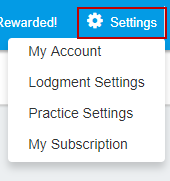

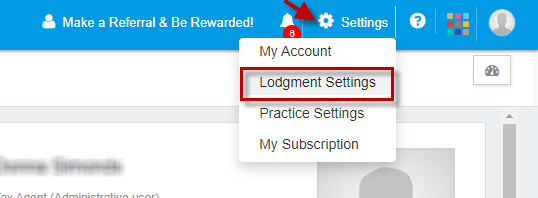

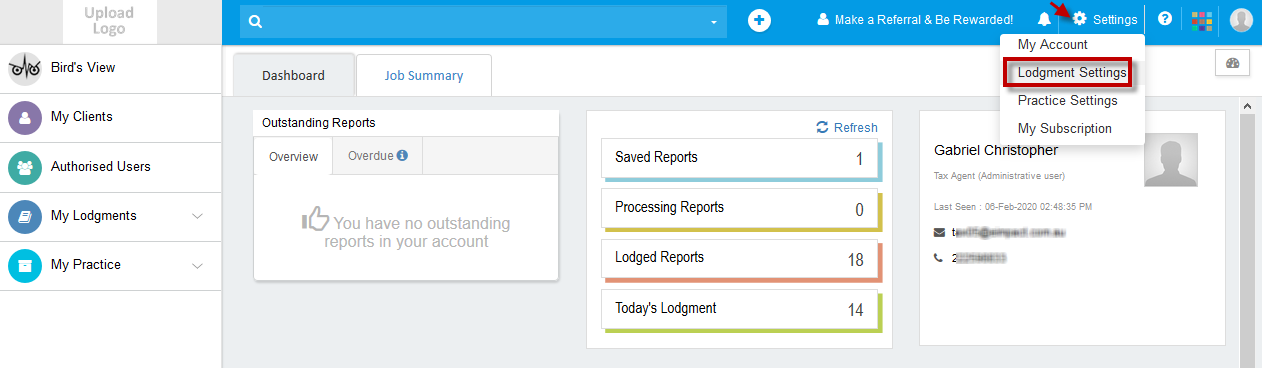

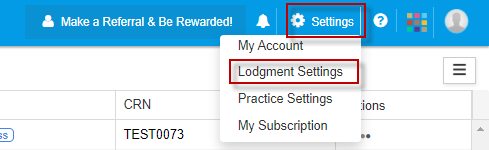

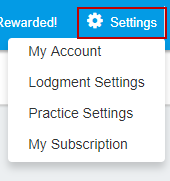

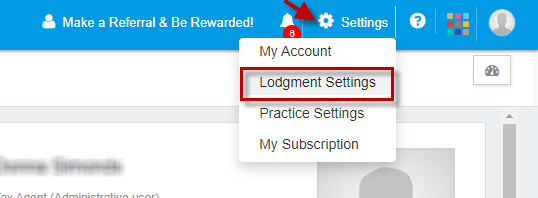

To access to your account settings and other related common setting services such as:

