ATO Reports

ATO Client Communication

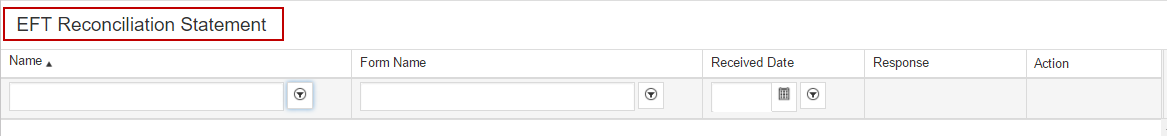

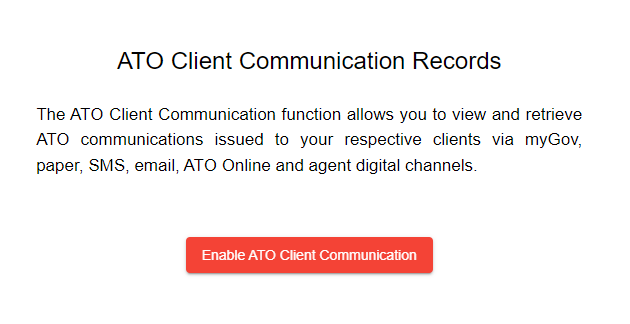

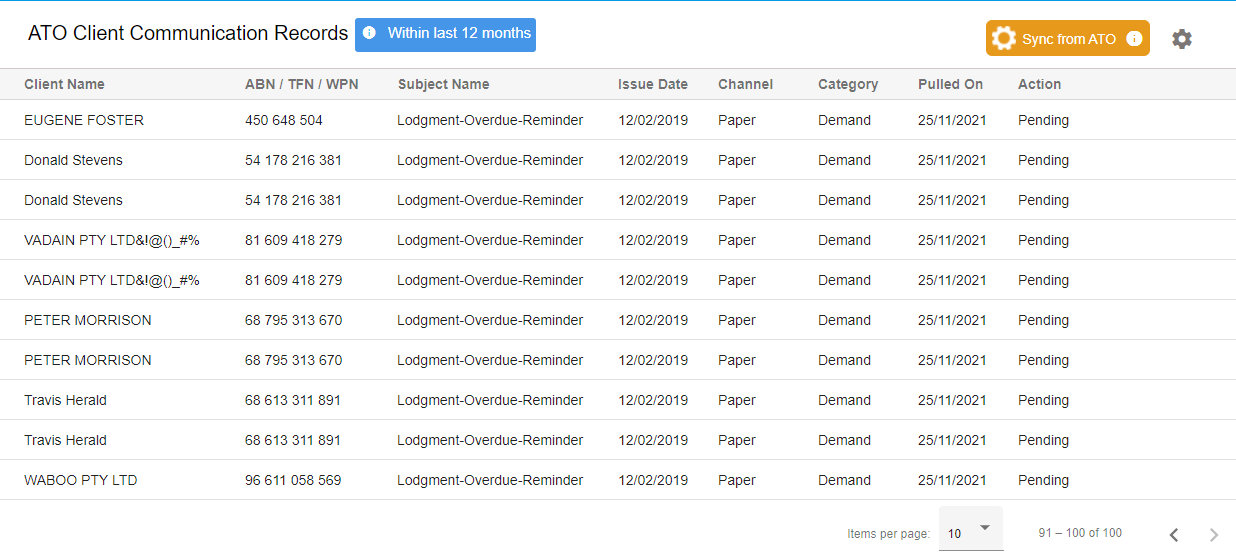

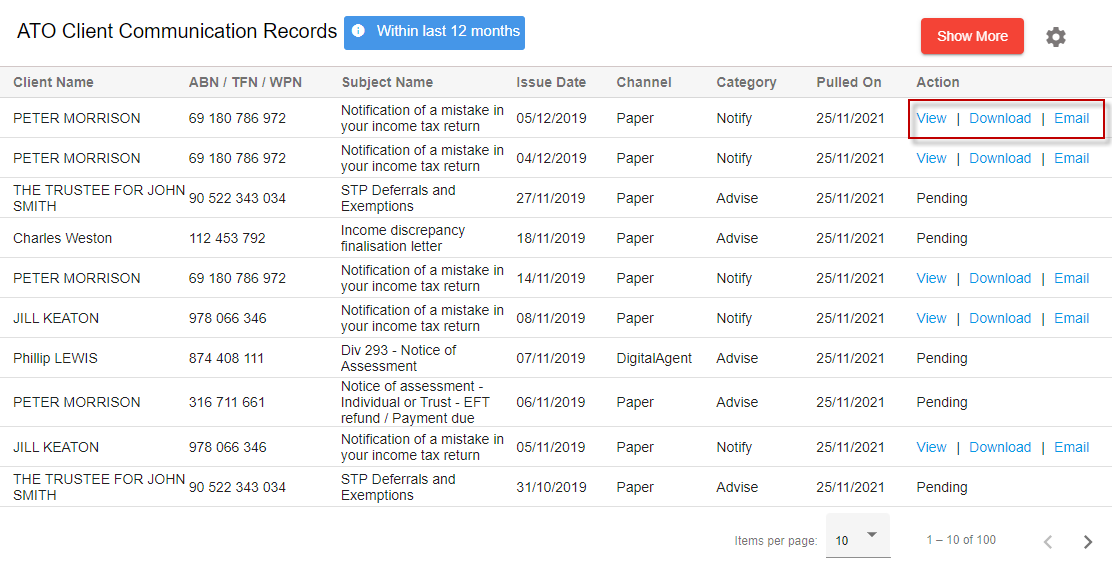

Throughout the year the ATO communicates with your clients via 6 channels – Paper, mygov, SMS, email, ATO Online and Agent Digital.

As you know they may send your client all sorts of communications such as a PAYG Instalment Notice, Notice of Assessment or STP information.

This feature allows you to conveniently request, retrieve, view, download and share ATO Client Communications from within GovReports.

