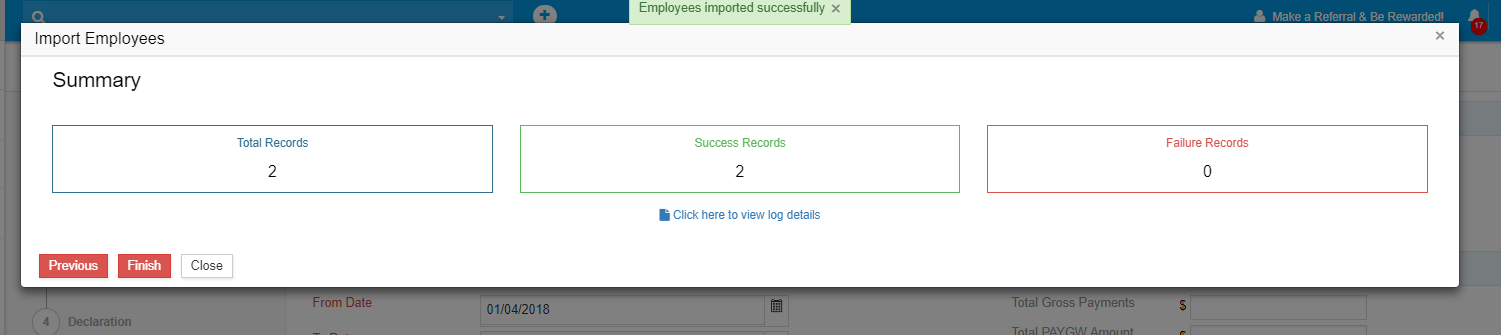

You can view the Summary which tells the total records, of which 2 are successful and there no failure records. You can click on "view log details" to view additional information in case if there are failure records. Click on "Finish".

Make a declaration and click on "Save".

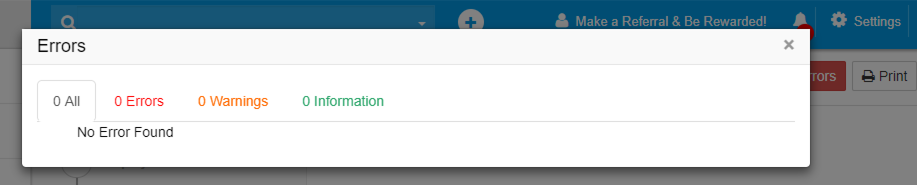

After the payroll details are saved, click on "Errors" on the top right corner.

If there are no errors, click on "Validate" and Submit. Remember that you can only lodge forms that are in "Valid" status.

The validated payroll information will be under "Saved Reports" and redirected to "Saved Reports" screen automatically. You can see the column, "Status" shows "Valid".

Click on the checkbox next to this report and click on "Lodge Selected" button.

Confirm to lodge the report.

The lodgment request will be in queue. After some time, it can be found in "History" under "My Lodgments".

You can click on that lodgment and view the receipt.

-

Import from Reckon

Login to GovReports account. This is a Business account. In case of Tax or BAS Agent account, Client is used synonymously instead of Business.

From the menubar on the left, click on "My Business". "My Clients" in case of Agent's account.

Select a business/client where employee information is to be added.

On the business/client screen, click on "Forms" on the top right corner.

From the list of forms in the tab "ATO", click on "Select" next to "STP Payroll Events" .

In the "Reporting Info" section, enter From date, To date and Date of Payment.

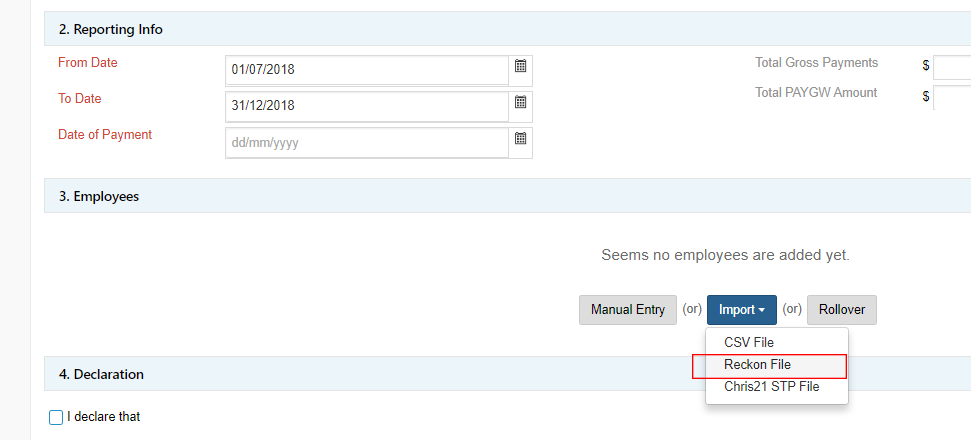

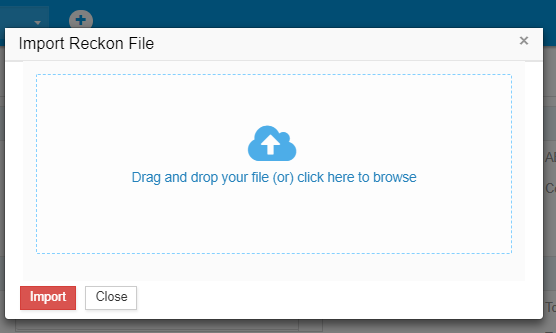

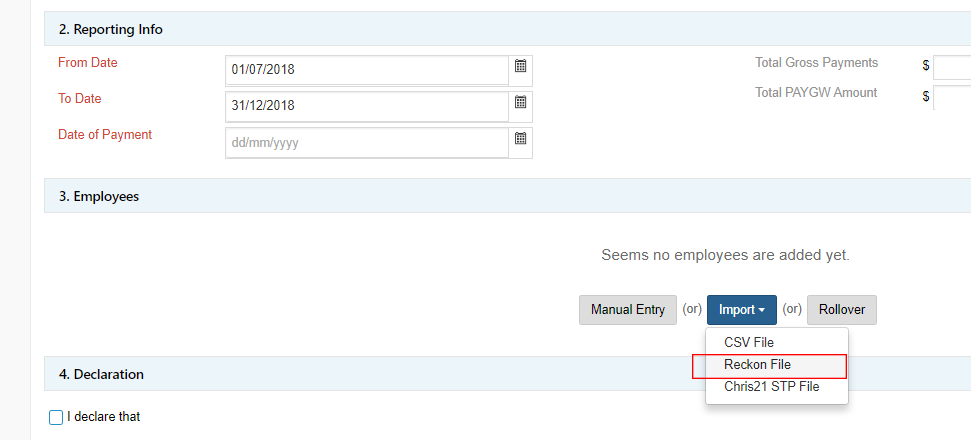

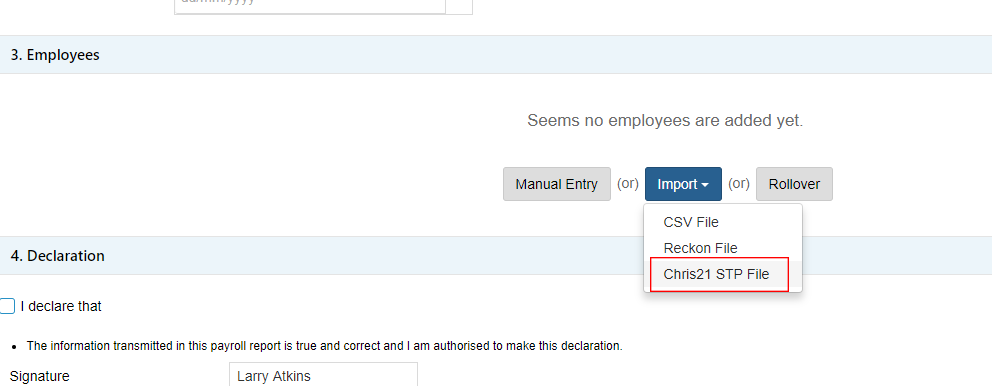

In the "Employees" section, click on Import-> Reckon file.

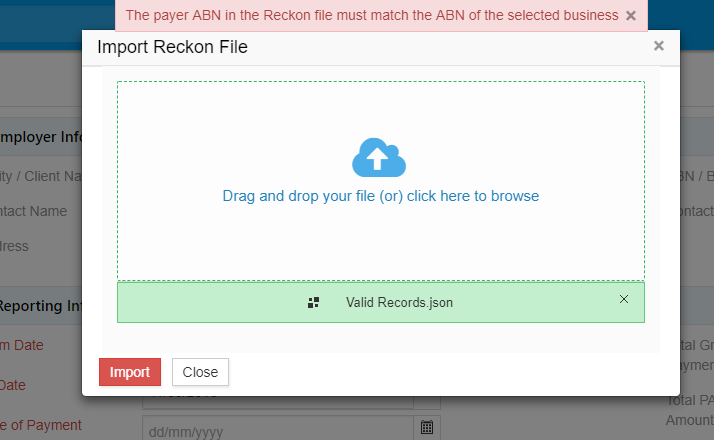

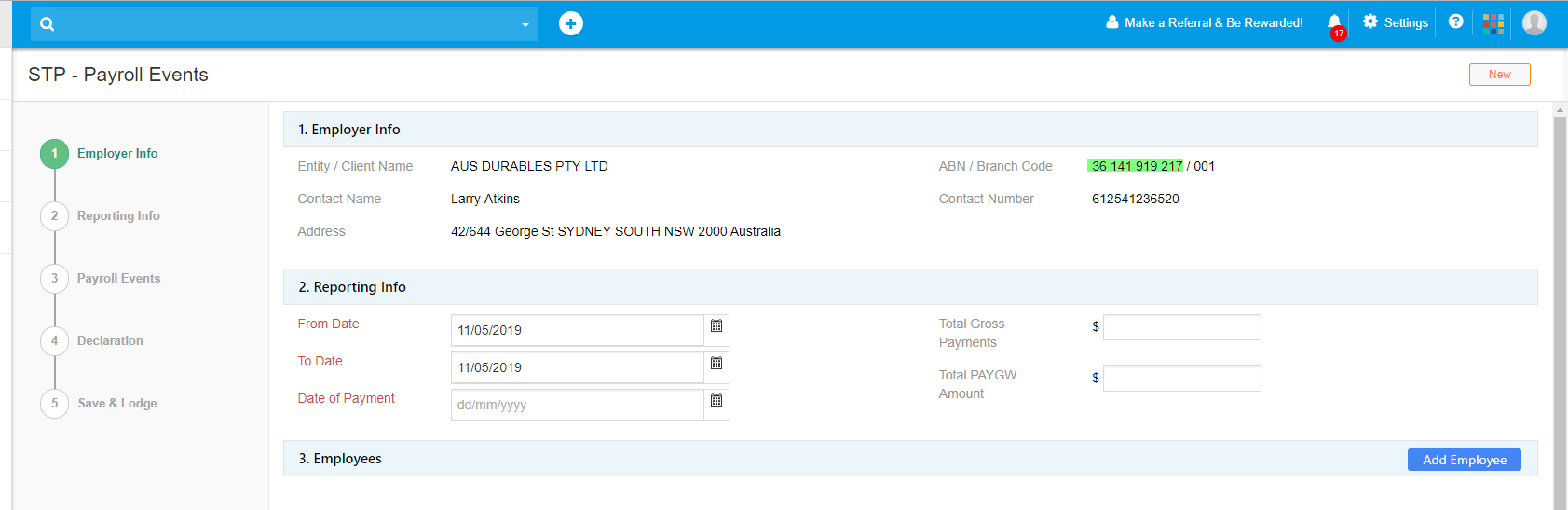

Make sure that The payer ABN in the Reckon file must match the ABN of the Employer given above.

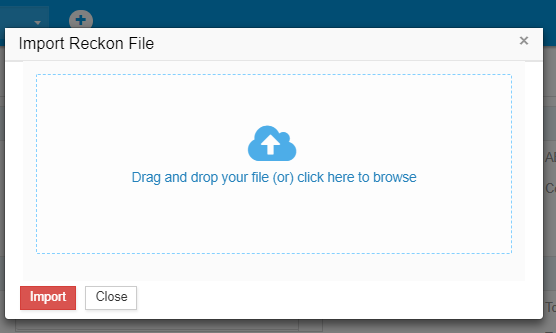

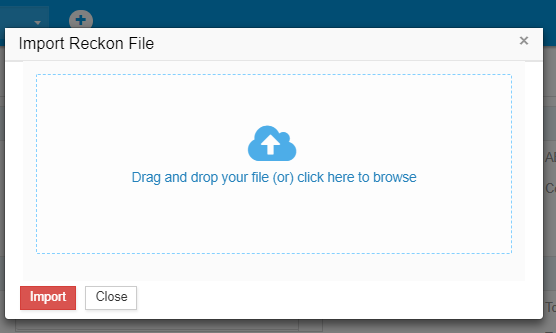

Click on "Drag and drop your file (or) click here to browse".

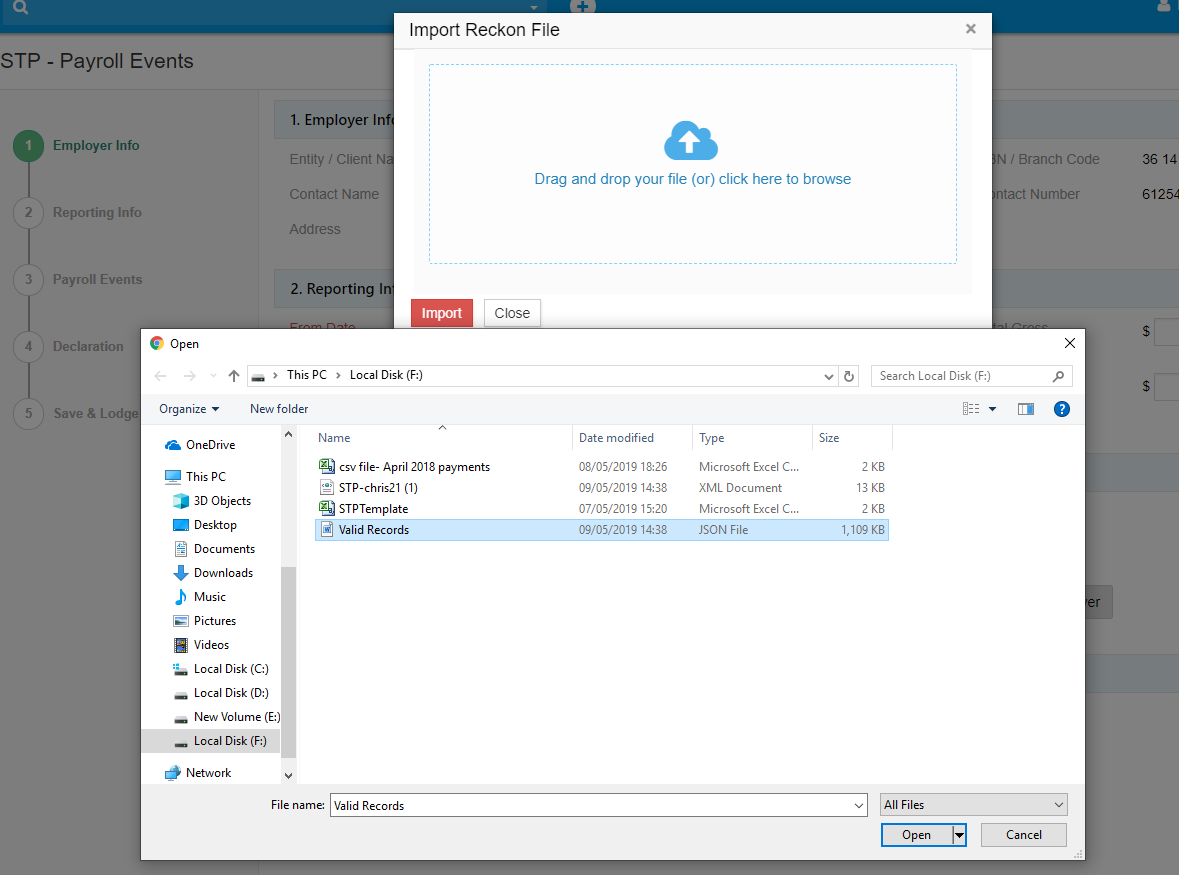

Select the Reckon file to be imported. Make sure that the gross pay, tax withheld and one among Super Liablility or Ordinary Time Earnings amount is present in all the entries. Allowances and Deductions are optional. Click on "Import".