- My Account

- a) My Business

- b) My Profile

- c) Security Setting

- d) Email Setting

- e) Email Log

-

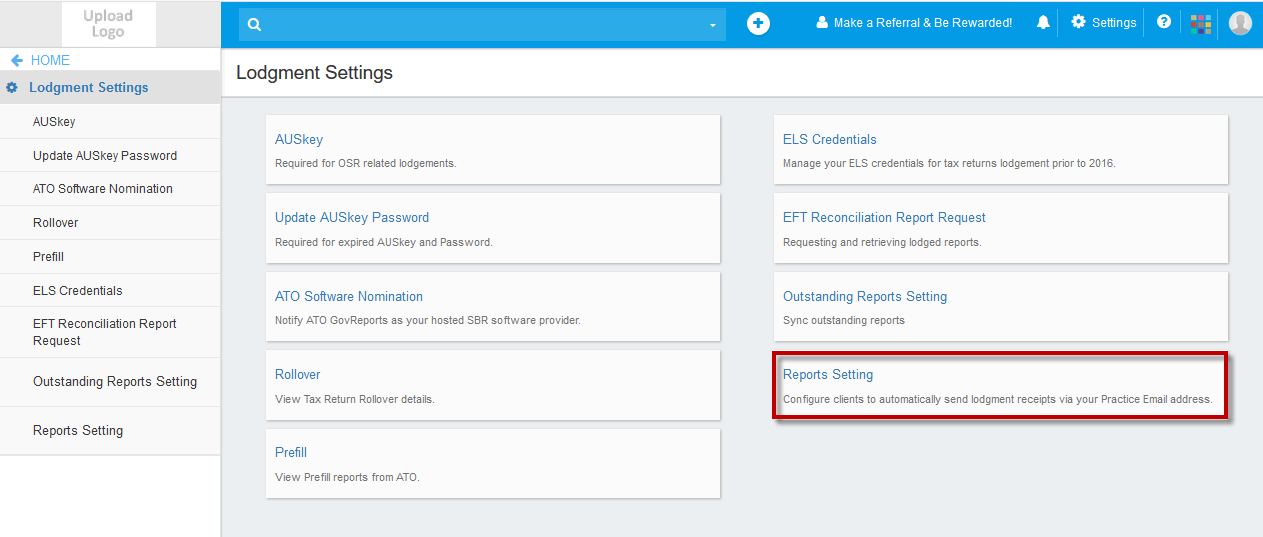

Lodgment Settings

- f) M2M Credentials

- g) ATO Software Nomination

- h) Rollover

- i) Setup Intuit SSO

-

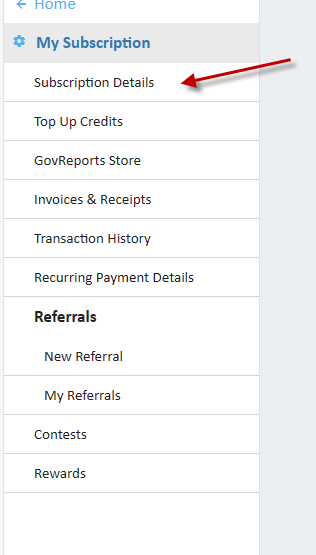

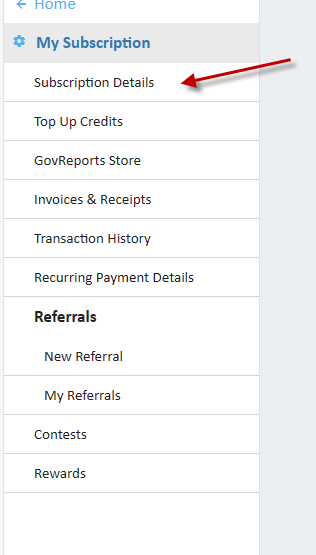

My Subscription

- j) Subscription Details

- k) Top Up Credits

- l) GovReports Store

- m) Invoices & Receipts

- n) Transaction History

- o) Recurring Payment Details

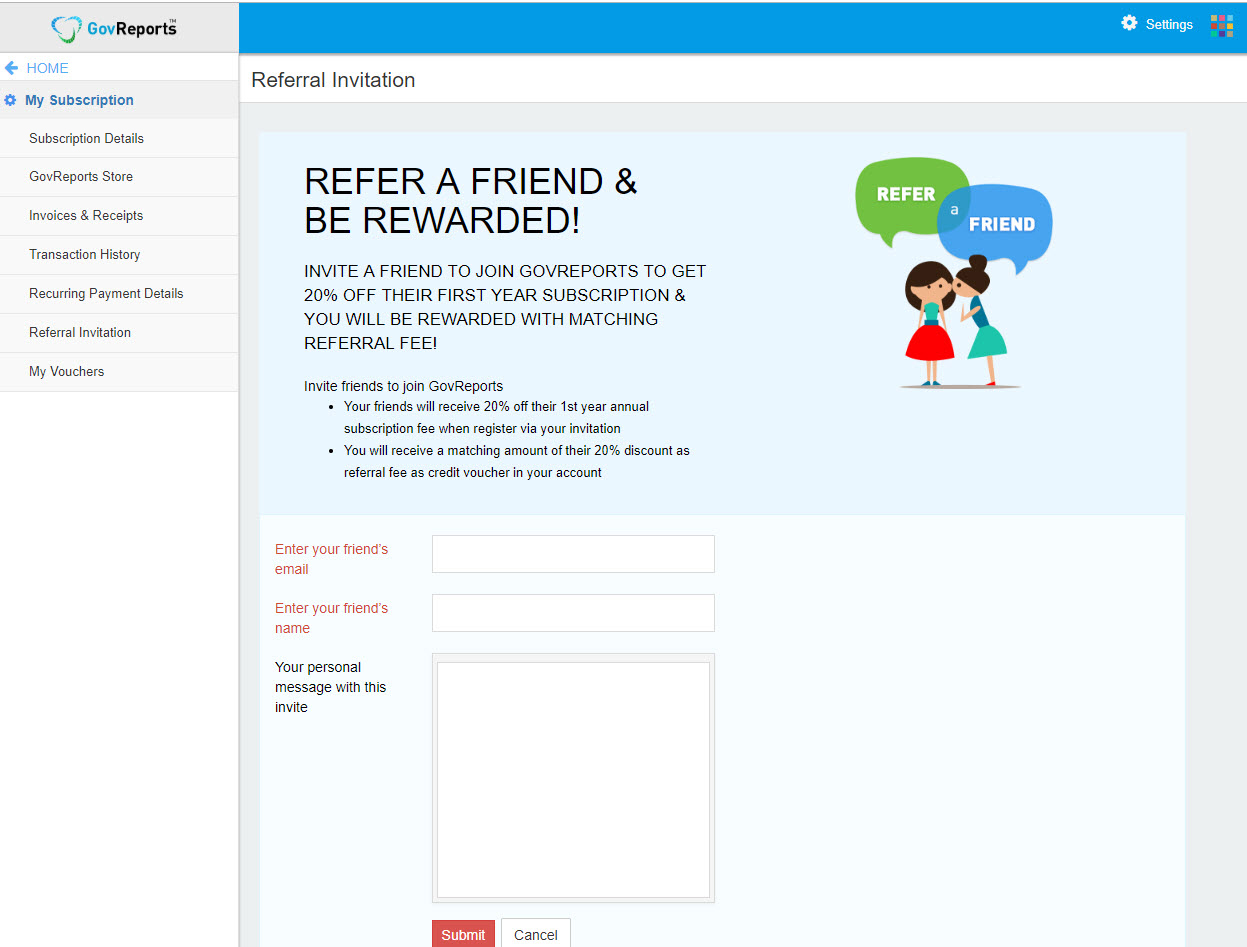

- p) Referral Invitation

-

Practice Settings

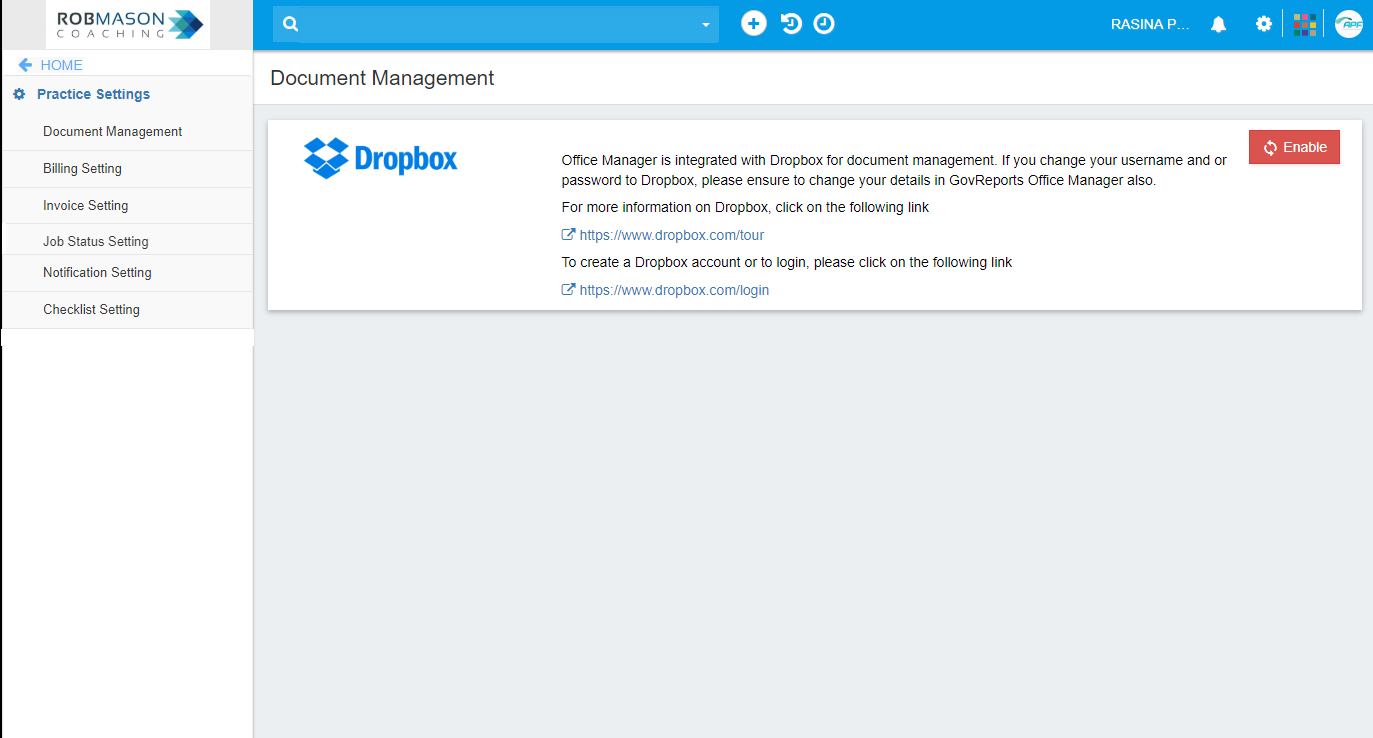

- q) Document Management Setting

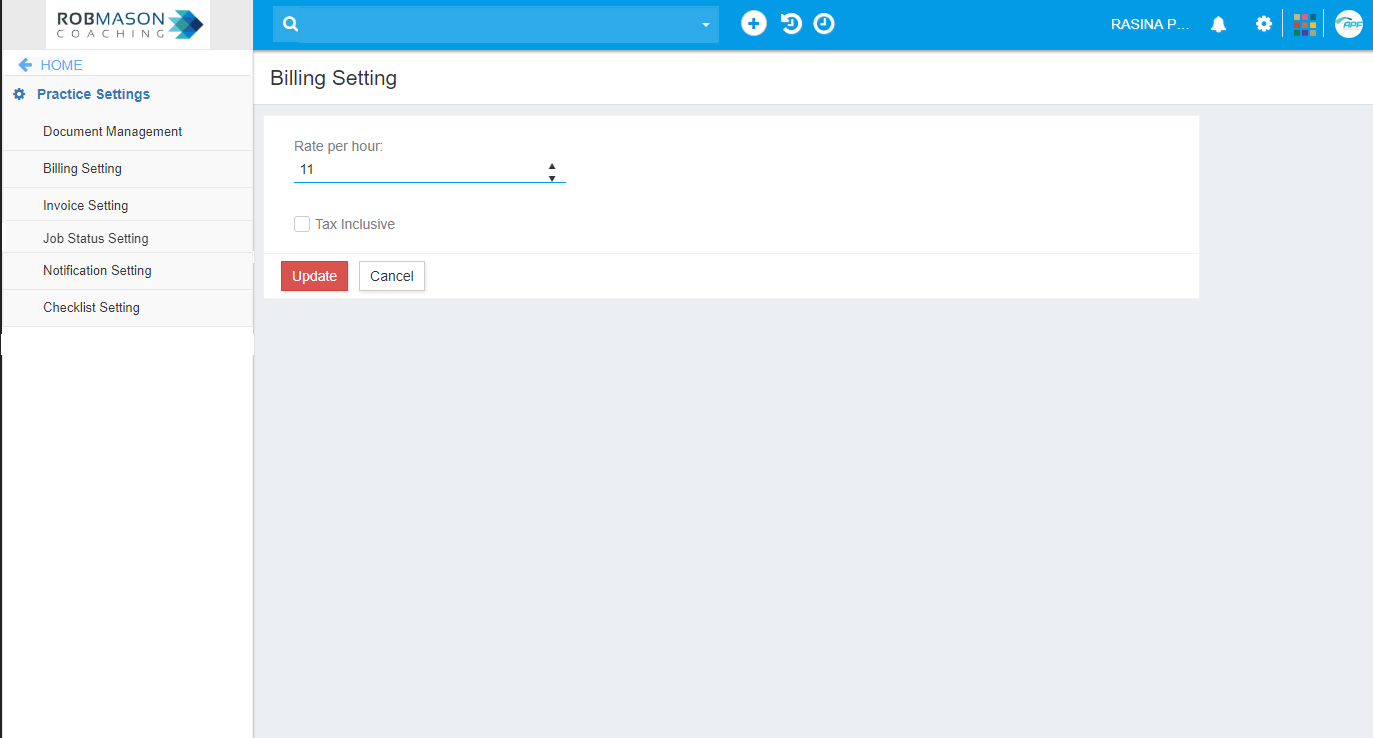

- r) Billing Setting

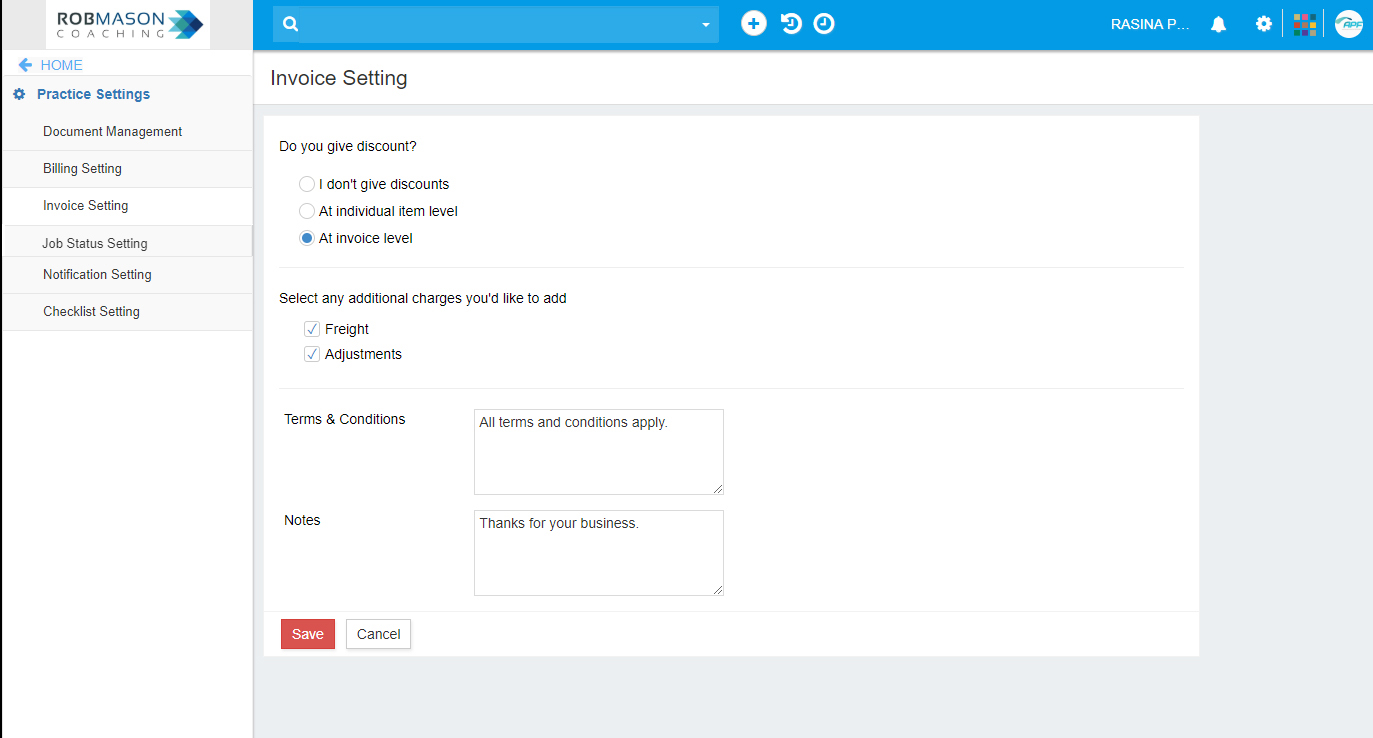

- s) Invoice Setting

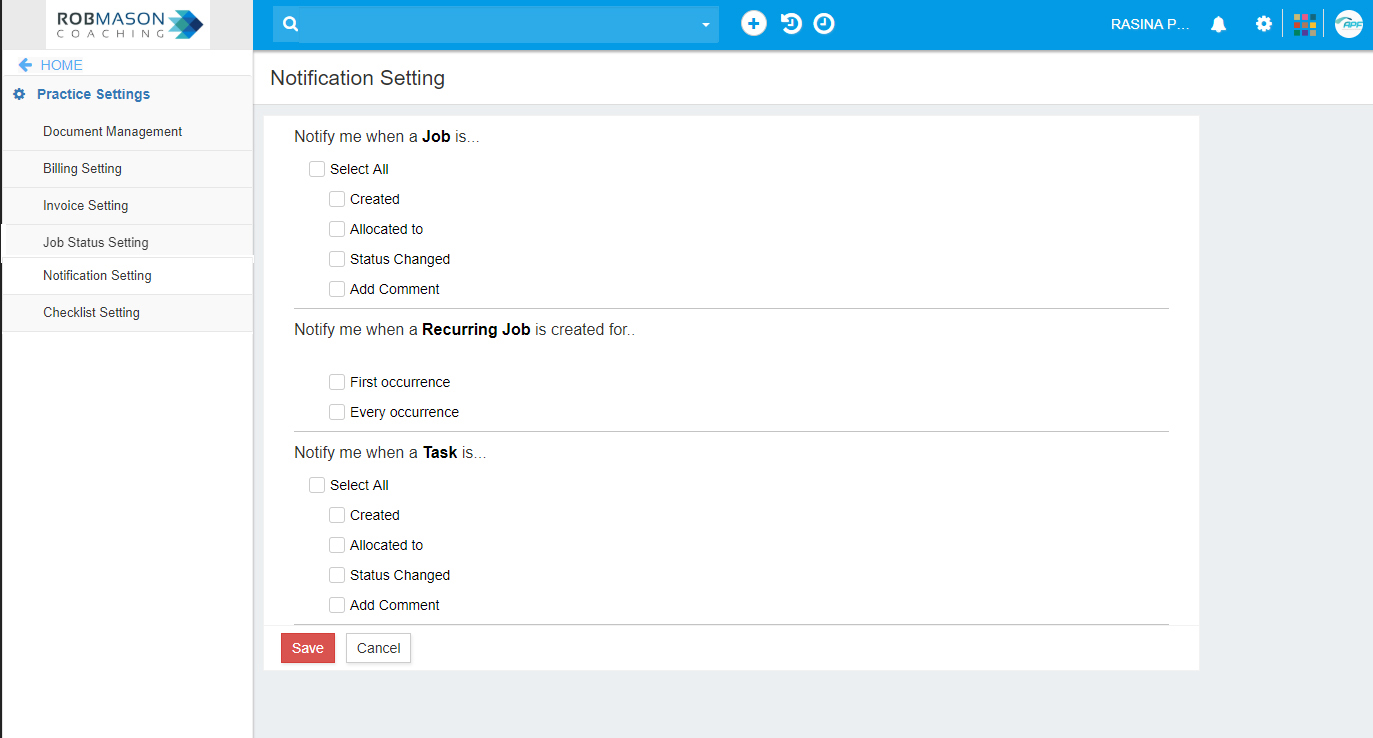

- t) Notification Setting

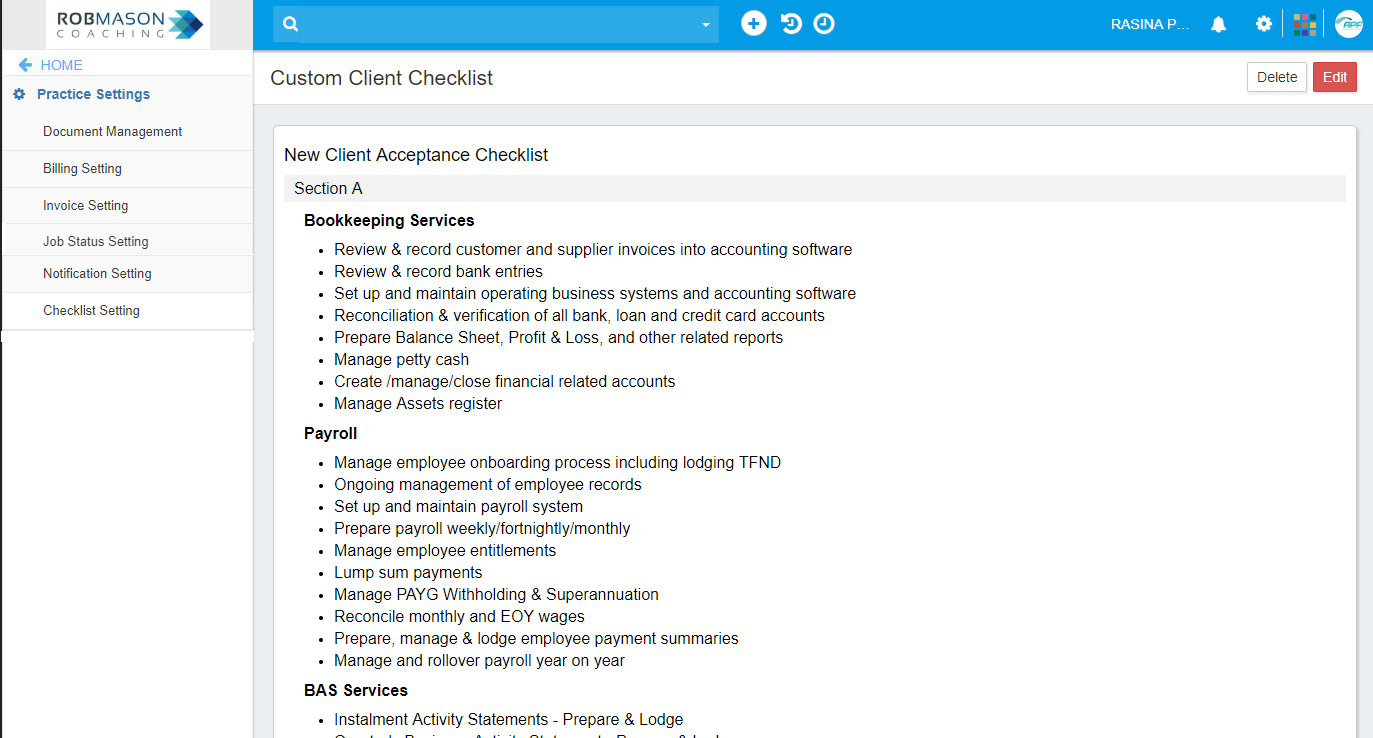

- u) Checklist Setting

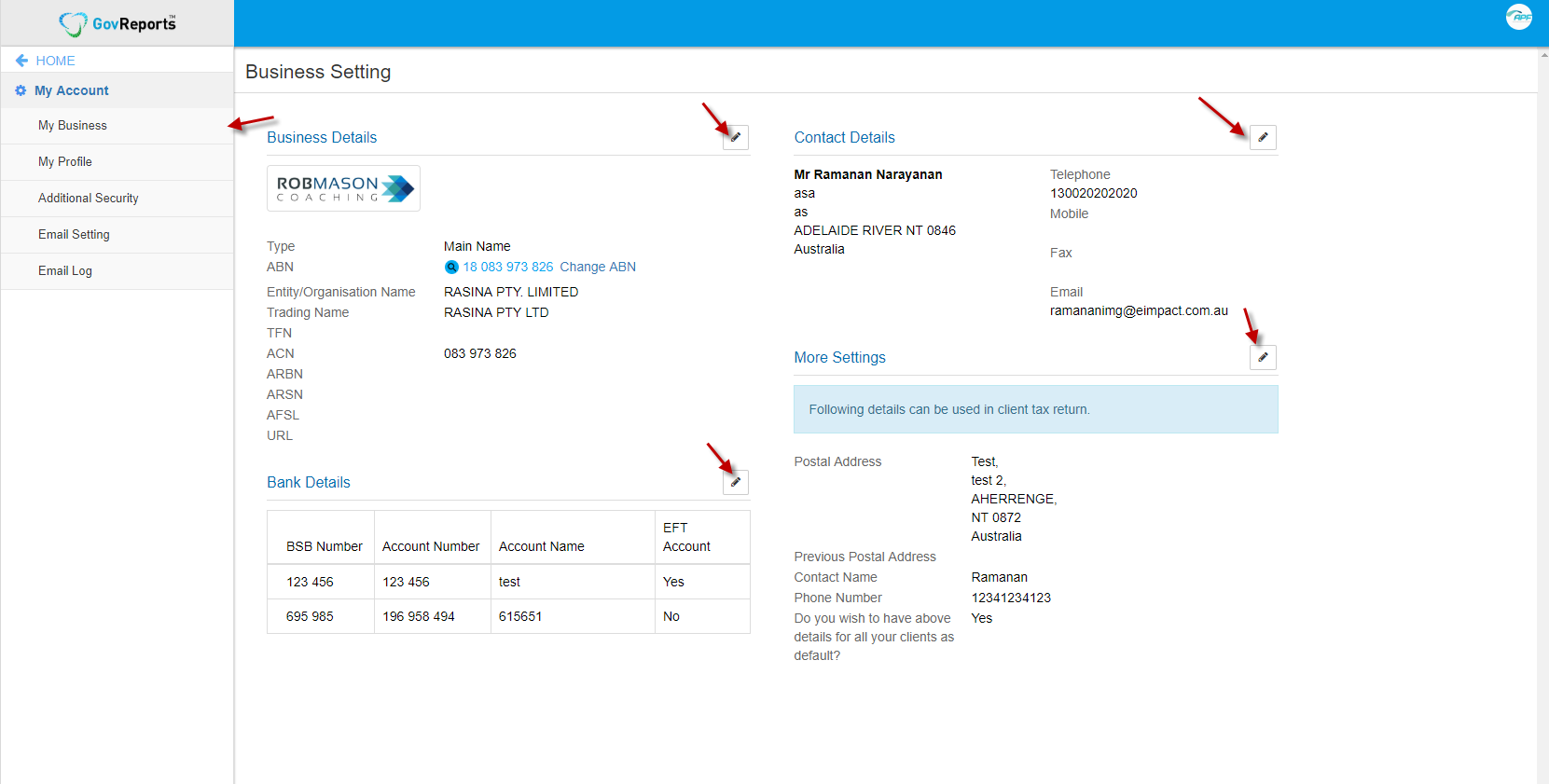

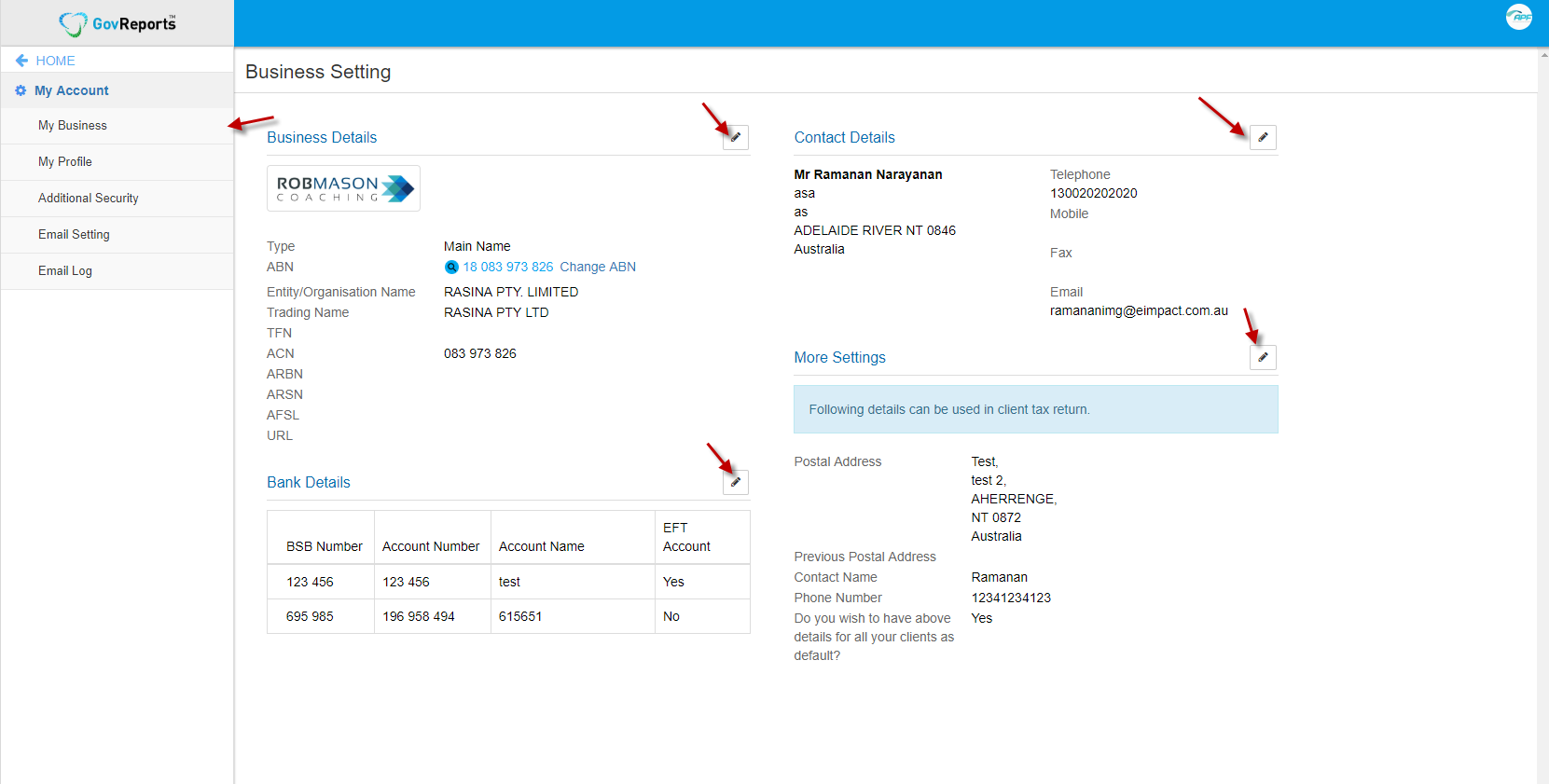

a. My Business

My Business setting here is for easy access to update changes to your business structure over time.

To make changes, click on Edit icon and change or update details where applicable.

