Help Center

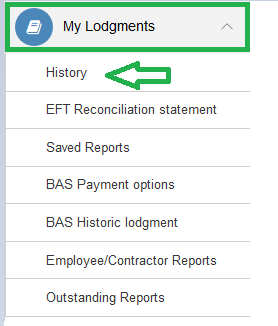

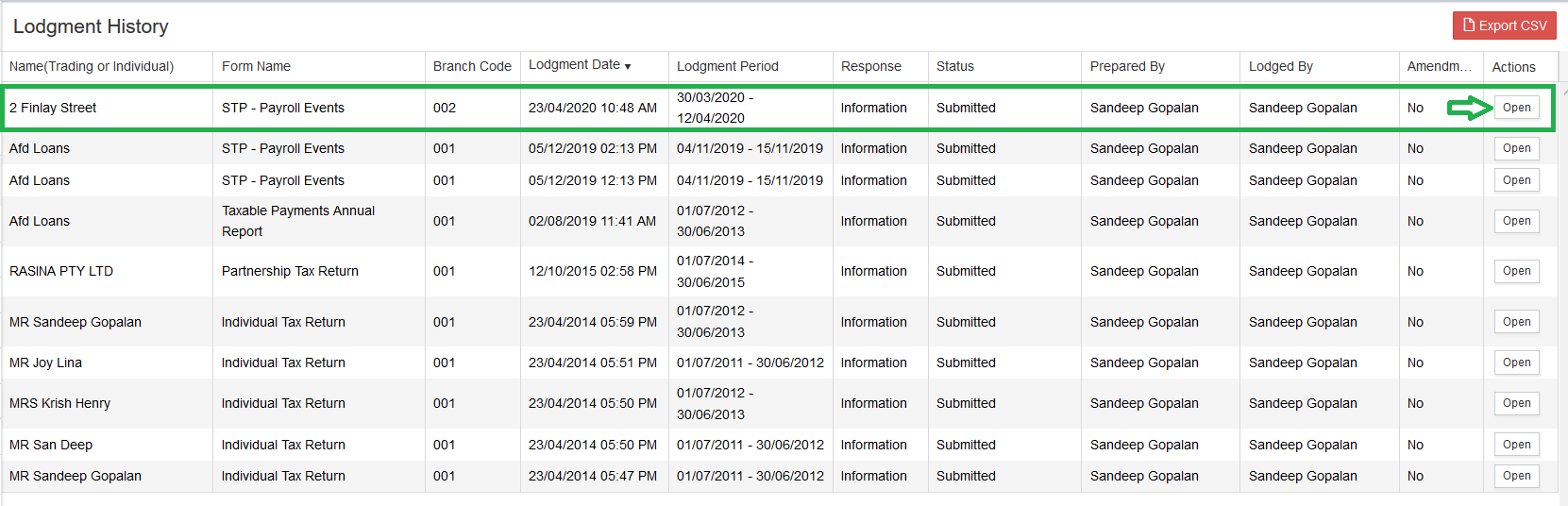

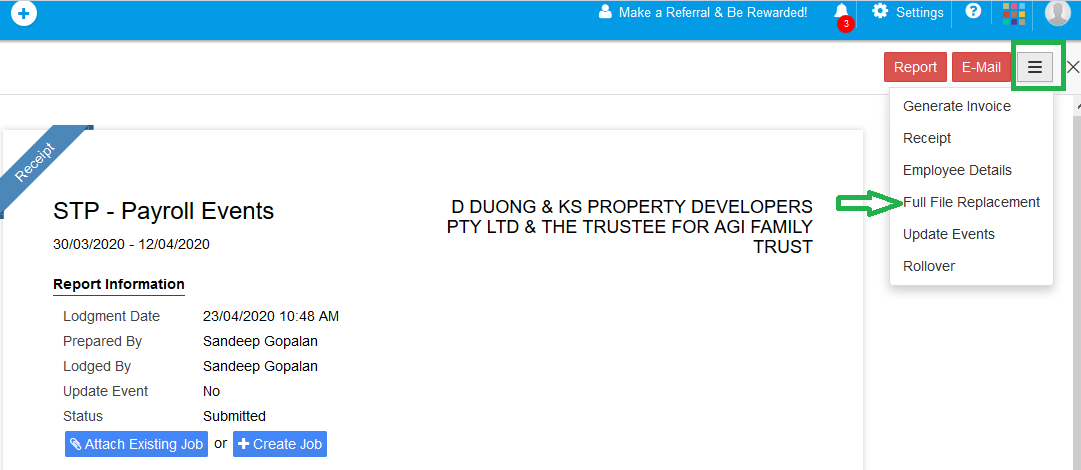