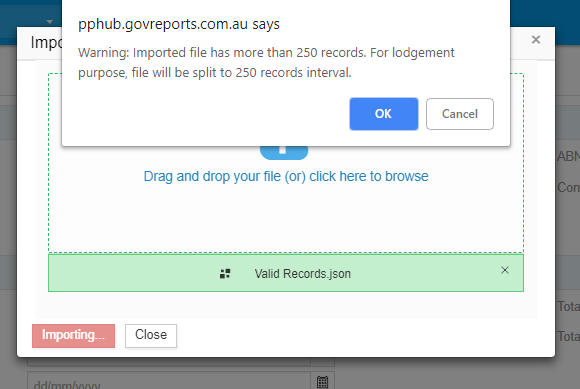

If there are more than 250 records, the file will be split to 250 records interval. Click on "Ok".

You can view the Summary which tells the total records, of which 544 are successful and there no failure records. You can click on "view log details" to view additional information in case if there are failure records. Click on "Finish".

You will be redirected to "Saved Reports". Click on that report. The report is in draft status. It must be validated before lodgment. On the top right corner, click on "Edit" button.

The "STP-Payroll Events" screen appears.The Date of Payment, Total Gross Payments and Total PAYGW Amount will be prefilled based on the imported data.

Make a declaration and click on "Save".

After the payroll details are saved, click on "Errors" on the top right corner.

If there are no errors, click on "Validate" and Submit. Remember that you can only lodge forms that are in "Valid" status.

The validated payroll information will be under "Saved Reports" and redirected to "Saved Reports" screen automatically. You can see the column, "Status" shows "Valid".

Click on the checkbox next to this report and click on "Lodge Selected" button.

Confirm to lodge the report.

The lodgment request will be in queue. After some time, it can be found in "History" under "My Lodgments".

You can click on that lodgment and view the receipt.

-

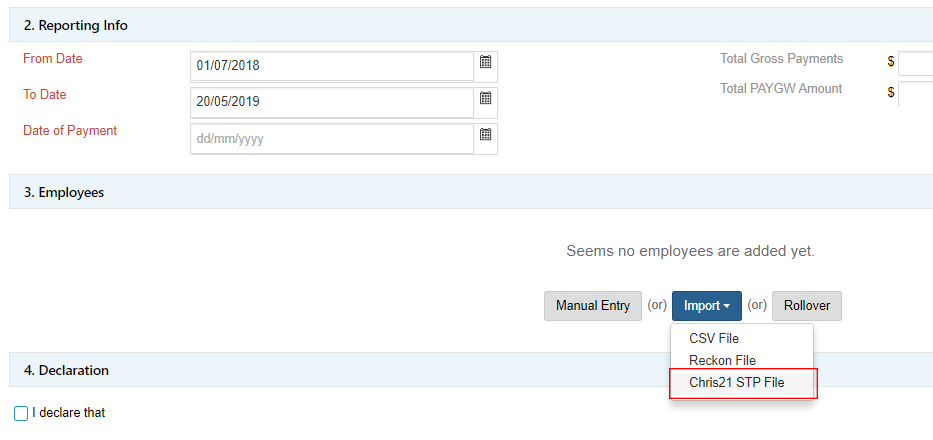

Import from Chris 21

Login to GovReports account. This is a Business account. In case of Tax or BAS Agent account, Client is used synonymously instead of Business.

From the menubar on the left, click on "My Business". "My Clients" in case of Agent's account.

Select a business/client where employee information is to be added.

On the business/client screen, click on "Forms" on the top right corner.

From the list of forms in the tab "ATO", click on "Select" next to "STP Payroll Events".

In the "Reporting Info" section, enter From date, To date and Date of Payment.

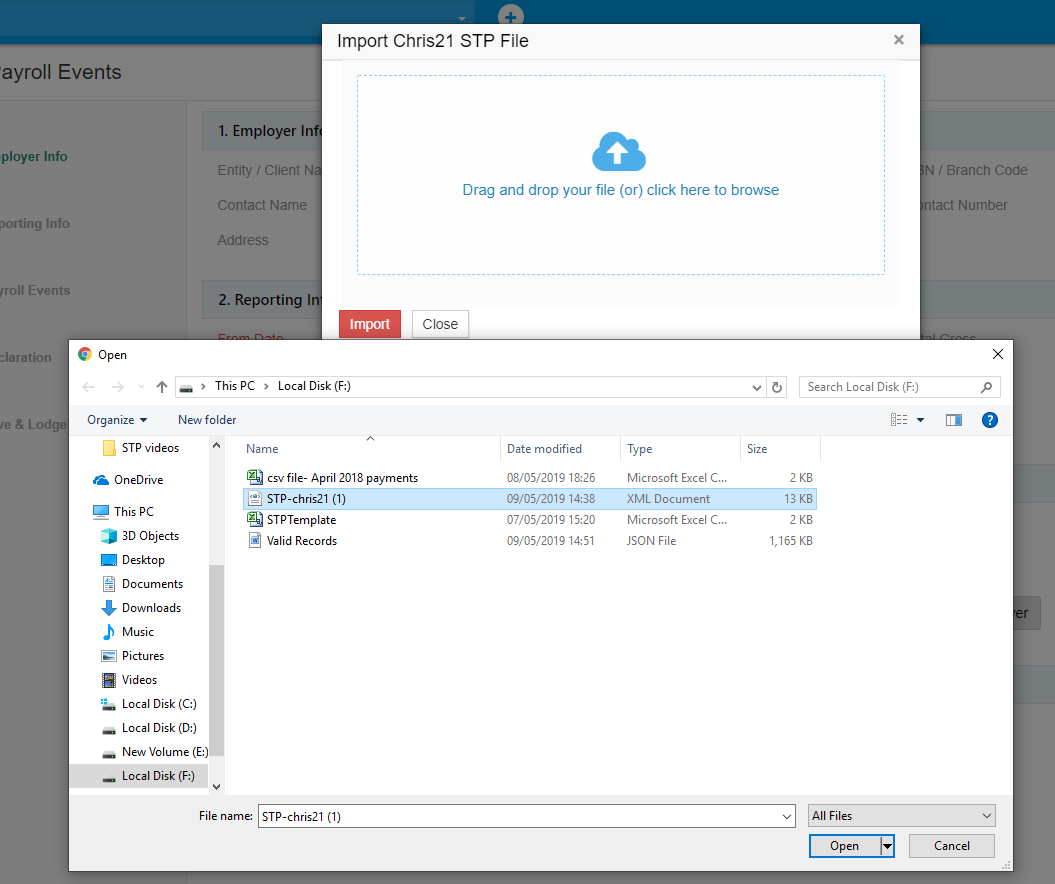

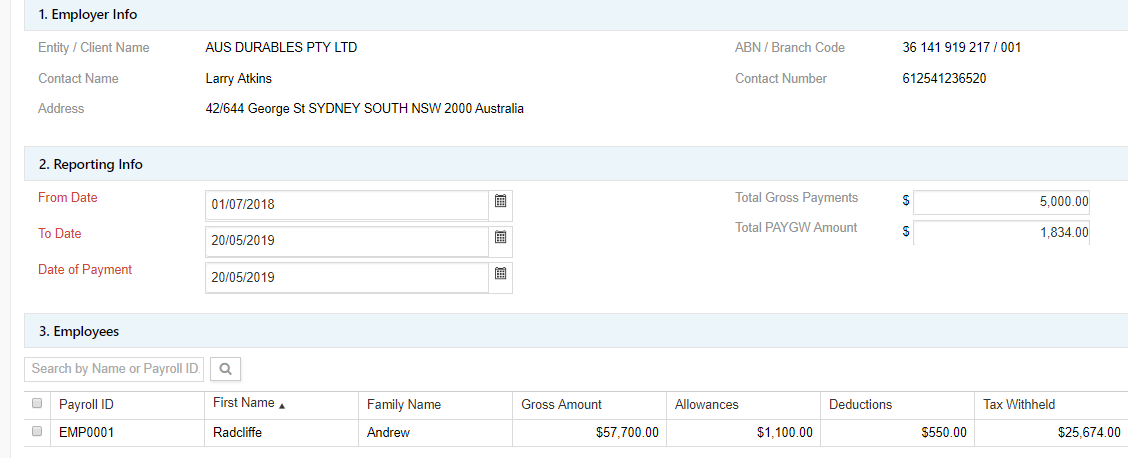

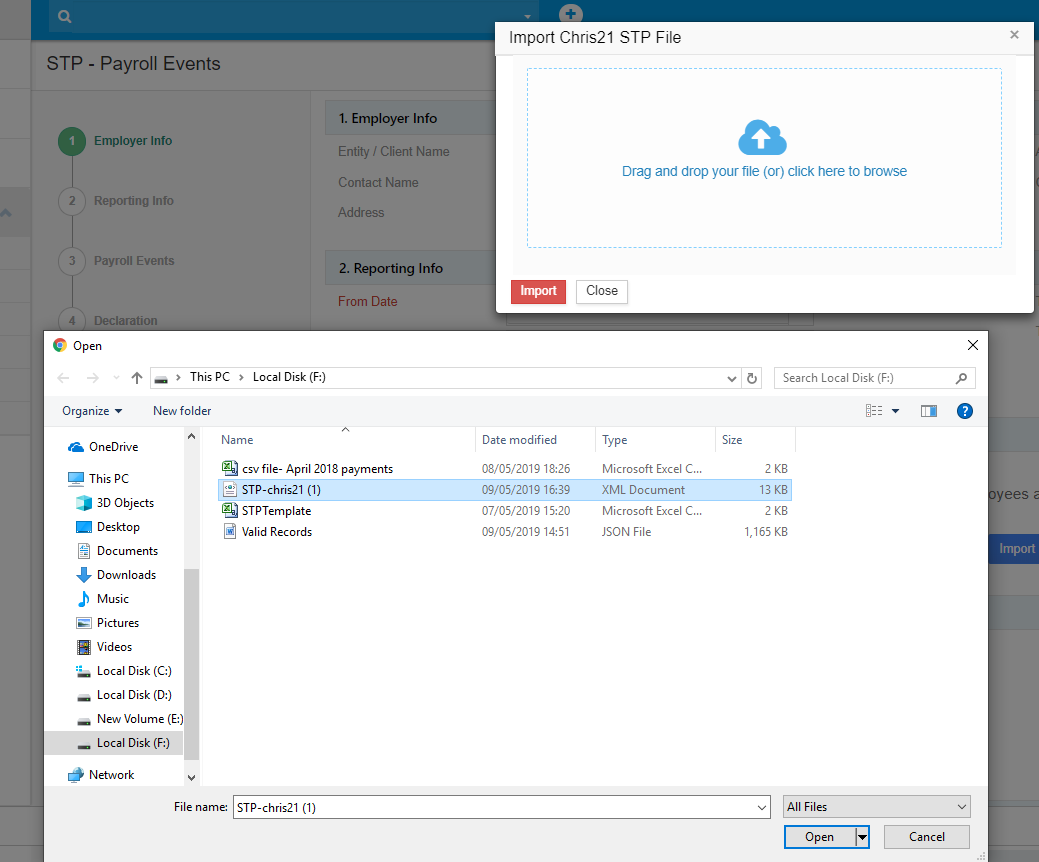

In the "Employees" section, click on Import -> Chris21 file.

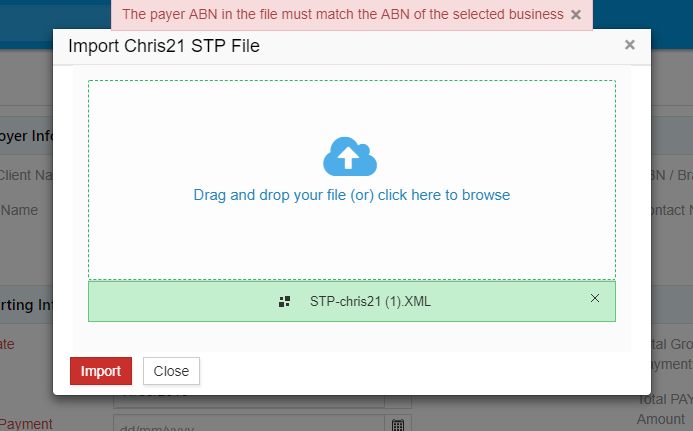

Make sure that The payer ABN in the Chris21 STP file must match the ABN of the Employer given above.

Click on "Drag and drop your file (or) click here to browse".

Select the Chris21 STP file to be imported. Make sure that the gross pay, tax withheld and one among Super Liablility or Ordinary Time Earnings amount is present in all the entries. Allowances and Deductions are optional. Click on "Import".

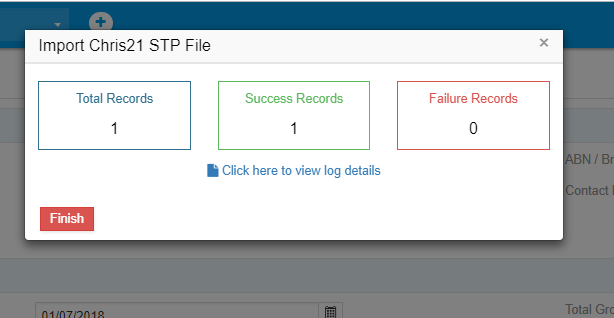

You can view the Summary which tells the total records, of which 1 is successful and there no failure records. You can click on "view log details" to view additional information in case if there are failure records. Click on "Finish".

In the "STP-Payroll Events" screen,the Date of Payment, Total Gross Payments and Total PAYGW Amount will be prefilled based on the imported data.

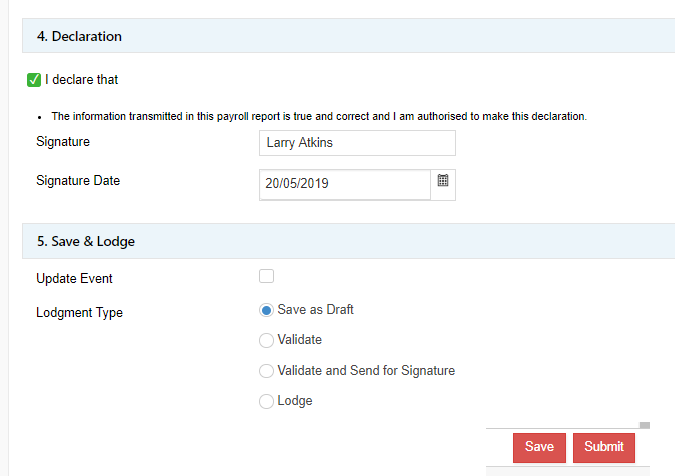

Make a declaration and click on "Save".

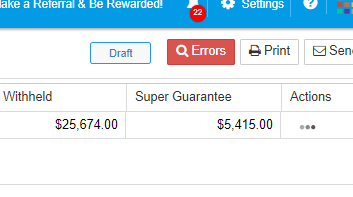

After the payroll details are saved, click on "Errors" on the top right corner.

If there are no errors, click on "Validate" and Submit. Remember that you can only lodge forms that are in "Valid" status.

The validated payroll information will be under "Saved Reports" and redirected to "Saved Reports" screen automatically. You can see the column, "Status" shows "Valid".

Click on the checkbox next to this report and click on "Lodge Selected" button.

Confirm to lodge the report.

The lodgment request will be in queue. After some time, it can be found in "History" under "My Lodgments".

You can click on that lodgment and view the receipt.

-

Checking for errors in Manual Entry

Checking the errors before validating STP Reports is very important. This is done after you either manually add employee details or importing the employee details. In this case, Let's add an employee using Manual entry.

Login to GovReports account. This is a Business account. In case of Tax or BAS Agent account, Client is used synonymously instead of Business.