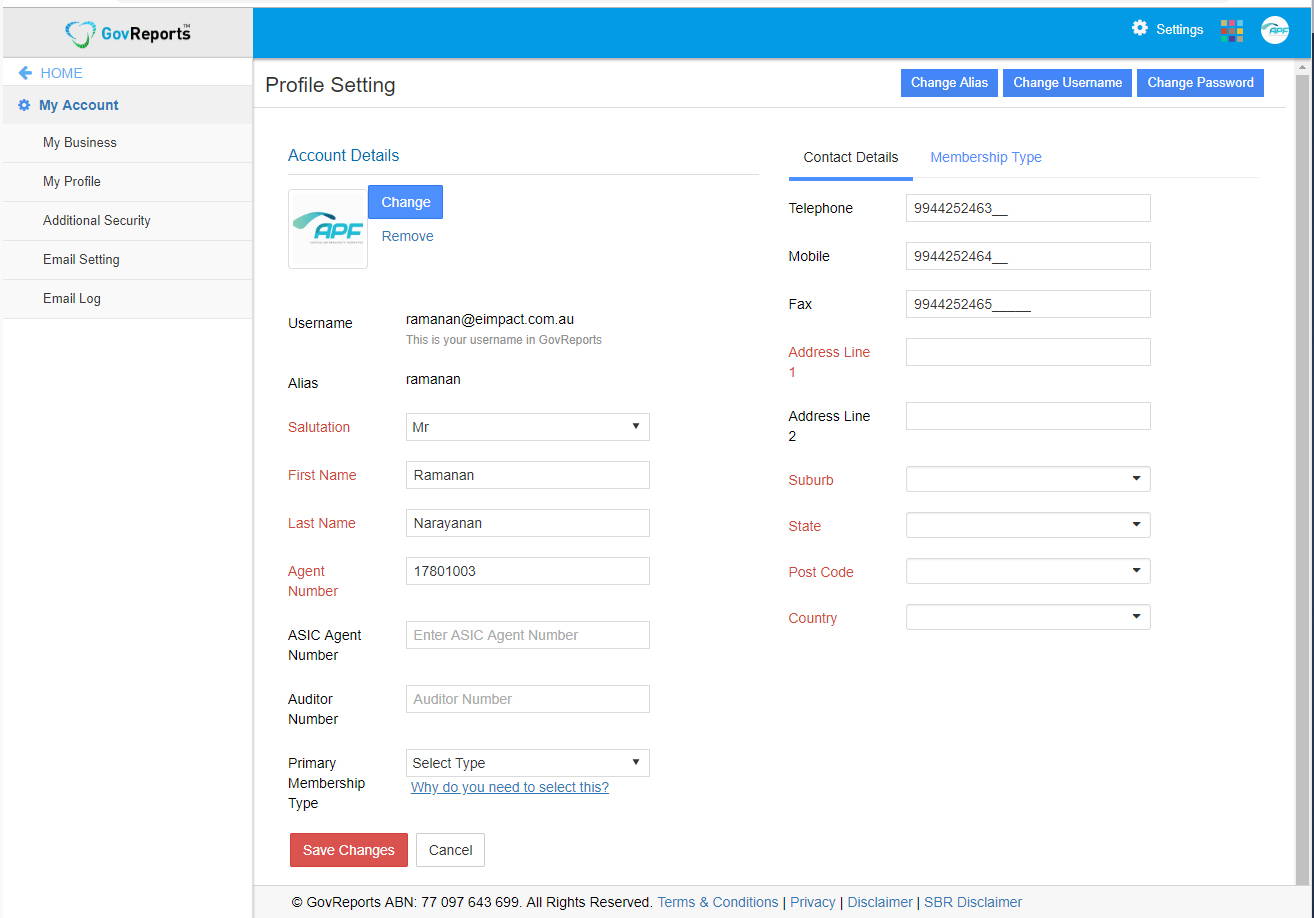

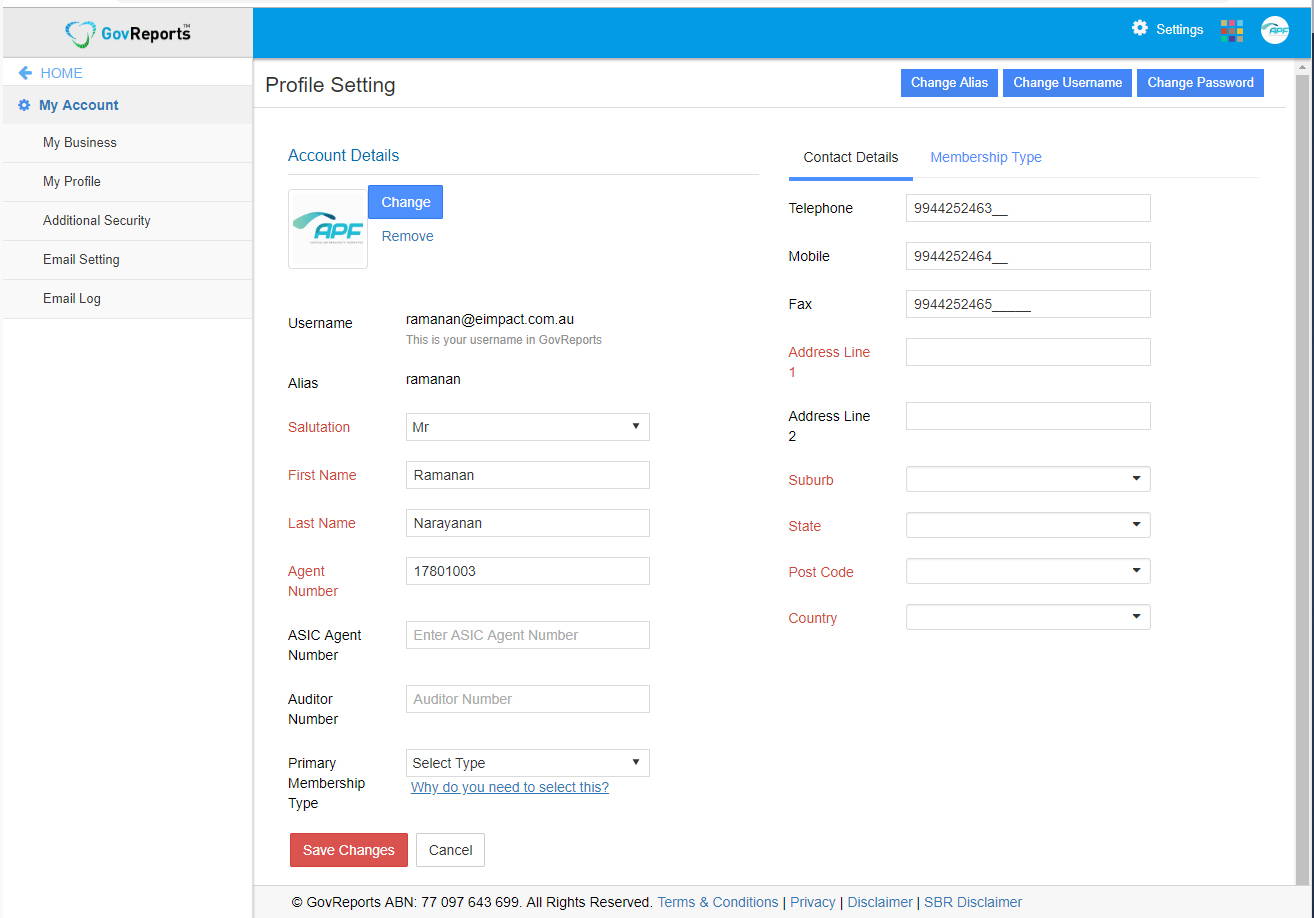

b. My Profile

Change your account status, contact & professional membership details, usernames and or password.

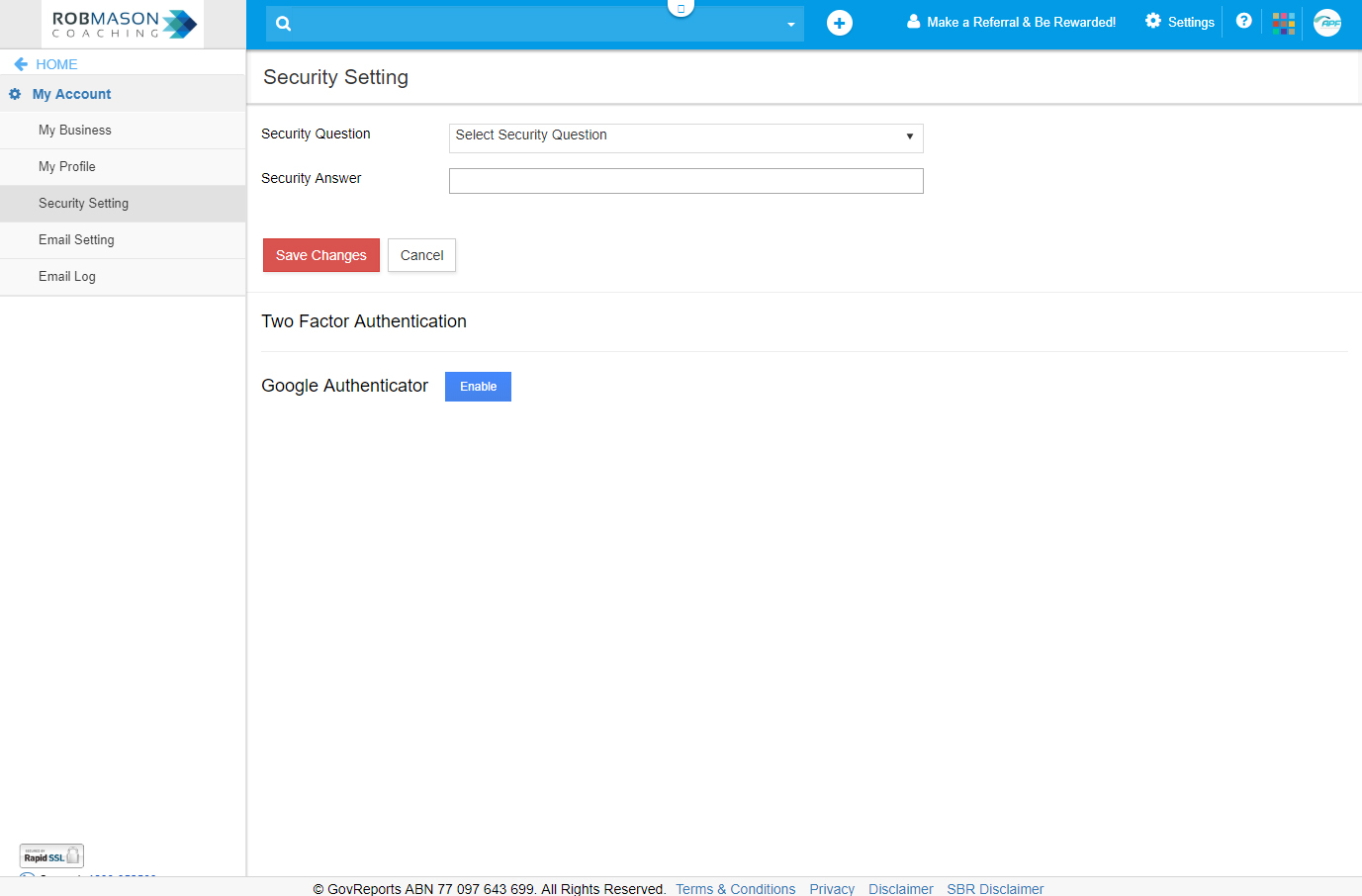

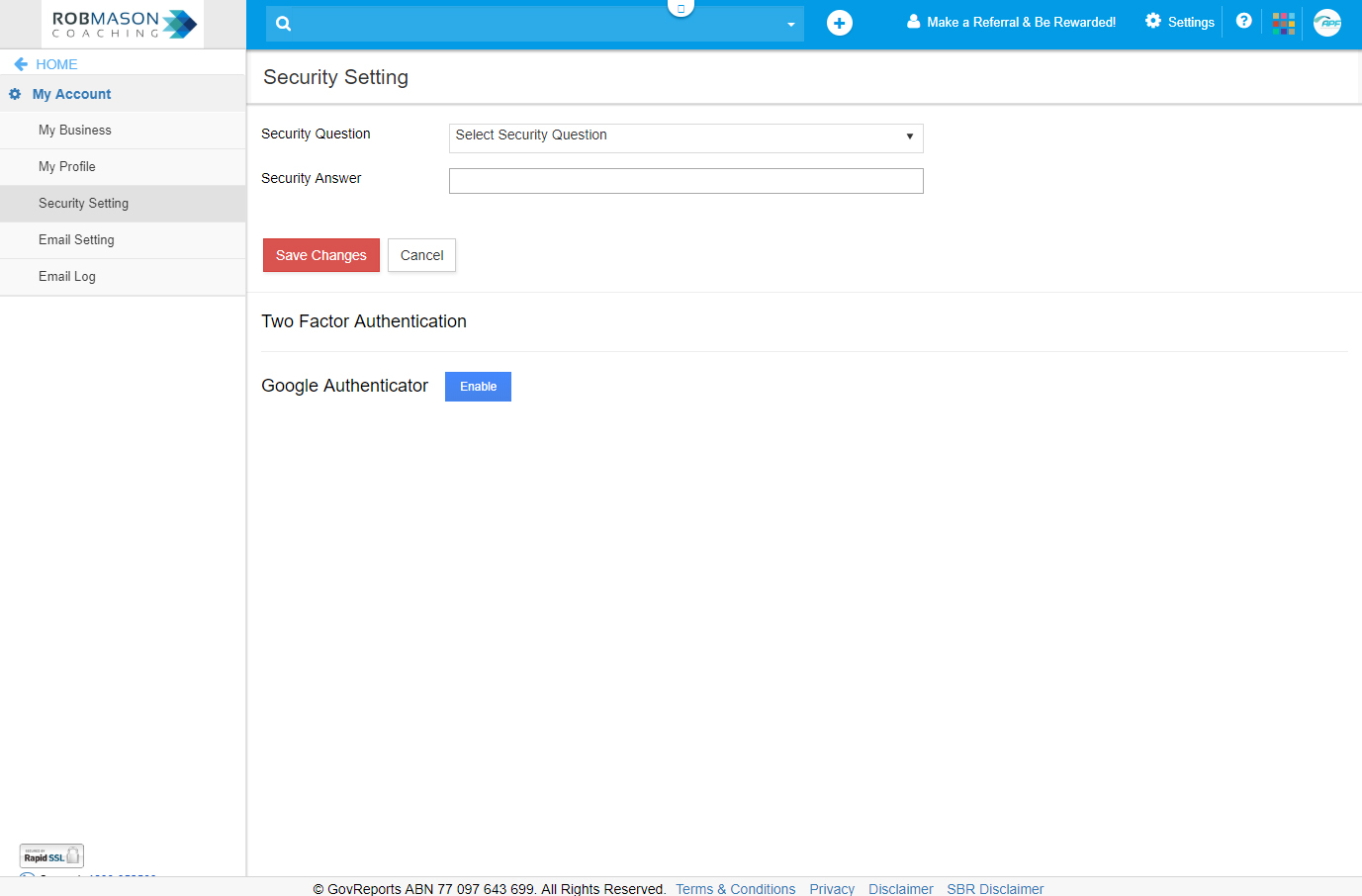

c. Security Setting

Add Google Cloud Authenticator to your login option.