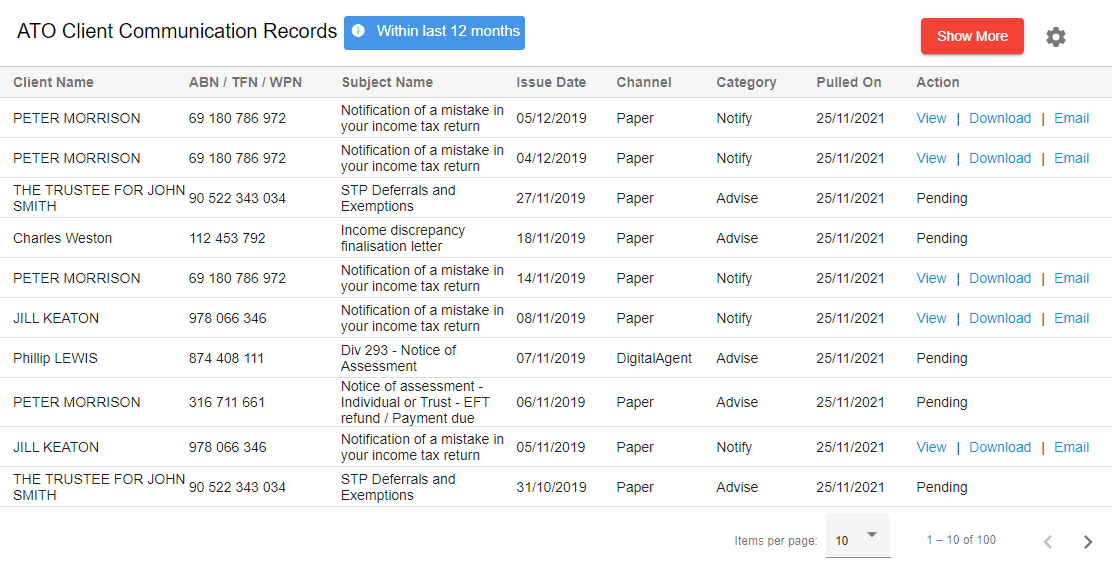

To activate ATO Client Communications

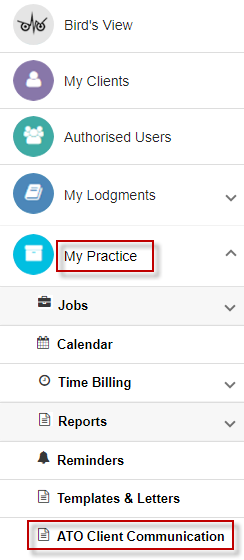

Step 1: Go to ATO Reports

Step 2: From the dropdown select ATO Client Communication

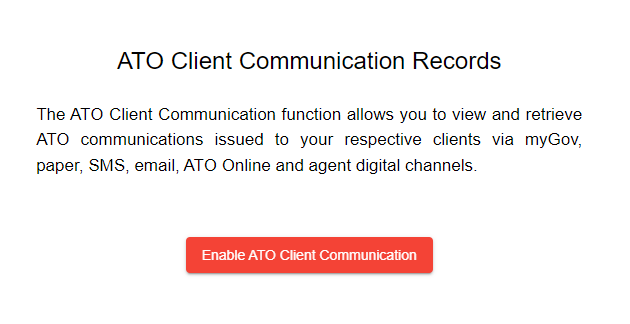

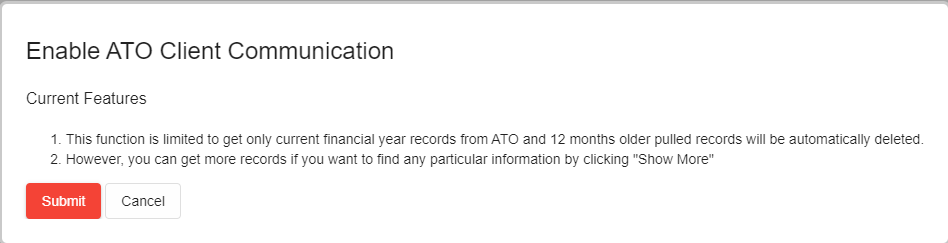

Step 3: Select Enable ATO Client Communication to list ATO communication records for respective clients.

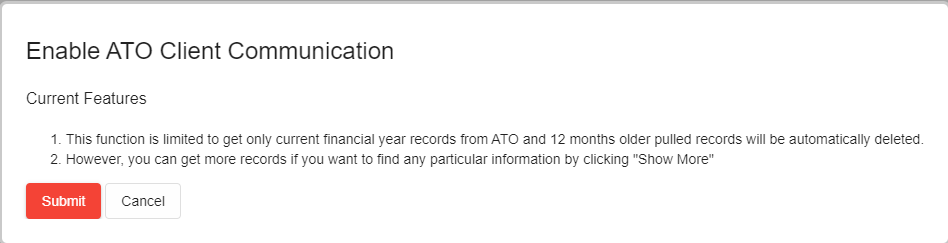

Step 4: Select Submit to enable ATO Client Communication Records

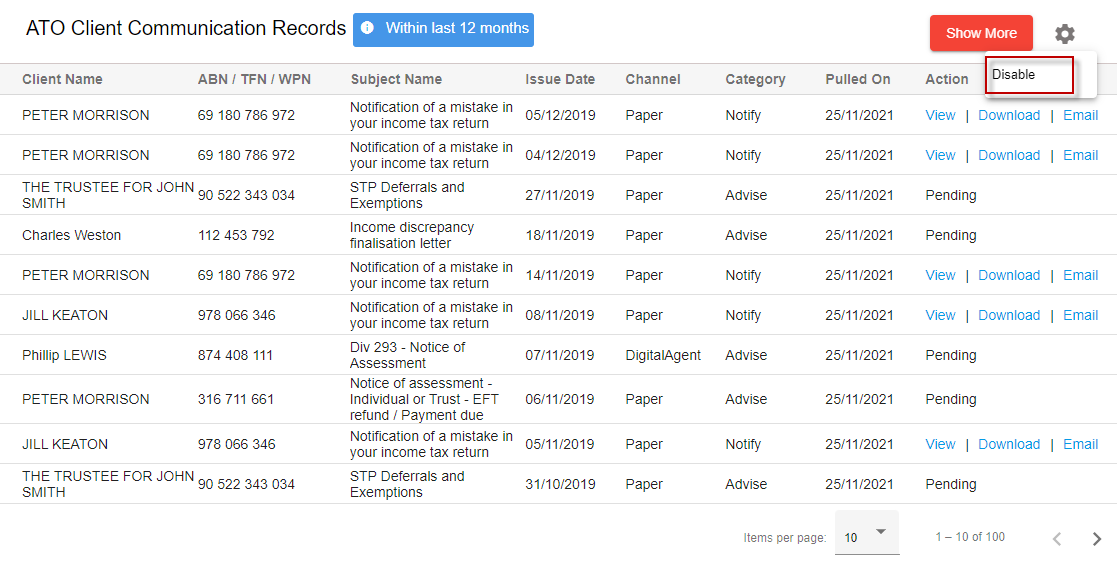

This service is limited to retrieving ATO Client Communication Records for the current financial year.