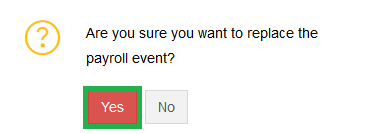

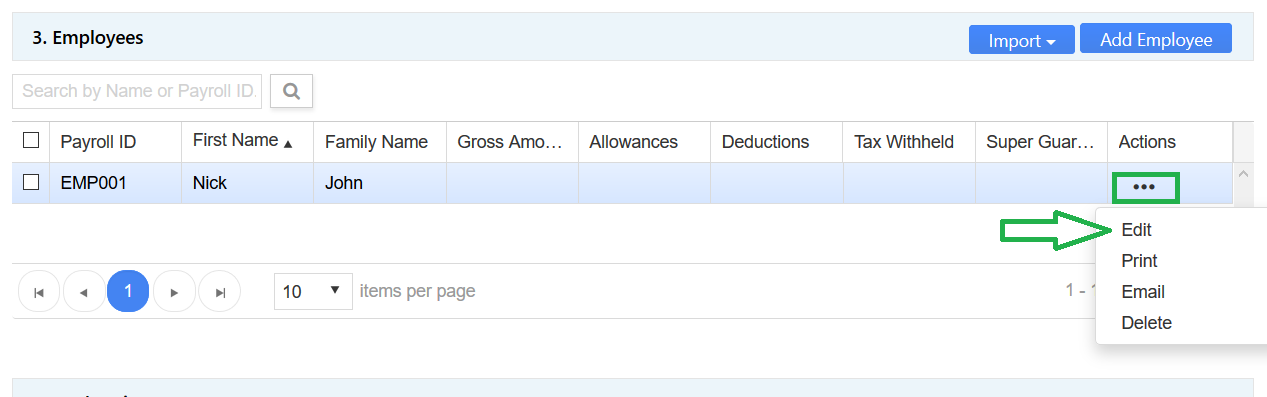

All STP reports lodged/reported earlier can be revised using Full-File replacement