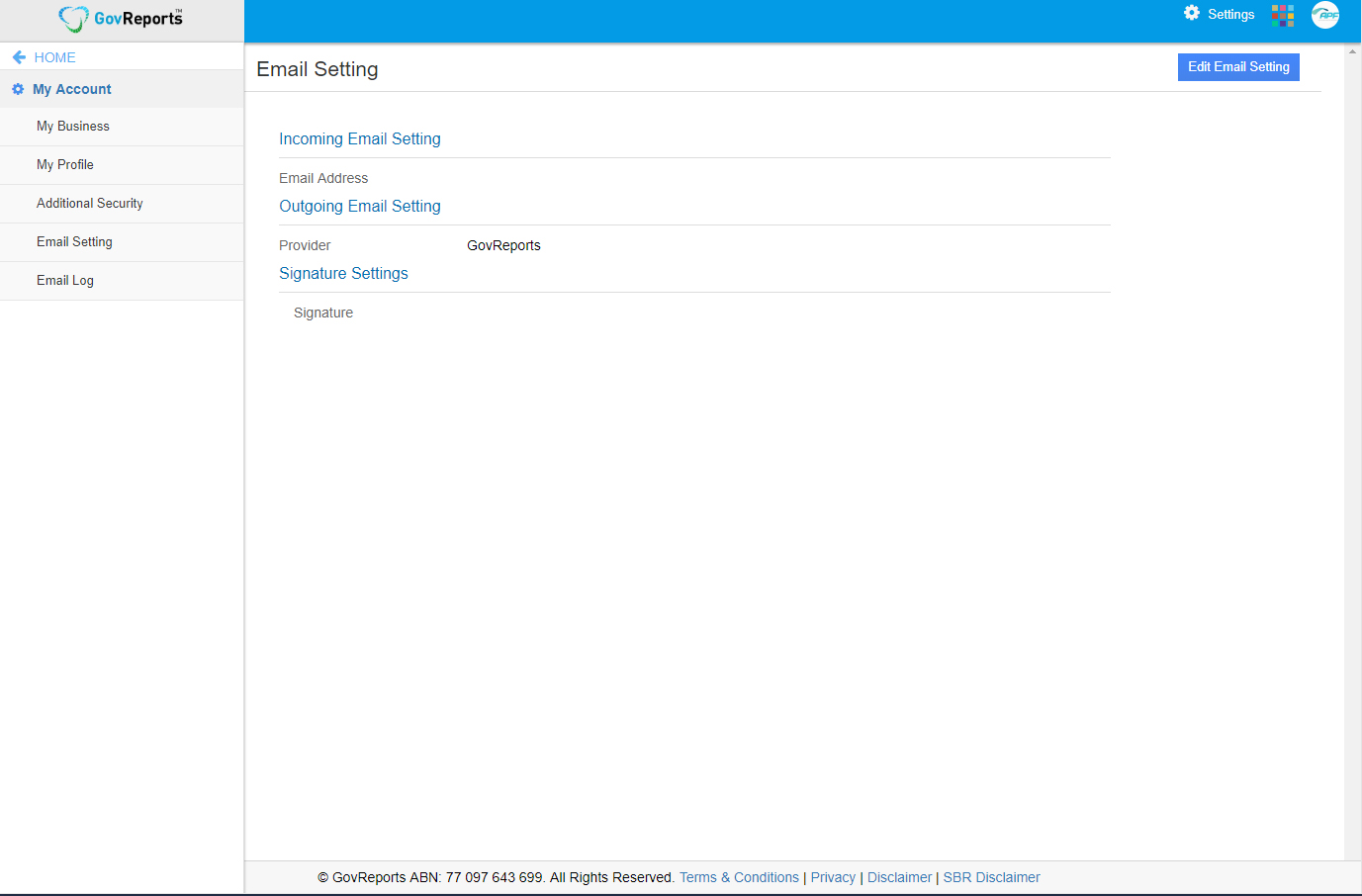

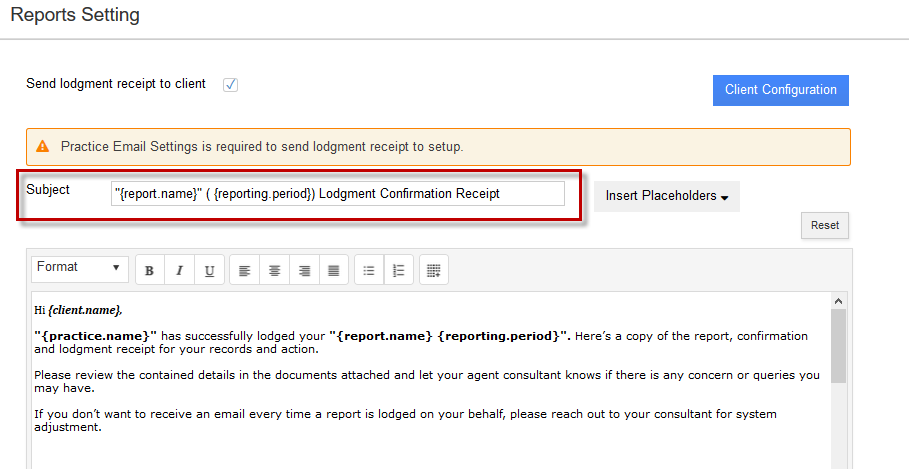

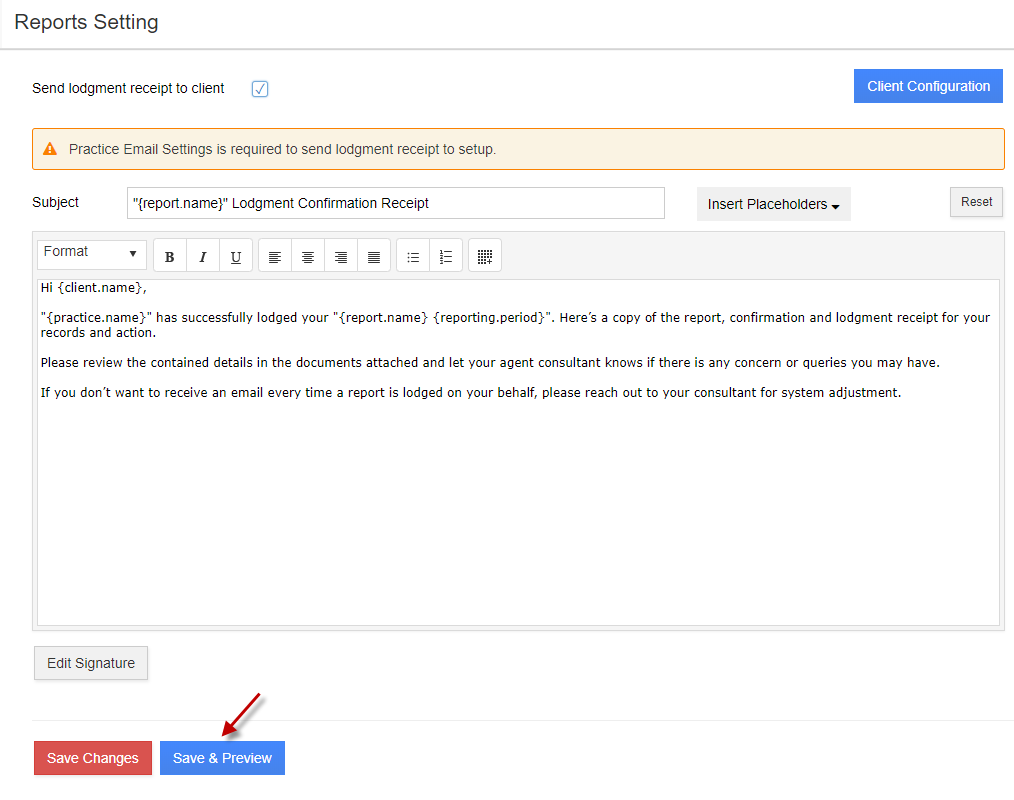

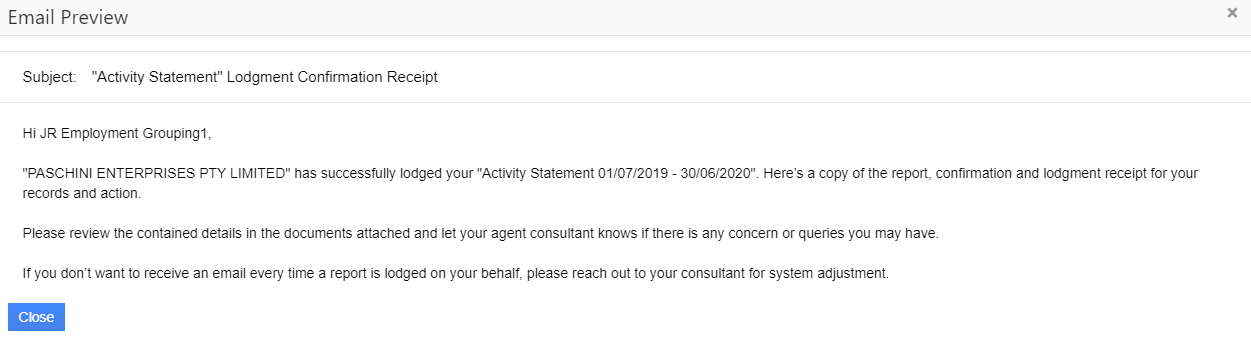

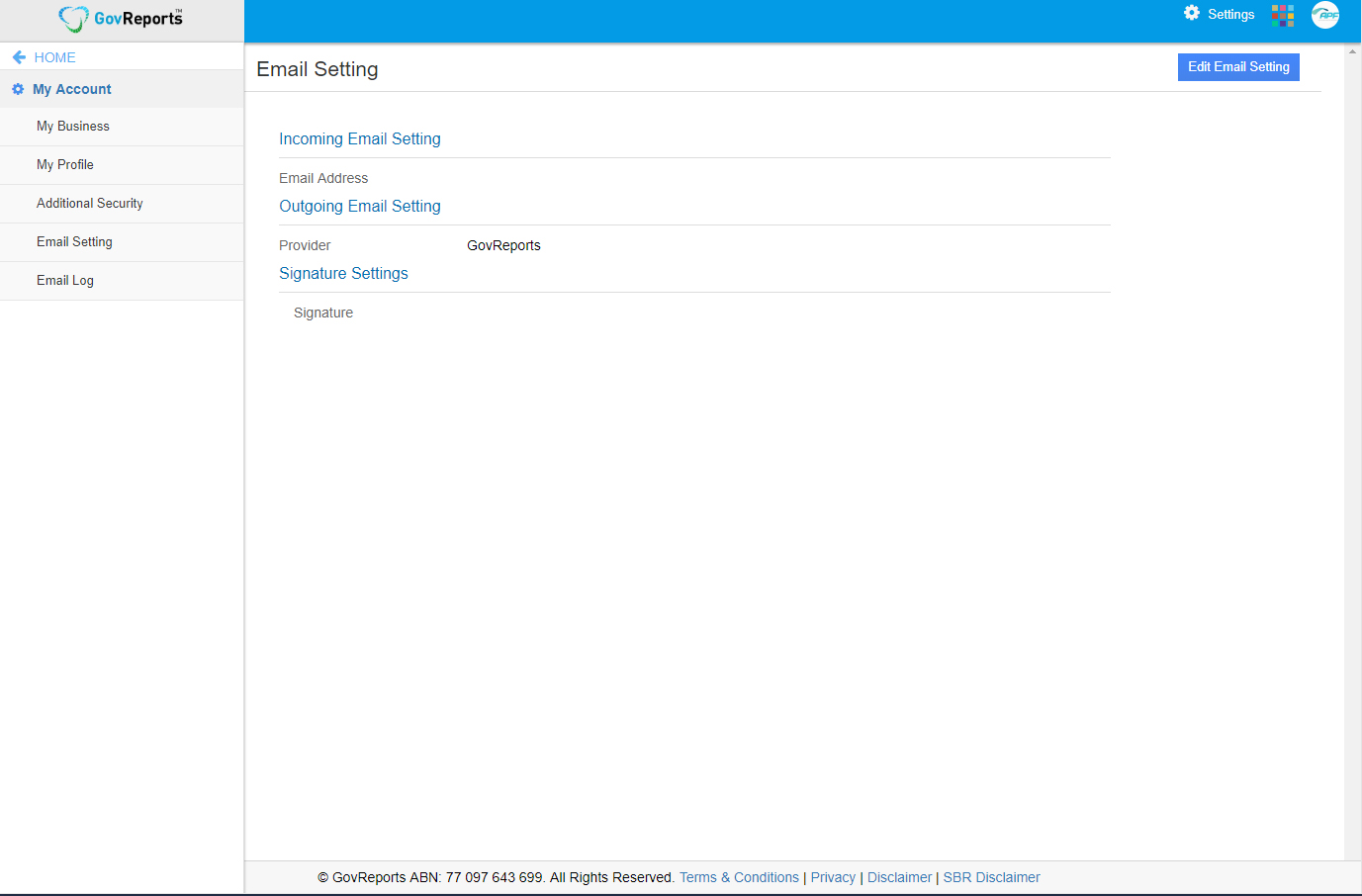

d. Email Setting

Configure your own emails on GovReports to send reports via emails or digital signature.

Customise Outgoing email from GovReports:

Users can set up their own email to send documents or reports generated from GovReports for

digital signature or as email. Depending on the users’ email service providers, setting up process can

be different. If you are unsure about your outgoing email setting, contact our friendly support team.

Gmail

Gmail requires additional settings to send emails from external tools or applications like GovReports.

-

1. Use current password with 2 factor authentication disabled for less secure app

(or)

-

2. Create an Application password and update (Recommended)

How to Create App password?

-

Click on the following link (https://security.google.com/settings/security/apppasswords)

-

Login to your Gmail account selected as the preferred outgoing email in

(Note: App password settings will be listed only when 2FA is activated.)

-

Select app as “Others”, enter name as “GovReports” and click on Generate

-

Copy 16 digits app password and paste in GovReports email setting password box

Microsoft Office 365:

Microsoft Office requires additional settings to send emails from external tools or applications like GovReports,

-

1. Use current password with 2 factor authentication to be disabled

(or)

-

2. Create an App password and update (Recommended for security)

How to Create App password?

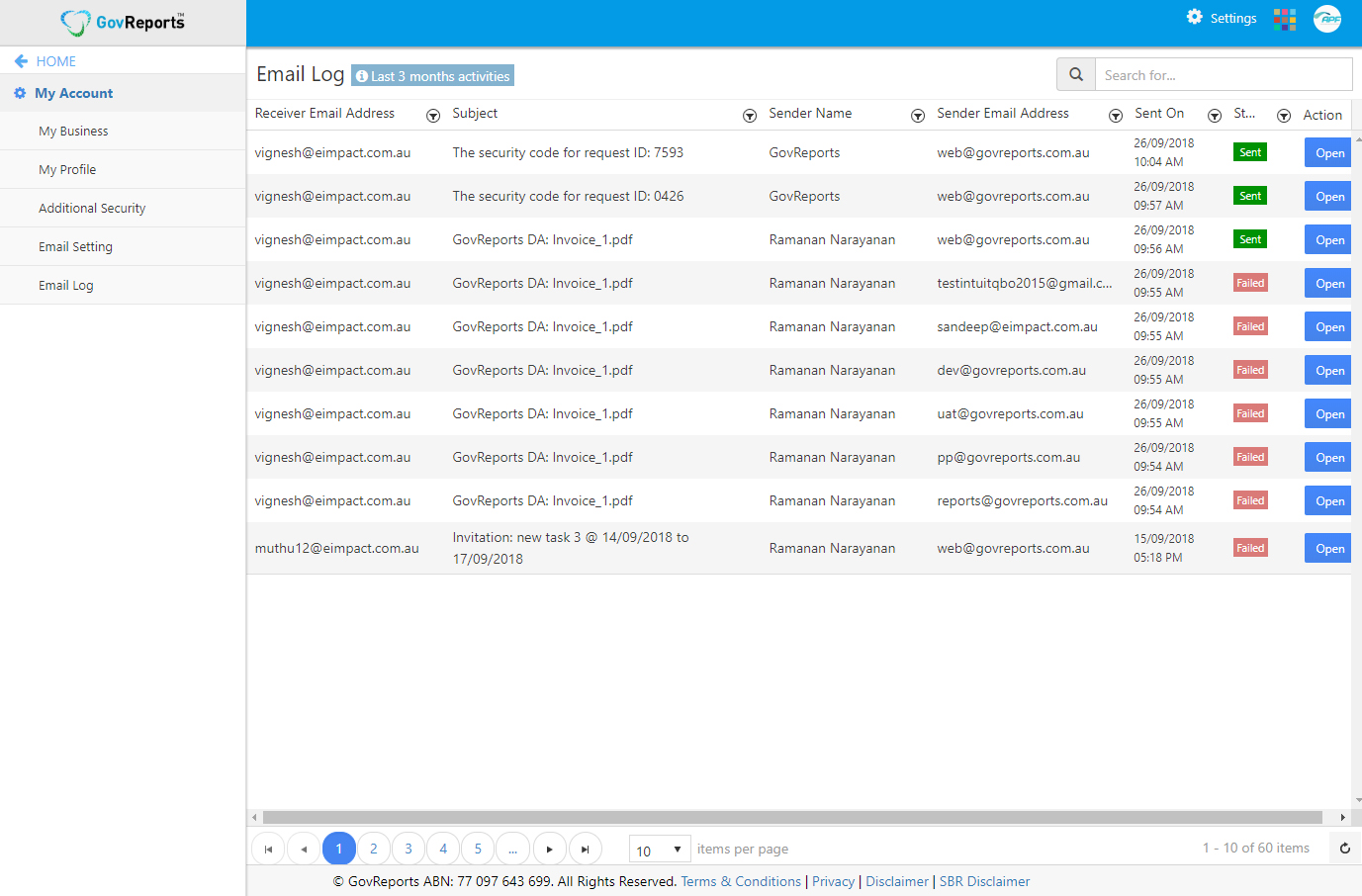

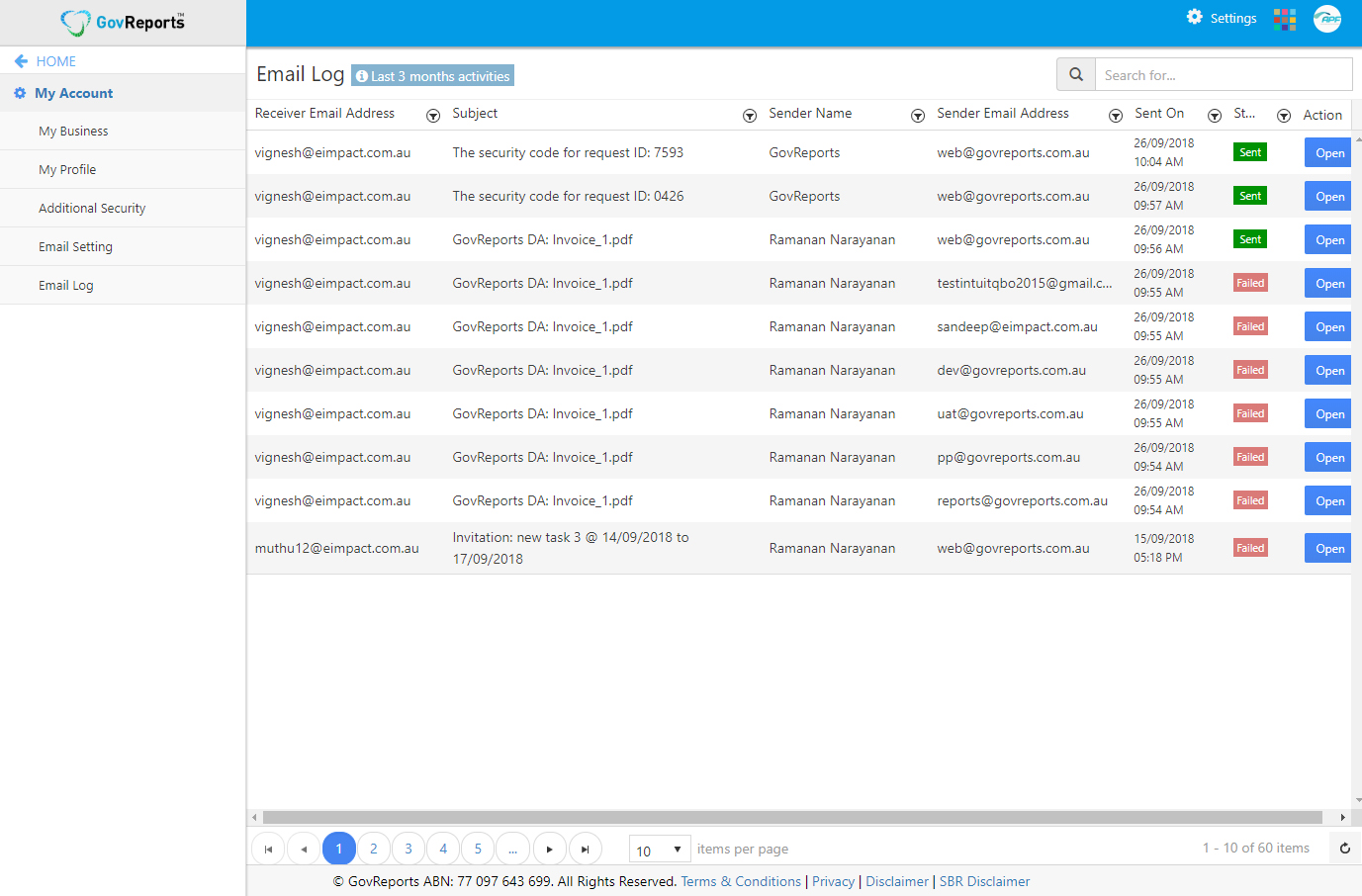

e. Email Log

Change your account status, contact & professional membership details, usernames and or password.