From the menu bar on the left, click on "My Business"."My Clients" in case of Agent's account.

Select a business/client where employee information is to be added.

On the business/client screen, click on "Forms" on the top right corner.

From the list of forms in the tab "ATO", click on "Select" next to "STP Payroll Events".

In the "Reporting Info" section, enter From date, To date.

In the Employees section, click on "Manual entry".

The Add Employee form appears. The details like TFN, Name, Address are entered. Remember, that the fields marked in red are mandatory.

The Period from and to date will be prefilled from the STP-Payroll Events forms.

The Gross payments and Tax withheld is entered. Click on "Save".

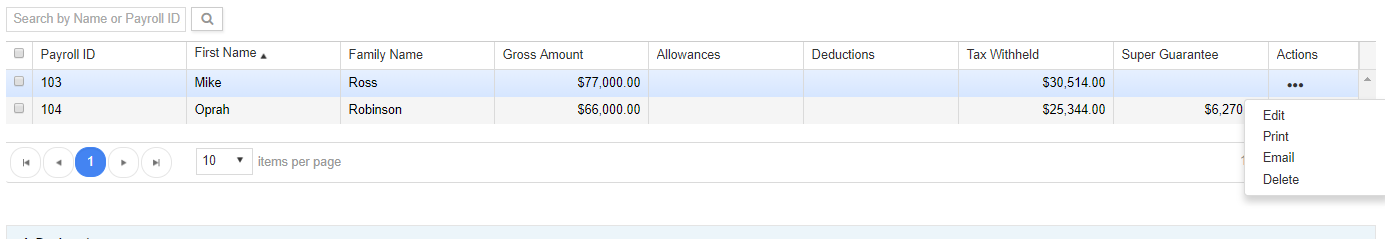

The employee entry is visible now in the Employees section.

Click on "Add employee" to add another employee.

In the "Add Employee" form, TFN, Name are entered.

The Period from and to date will be prefilled from the STP-Payroll Events forms.

The gross payment, tax withheld and Super entitlement amount fields are entered.

Click on "Save".

The details cannot be saved as a prompt appears on the top of the screen saying that the address fields are not entered. Hence, make sure to enter values in the mandatory fields.

After entering, click on Save.

The second employee is also added.

Make a declaration and click on "Save". The details will be saved.

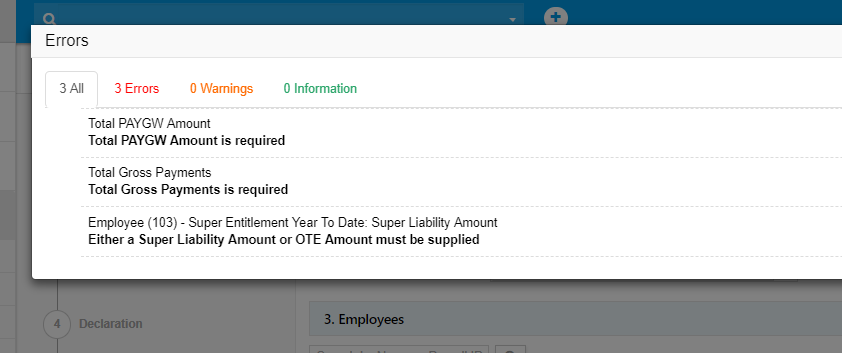

Click on "Errors" button to check the errors.

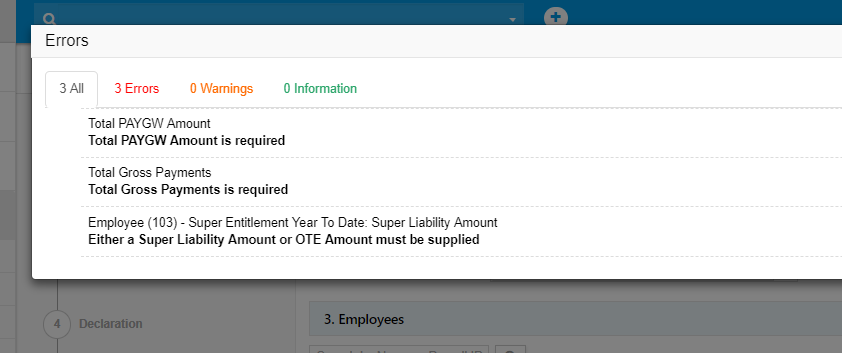

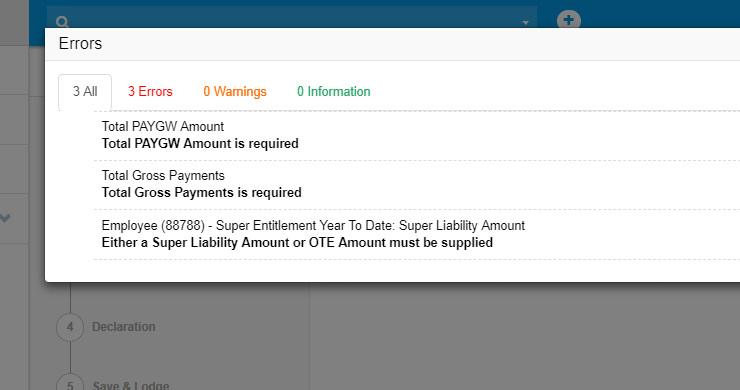

There are 3 errors. The Total PAYGW amount and Total Gross payment fields must be entered.

After entering the respective fields, Click on Save.

Check for errors. There is an error.

The error says that for Employee ID 103, one among Super entitlement amount must be entered.

Click on the Employee entry 103 and under Actions column, click on "Edit".

The Edit employee screen appears. Go to Super entitlement section and add the Super entitlement amount. Click on "Save changes".

The employee details will be saved.

Click on "Errors" button.

All the errors have been cleared and now the form can be validated.

Click on "Validate" radio button and click on "Submit".

The report will be validated and it will be under "Saved Reports".

This report can be lodged.

-

Checking for errors in Reckon, Chris21 and CSV STP files

Let's see how to rectify errors when either a Reckon or a Chris21 STP or CSV file is imported.

Always remember to match the ABN of the File to the ABN present in the Employer section in STP Payroll Events form.

Let's see a scenario where the ABN does not match and how to rectify it.

Login to GovReports account. This is a Business account. In case of Tax or BAS Agent account, Client is used synonymously instead of Business.

From the menu bar on the left, click on "My Business". "My Clients" in case of Agent's account.

Select a business/client where employee information is to be added.

On the business/client screen, click on "Forms" on the top right corner.

From the list of forms in the tab "ATO", click on "Select" next to "STP Payroll Events".

Import the Reckon File by clicking on "Import->Reckon file" under Employees section.

Drop the file.

Click on "Import". There is an error message which says that the ABN in the Reckon file must match the ABN of the business.

This error message prevents you from importing payroll information that does not match the employer ABN, thus making the process systematic and error-free for lodgments.

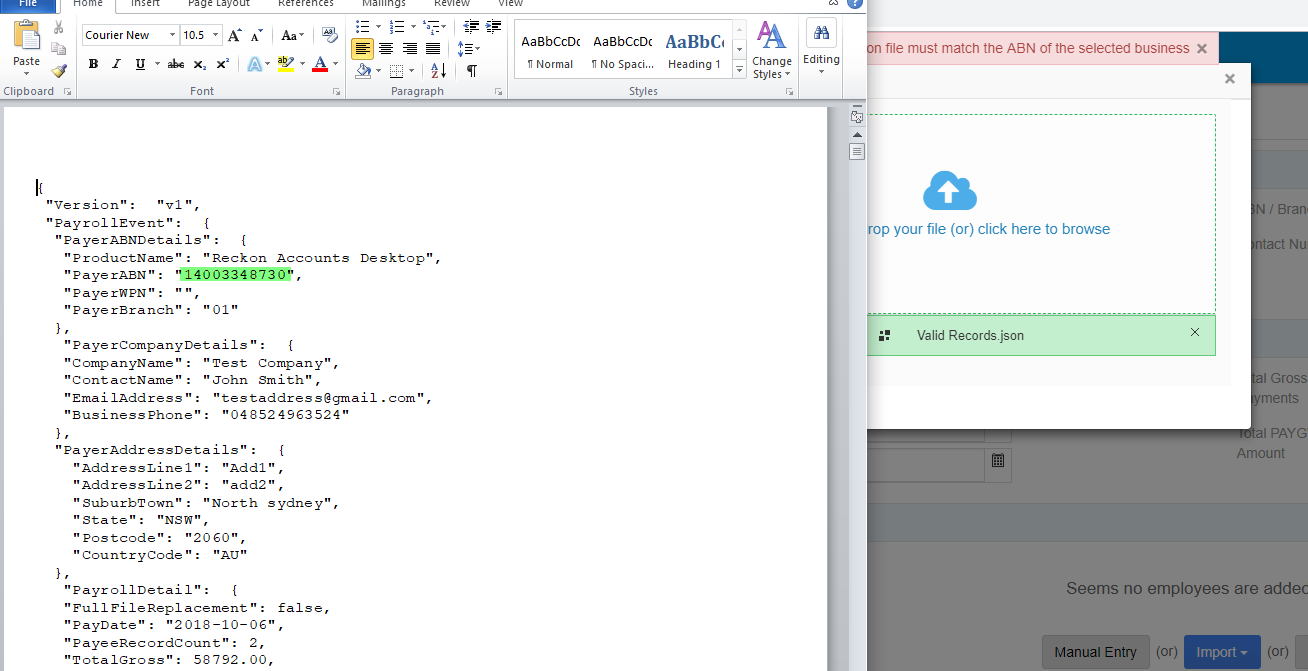

Open the Reckon file. You can see the ABN information in the Reckon file. Before importing Reckon file, you can check the ABN.

Next, let's see the scenario of importing Chris21 STP file and the possible errors.

Import the Chris21 STP File by clicking on "Import->Chris21 STP File" under Employees section.

Click on "Import". There is an error message which says that the ABN in the Chris21 STP file must match the ABN of the business".

If you get this message, the selected Chris21 STP file can not be imported but a different file matching the ABN can be imported.

Select the appropriate Chris21 STP file and import.

The last scenario is when we get errors in importing CSV File.

Click on "Import->CSV File" under Employees section.

Drop the file. Click on "Next".

The Import Employees screen appears. Check the mapping fields and click on "Import".

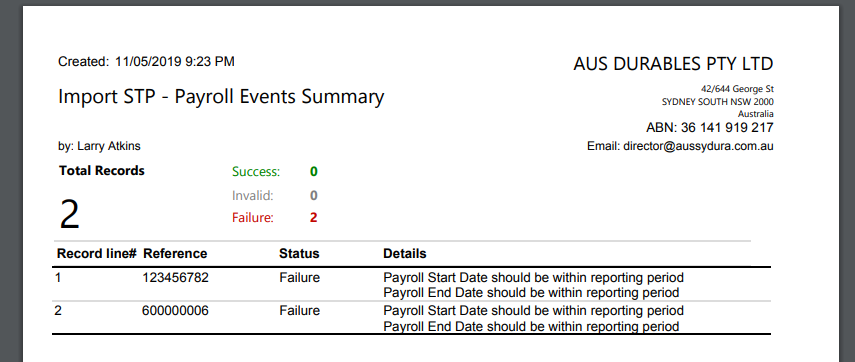

You get a summary to Total Records of which you can see Success Records and Failure Records.

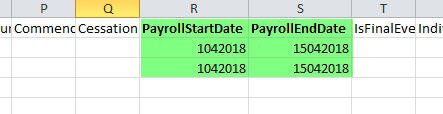

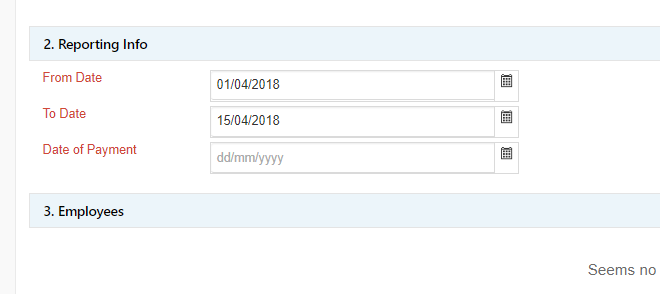

You can view the log. The error details will be given. It says that the Payroll Start Date and End Date should be within the reporting period.

Open the CSV file and check for the Payroll Start and End date.

Enter the same date range in the "Reporting Info" section in STP Payroll Events Form.

Enter the correct date range as mentioned in CSV file and click on "Import CSV file".

Now, the total records has been imported successfully.

Make a declaration, click on Save.

Click on Errors button.

There are 3 errors stating that the Total PAYGW Amount, Total Gross Payments and Super Liability Amount must be supplied.

You can clearly see from the employee entries that the Gross Amount, Tax Withheld, etc has not been entered.

Open the CSV file and edit the fields in the appropriate CSV file by making sure the Gross Pay, PAYGW amount and Super Liability Amount are entered.

Hence, the errors in importing Reckon, Chris 21 and CSV file can be rectified.

-

Rollover

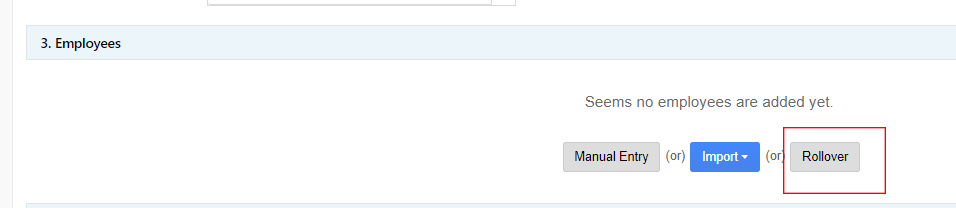

Rollover option is available for repeat on each pay cycle. You need not enter the employee basic information everytime when the pay is run. You can make use of "Rollover" option in GovReports and can enter the appropriate periodic salary figures for the employee. Let's see an example of how rollover can be used.

Login to GovReports account. This is a Business account. In case of Tax or BAS Agent account, Client is used synonymously instead of Business.

From the menu bar on the left, click on "My Business". "My Clients" in case of Agent's account.

Select a business/client where employee information is to be added.

On the business/client screen, click on "Forms" on the top right corner.

From the list of forms in the tab "ATO", click on "Select" next to "STP Payroll Events".

In the "Reporting Info" section, enter From date, To date and Date of Payment.

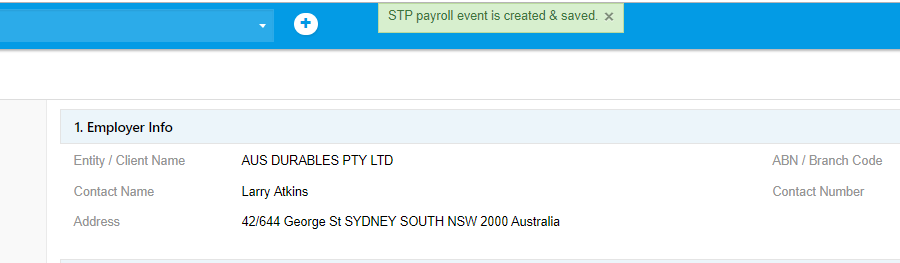

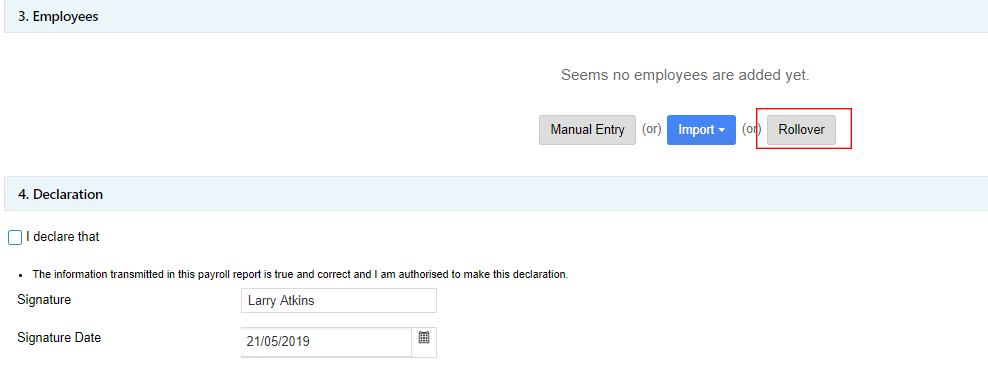

In the "Employees" section, click on Rollover button.