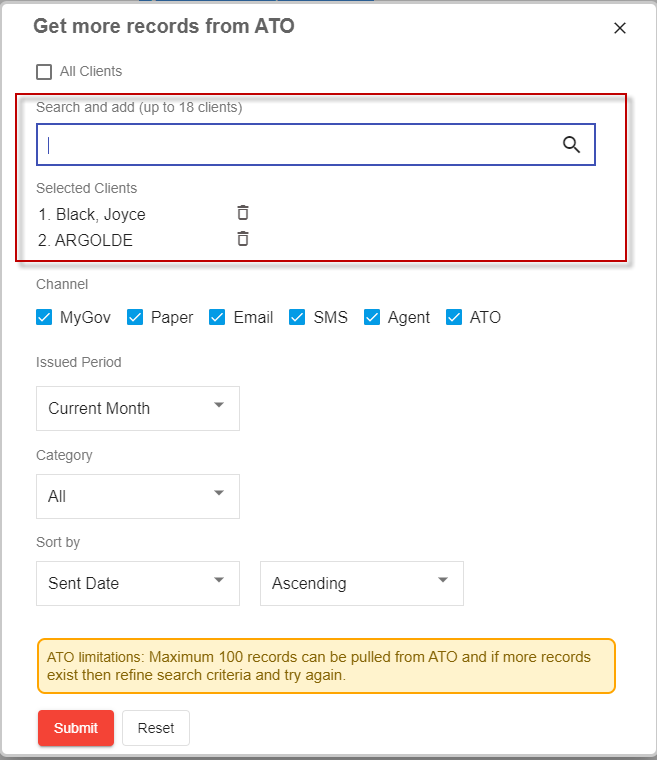

To retrieve older client records from the ATO, select Show More (Top RHS).

You can search records for either:

Searching All Clients

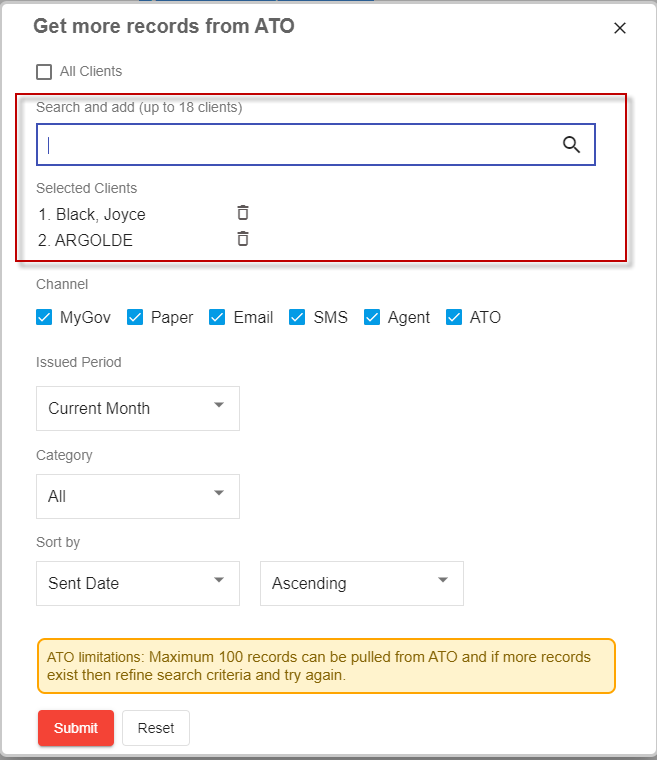

Searching Single or Multiple Clients

You can also search records for Single or Multiple clients by period and/or category. Based on the search criteria, the ATO retrieves the communications.

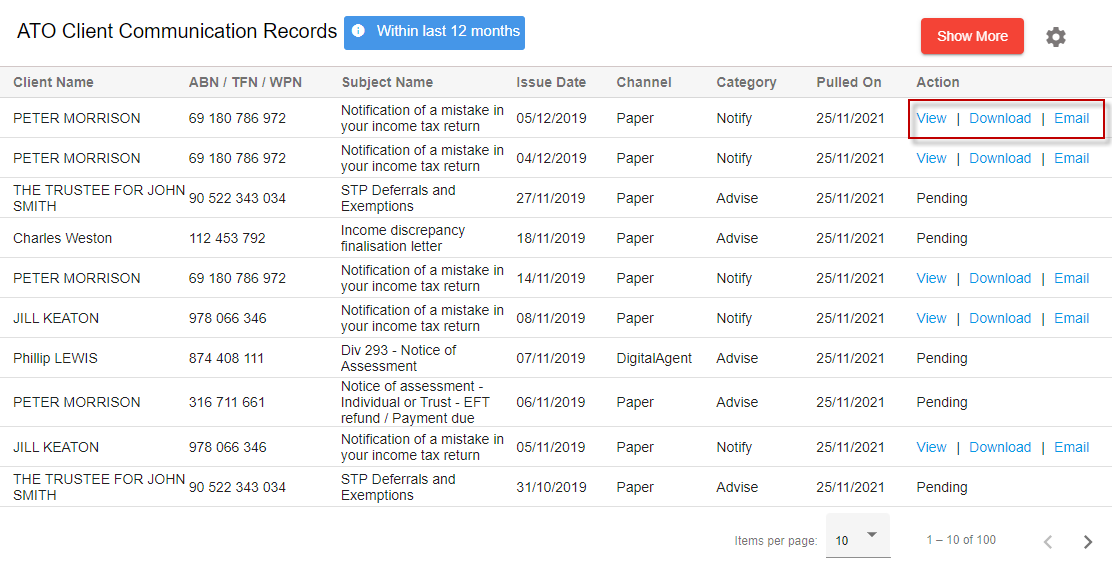

For each client record retrieved you have options to either:

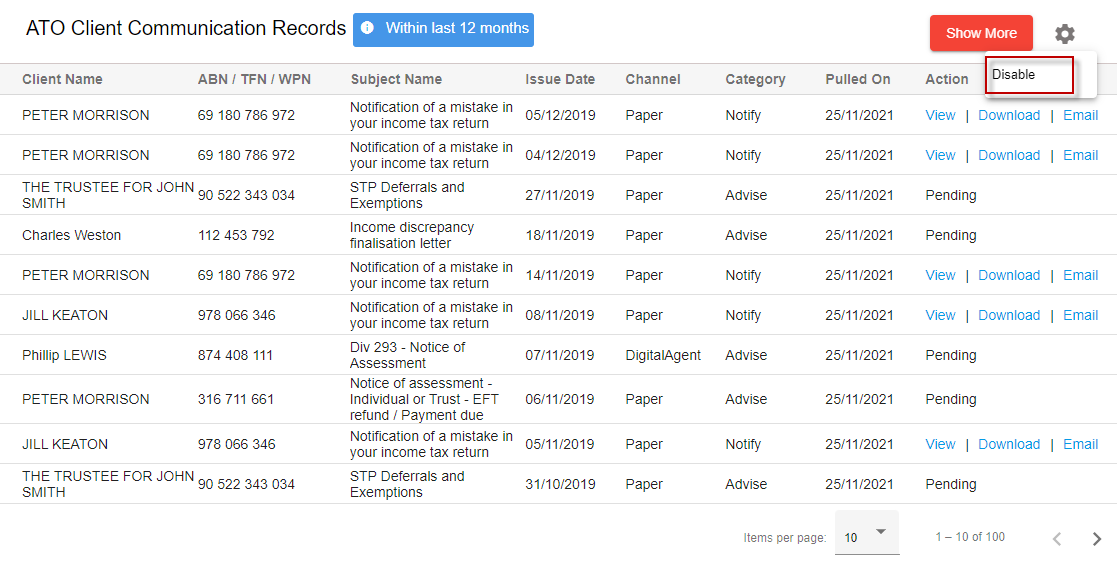

Disabling ATO Client Communications

At any time you can disable this service by selecting Disable from the Settings icon.