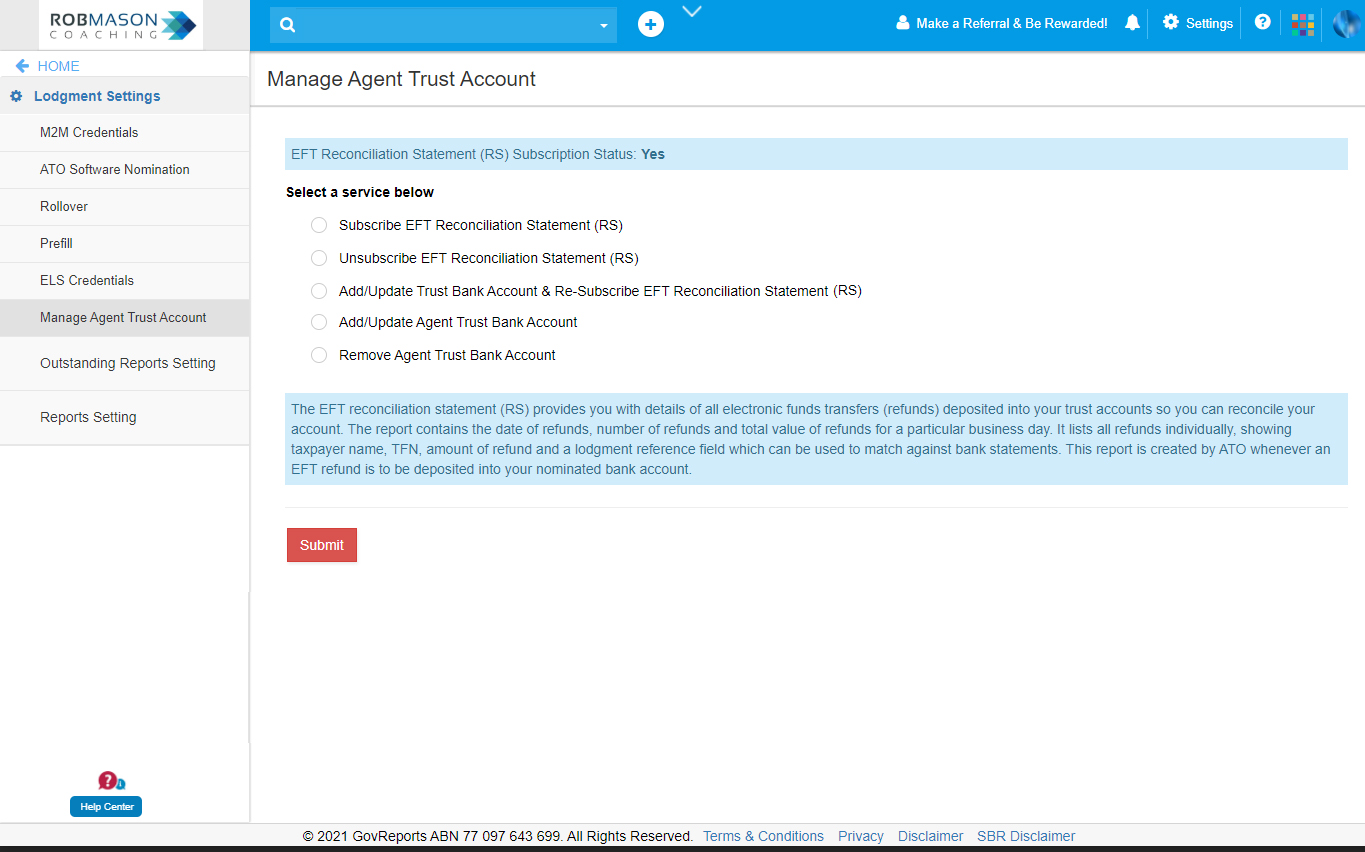

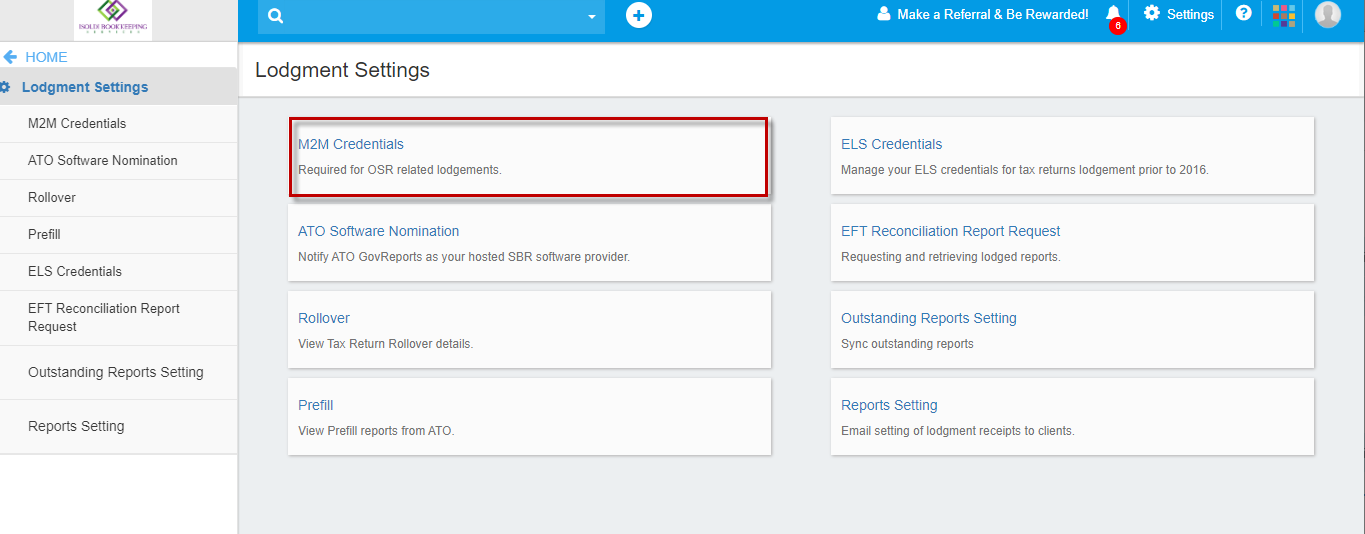

f. M2M Credentials

Machine credentials allow digital service providers (DSP), businesses and tax professionals to interact with ATO online services through their

Standard Business Reporting (SBR) enabled software. A machine credential – equivalent to a Device AUSkey credential. It is mainly used for lodging OSR forms.

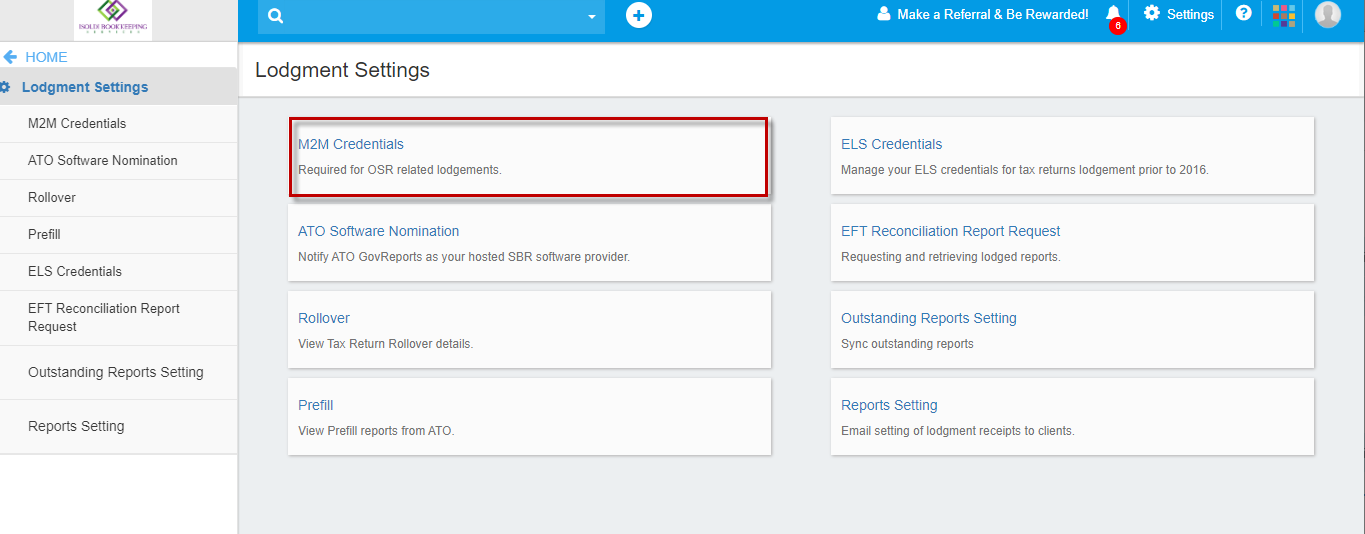

To maintain the M2M credentials, go to Settings -> Lodgment Settings

Select M2M Credentials

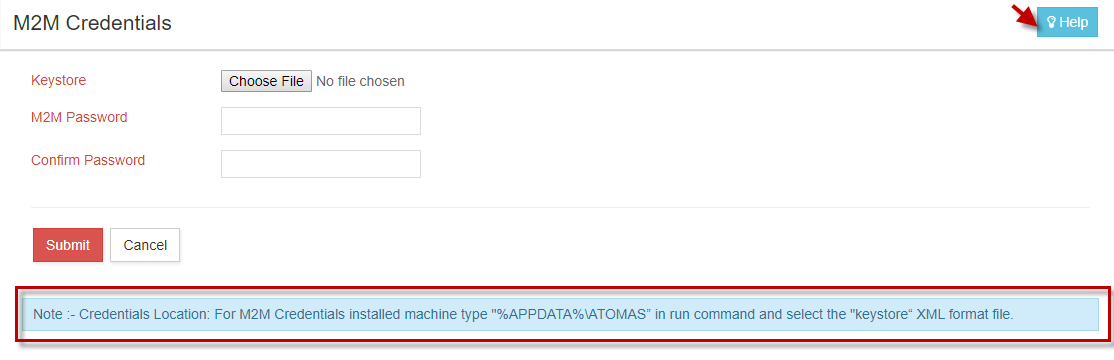

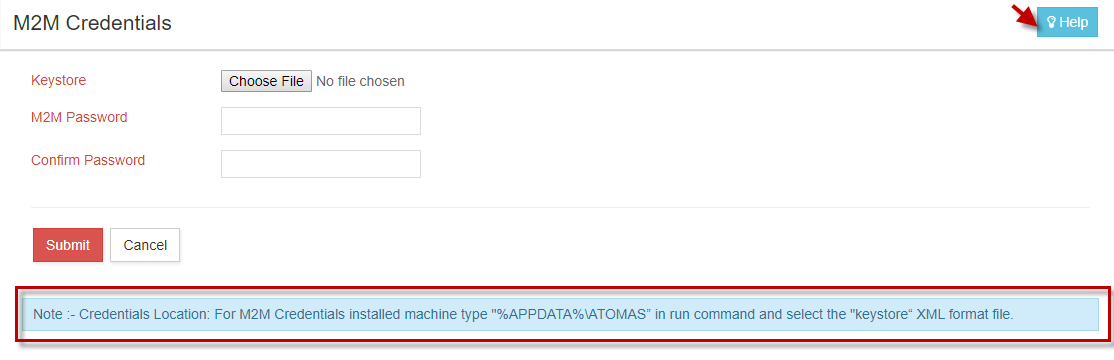

Upload the file and enter the credentials. For more details on how to upload, click on "Help" on the top right corner.

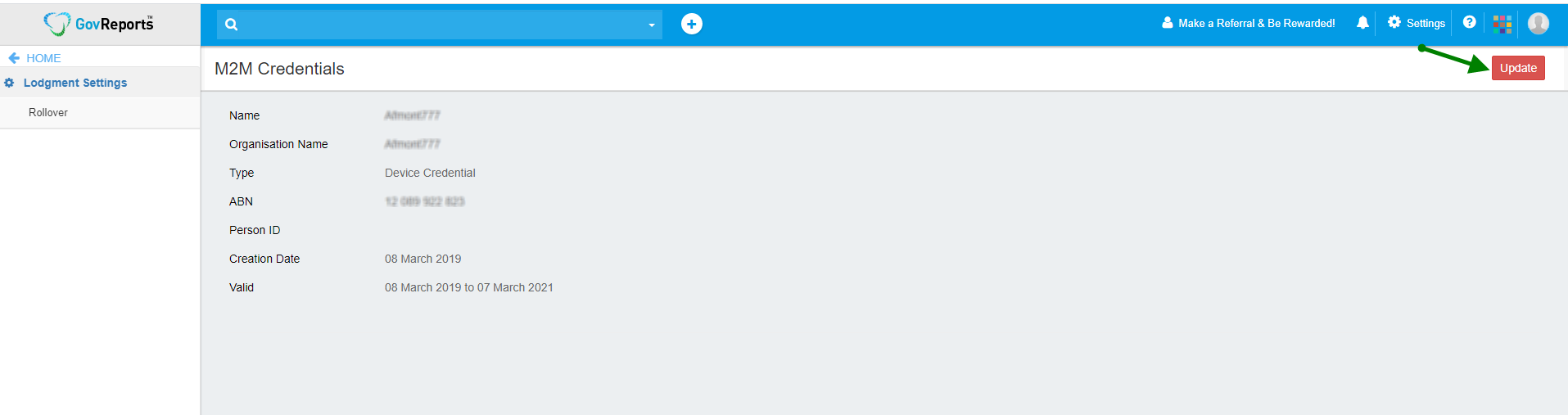

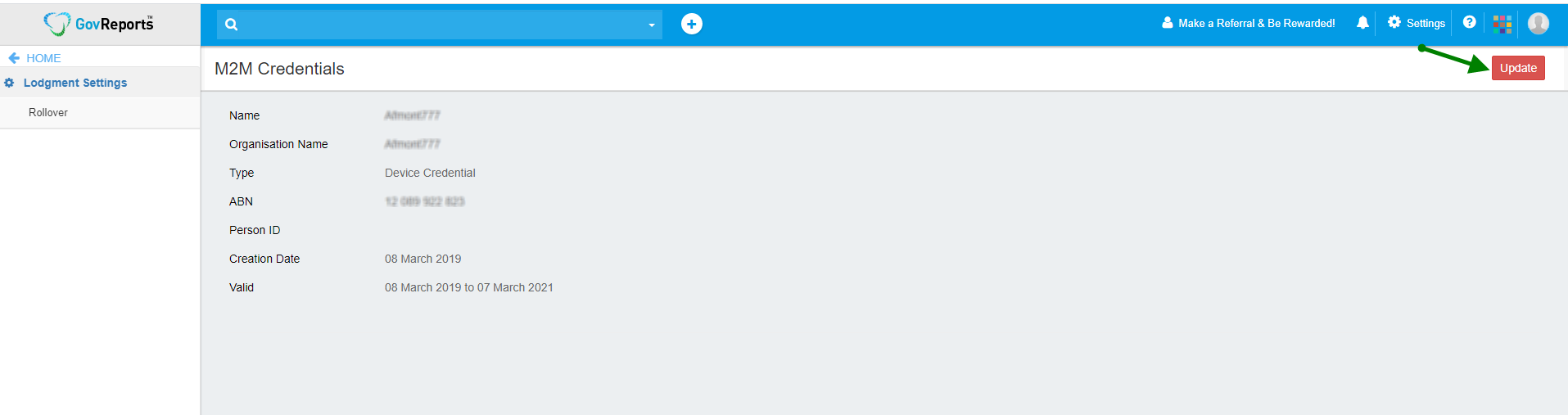

Update M2M credentials: If M2M credential is expired, you an update it by clicking on "Update"