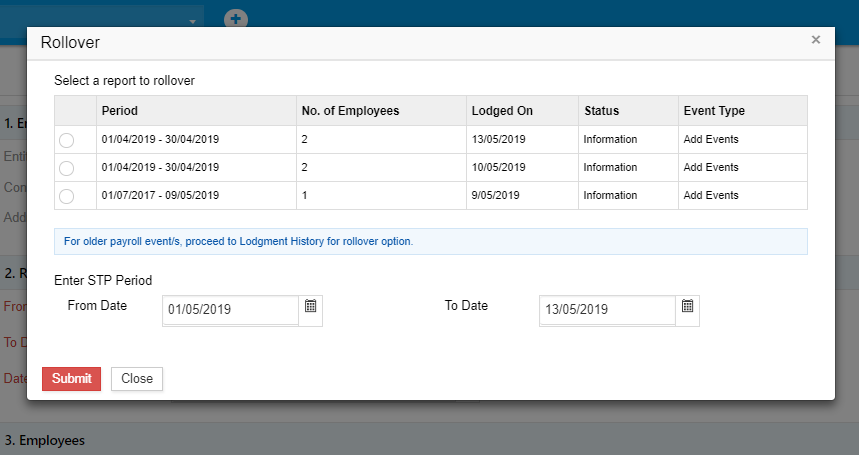

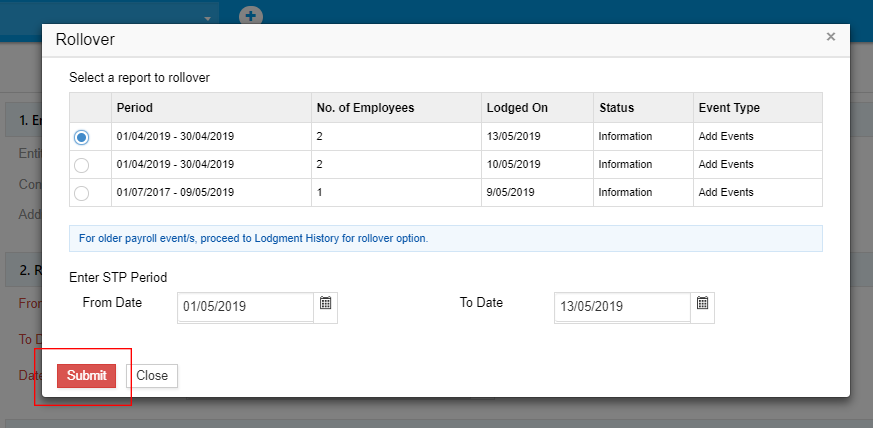

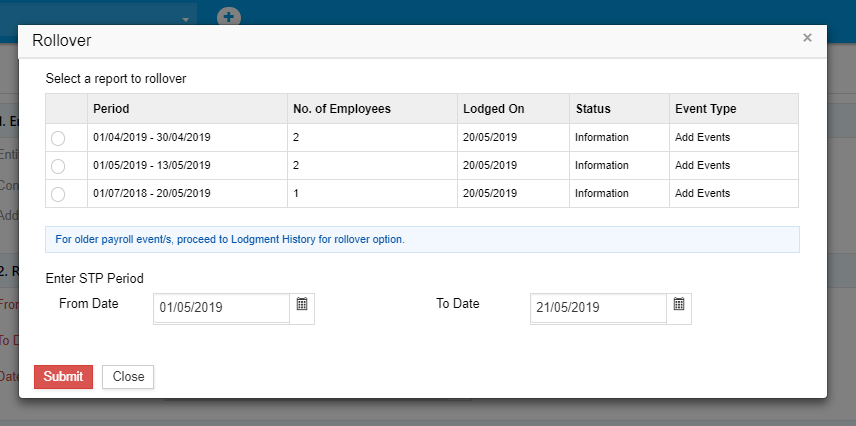

The rollover window opens, from the list of lodged reports, select the report to "Rollover". From each report, you can see the number of employees involved in that particular report.

Select the required report to rollover and click on "Submit".

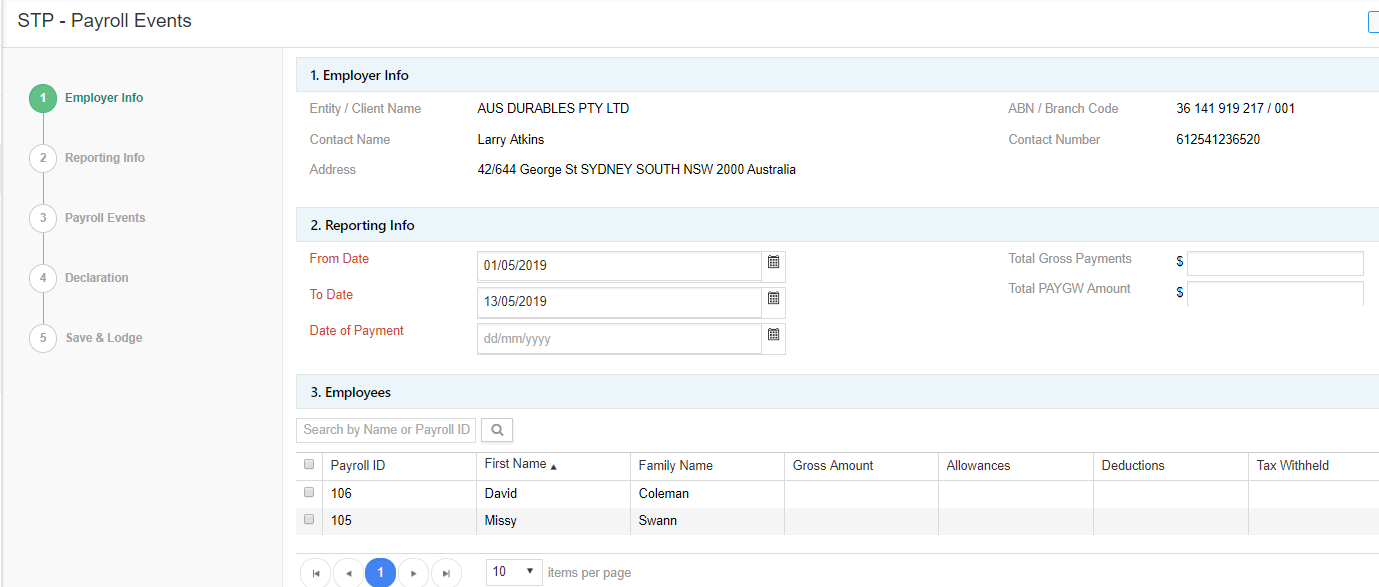

In the Employees section, you can see those employee records being rolled over to the current reporting period.

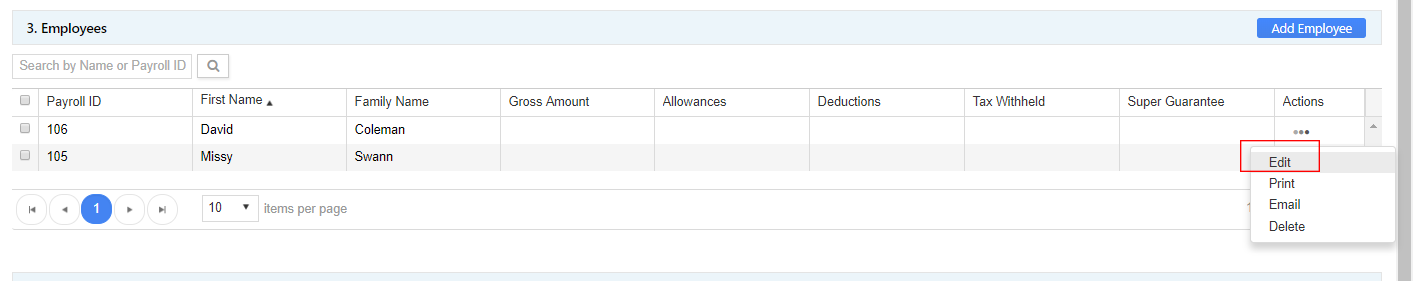

From the Actions column, on each employee entry, click on "Edit".

The Employee basic details like TFN, Payroll Id, Name, Address details are prefilled.

The Period from and to date has been taken from STP Payroll Events form.

The gross salary, tax withheld and Super entitlement amount are entered.

The same steps are repeated for the next employee.

Make a declaration.

Click on "Save".

Click on the Errors button on the top.

If there are no errors, click on "Validate" radio button in the "Save and Lodge" section and click on "Submit".

The validated payroll information will be under "Saved Reports" and redirected to "Saved Reports" screen automatically. You can see the column status shows "Valid".

Click on the checkbox next to this report and click on "Lodge Selected" button.

Confirm to lodge the report.

The lodgment request will be in queue. After some time, it can be found in "History" under "My Lodgments".

You can click on that lodgment and view the receipt.

There is another way to rollover the lodged report and use it for periodic pay events.

From the receipt screen, you can click on "More options" button. You can see "Rollover" option there.

The steps are similar to using "rollover" option in STP Payroll Events form.

-

End of Financial Year (EOFY) Payroll events

- Under changed STP environment, employers need not issue PAYG payment summary to employees and, they are not obligated to report payment summary annual report to ATO.

- To be exempt from issuing these payment summaries to your employees, you will need to make a Final Event Indicator along with an update event. This declares you have provided all required payroll information for the financial year through your STP reporting.

- You make a finalisation declaration by providing a final event indicator for an employee (including directors, contractors, etc.) as part of your STP reporting.

- You can make a Final Event Indicator for an employee any time during the financial year (for example, for employees who have ceased employment in the middle of the financial year), or after the end of the financial year up to 14 July.

-

Finalizing payroll events is important for End of Financial year accounts reconciliation. After Final event indicator, you must also update the payroll events.

To finalise payroll events, login to GovReports.

-

From the menubar on the left, Click on "My Business". Select the Business name from the available list.

Click on the "Forms" button on the top right corner. From the list of forms, select on "STP-Payroll Events".

Click on Rollover button under "Employees" section.

-

The rollover window appears. Click on the radio button of the latest pay event and click on Submit.

-

Check the box of the employee entry or entries in case of multiple employees.

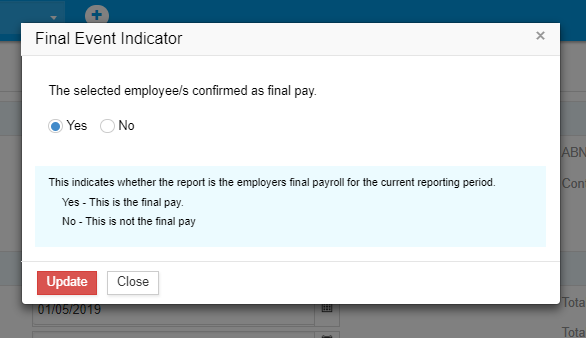

Click on Final Event Indicator. Confirm that this is a final pay and click on Update.

-

In the employee entry, under "Action" column, click on those three dots. A drop down menu appears. Click on "Edit".

Enter the gross payment, PAYG amount, allowance; if any and super entitlement amount.

Click on "Save Changes". You can see the employee entry.

Make a declaration.

Under "Save and Lodge" section, check the box next to Update event and click on "Submit".

Your update event along with final event indicator is validated and ready for lodgment.

Check the box and click on "Lodge Selected" button on top.

-

After few minutes, the lodgment made can be found in History.

Click on that lodgment and you can view the receipt.

Even if you are not in STP reporting, the End of Financial Year can be made through STP for this Financial Year. You can join the STP bandwagon and need not submit PAYG summary and Payment Summary Annual Report.

-

Manage subscription

-

Login to your GovReports Account.

-

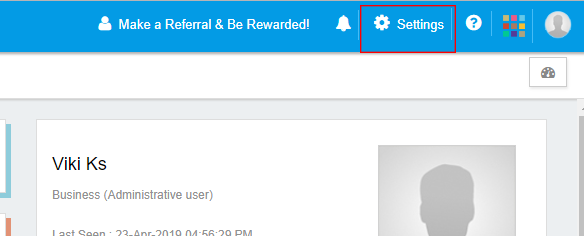

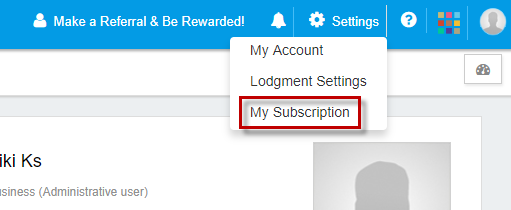

Click on "Settings", the gear icon on the top right corner.

-

Click on "My Subscription" from the list of options.