As you know they may send your client all sorts of communications such as a PAYG Instalment Notice, Notice of Assessment or STP information.

This feature allows you to conveniently request, retrieve, view, download and share ATO Client Communications from within GovReports.

To activate ATO Client Communications

Step 1: Go to ATO Reports

Step 2: From the dropdown select ATO Client Communication

Step 3: Select Enable ATO Client Communication to list ATO communication records for respective clients.

Step 4: Select Submit to enable ATO Client Communication Records

This service is limited to retrieving ATO Client Communication Records for the current financial year.

To retrieve older client records from the ATO, select Show More (Top RHS).

You can search records for either:

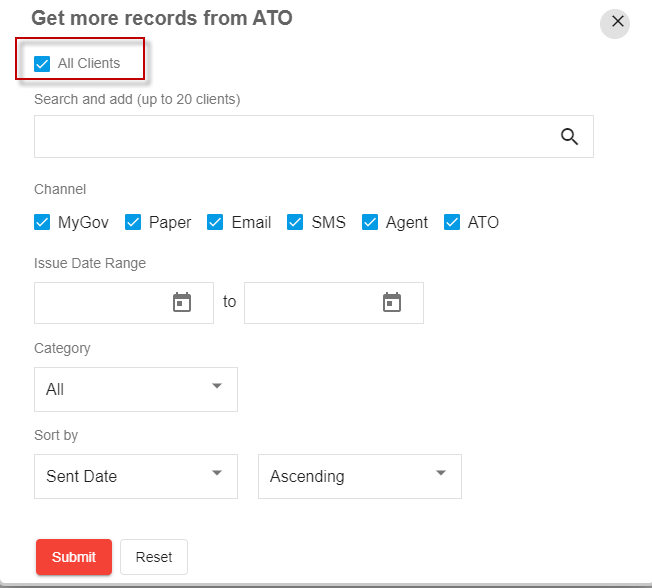

- 1. All Clients

- 2. Single or Multiple Clients (Up to 20)

Searching All Clients

-

Selecting All clients will allow you to retrieve records for all clients within your account.

Searching Single or Multiple Clients

You can also search records for Single or Multiple clients by period and/or category. Based on the search criteria, the ATO retrieves the communications.

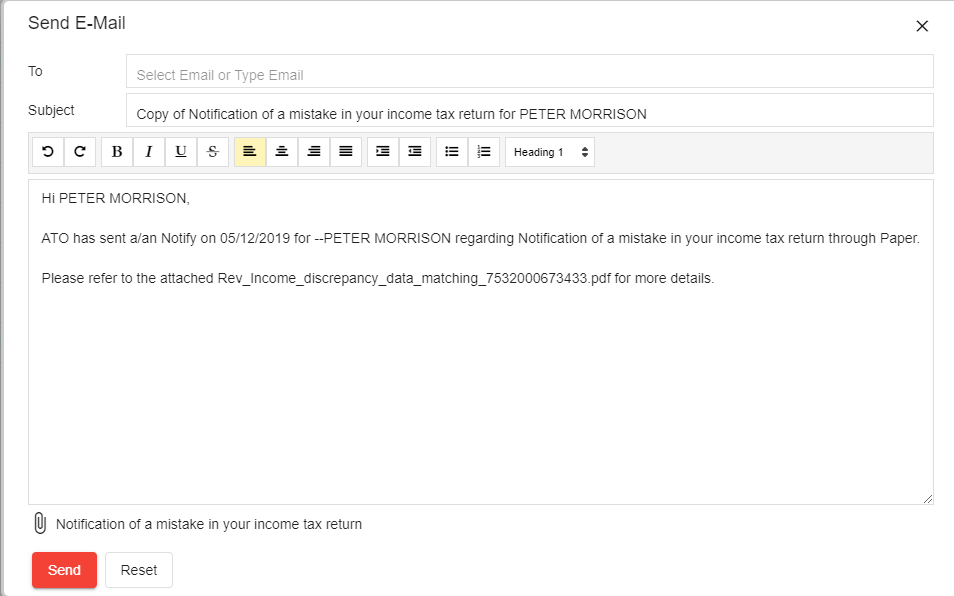

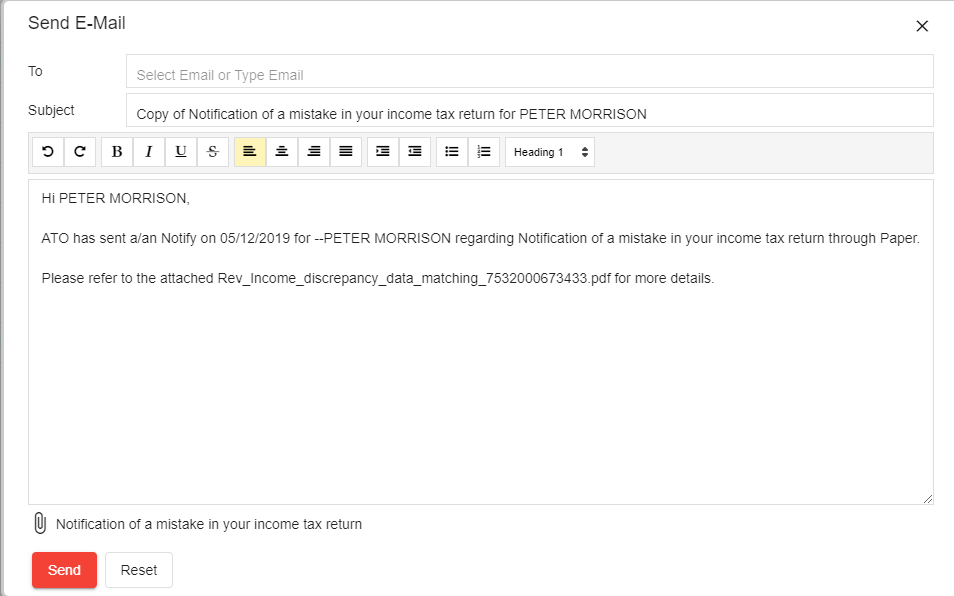

For each client record retrieved you have options to either:

- View

- Download and/or

- Email documents to clients.