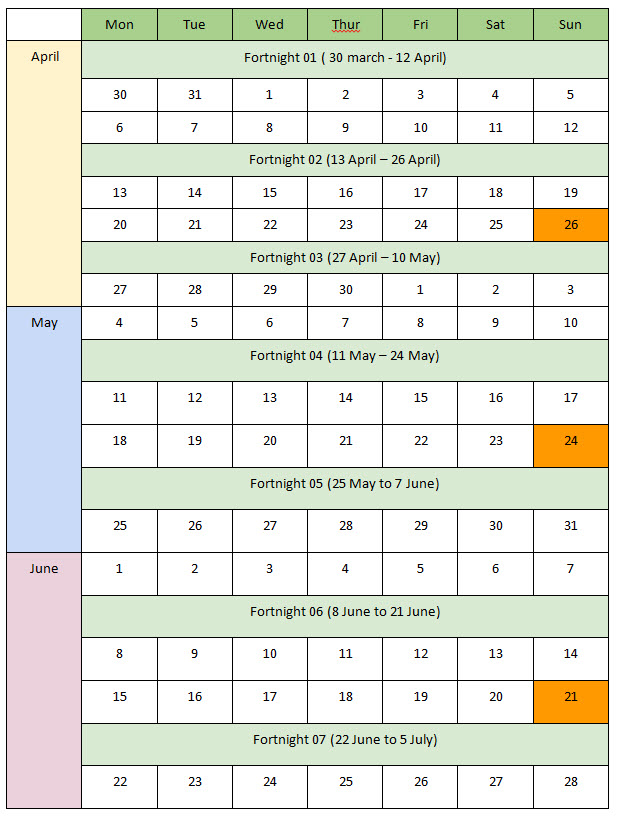

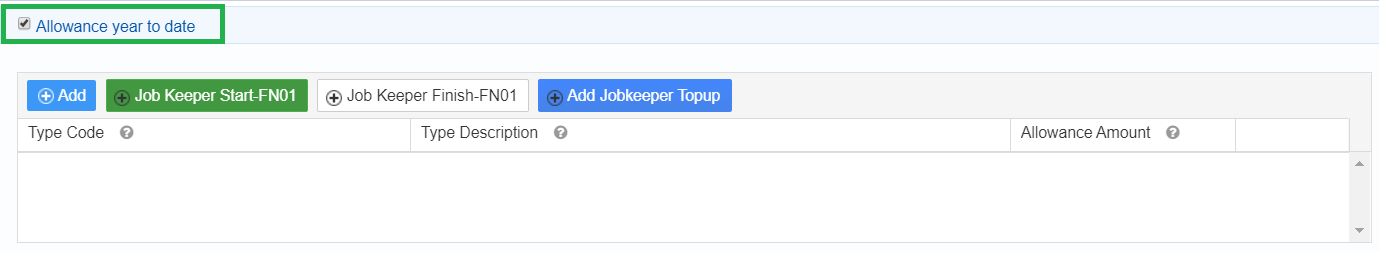

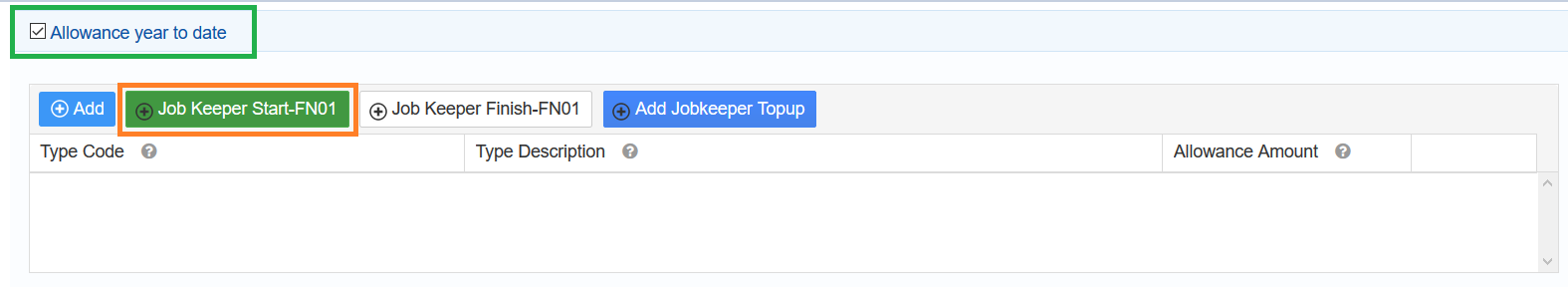

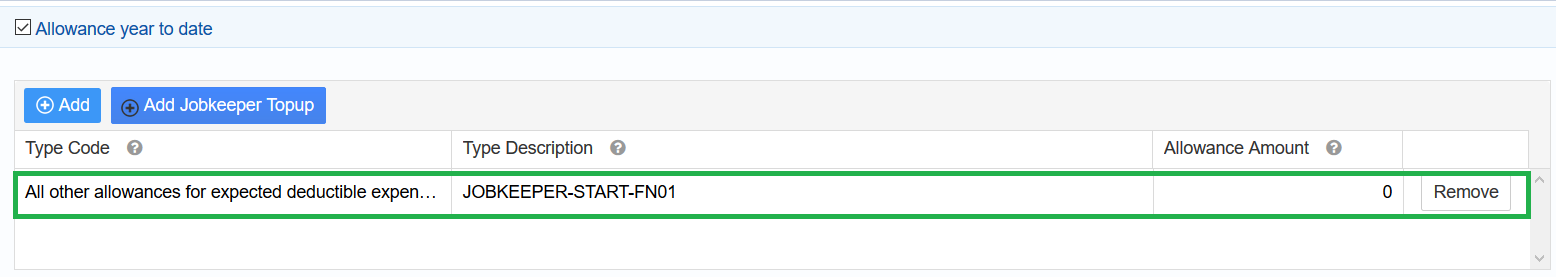

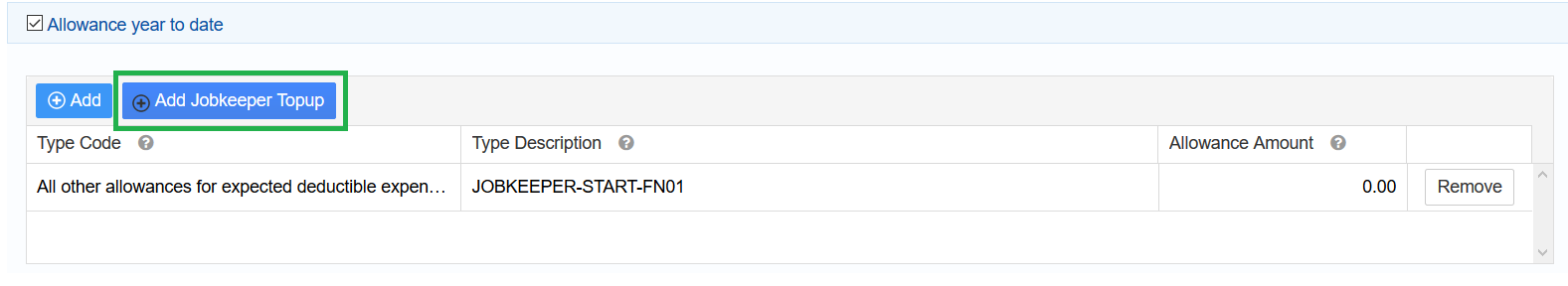

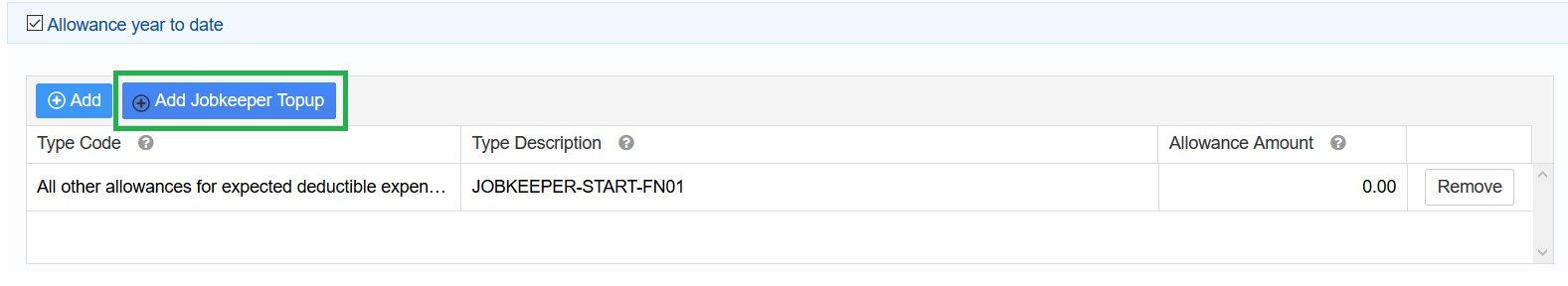

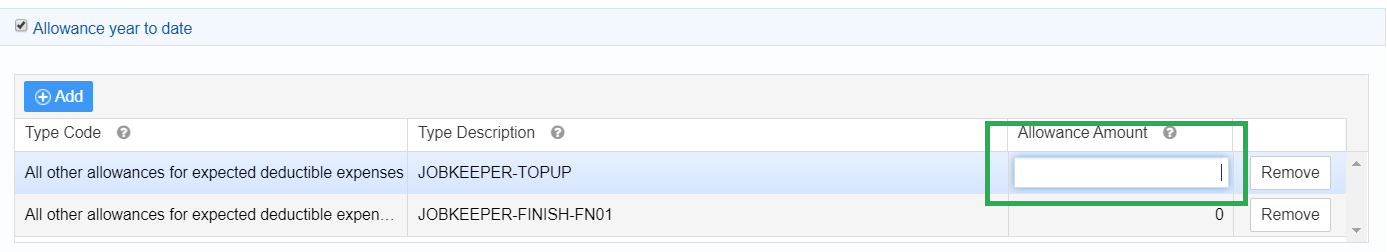

| FN | Dates | Start allowance | Finish Allowance |

|---|---|---|---|

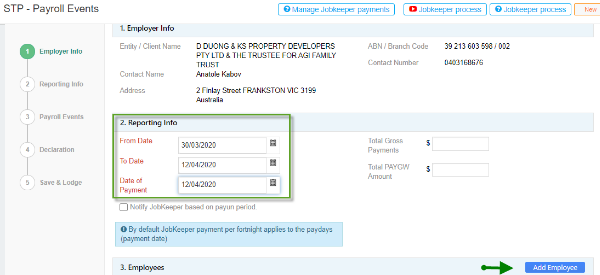

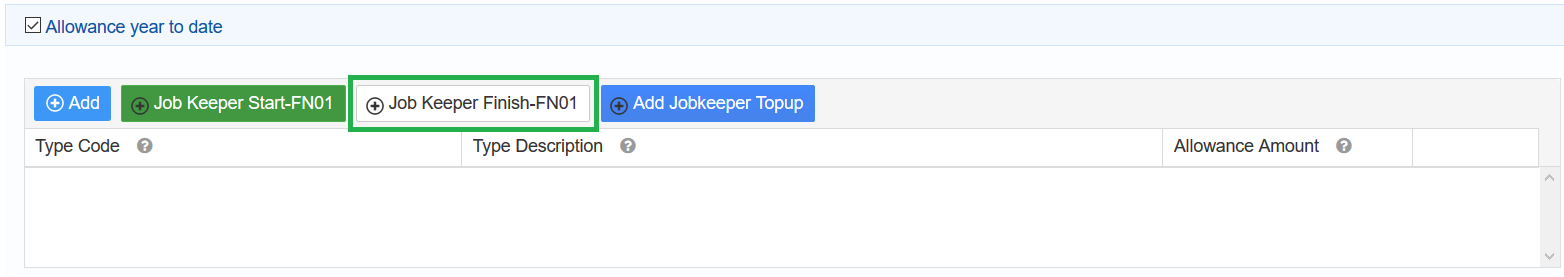