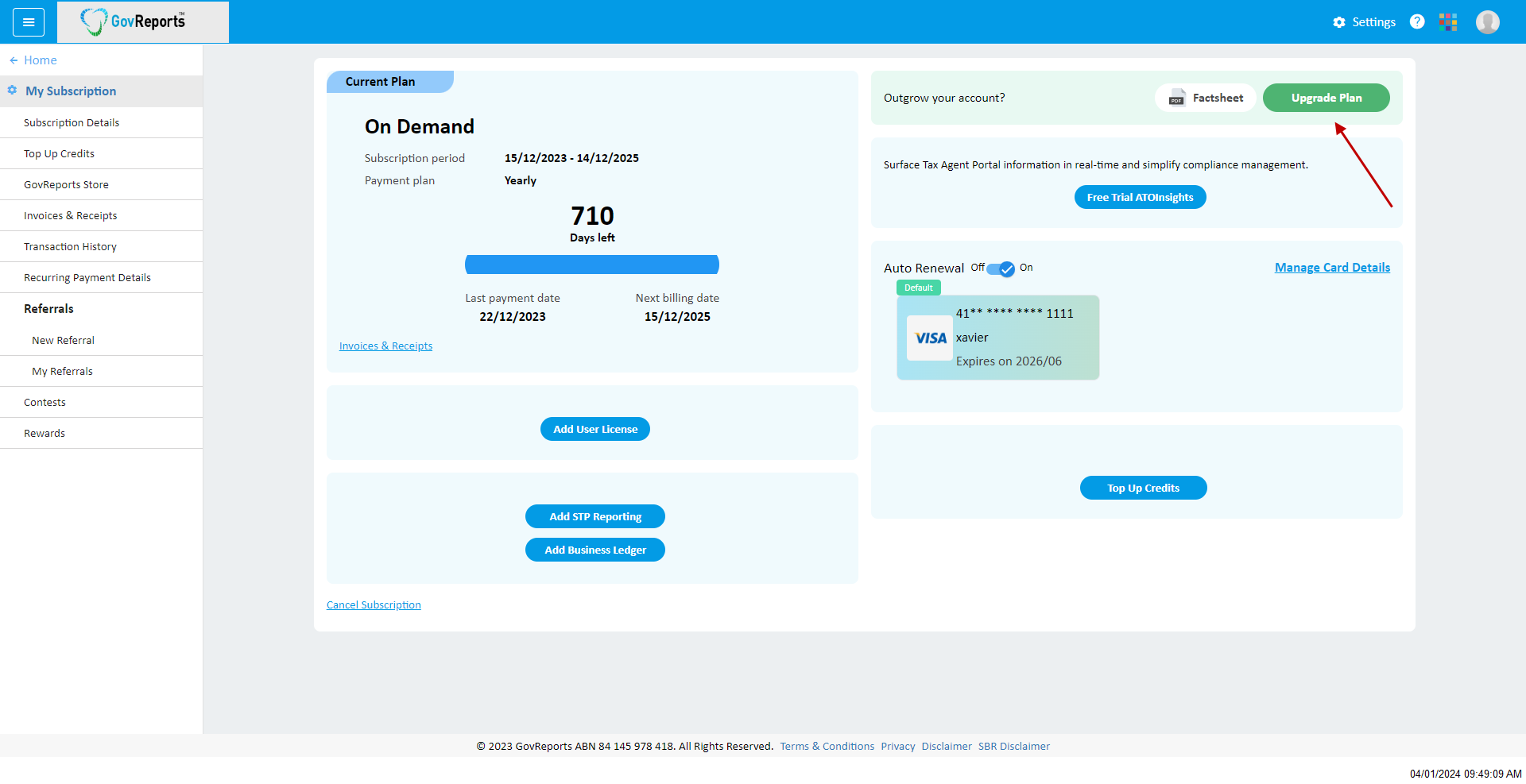

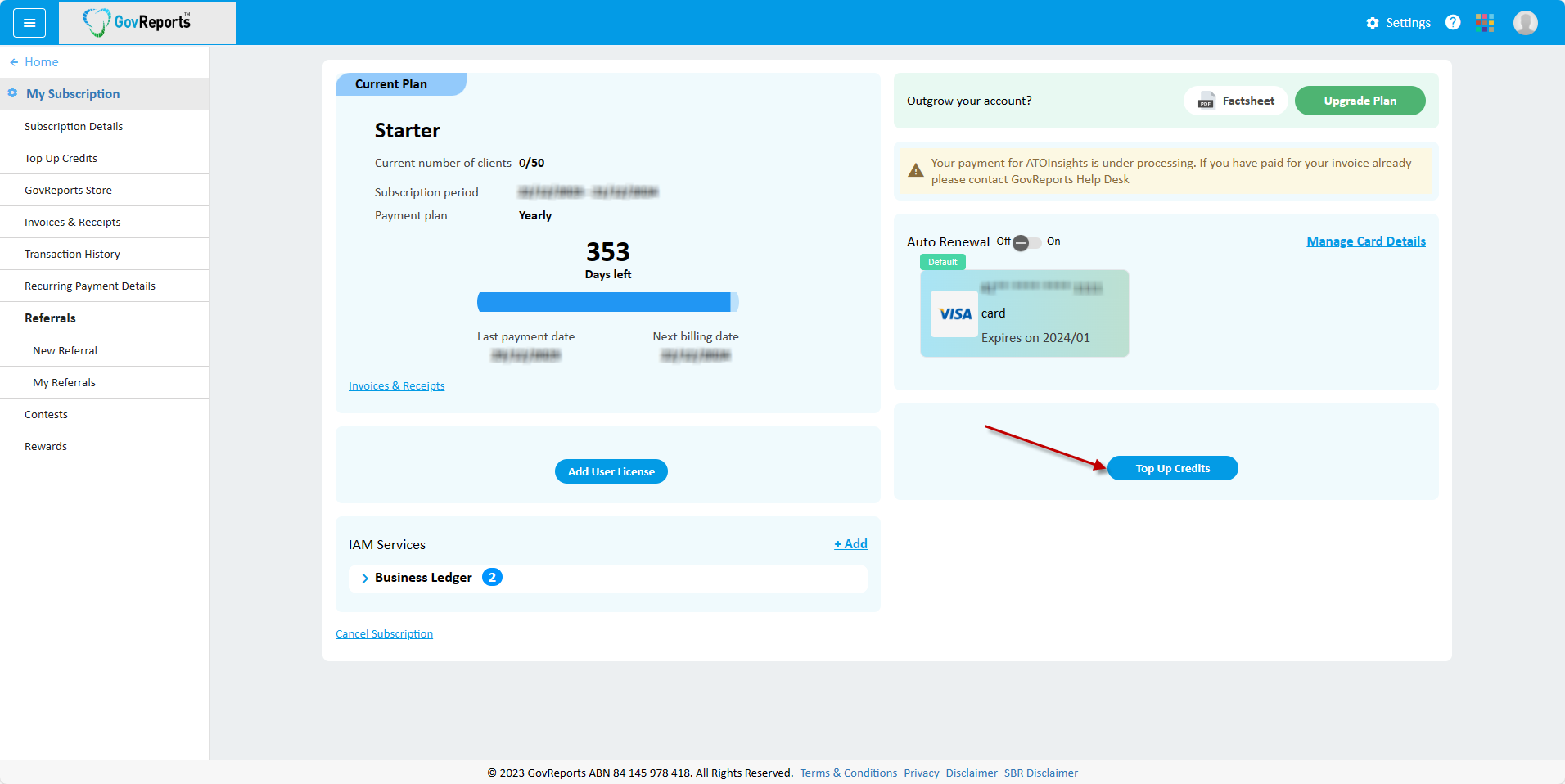

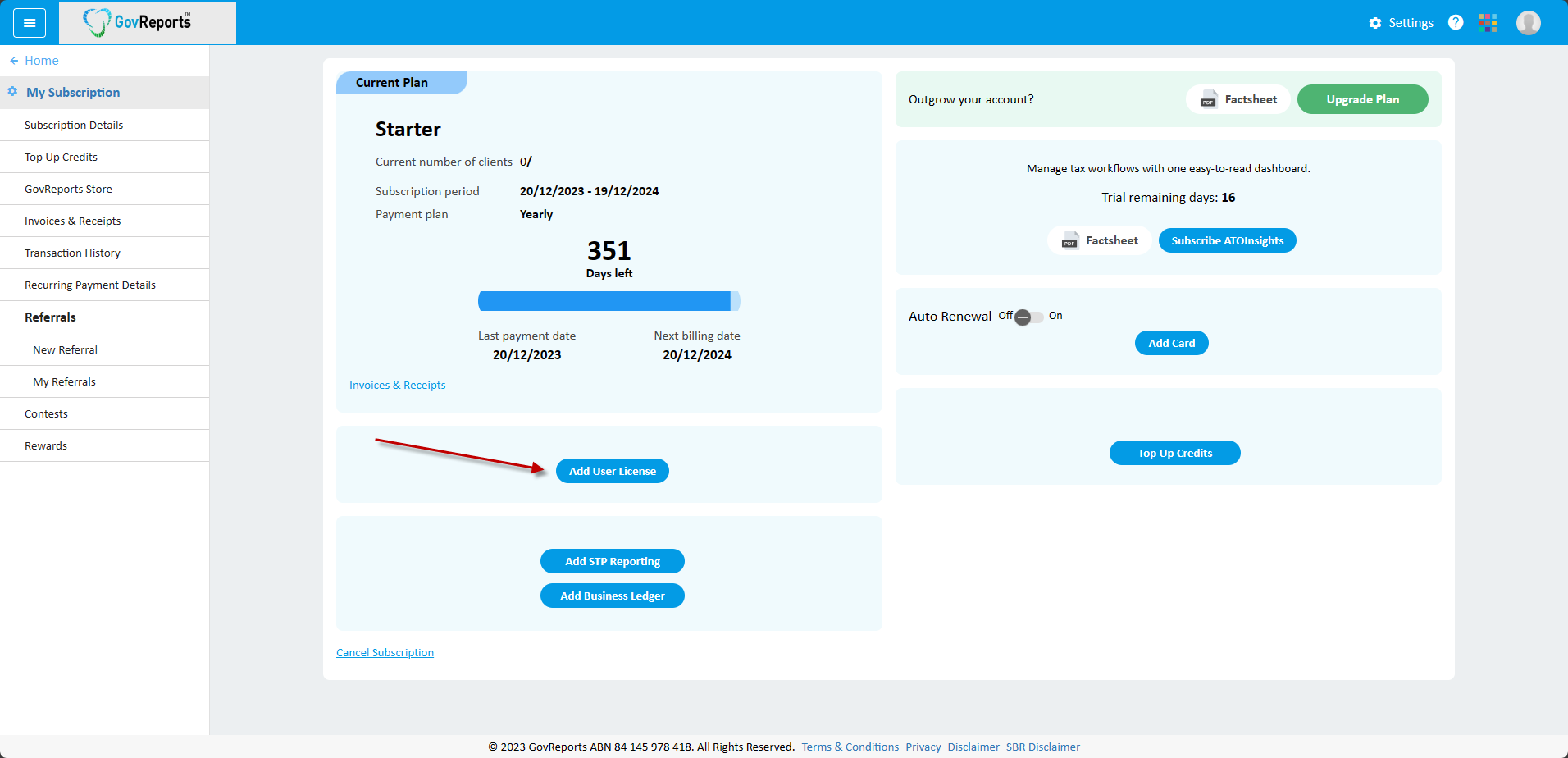

- The current subscription is "Starter" package. The details regarding the start date, end date and next billing data can be seen.

-

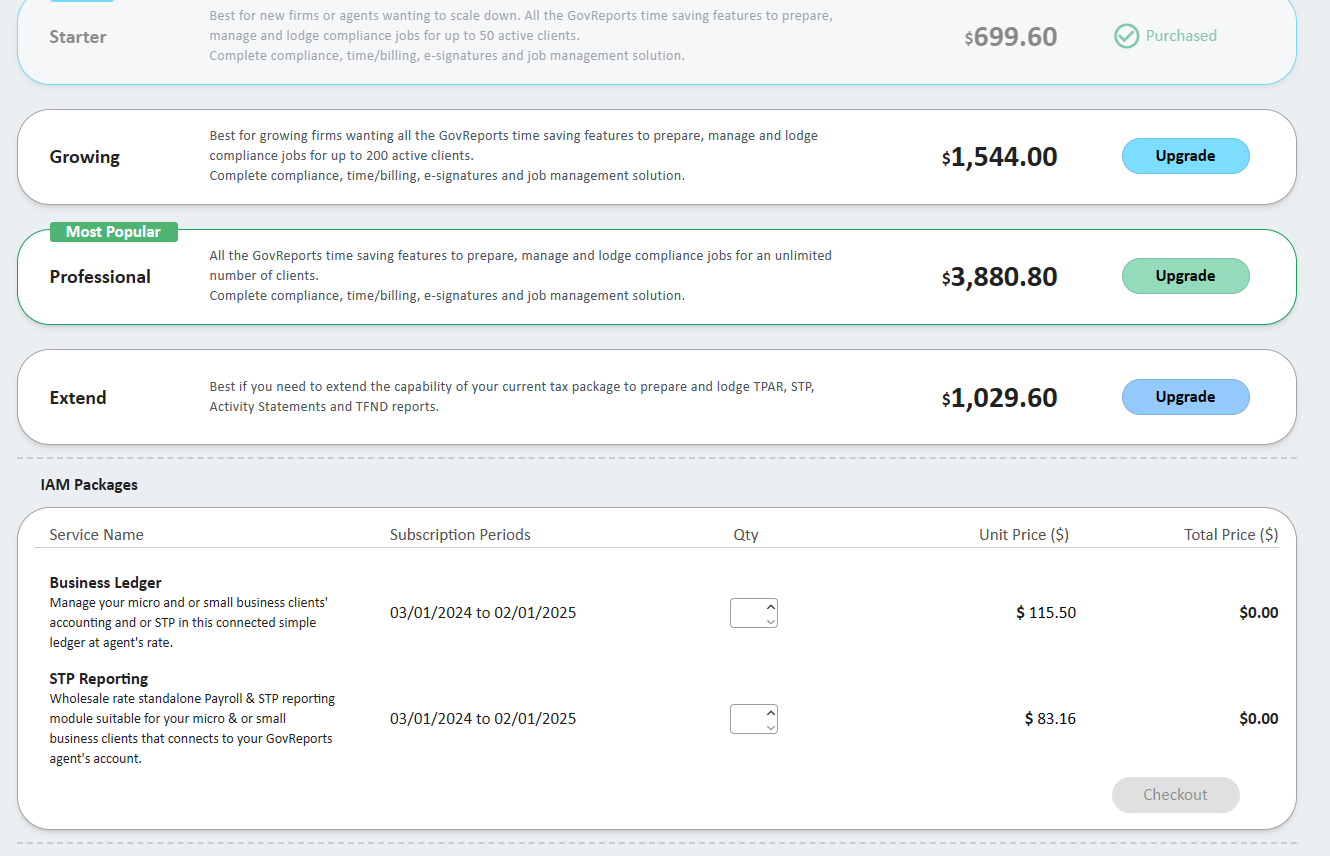

Click on "Upgrade plan" button to view other packages available.

- You can see "Professional" package with the price for annual subscription and the features.

-

You can click on "Upgrade" if you wish to change your subscription type from "Starter" to "Professional".

-

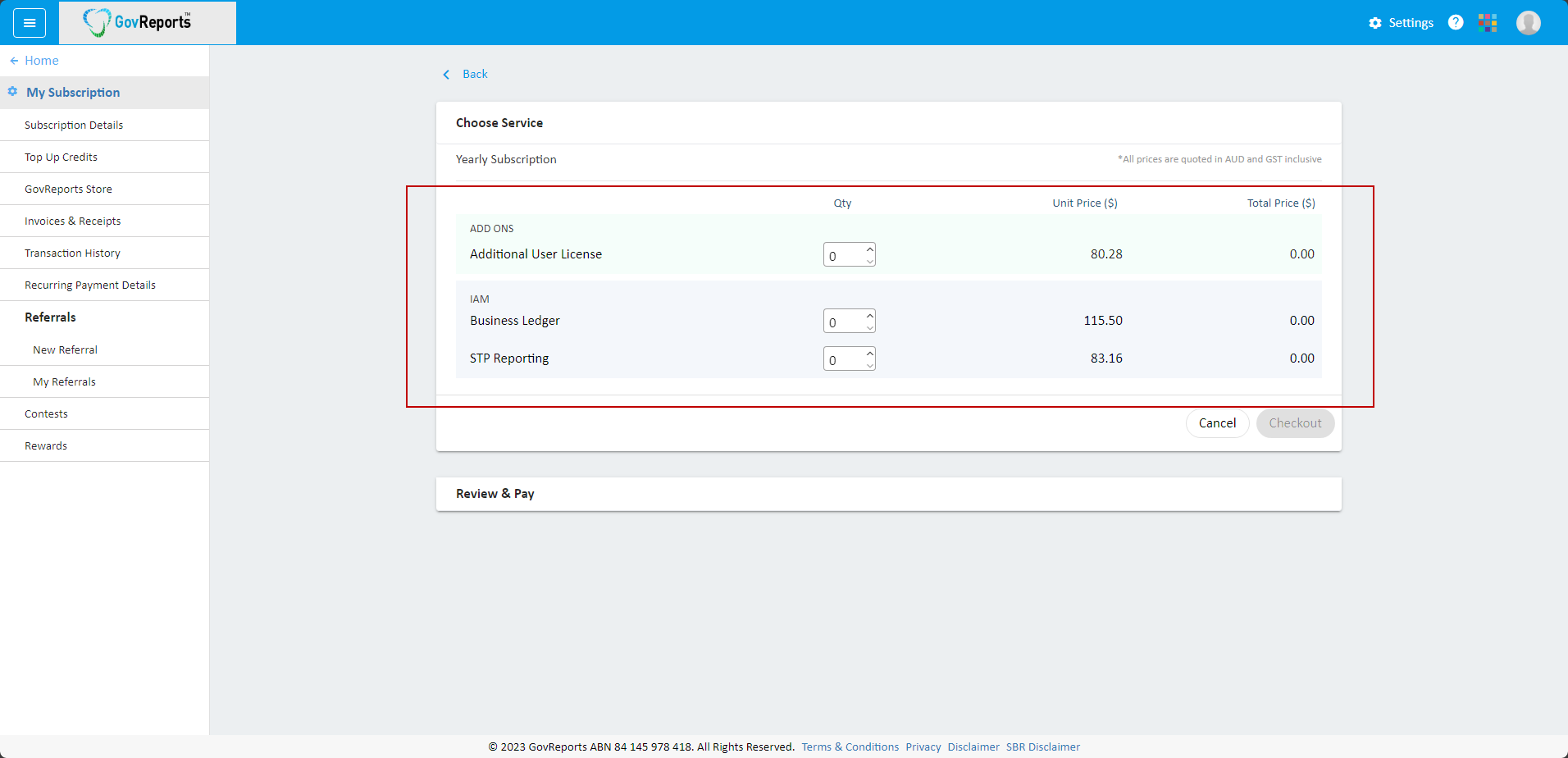

If you need additional user licence for the second user and so on, you can mention the number of licenses you need and make a payment.