Disabling ATO Client Communications

At any time you can disable this service by selecting Disable from the Settings icon.

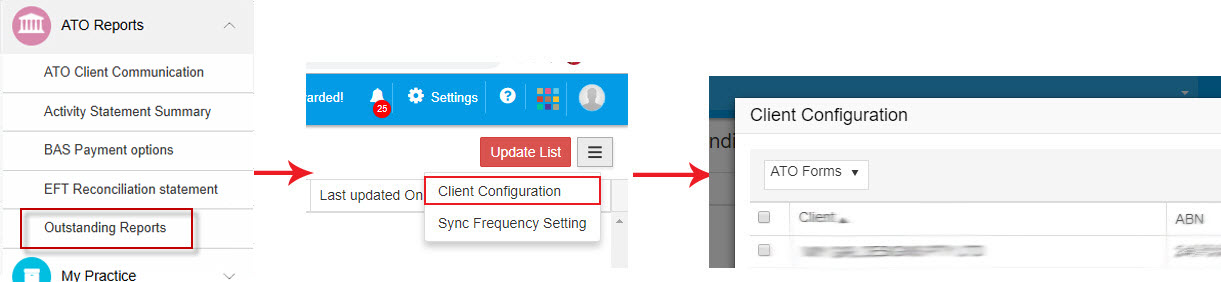

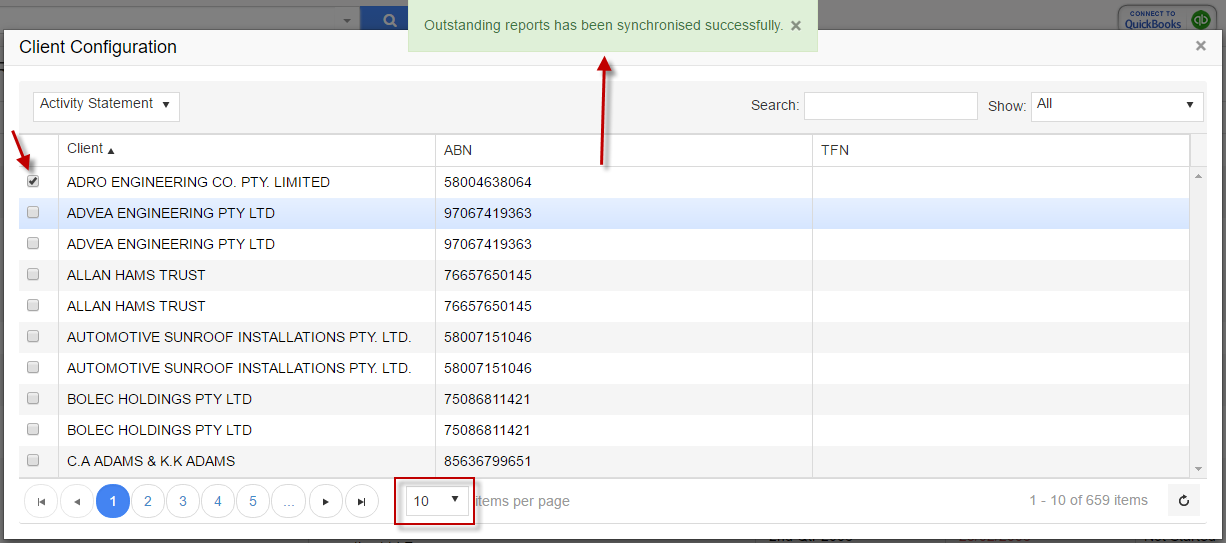

Outstanding Reports

Outstanding Reports is the Dashboard Notification Service Tool that synchronises with the ATO system and all Office of State and Territory Revenue Offices to list out all issued compliance reports required for the selected business entity and or the individual tax payer. These compliance reports include Activity Statements and all tax returns related to that tax payer as well as payroll tax obligations in the relevant State or Territory.

Depending on the tax payer’s business structure and its related reporting obligations, the listing of issued reports to be lodged will be tallied up from the list and the respected report will be removed as you prepare and successfully lodge the report to that end agency.

If the issued report becomes overdue, that particular report will be relisted on the Overdue tab for further emphasis on its overdue status.

You may and can click on the tallied number of outstanding reports to expand the list of issued reports and select to start working on the selected report direct without having to go and search for client.