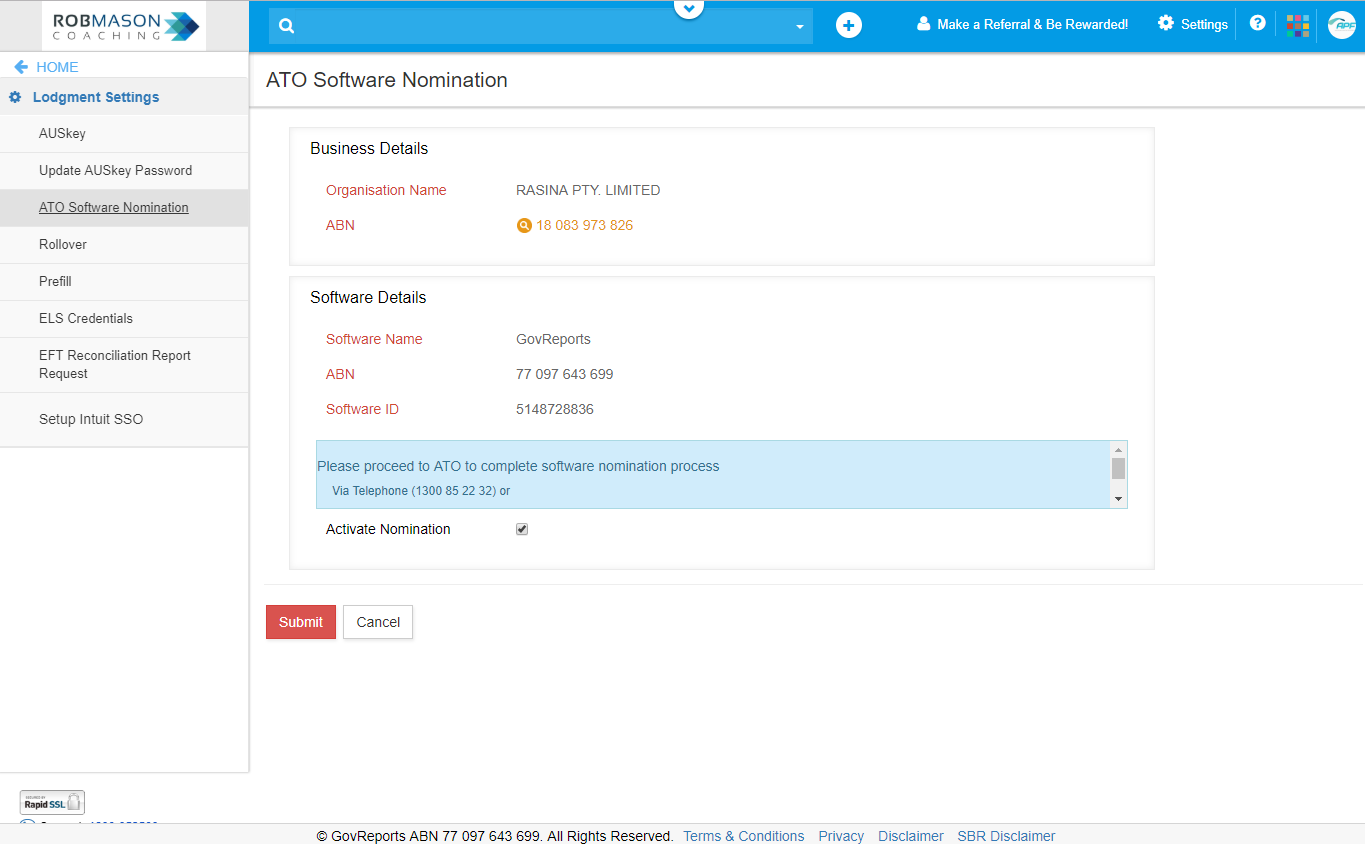

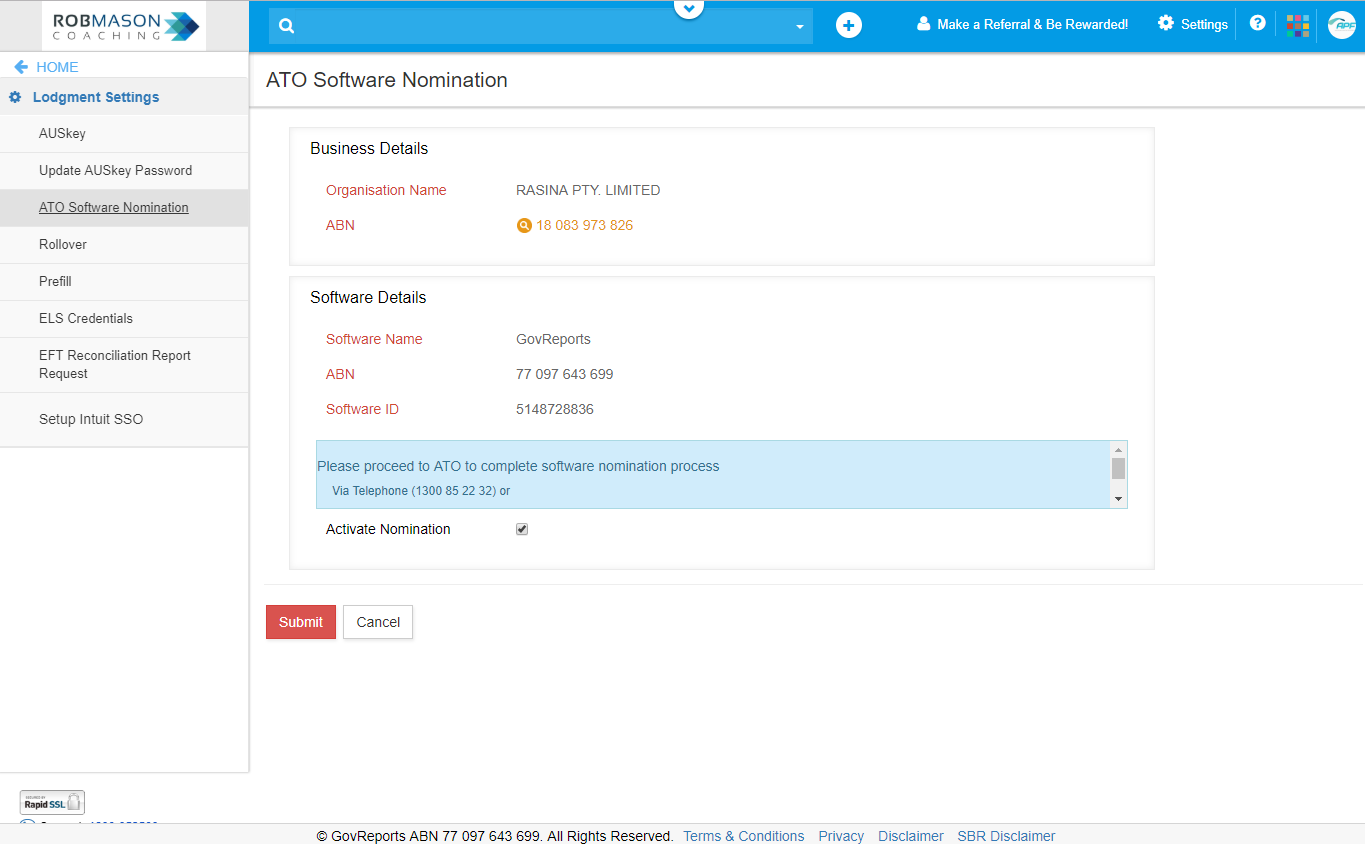

g. ATO Software Nomination

ATO Software Nomination is required when you registered and want to use GovReports to prepare and submit compliance and regulatory reports to ATO.

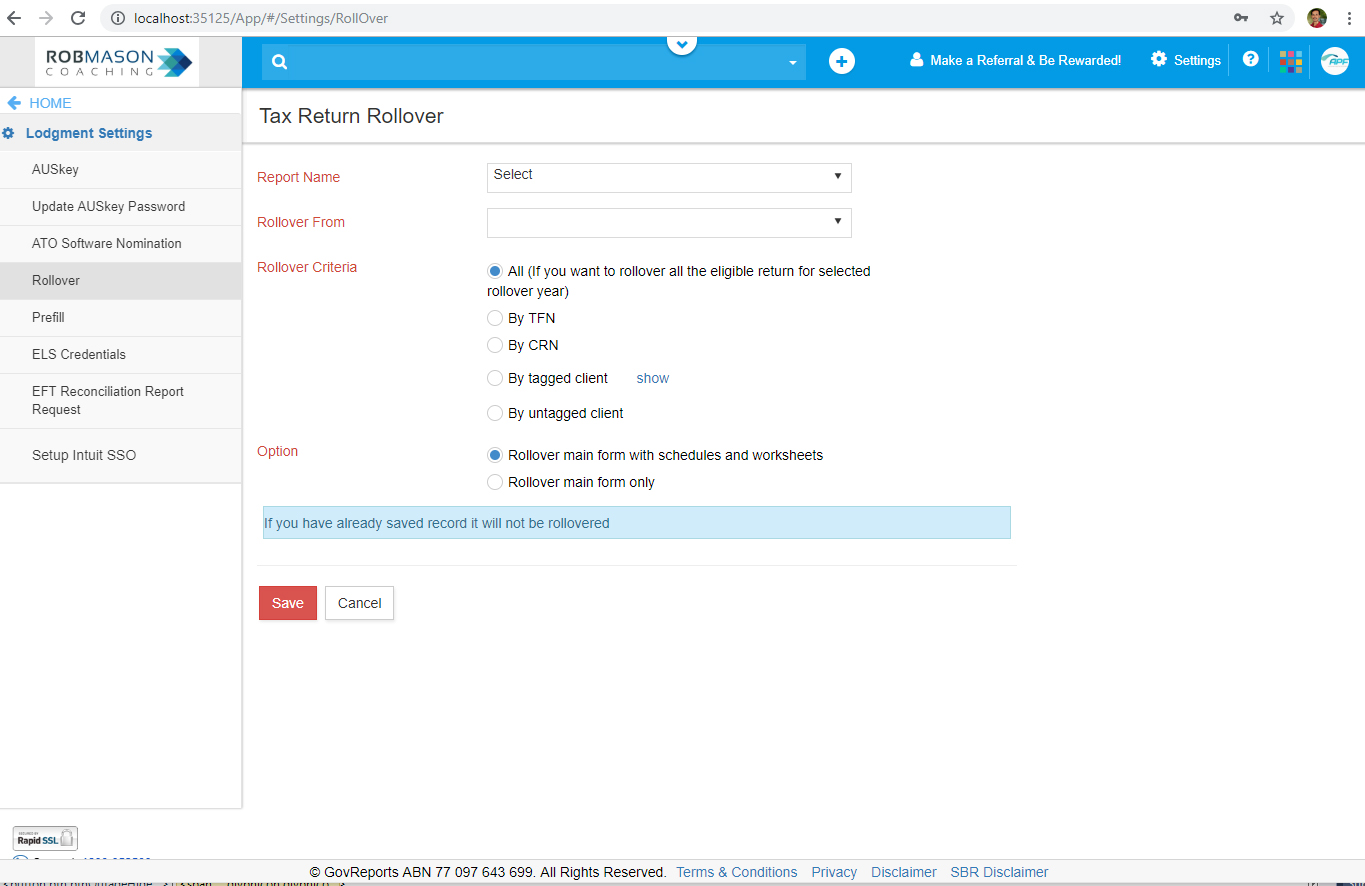

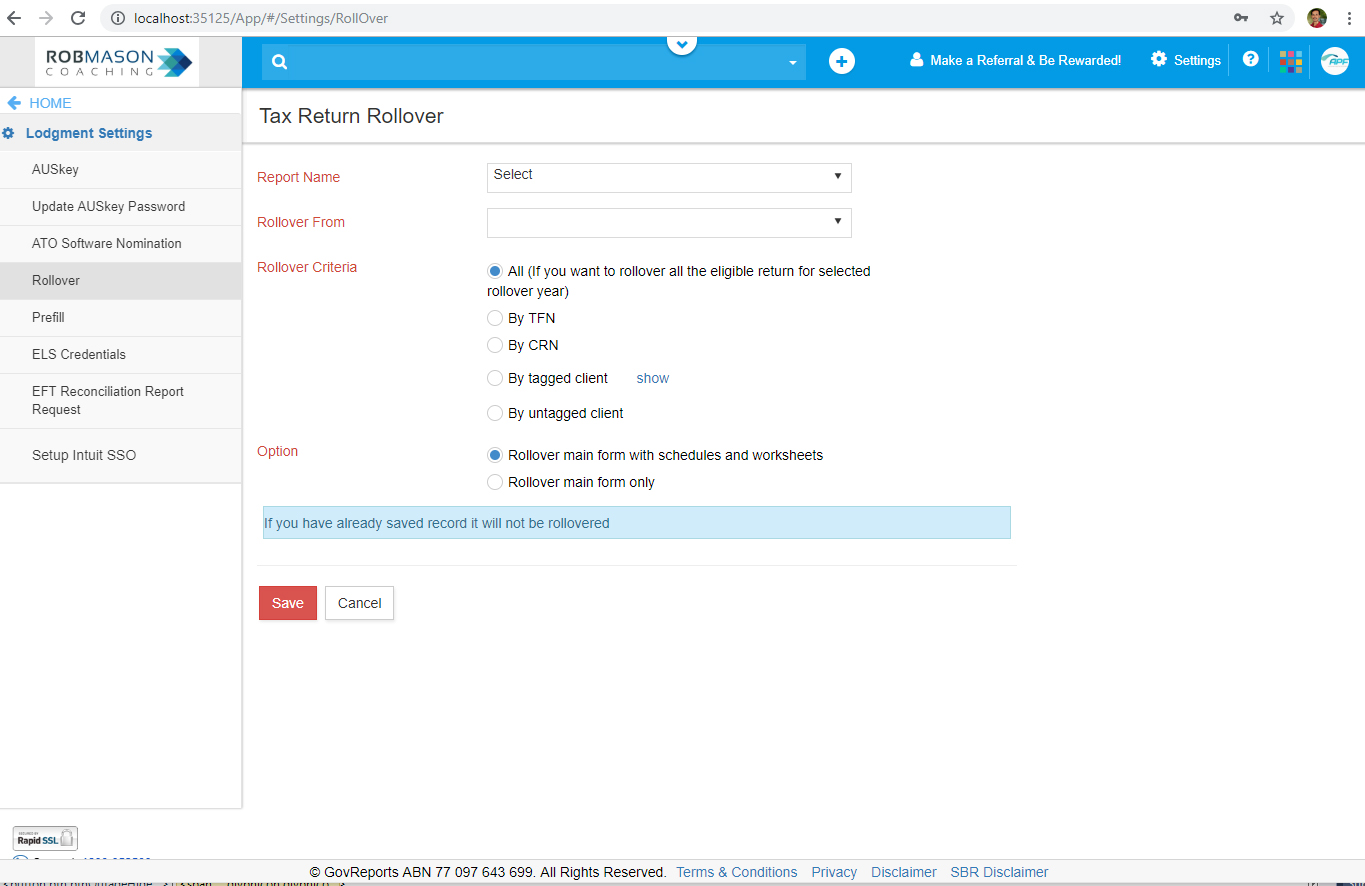

h. Rollover

View Tax Return Rollover details.

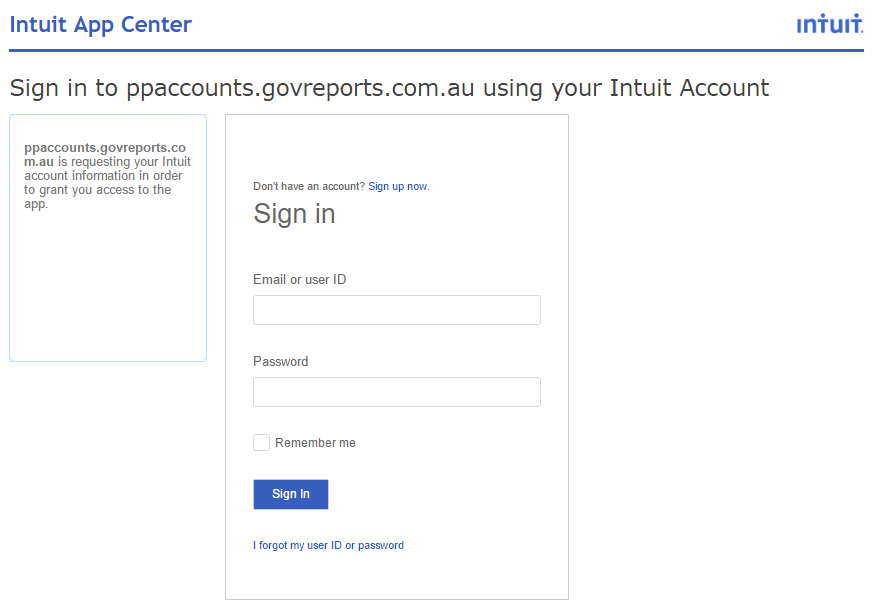

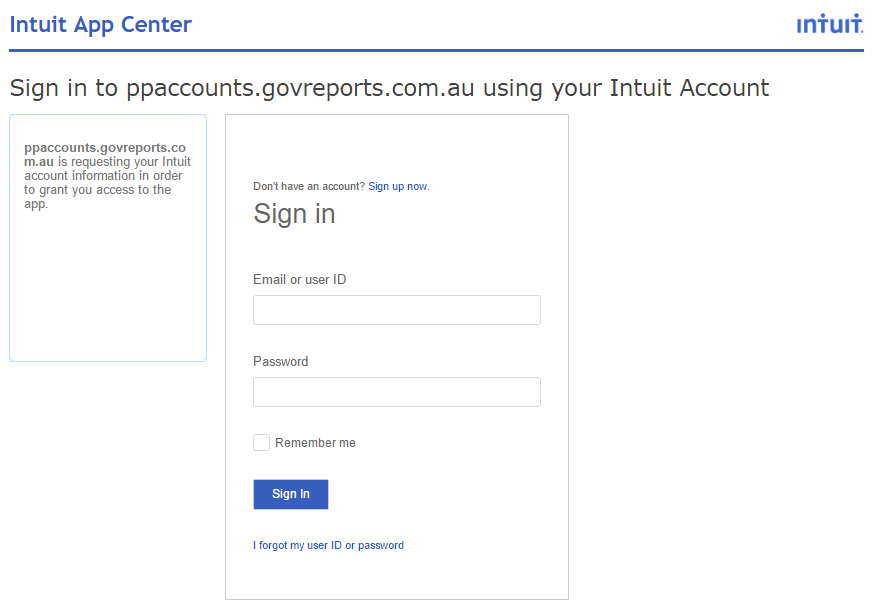

i. Set Up Intuit SSO

Want quick access to your Intuit Client Accounts.