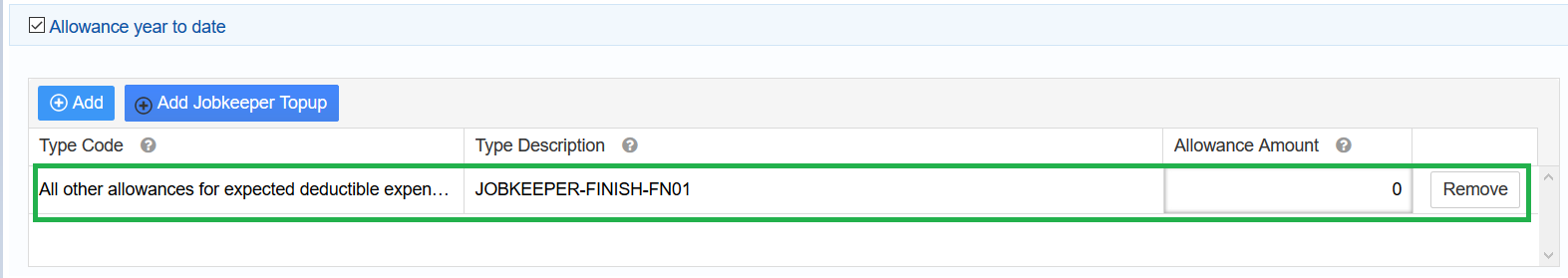

| 01 | 30/03/2020 - 12/04/2020 | JOBKEEPER-START-FN01 | JOBKEEPER-FINISH-FN01 |

| 02 | 13/04/2020 - 26/04/2020 | JOBKEEPER-START-FN02 | JOBKEEPER-FINISH-FN02 |

| 03 | 27/04/2020 - 10/05/2020 | JOBKEEPER-START-FN03 | JOBKEEPER-FINISH-FN03 |

| 04 | 11/05/2020 - 24/05/2020 | JOBKEEPER-START-FN04 | JOBKEEPER-FINISH-FN04 |

| 05 | 25/05/2020 - 07/06/2020 | JOBKEEPER-START-FN05 | JOBKEEPER-FINISH-FN05 |