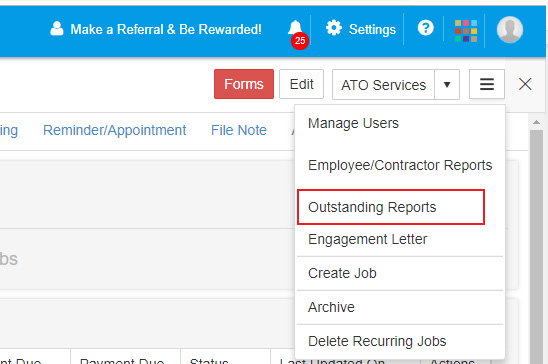

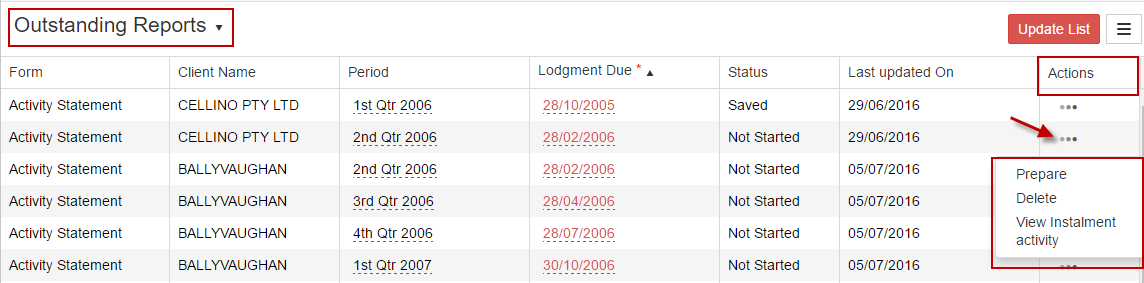

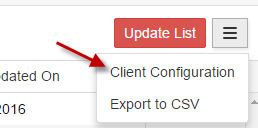

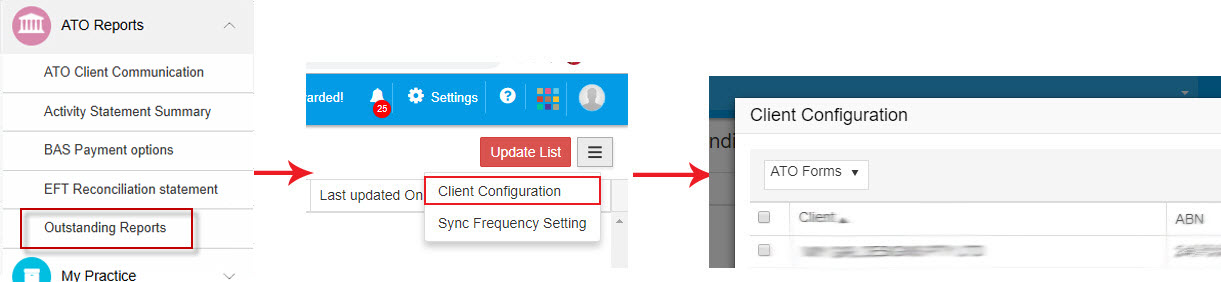

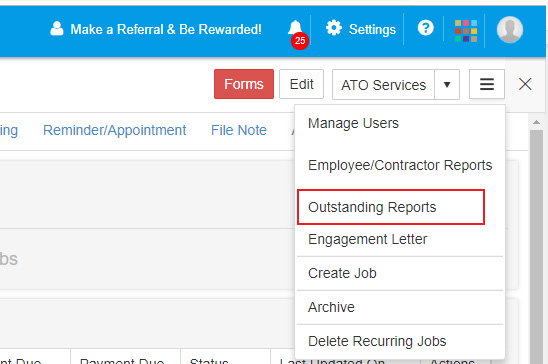

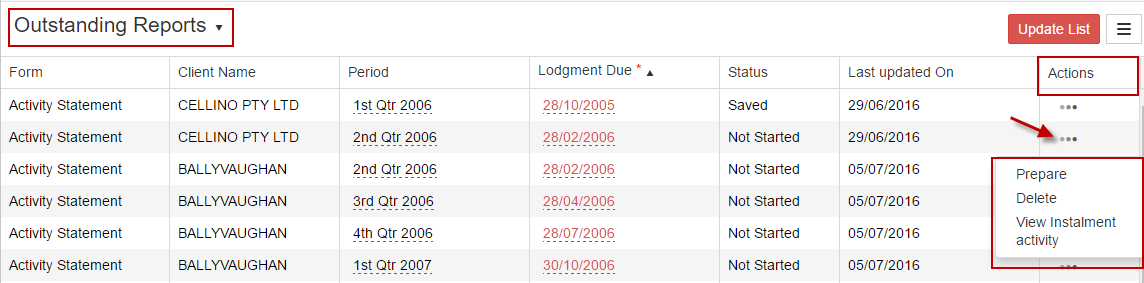

Outstanding reports show you what lodgments have been issued, but not lodged. There are 3 ways to access the settings for your "Outstanding Reports".

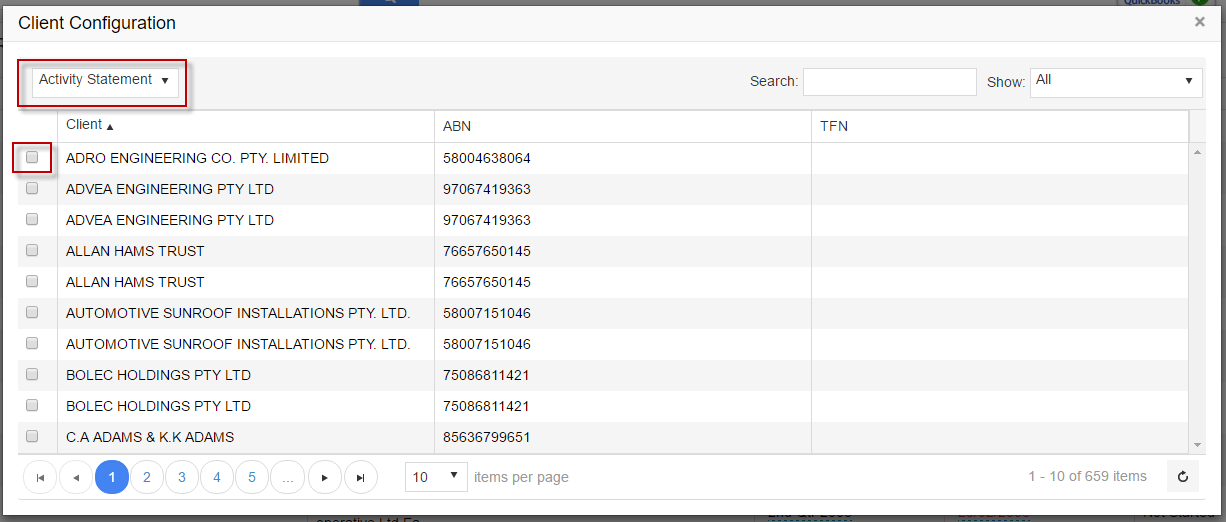

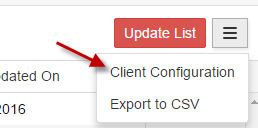

1. From your dashboard select ATO Reports => Outstanding Reports => Action Tab => Client Configuration

From here, you can select the Government Department ie ATO or relevant OSR and all clients that have the reporting to this selected government agency.

2. From the client’s profile page, Go to Action tab and selecting the Outstanding Reports option to follow the prompts

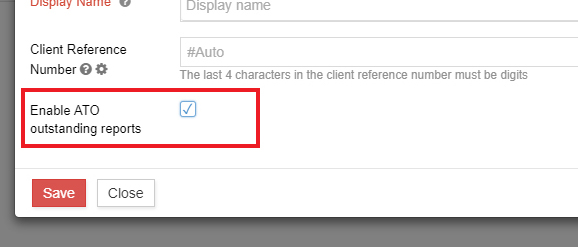

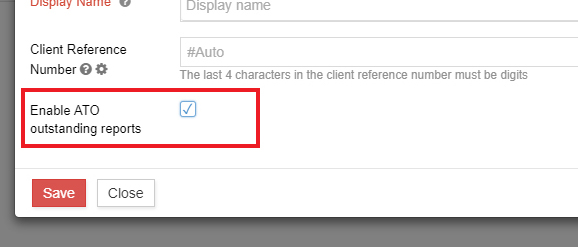

3. When Adding a New Client to GovReports

Outstanding Reports setting is also available from the new client set up.