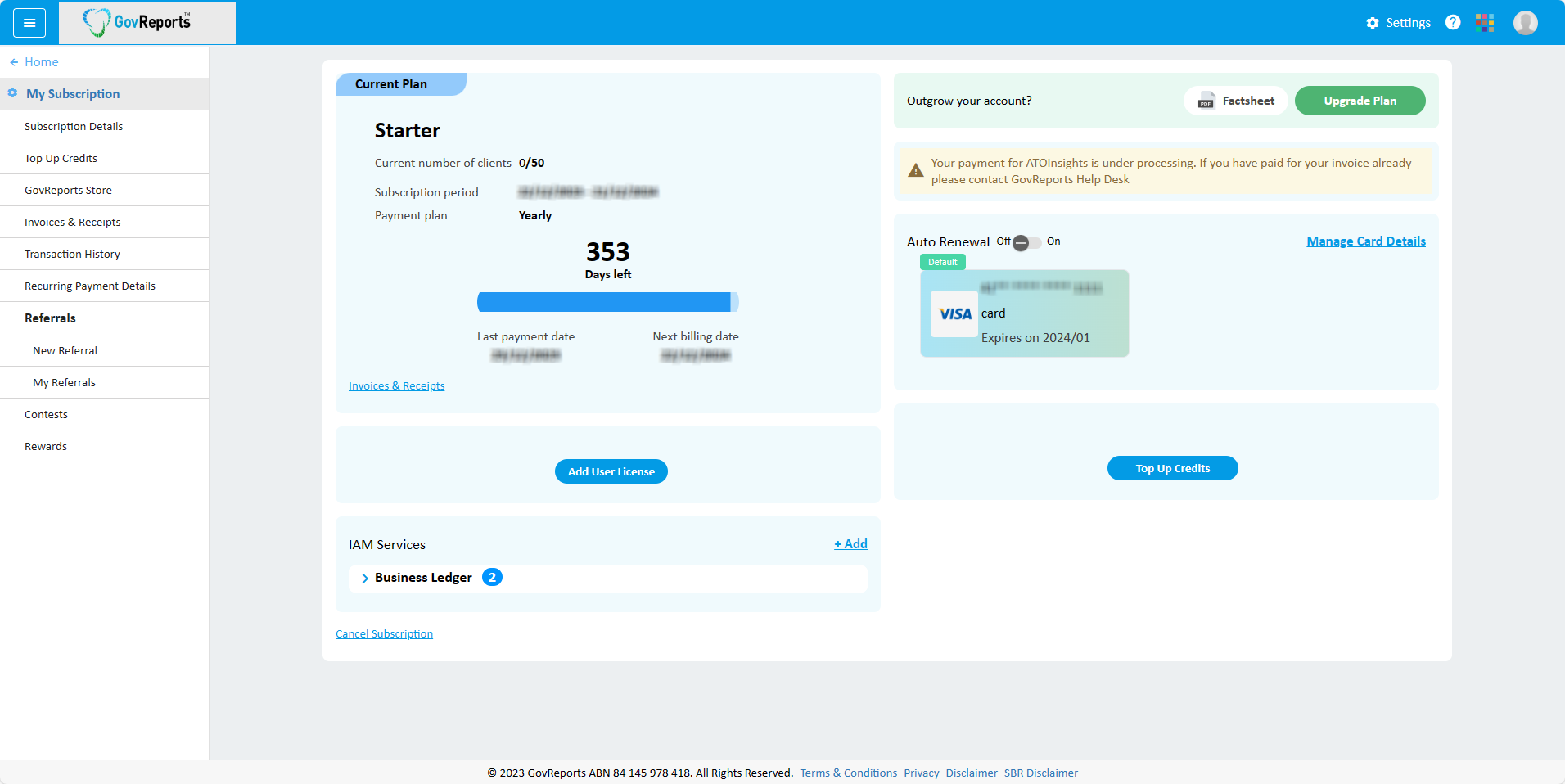

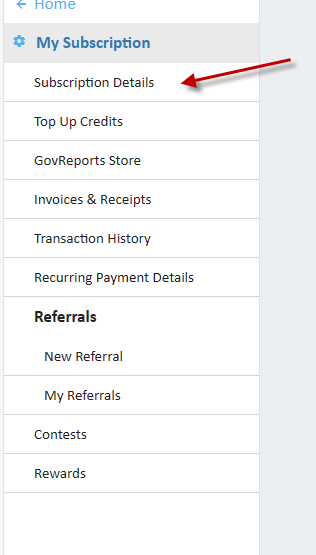

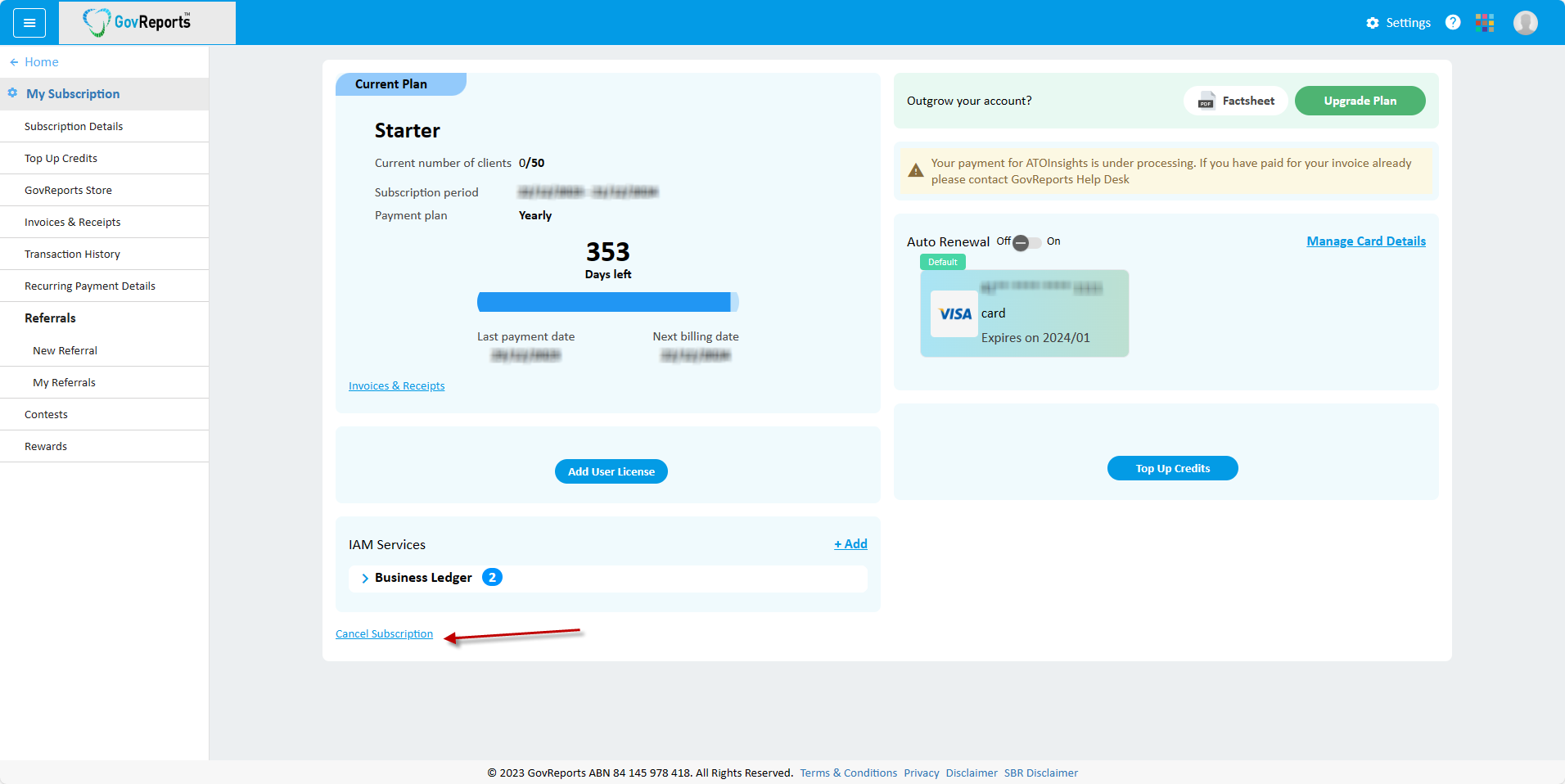

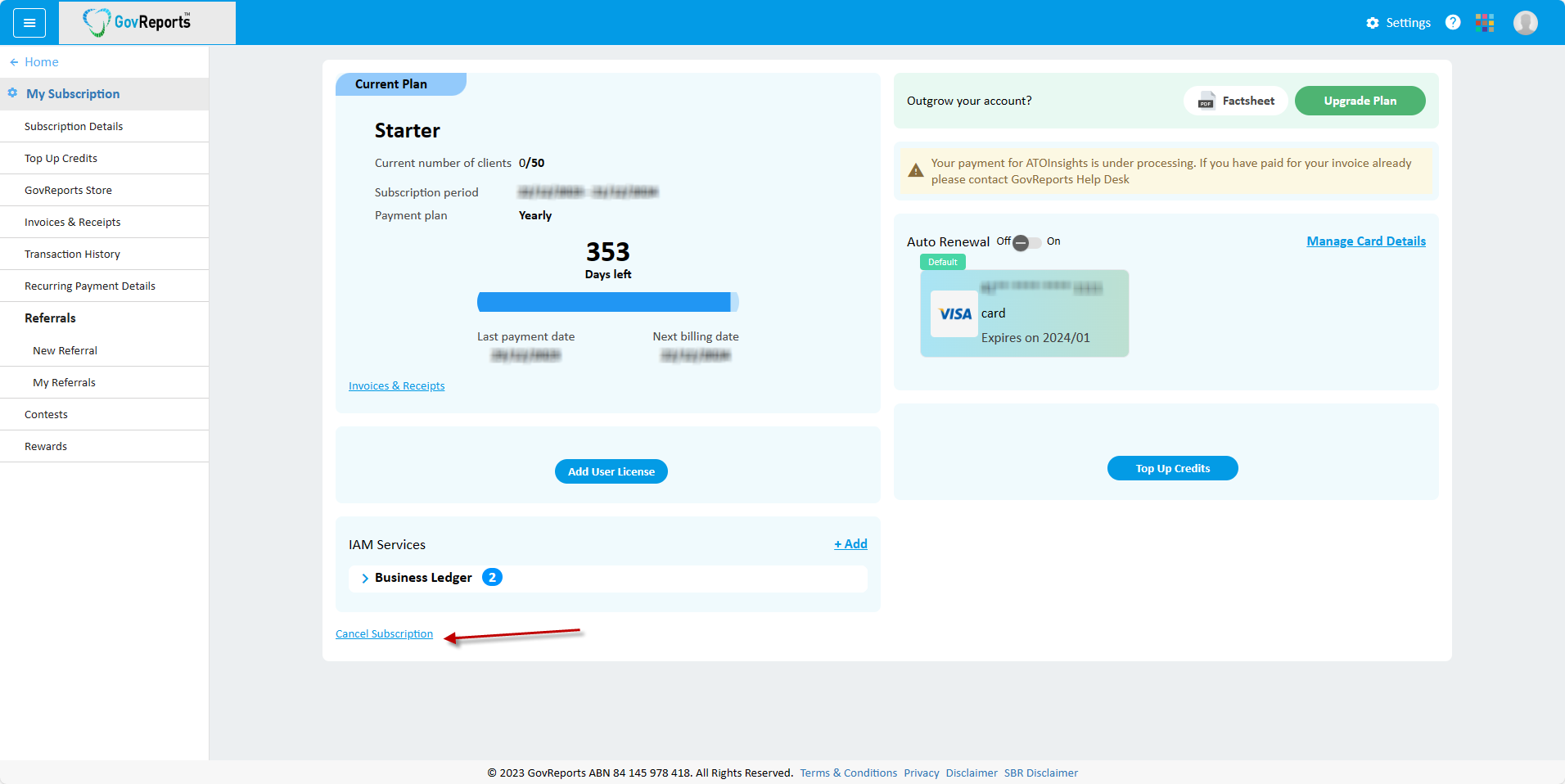

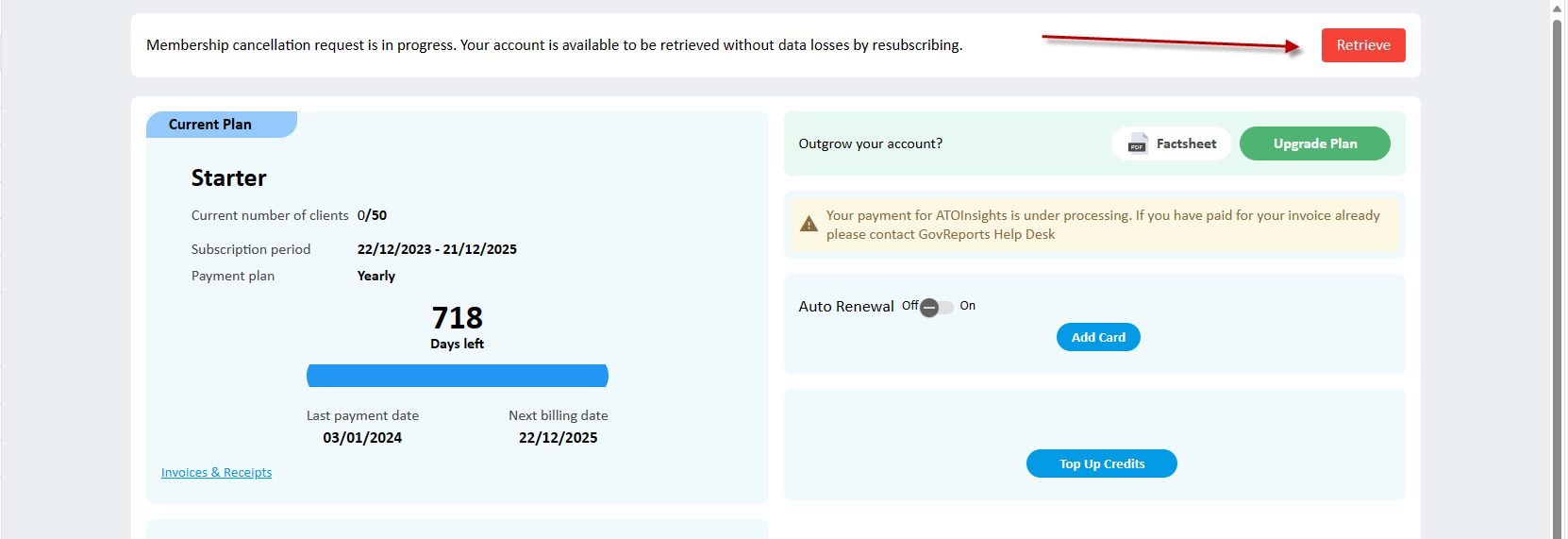

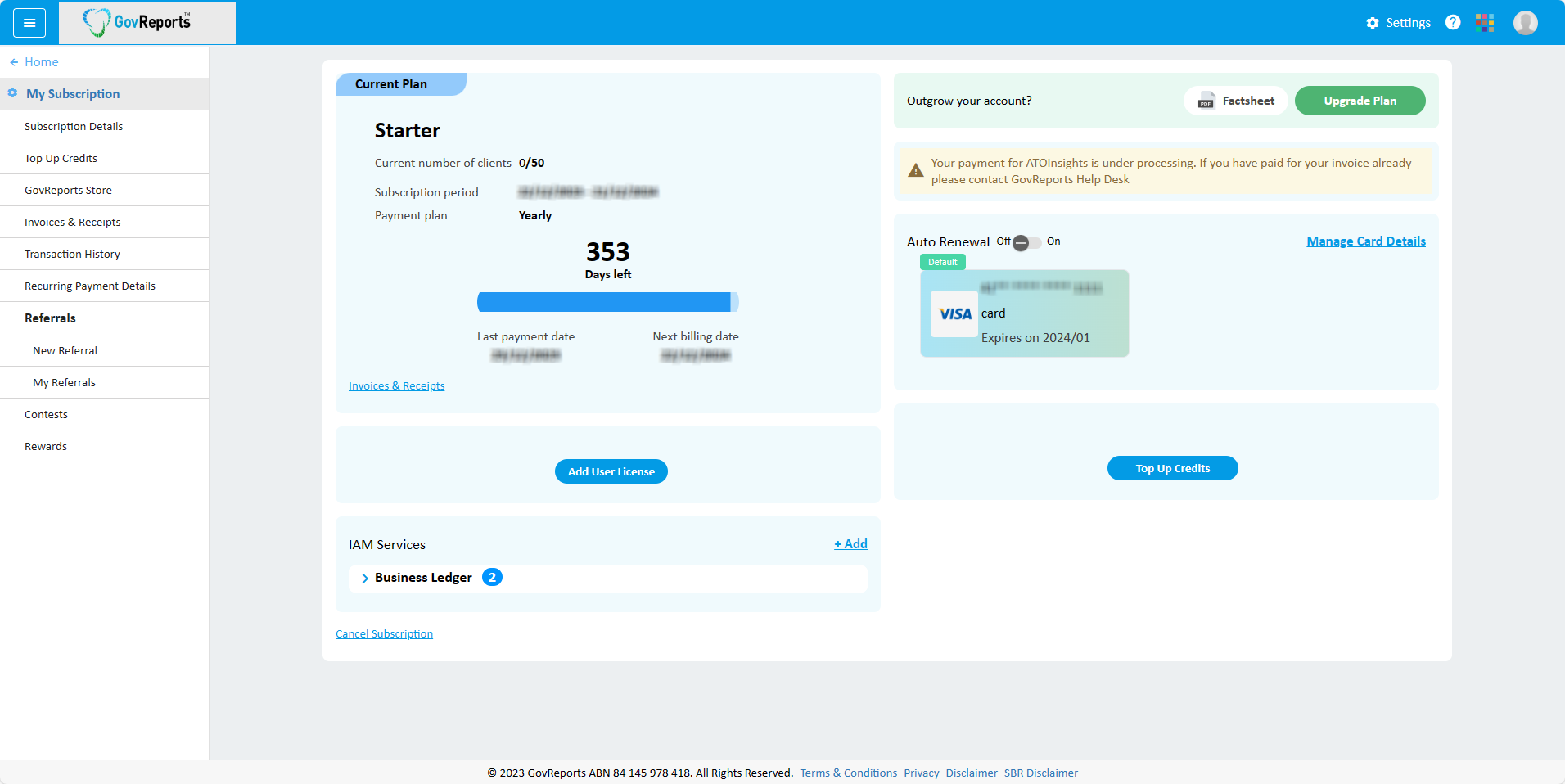

j. Subscription Details

Details of your subscription and purchases.

k. Top Up Credits

To Top up your account with credits.