| 06 | 08/06/2020 - 21/06/2020 | JOBKEEPER-START-FN06 | JOBKEEPER-FINISH-FN06 |

| 07 | 22/06/2020 - 05/07/2020 | JOBKEEPER-START-FN07 | JOBKEEPER-FINISH-FN07 |

| 08 | 06/07/2020 - 19/07/2020 | JOBKEEPER-START-FN08 | JOBKEEPER-FINISH-FN08 |

| 09 | 20/07/2020 - 02/08/2020 | JOBKEEPER-START-FN09 | JOBKEEPER-FINISH-FN09 |

| 10 | 03/08/2020 - 16/08/2020 | JOBKEEPER-START-FN10 | JOBKEEPER-FINISH-FN10 |

| 11 | 17/08/2020 - 30/08/2020 | JOBKEEPER-START-FN11 | JOBKEEPER-FINISH-FN11 |

| 12 | 31/08/2020 - 13/09/2020 | JOBKEEPER-START-FN12 | JOBKEEPER-FINISH-FN12 |

| 13 | 14/09/2020 - 27/09/2020 | JOBKEEPER-START-FN13 | JOBKEEPER-FINISH-FN13 |

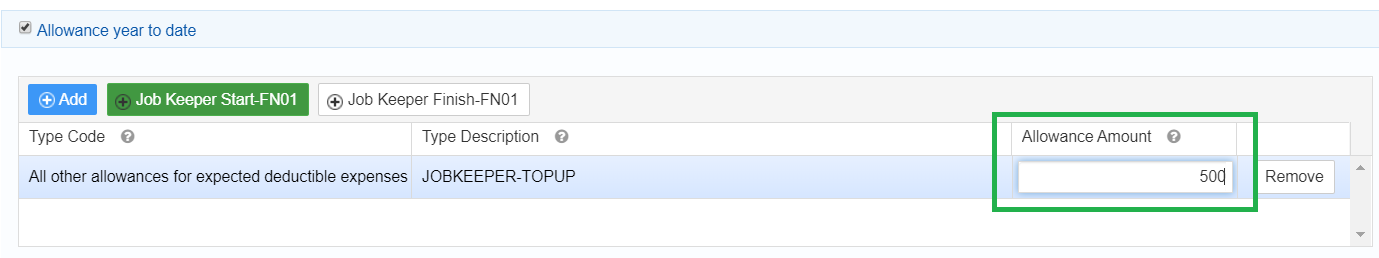

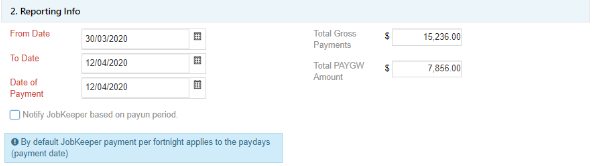

| Pay frequency | JK Payment | Calculation |

|---|---|---|

| Weekly | 750 | 1500 / 2 |

| Fortnightly | 1500 | 1500 X 1 |

| Twice a month | 1625 | 1500 X 26 / 24 |

| Monthly (average) | 3250 | 1500 X 26 /12 |