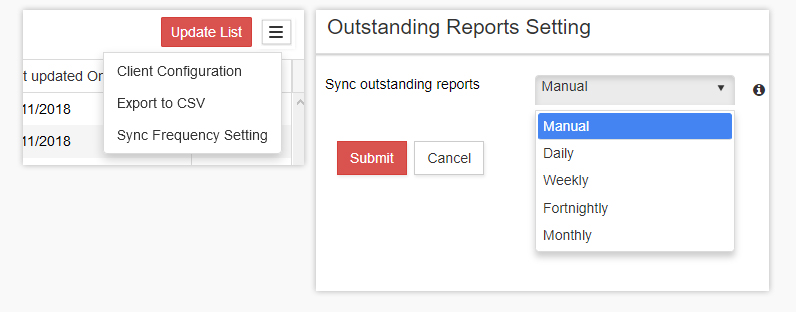

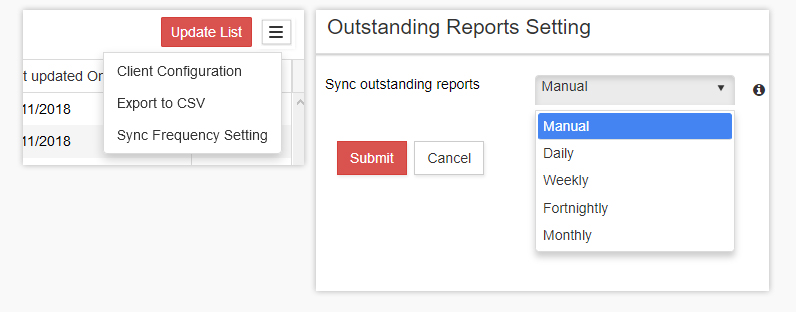

AUTO SYNC

Your Outstanding Reports list can now be automatically refreshed. There are two ways to access these settings;

1. From the Outstanding Reports page, goto more tab and select Sync Frequency Setting

From the drop down menu, select your preference, and hit Submit

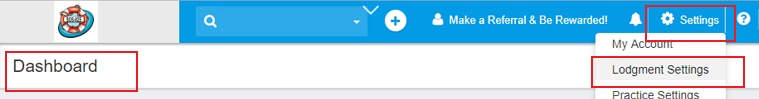

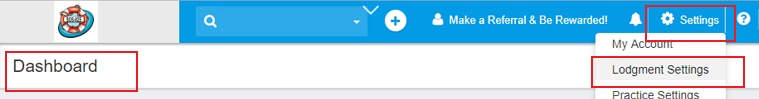

2. From Dashboard, go to Settings and select Lodgment Settings

and you’ll be redirected to Synchronisation Frequency Setting page to select from the drop down, the preferred frequency and click Submit to confirm.

For each of the outstanding report associated with the client listed here, to access, you can click on Actions which will further provide you the options to either

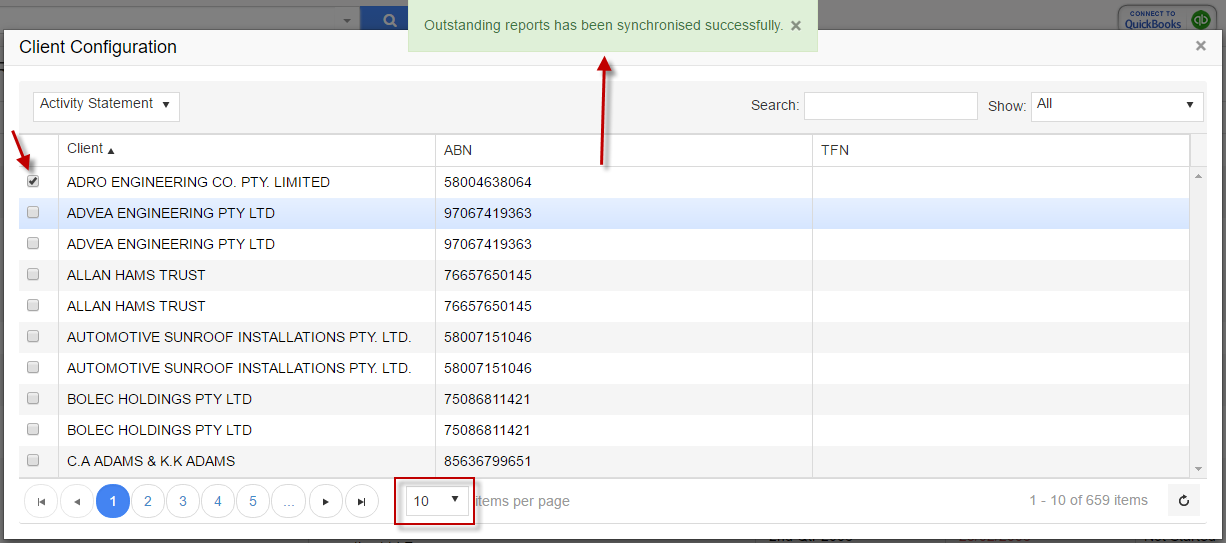

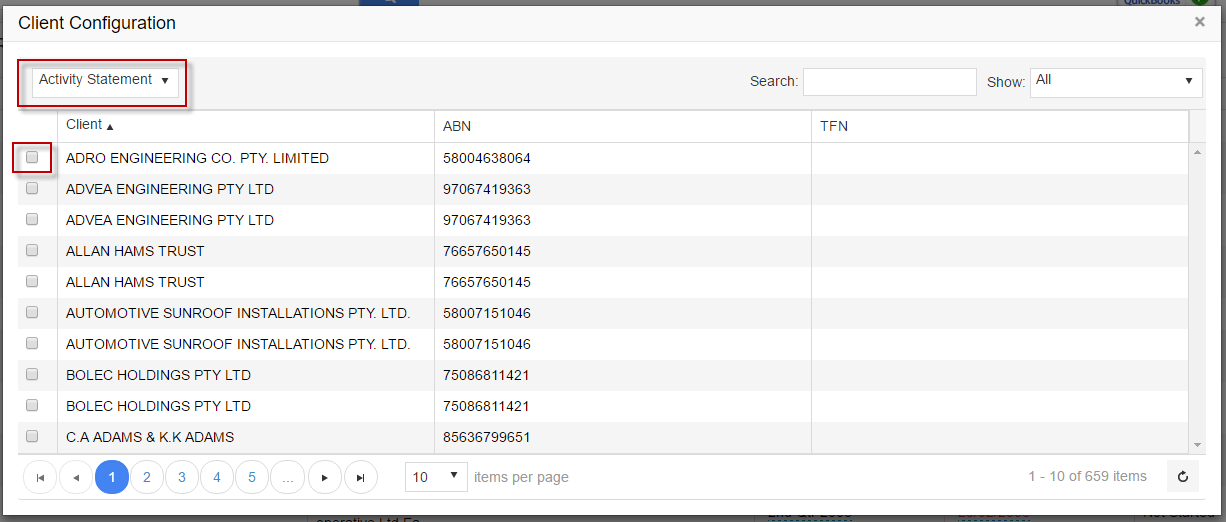

Client Configuration in Outstanding Reports must be set up at for the system to identify which clients you want to set reminder and synchronise with ATO to provide you the list of outstanding reports. As BAS and Tax agent provides different type of service for clients and clients to clients can be different set of arrangement, this is not automatically switched on if you purchase the service.

GovReports is currently set up to list outstanding reports for Activity Statements and payroll tax to State and Territories

You will need to select the form and tick to select to which client to apply for outstanding reports to. You may also select all clients by going to the Show drop down option and select Assigned or Unassigned to deselect all client configuration.