-

Payment can be made using:

i. Credit card – Use credit card for your payment. You can also save a card in your account to use it for subsequent purchases easily

ii. Pay by invoice – Direct deposit via billing

iii. Promotional Code – Enter promotional code (if you have any) and can utilize discounts for your purchase. - Similarly you can subscribe for an STP Reporting or Business Ledger account and make a payment.

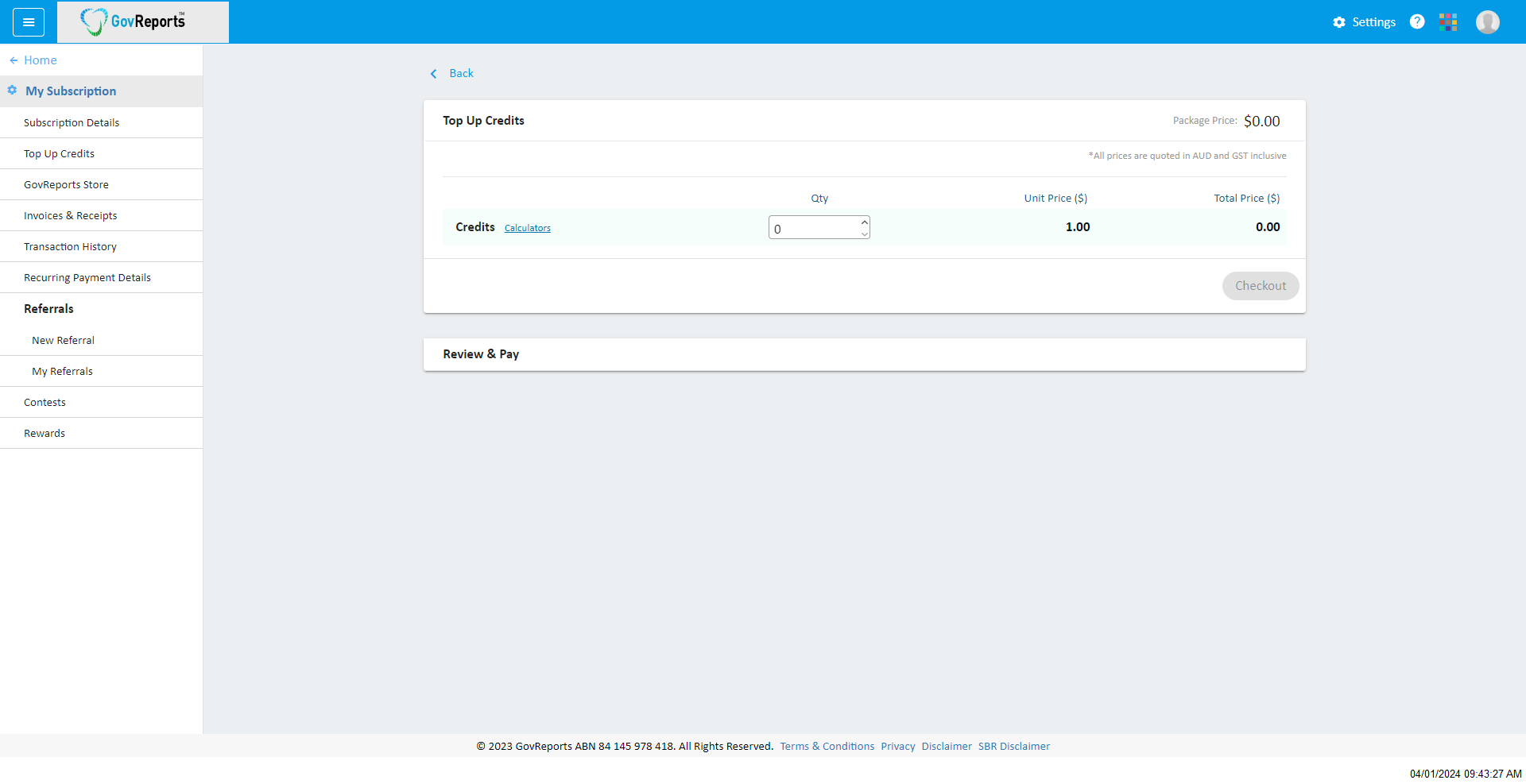

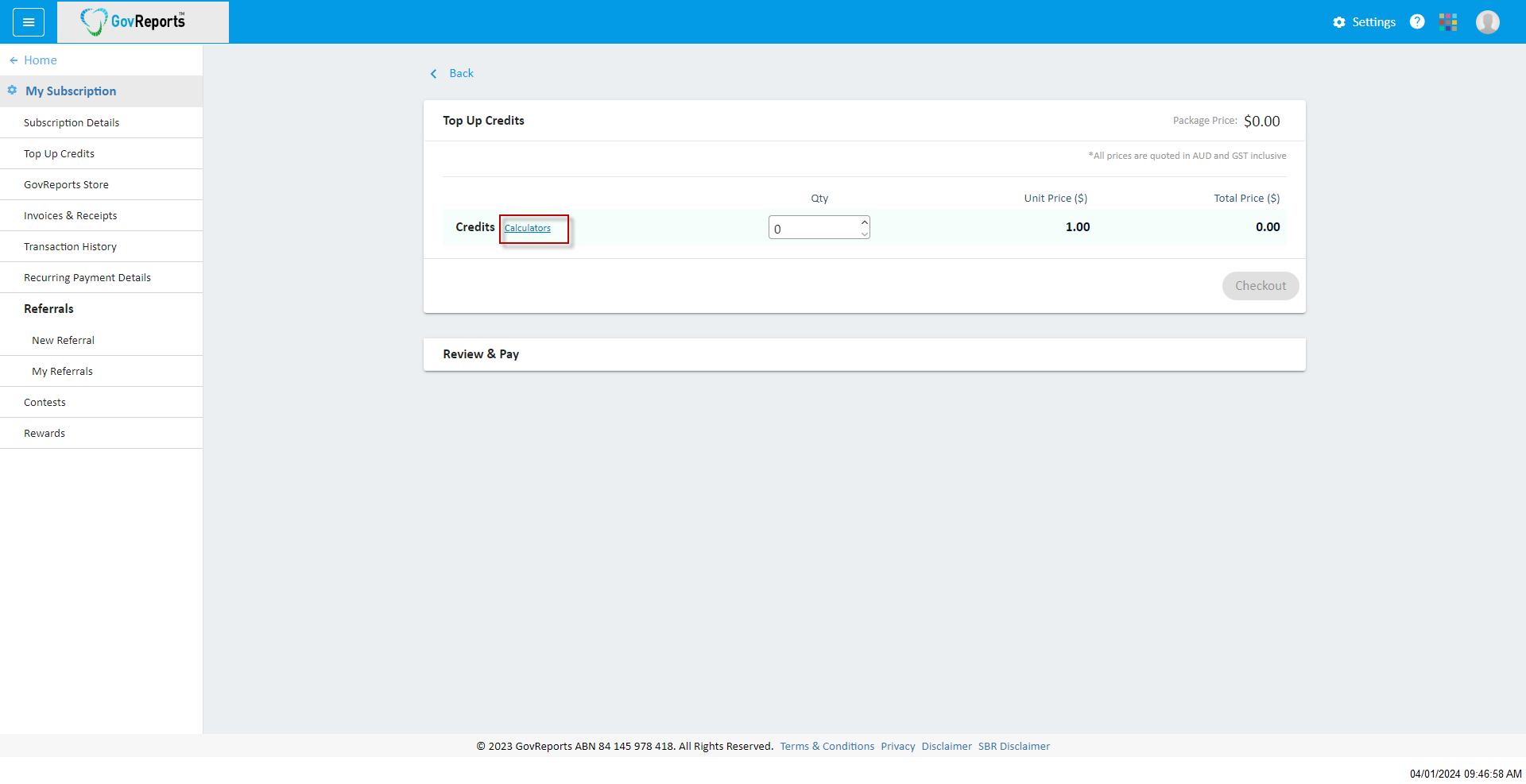

- In the "Subscription Details" window, there is an option for "Top Up Credits"

- Click on "Top-Up" to add credits. Ensure the billing name and billing address. Add the credit amount and make a payment.

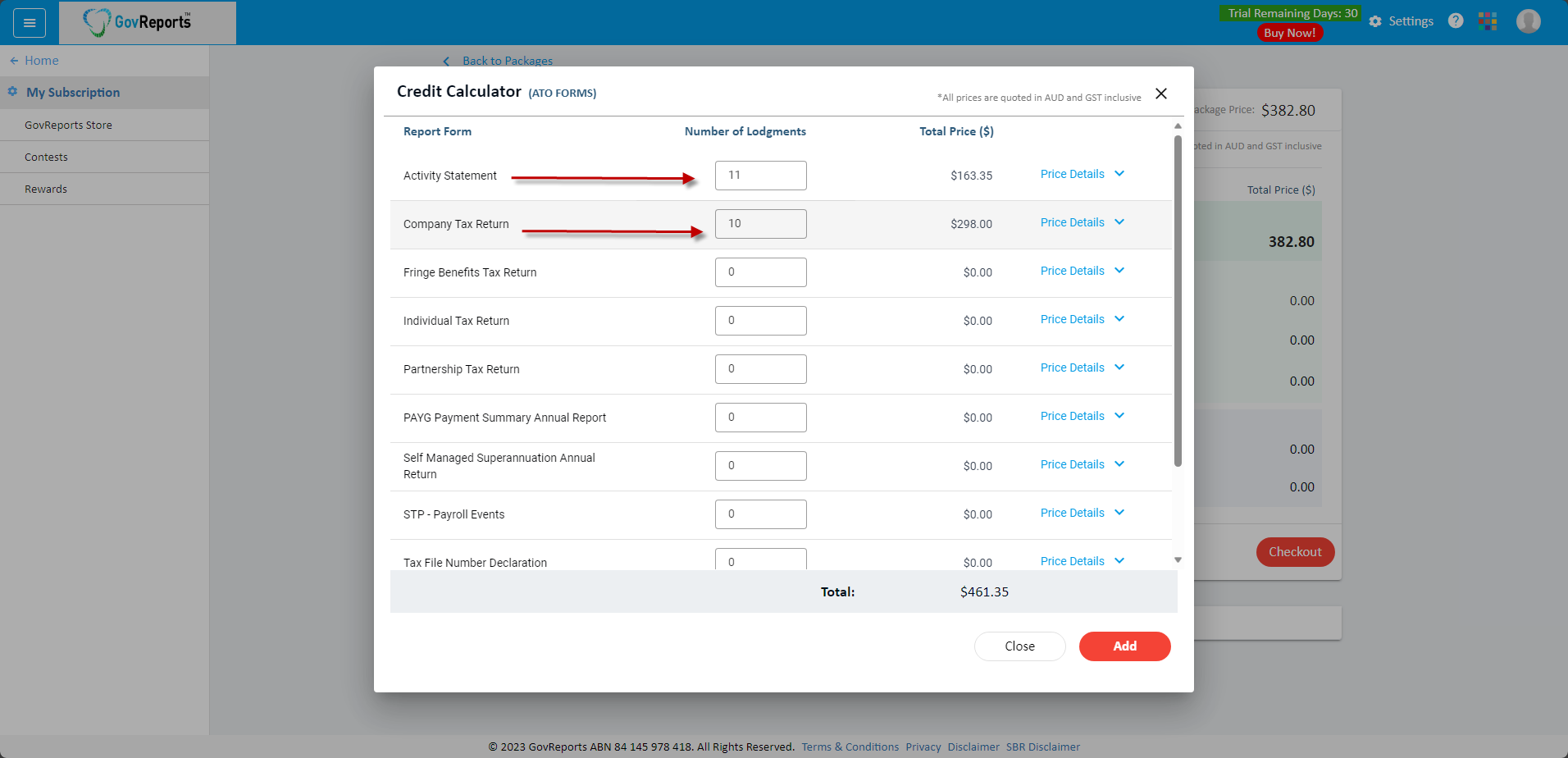

- If you are not sure how much credit you need, you can make use of the option called "Credit calculator".Credit Calculator option is only available for "On-Demand" subscription package.

- You can utilize your available credits and can purchase module.

-

For example, if you need "5 Activity Statements", "1 company tax return", "10 STP Payroll Events" and "10 TFN Declaration" the credit is calculated,

and hence appropriately you can purchase credits.

- Top-up credits option can also be done from the left side menu "Top-up credits".

- In "My subscription" window, you can also add "Additional user license" directly by clicking on "Add" button in "User License" section.

-

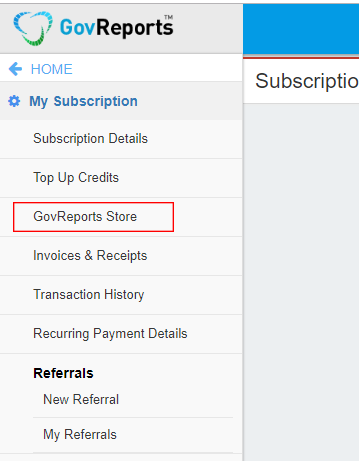

From the menu bar on the left, you can click on "GovReports Store" menu to add "Professional" package or "STP Reporting", "Business Ledger" packages.

-

Login to your GovReports Account.

Getting started with STP phase 2

Single Touch Payroll (STP) sends tax and super information from your STP-enabled payroll or accounting software to the ATO from your payroll.

STP Phase 2 won’t change the payments you report through STP, but it changes how those amounts are reported.

To learn more about STP 2, visit the ATO website.

What you need to do

Collect additional employee details and income types before starting with STP phase 2, such as:

Employee details:

1. Commencement date

2. Employment basic code

The basis of payment indicates the type of arrangement between the employer and employee (Full Time, Part Time, Casual, Labour hire etc…)

3. Tax Category & Options

Choose employee’s tax category and option to declare the tax code. (Regular, Actors, Foreign Resident, No TFN etc…)

4. Select Income Type

Add income types based on tax category selected: salary & wages, closely held, foreign employment etc…

Before commencing STP Phase, you'll be prompted to collect more details of the employees to meet the ATO's new requirements.

What remains unchanged

- How you lodge your STP reports

- Rollover from previous reports

- BMS ID is same from previous lodgement

- End of year finalisation.

What GovReports will do

We release STP phase 2 simultaneously with STP phase 1 earlier than the official starting date of January 2022 to give more time for you to transition and adjust with the changes. If & when you are ready to switch to STP V2, the process is irreversible!

For those uploading payroll in CSV for STP phase 2 lodgements, the STP phase 2 CSV file import specification can be downloaded here whilst earlier version will still work with some additional manual inputs required.

Useful links to kick start?

ATO Employer Guide:

STP phase 2 key changes:

Preparing STP phase 2 in GovReports:

Download latest CSV file Specification

Preparing for STP V2 New Version

Before proceeding to STP V2, you must clear any draft records from the previous version.

Once you activate STP V2, you will not be able to complete any draft pay runs in STP V1. A draft pay run in STP V1 will not convert to STP V2, therefore you need to clear any drafts from STP V1.

If a draft pay run exists in the STP V1, you must delete it or lodge it to clear all draft records.

Once there are no more drafts in STP V1, you can proceed to activating STP V2. If required, you can then recreate pay runs from STP V1 in STP V2.

Converting to STP V2 (New Version)

To convert a client to STP V2, go to My Clients > select client.

Select Forms from the Actions menu.

Select Confirm to upgrade to V2.

The process is irreversible once you have completed lodgments using STP V2 for the selected client.

This confirms STP V2 for the selected client. To start entering a Payroll Event, select the relevant client from My Clients. Go to Forms > STP – Payroll Events > New Version. If any client details are missing, these must be completed before being able to proceed with a Payroll Event.

If all client details are complete, STP – Payroll Events will load.

Entering Payroll Event Details Manually

To prepare the STP report manually in GovReports, go to My Clients > select client.

Select Forms from the Actions menu.

The STP - Payroll Events screen will load.

Check that the prefilled employer information is correct.

In Reporting info for specified pay period, enter pay run start date, end date and date of payment.

Make sure these details are correct before proceeding.

Once the employees are added and any details saved, it is not possible to edit this section and you will need to delete the Payroll Event and start again.

Reporting information may be edited before the form is saved.

Note that using the Enter key will automatically save the form. To proceed through the fields, use the tab key or mouse.

Enter the amount in Total gross payments (W1) and Total PAYGW amount (W2) for the specified pay period.

This amount represents the figures for the specified pay period only. In the next section you will enter the year to date figures.

In the Employees section, select Manual Entry, or Add Employee. Either option will then take you to the Add Employee details screen.

![]()

Enter all required employee information. Fields in red are compulsory to fill in.

To find more information about a particular field, hover over the question mark next to the field name.

In Employment conditions , enter employment commencement date and employment basic code to define the employment status.

In Tax treatment , the Category and Option are required. Select from the drop-down menu in each field. The Tax treatment code will be prefilled automatically based on your selection.

Depending on the category chosen, other fields may appear to allow tax file number declaration details to be completed.

The pay run Period start date and Period end date will be prefilled based on the pay period entered in the Reporting Info for specified pay period .

Based on the category selected in the Tax treatment section, the list of possible income streams will be available. Select the income stream from the options and select Add income stream button.

Enter the employee’s Salary and wages year to date (YTD) figures in corresponding fields.

To record paid leave, allowances, salary sacrifice, lump sum payments or termination payments, tick the checkbox for each required section and select the Add option.

Enter the year to date amounts for each payroll category.

If there is more than one type of income stream, another income stream can be selected and year to date figures entered for all required payroll categories for the second income stream.

Once you have recorded employees’ year to date figures for all required income streams and payroll categories, select Save.

The employee’s payroll details will be populated in the Employees section as a summary.

Add more employees by selecting the Add Employee button .

Before making the declaration, check for any errors.

If there are errors present, these will show as a summary to the right of the Payroll Event screen.

Select the Errors button to expand the error report.

Fix the errors and review the warnings before proceeding. Correct any errors by selecting Edit from the Actions menu, correct relevant details, then Save again.

Further details about correcting errors are explained in the Checking and Correcting Errors section.

Save and Lodge Options

There are several options for saving and lodging reports, including linking a report to a digital signature request for authorisation from the employer.

Save as draft saves the STP report as a draft for later use under My Lodgments > Saved Reports or in the client dashboard under Valid/Draft tab.

Validate and Save validates the STP report with the ATO for verification. This option checks for any lodgment errors prior to submitting to the ATO. If there are no errors, the STP report will be saved as Valid status under My Lodgments > Saved Reports.

Validate and Send for Signature validates the STP report, then redirects to GovReports Digital Authentication to send the STP report to your client for their authorisation.

Once authorised by the client, you can proceed to lodge the report from My Lodgments > Saved Reports.

See Sending STP Reports for Digital Signature for more details.

Lodge validates the report and directly submits it to the ATO without the digital signature authorisation process.

Choose the required option, complete the Declaration then select Submit.

Lodging Draft Reports from Saved Reports

To access saved reports, go to My Lodgments > Saved Reports .

This will show a list of all saved reports for all clients.

To review or edit a report, Open the draft status report under Actions menu for the required client report.

This displays the reporting information for the Payroll Event. Select Edit to open the event.

Review and make required changes, then select lodgment type. If you select Lodge and there are errors in the report, it will not lodge. You will need to fix the errors and then lodge again. If there are no errors, the report will lodge directly.

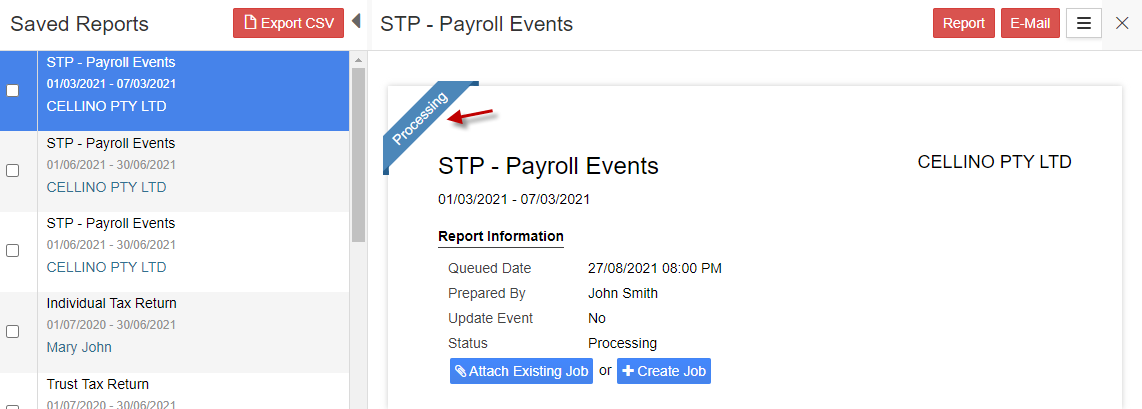

Once you Submit the STP report, the status will change to Processing, which means it is in queue to the ATO. The report will be automatically lodged once it has proceeded through the ATO queue.

Once the report has been successfully submitted to the ATO, the report will display under My Lodgments > History.

Lodging Valid Reports from Saved Reports

If you have already validated the STP report, (i.e., it is free from errors), and it is not yet lodged, then the report will be listed in Saved Reports with Valid status.

Valid status reports can be lodged directly. Go to My Lodgments > Saved Reports. Tick the required valid status report, then select Lodge Selected and Confirm.

Multiple valid status reports can be selected at the same time for lodgment.

Once you select Lodge Selected, the STP report status will change to Processing. The report will be automatically lodged once it has proceeded through the ATO queue.

Once the report has been successfully submitted to the ATO, the report will display under My Lodgments > History .

Once a report has been lodged, it can be viewed from My Lodgments > History.

Open the required report to view the lodgment details and receipt.

Updating Payroll Events

A payroll event can be updated to report changes to employee year to date amounts previously reported to the ATO. If a payroll event is lodged with the ATO with incorrect information, errors can be rectified and then resubmitted with corrected employee YTD figures.

An updated event is a revision to a previously submitted event and is only done throughout the financial year to correct the amounts reported to the ATO.

Total amounts for the financial year will be reported at the STP Finalisation process.

Go to My Lodgments > History.

Open the lodged STP report and select the overflow menu icon. Select Update Events and then select Yes to confirm the update.

The STP report will be opened with the previously lodged data.

Note that the Update Event indicator is now selected automatically. This notifies the ATO that the event is an updated event, not a new event.

Go to the Employees section and select Edit from the Actions menu. Make the required changes to employee year to date figures and Save.

Complete the Declaration, select the lodgment type and Submit.

Full file replacement

1. A full file replacement provides the ability to replace the latest payroll event that was sent to the ATO in error or contains significant corrupt data.

2. ATO performs data matching on payroll details lodged via STP reports. To amend the total wages paid W1 and PAYG withheld W2 on the Activity statement, full file replacement of the lodged STP is the option to do so.

3. Full file replacement cannot be sent if any payee information sent in the original lodgement has been changed by a subsequent submit or update action.

Note : Full file replacement can be submitted only once for a lodged payroll event.

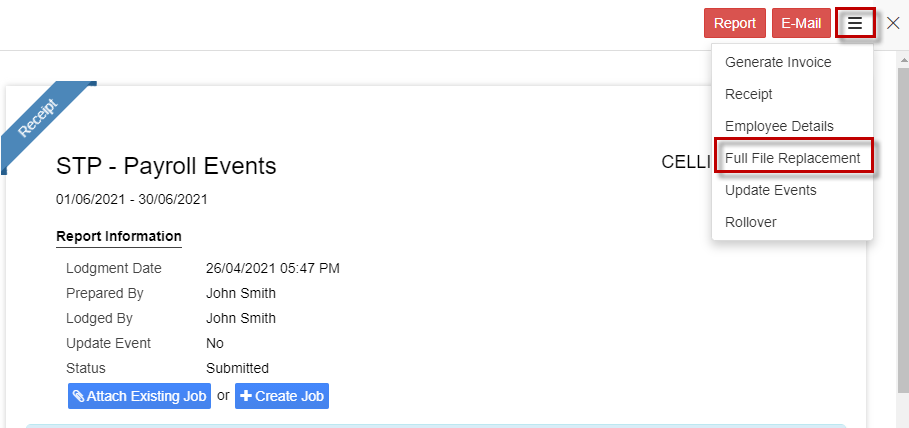

To do Full file replacement, Go to My Lodgments > History.

Open the lodged STP report

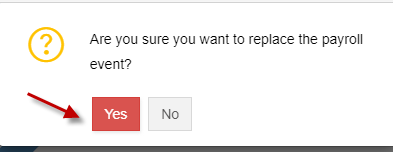

Select Full File Replacement from More actions menu and then select Yes to confirm.

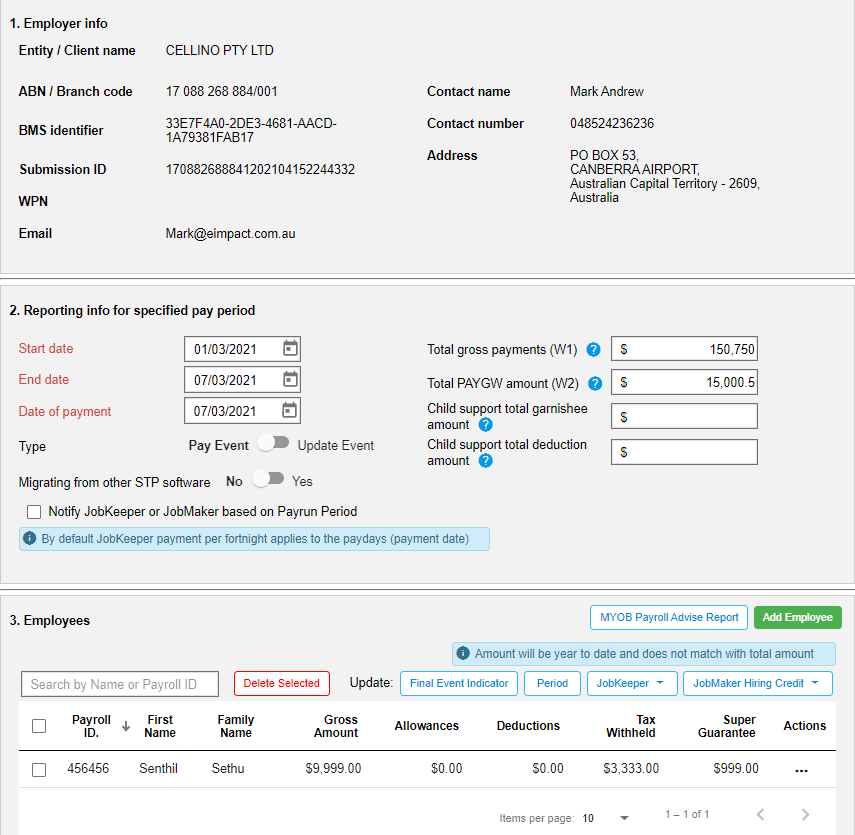

The STP report will be opened with the previously lodged data. Make necessary corrections and Save.

Complete the Declaration, select the lodgment type and Submit.

Once you Submit the STP report, the status will change to Processing, which means it is in queue to the ATO. The report will be automatically lodged once it has proceeded through the ATO queue.

Once the report has been successfully submitted to the ATO, the report will display under My Lodgments > History.

Importing Payroll Event Details from CSV File

To prepare the STP report by importing details from a CSV file into GovReports, go to My Clients > select client.

Follow the instructions in Converting to STP V2 (New Version) to select the client and swap to STP V2 if this has not already been completed.

To start a new payroll event go to My Clients > select client. Select Forms then STP – Payroll Events.

Check that the prefilled employer information is correct.

In Reporting info for specified pay period, enter pay run start date, end date and date of payment.

Make sure these details are correct before proceeding.

In the Employees section, select Import.

Currently GovReports accepts both STP CSV files version 1 and 2. If you are using an STP CSV File V1 note that you will need to complete additional mandatory fields after importing before you can lodge. This is because STP V1 CSV files do not have all the ATO required fields for STP V2 reporting.

Select Version 1 or 2.

The Import File screen appears. Download the sample file.

The sample CSV file has demonstration employee entries. The employee entries to be imported must be in this format.

View the import specification document in the GovReports blog link for more details: https://blog.govreports.com.au/single-touch-payroll-import-specification-document/

Upload the CSV file.

The CSV file will be uploaded. Select Next.

Review the fields and the mapping. Make any required changes, then select Next.

View the import summaryand check for errors.

If needed, Cancel the import, make corrections to the CSV file and import again.

Once the import shows as Valid it is ready to Import.

Once the details have been saved, select log file to check the import log.

Select Open Report and the details will populate the Employees section.

Review the employee details and complete the declaration before submitting.

Before making the declaration, check for any errors.

If there are no errors, select lodgment type and Save or Submit.

The validated payroll information will be redirected to Saved Reports screen automatically. The status shows as Valid.

The report will also be listed under Saved Reports and client dashboard.

To lodge saved reports, follow instructions at Save and Lodge Options .

Importing from Reckon

To prepare the STP report by importing details from a Reckon file into GovReports, go to My Clients > select client then open the STP form.

Follow the instructions in Converting to STP V2 (New Version) to select the client and swap to STP V2 if this has not already been completed.

To start a new payroll event go to My Clients > select client. Select Forms then STP – Payroll Events.

Check that the prefilled employer information is correct.

In Reporting info for specified pay period, enter pay run start date, end date and date of payment.

Make sure these details are correct before proceeding. Check that the payer ABN in the Reckon file matches the ABN listed in the employer information.

In the Employeessection, select Import.

Select Reckon File V1.

Upload the Reckon JSON file then select Next.

If records are validated, select Next again.

Review the fields and the mapping. Make any required changes, then select Next.

View the import summary and check for errors.

If needed, Cancel the import, make corrections to the Reckon file, export the JSON file and import again.

Once the import shows as Valid it is ready to Import.

Once the details have been saved, select log file to check the import log.

Select Open Report and the details will populate the Employees section.

Review the employee details and complete the declaration before submitting.

Before making the declaration, check for any errors.

If there are no errors, select lodgment type and Save or Submit.

To lodge saved reports, follow instructions at Save and Lodge Options .

Importing from Chris21

To prepare the STP report by importing details from a Chris21 STP file into GovReports, go to My Clients > select client then open the STP form.

Follow the instructions in Converting to STP V2 (New Version) to select the client and swap to STP V2 if this has not already been completed.

To start a new payroll event go to My Clients > select client. Select Forms then STP – Payroll Events.

Check that the prefilled employer information is correct.

In Reporting info for specified pay period, enter pay run start date, end date and date of payment.

Make sure these details are correct before proceeding. Check that the payer ABN in the Chris21 file matches the ABN listed in the employer information.

In the Employees section, select Import.

Upload the Chris21 file then select Next.

Upload the Chris 21 XML file then select Next.

If records are validated, select Next again.

View the import summary and check for errors.

If needed, Cancel the import, make corrections to the Chris21 file, export the XML file and import again.

Once the import shows as Valid it is ready to Import.

Once the details have been saved, select log file to check the import log.

Select Open Report and the details will populate the Employees section.

Review the employee details and complete the declaration before submitting.

Before making the declaration, check for any errors.

If there are no errors, select lodgment type and Save or Submit.

To lodge saved reports, follow instructions at Save and Lodge Options .

Importing from MYOB Payroll Advice Report

Importing information from MYOB is a slightly different process from importing from other software.

The first time you add details from MYOB, you need to enter the employee details manually. The employee’s payroll ID number must be exactly the same as the identifier in MYOB. Other identification fields including name and TFN must also match MYOB; for example, if the employee name in MYOB includes a middle name this must be added to GovReports.

Once this has been added manually the first time, future pay runs can be rolled over and employee details will populate.

Export the MYOB payroll advice report to CSV format.