As each computer monitor and or access will have some restriction on the view of your account and of course with the full list of your outstanding reports. You can adjust and set the number of reports you want to see on your screen by selecting whether you want to list 10, 25, 50 or 100 at a time. Once it is set, next login or access, will show the set number of outstanding reports from this access.

Depending on the tax payer’s business structure and its related reporting obligations, the listing of issued reports to be lodged will be tallied up from the list and the respected report will be removed as you prepare and successfully lodge the report to that end agency.

If the issued report becomes overdue, that particular report will be relisted on the Overdue tab for further emphasis on its overdue status.

You may and can click on the tallied number of outstanding reports to expand the list of issued reports and select to start working on the selected report direct without having to go and search for client.

Outstanding reports show you what lodgments have been issued, but not lodged. There are 3 ways to access the settings for your "Outstanding Reports".

1. From your dashboard select ATO Reports => Outstanding Reports => Action Tab => Client Configuration

From here, you can select the Government Department ie ATO or relevant OSR and all clients that have the reporting to this selected government agency.

2. From the client’s profile page, Go to Action tab and selecting the Outstanding Reports option to follow the prompts

3. When Adding a New Client to GovReports

Outstanding Reports setting is also available from the new client set up.

AUTO SYNC

Your Outstanding Reports list can now be automatically refreshed. There are two ways to access these settings;

1. From the Outstanding Reports page, goto more tab and select Sync Frequency Setting

From the drop down menu, select your preference, and hit Submit

2. From Dashboard, go to Settings and select Lodgment Settings

and you’ll be redirected to Synchronisation Frequency Setting page to select from the drop down, the preferred frequency and click Submit to confirm.

For each of the outstanding report associated with the client listed here, to access, you can click on Actions which will further provide you the options to either

- a) Prepare

- b) Delete

- c) View Instalment activity

Client Configuration in Outstanding Reports must be set up at for the system to identify which clients you want to set reminder and synchronise with ATO to provide you the list of outstanding reports. As BAS and Tax agent provides different type of service for clients and clients to clients can be different set of arrangement, this is not automatically switched on if you purchase the service.

GovReports is currently set up to list outstanding reports for Activity Statements and payroll tax to State and Territories

You will need to select the form and tick to select to which client to apply for outstanding reports to. You may also select all clients by going to the Show drop down option and select Assigned or Unassigned to deselect all client configuration.

As each computer monitor and or access will have some restriction on the view of your account and of course with the full list of your outstanding reports. You can adjust and set the number of reports you want to see on your screen by selecting whether you want to list 10, 25, 50 or 100 at a time. Once it is set, next login or access, will show the set number of outstanding reports from this access.

Employee/Contractor Reports

Group certificates, TFN Declaration can be accessible from here as a quick guide or from the lodged reports of the PAYG Payment Summary Annual Report and TFND lodgments. This screen provides the list of all your PAYG Payment Summary, TPAR reports and TFND lodgments with quick access to the Employee reports by clicking on View.

Email option is available to select and that would automatically pick up the client details including email address and attach with it the lodgment receipt, and the employer report of the PAYG or TFND.

To email the individual employee’s payment summary or group certificate, you will need to click View Employee/Contractor Details and from there, you can click on the action icon on the same row as the employee you want to select, you will have options to print the download version of the report or email directly to the employee or employer or whoever is requesting it. The email will include it as a PDF attachment.

As each computer monitor and or access will have some restriction on the view of your account and of course with the full list of your lodged PAYG Payment Summary Annual Report and or TFND reports. You can adjust and set the number of reports you want to see on your screen by selecting whether you want to list 10, 25, 50 or 100 at a time. Once it is set, next login or access, will show the set number of saved reports.

Search field will enable you to search a particular reports using any of the field name set in GovReports Lodged Reports including client name, report type, ABN, TFN, date of lodgment or lodgment period, status of report,..etc

Email option is available to select and that would automatically pick up the client details including email address and attach with it the lodgment receipt, and the employer report of the PAYG or TFND.

To email the individual employee’s payment summary or group certificate, you will need to click View Employee/Contractor Details and from there, you can click on the action icon on the same row as the employee you want to select, you will have options to print the download version of the report or email directly to the employee or employer or whoever is requesting it. The email will include it as a PDF attachment.

As each computer monitor and or access will have some restriction on the view of your account and of course with the full list of your lodged PAYG Payment Summary Annual Report and or TFND reports. You can adjust and set the number of reports you want to see on your screen by selecting whether you want to list 10, 25, 50 or 100 at a time. Once it is set, next login or access, will show the set number of saved reports.

Search field will enable you to search a particular reports using any of the field name set in GovReports Lodged Reports including client name, report type, ABN, TFN, date of lodgment or lodgment period, status of report,..etc

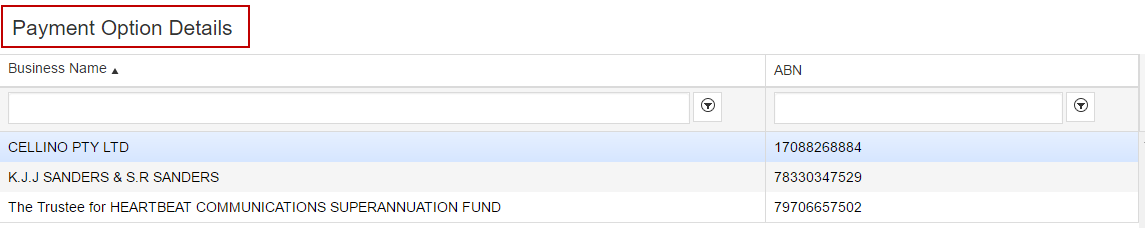

BAS Payment Options

With search option for you to enter the entity’s information ie name, ABN or which ever the field applicable on their profile and the associated BAS payment options for that entity. Once you have located the right entity click on the entity’s name and the BAS payment option will prevail for you to advise client. This is a quick access option without the download requirement. Downloaded options to be explored from the Lodged Reports.

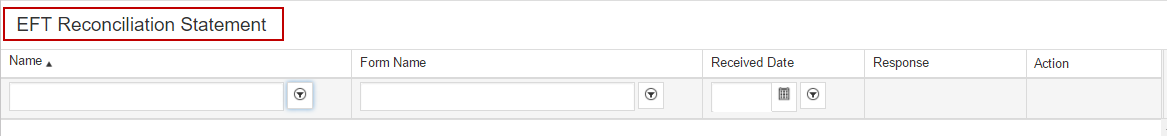

EFT Reconciliation Statement

Particular useful for tax agentsto request for the Electronic Funds Transfer (EFT) refunds expected to be deposited into the trust account to assist with reconciliation before issuing payments to clients