To prepare the STP report by importing details from an MYOB Payroll Advice Report into GovReports, go to My Clients > select client then open the STP form.

Follow the instructions in Converting to STP V2 (New Version) to select the client and swap to STP V2 if this has not already been completed.

To start a new payroll event go to My Clients > select client. Select Forms then STP – Payroll Events.

Check that the prefilled employer information is correct.

In Reporting info for specified pay period, enter pay run start date, end date and date of payment to match the MYOB Payroll Advice Report that is being imported.

Make sure these details are correct before proceeding.

Enter employee details manually before importing the first MYOB payroll advice report.

Select MYOB Payroll Advice Report and choose the file or drag and drop .

The file must be CSV format. Once successfully uploaded, select Next.

Select Import.

Check that the payroll details and year to date amounts are correct.

Before making a declaration or lodging, check for errors . Correct any errors by selecting Edit from the Actions menu, correct relevant details, then Save again.

Choose the required lodgment type option, complete the Declaration then select Submit.

To lodge saved reports, follow instructions at Save and Lodge Options .

Checking and Correcting Errors

STP reports must be free from errors before being submitted to the ATO.

Errors are shown on the right side of STP forms as shown previously at checking for errors .

Hover your mouse over the error and select View which will redirect you to the respective field to correct the error. You will also be shown steps to resolve the error.

After entering the required information to correct the error, select Save.

After the listed errors have been corrected, the form is ready for lodgment.

Before making the declaration, select lodgment type and Save or Submit.

To lodge saved reports, follow instructions at Save and Lodge Options .

The validated payroll information will be redirected to Saved Reports screen automatically. The status shows as Valid.

The report will also be listed under Saved Reports and client dashboard.

Remember that you can only lodge forms that have Valid status. If you try to lodge a draft report, you will receive a notification that the report is still draft status, and that you must validate it before lodging.

To lodge saved reports, follow instructions at Save and Lodge Options .

Checking and Correcting Errors in CSV File

To correct errors in a CSV file, open the CSV file, check for payroll start and end dates.

The dates in the CSV file should be the same as the Reporting Info for specified pay period section in STP Payroll Events form.

Other common errors relate to incorrect codes or formats being used or missing data in required fields.

View the import specification document in the GovReports blog link for more details: https://blog.govreports.com.au/single-touch-payroll-import-specification-document/

After correcting any errors in the CSV file upload again.

Once all records have been validated successfully select Import.

Once the details have been saved, select log file to check the import log.

Select Open Report and the details will populate the Employees section.

In this example, the error is caused by missing amounts in the gross payment and PAYGW fields.

In this case, you do not need to import the CSV file again but can manually enter the missing amounts then select Save to proceed with reviewing, validating, authorising and lodging.

Checking and Correcting Errors in Reckon File

If you receive the error message “The payer ABN in the Reckon file must match the ABN of the selected business” you will be prevented from importing the file.

Open the Reckon file. Check the ABN information in the Reckon file.

If the ABN is correct in the Reckon file, check the client details in GovReports. Edit the client details so that the ABN is the same as the Reckon file.

If the ABN is correct in GovReports and incorrect in Reckon, the details must be updated in Reckon, the JSON file exported again, and then uploaded again to GovReports.

Checking and Correcting Errors in Chris21 File

If you receive the error message “The payer ABN in the Reckon file must match the ABN of the selected business” you will be prevented from importing the file.

If you get this message, the selected Chris21 STP file cannot be imported but a different file with matching ABN can be imported.

When the correct Chris21 STP file is imported, the import summary will be valid.

Checking and Correcting Errors in MYOB Payroll Advice Report

If you receive the error message “No records found for the given period”, check that you have entered the pay run dates and payment date into GovReports exactly as is listed in the MYOB report.

If you receive the error message “Amount will be year to date and does not match with total amount”, check that you have entered the year to date figures, not just the specified pay period figures.

Correct the entries in Reporting info for specified pay period and import the MYOB Payroll Advice Report again.

Deleting Draft Pay Events

To delete a draft event, for example if pay events have been unnecessarily duplicated, find the event under My Lodgments > Saved Reports.

Select the report to be deleted, then Delete Selected.

Rolling Over Employee Information

The roll over option is available for each pay cycle to easily repeat pay runs. The employee’s basic information is populated every payroll event. Use the Roll Over option in GovReports Employees information to enter appropriate payroll category figures.

To prepare the STP report in GovReports, go to My Clients > select client.

Follow the instructions in Converting to STP V2 (New Version) to select the client and swap to STP V2 if this has not already been completed.

If STP has already been swapped to V2, go to My Clients > select client > Forms. Select STP – Payroll Events.

The STP - Payroll Events screen will load.

Check that the prefilled employer information is correct.

In the Employees section, select Roll Over.

The rollover window opens. From the list of lodged reports, select the report to roll over. From each report, you can see the number of employees included in the report.

Select the required report to rollover and select Submit.

Enter the dates of the new or current STP pay period then select Submit.

In the Employees section, review the employee records being rolled over to the current reporting period.

From the Actions menu, select Edit.

The employee’s basic details are prefilled from the previous payroll event that was rolled over.

The period start and end dates have been populated from the STP Payroll Event information. Check these are correct or edit.

If there are any additional payroll categories for this payroll event, add amounts at relevant fields.

Return to the Reporting info for specified pay period section. Enter the gross payments, PAYGW and superannuation amounts.

Before making a declaration, check for errors .

Correct any errors by selecting Edit from the Actions menu, correct relevant details, then Save again.

Choose the required lodgment type option, complete the Declaration then select Submit.

Alternatively, to roll over lodged reports, go to My Clients > select client > select lodged report and Open.

From the lodgment receipt screen, select Rollover from the overflow menu.

You can then proceed as per instructions above for rolling over previous payroll event details to a new payroll event.

EOFY Payroll Finalisation

At the end of each financial year, employers must provide payroll information to all employees. Using Single Touch payroll to finalise payroll information submits the data to the employees’ myGov account, where they will see their income statement for the year from each employer.

In GovReports STP V2, you will need to indicate the final pay run of the year. This declares that you have provided all required payroll information for the financial year through your STP reporting and submits it to the ATO.

You make a finalisation declaration by providing a final event indicator for each employee.

You can mark a pay run as a final event for an employee any time during the financial year. For example, for employees who have ceased employment in the middle of the financial year, you can submit the final event indicator upon their termination.

STP finalisation must be completed for all employees by 14 July each year.

STP Finalisation

To prepare the STP finalisation in GovReports, go to My Clients > select client.

Follow the instructions in Converting to STP V2 (New Version) to select the client and swap to STP V2 if this has not already been completed.

If STP has already been swapped to V2, go to My Clients > select client > Forms. Select STP – Payroll Events.

The STP - Payroll Events screen will load.

Check that the prefilled employer information is correct.

Complete the final pay run by manual data entry , importing a file from CSV, Reckon , Chris 21 or MYOB Payroll Advice Report or rolling over a previous pay run .

Records will be filled in the Employees section. Select all employees to be finalised for the year.

You can select one employee there is only one person to finalise in a particular pay run.

Select Final Event Indicator .

Confirm that this is a final pay for selected employees and select Update.

Final event indicator is updated successfully.

In the employee entry, under the Actions menu, select Edit.

In the payrun section Final Event Indicator is checked.

If the report has not been saved or submitted, at this point you can still edit the report and deselect the final event indicator if this has been done in error.

Enter the PAYG amount and superannuation entitlement amount.

Because you are entering the year to date amount for the entire financial year, this will override previous amounts submitted.

Choose the required lodgment type option, complete the Declaration then select Submit.

The validated payroll information will be available under Saved Reports and also in the client dashboard under the Valid/Draft tab.

Your final event is ready for lodgment. Select the report to be lodged, select Lodge Selected and Confirm.

Select that lodgment to view the receipt if required.

Once the report has been successfully submitted to the ATO, the report will display under My Lodgments > History and also in the client dashboard under the Lodged tab.

Saving and Emailing Lodged Report PDFs

To access lodged reports, go to My Lodgments > History . From the Actions menu of the required report, select Open.

This will open the summary screen showing lodgment status. If the report has already been lodged, the status will show Receipt.

Select Report.

The payroll event report will open in PDF format, showing a summary of the payroll information submitted to the ATO. Save the report as desired

The PDF can be emailed to the client from the same screen.

Select E-Mail to open the Send E-Mail screen. Select Client button.

Check the email address and name of the client are correct, customise the message if required, then Send. Both the payroll event report and the lodgment receipt are automatically attached to the email.

Alternatively, go to My Lodgments > Employee/Contractor Reports .

Select E-Mail icon from employees list.

The same Send E-Mail screen appears. Select the receiver: Myself, Client or Other.

Once the email has been sent, the success message displays.

Sending STP Reports for Digital Signature

Single Touch payroll pay events require authorisation for every electronic lodgment.

The ATO allows an annual authorisation agreement between registered agents and eligible businesses. To check if you and your client are eligible for an annual authorisation, go to ATO STP engagement authority for details.

If the business is not eligible for an annual STP authority, the employer must authorise each STP payroll event before a registered agent can lodge on their behalf.

GovReports includes an integrated digital signature function to enable quick and easy authorisation of each payroll event.

Once an STP report is ready for lodgment, you can send the report to your client for their digital signature.

In the Save & Lodge section of a payroll event, select Validate and Send for Signature, then Submit.

This takes you to GovReports Digital Authentication in a separate browser tab. Check the email address and name of the client are correct. The payroll event report will automatically be attached to the email. Customise the message if required.

Select Next.

Mark the signature location on the document.

Select Send for Signature.

You will be taken to the Digital Authentication summary screen where you can see the status and audit log of the digital signature form.

An email will be sent to your client where they can review and sign the report digitally.

You will be notified by email once the client has signed. Once authorised by the client, you can proceed to lodge the report from My Lodgments > Saved Reports.

Printing and Emailing Employee Details

Employee details within all lodged STP reports can be viewed under My Lodgments > Employee/Contractor Reports.

Select View for the required report. You can now see the list of all employees contained in that lodgment period.

Under the Actions menu, select Print or E-Mail.

Save or send as required.

The Response option shows the status of that lodgment.

Migrating from Other Software

If you are migrating from other STP software to GovReports, first you will need to submit an updated event. This notifies the ATO that the reporting software has been changed from another software to GovReports.

Although the year to date figures are not being adjusted, the BMS is being updated.

To prepare the first STP update event, go to My Clients > select client.

Follow the instructions in Converting to STP V2 (New Version) to select the client and swap to STP V2 if this has not already been completed.

The STP - Payroll Events screen will load.

Check that the prefilled employer information is correct.

In Reporting info for specified pay period, enter pay run start date, end date and date of payment.

Make sure these details are correct before proceeding.

Select Update Event in the Reporting info for specified pay period section.

Select Yes for Migrating From other STP software . Enter Previous BMS Identifier. You will need to retrieve this from the software previously used to lodge STP or from the ATO online services STP reporting history.

Previous BMS identifier is a unique number which identifies the previous Business Management System (BMS) software used by the payer.

Manually enter or import the employees and enter the year to date figures for all employees.

Edit the Employee info and enter the Previous payroll ID . The previous payroll ID is used to transfer payee YTD values from an old payroll ID to the new payroll ID for the payee. This is required for ATO matching of employee data already submitted via other software.

Check the employee amounts are correct.

Choose the required lodgment type option, complete the Declaration then select Submit.

You can then proceed with entering new payroll events once the BMS update has been submitted and successfully lodged with the ATO.

Help Centre

The Help Centre is available from the main menu and any screen.

The GovReports

Help Centre

provides further resources and links to

videos, email support and phone support.

Business Activity Statement

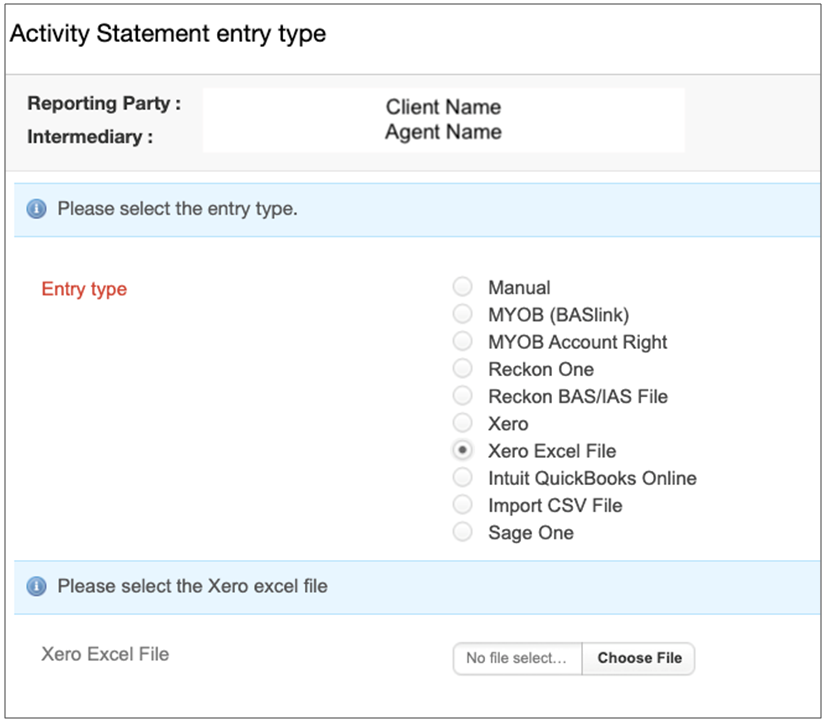

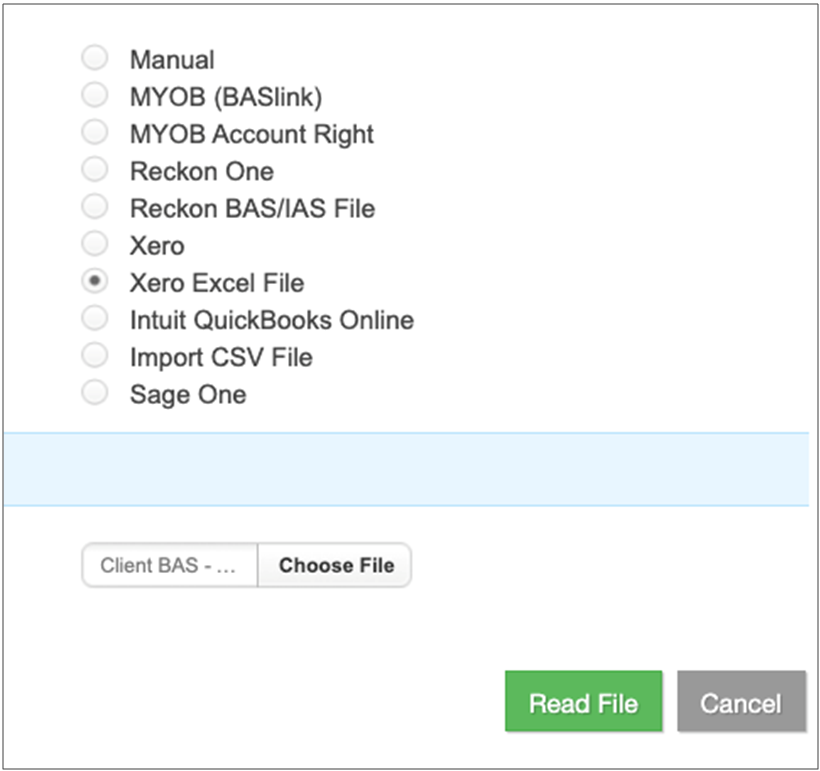

Activity Statement Xero Excel File Import

Xero’s “new version” activity statement report cannot be directly synced with GovReports. If you are completing the BAS in Xero using the new version report, you can either complete the fields manually or import the BAS using an Excel file.

Export the completed BAS to Excel.

From the client dashboard, go to Forms > Activity Statement > select the period > select the relevant BASperiod.

The list of entry types will display. Choose Xero Excel File.

From Choose File, select the saved Xero BAS Excel file, then select Read File.

The details of the BAS will populate, and you can now proceed with the BAS as usual.