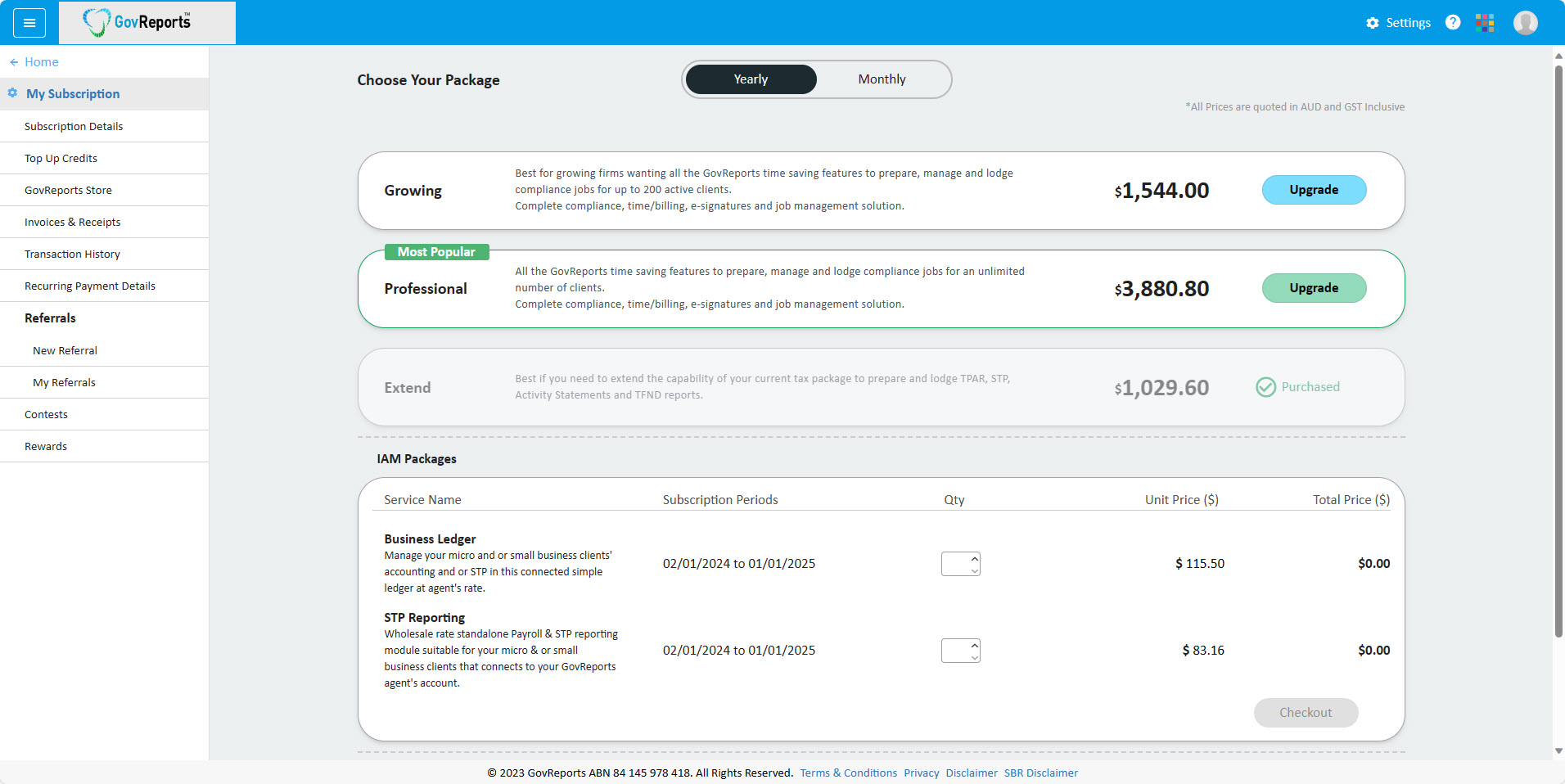

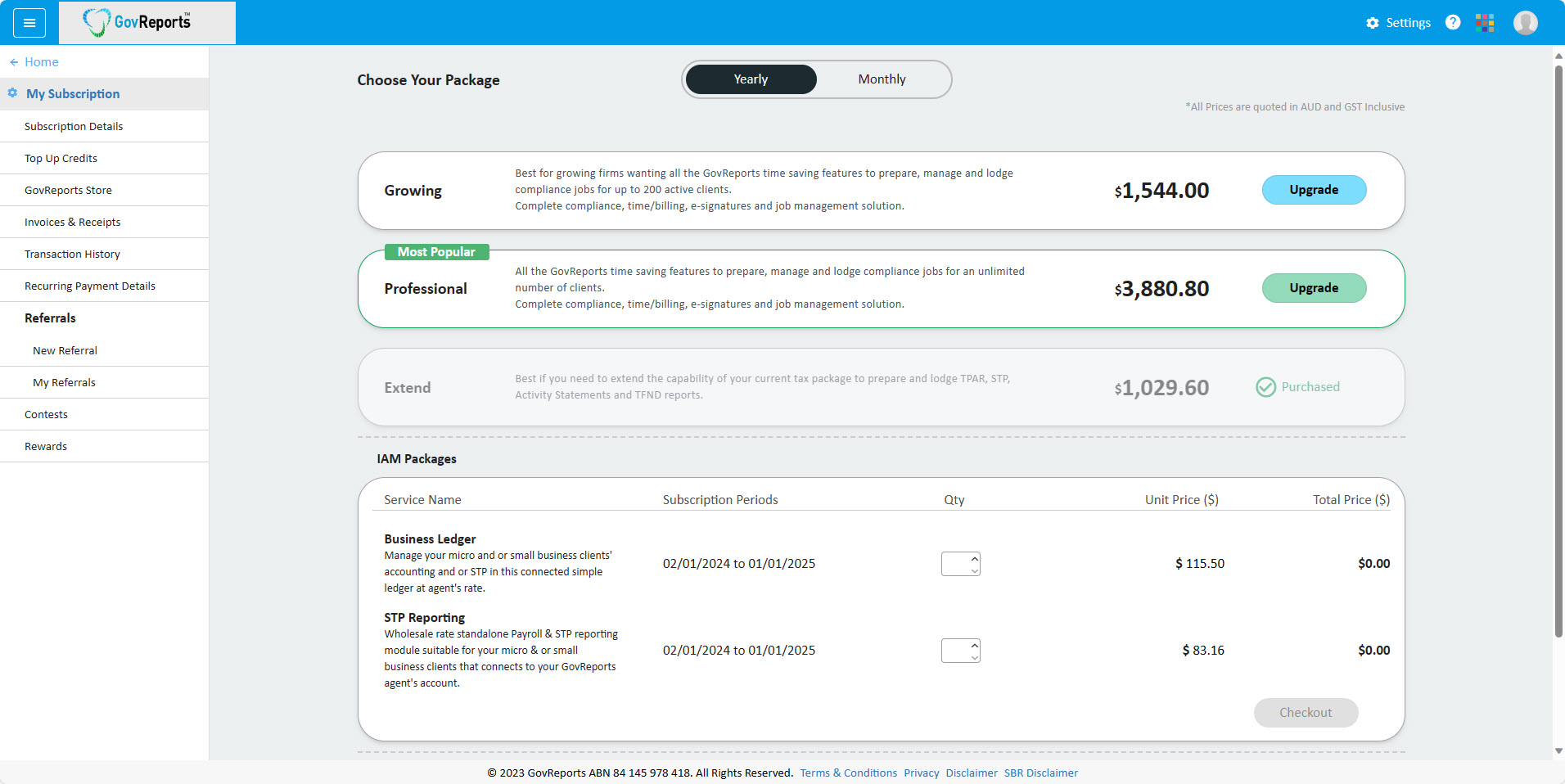

l. GovReports Store

View, change and or add GovReports service options.

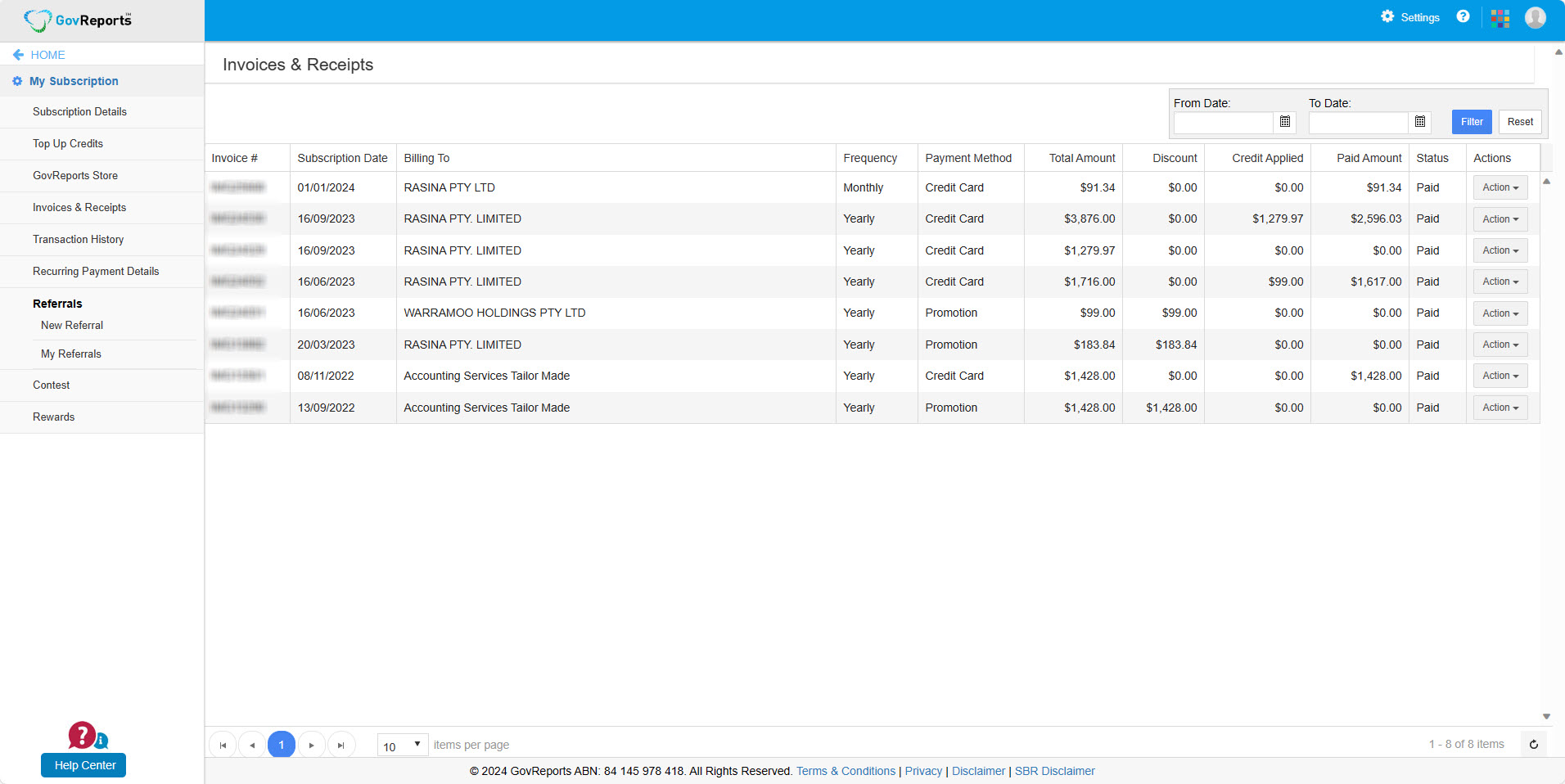

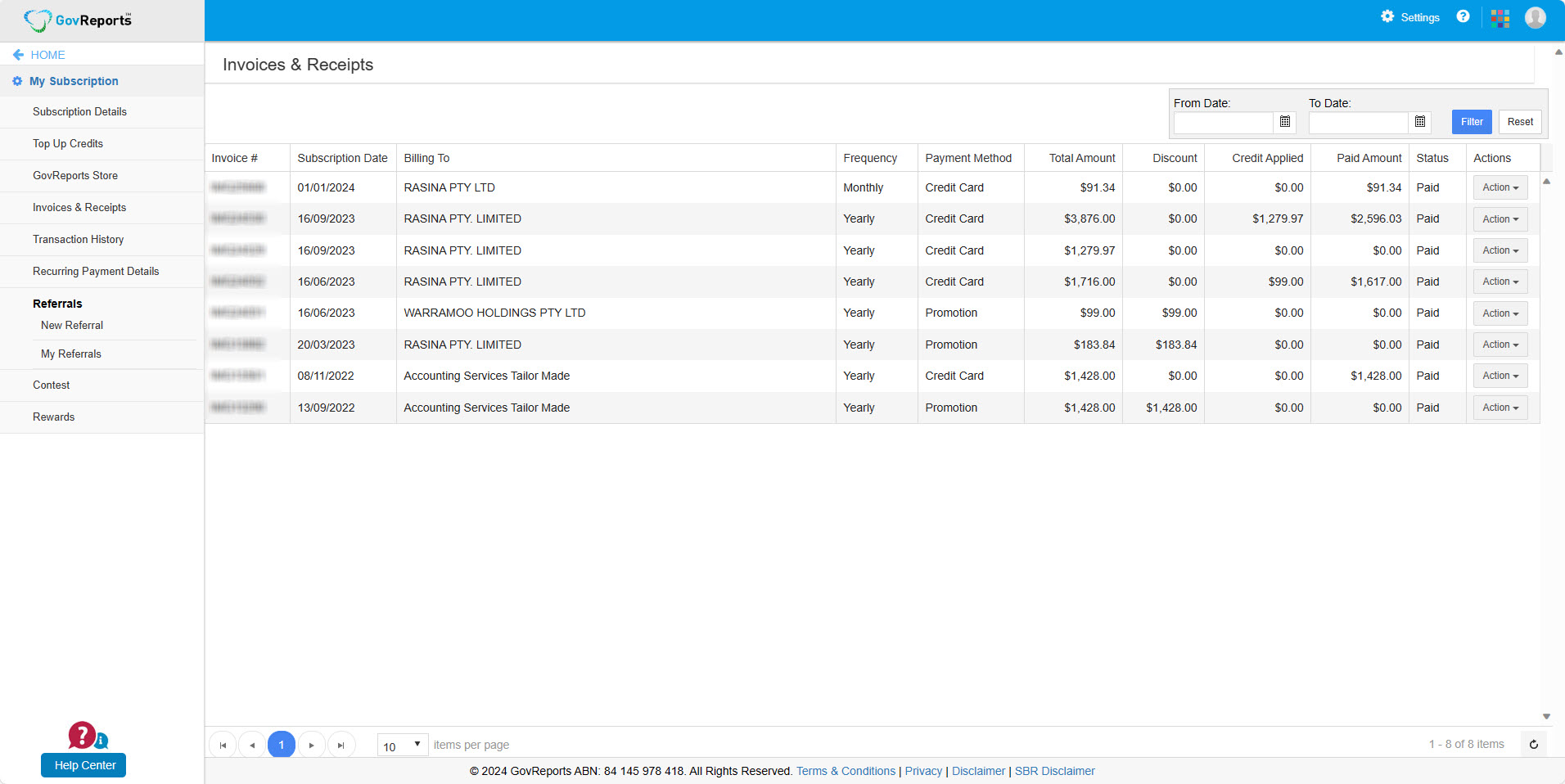

m. Invoices & Receipts

View current invoices and billing history.

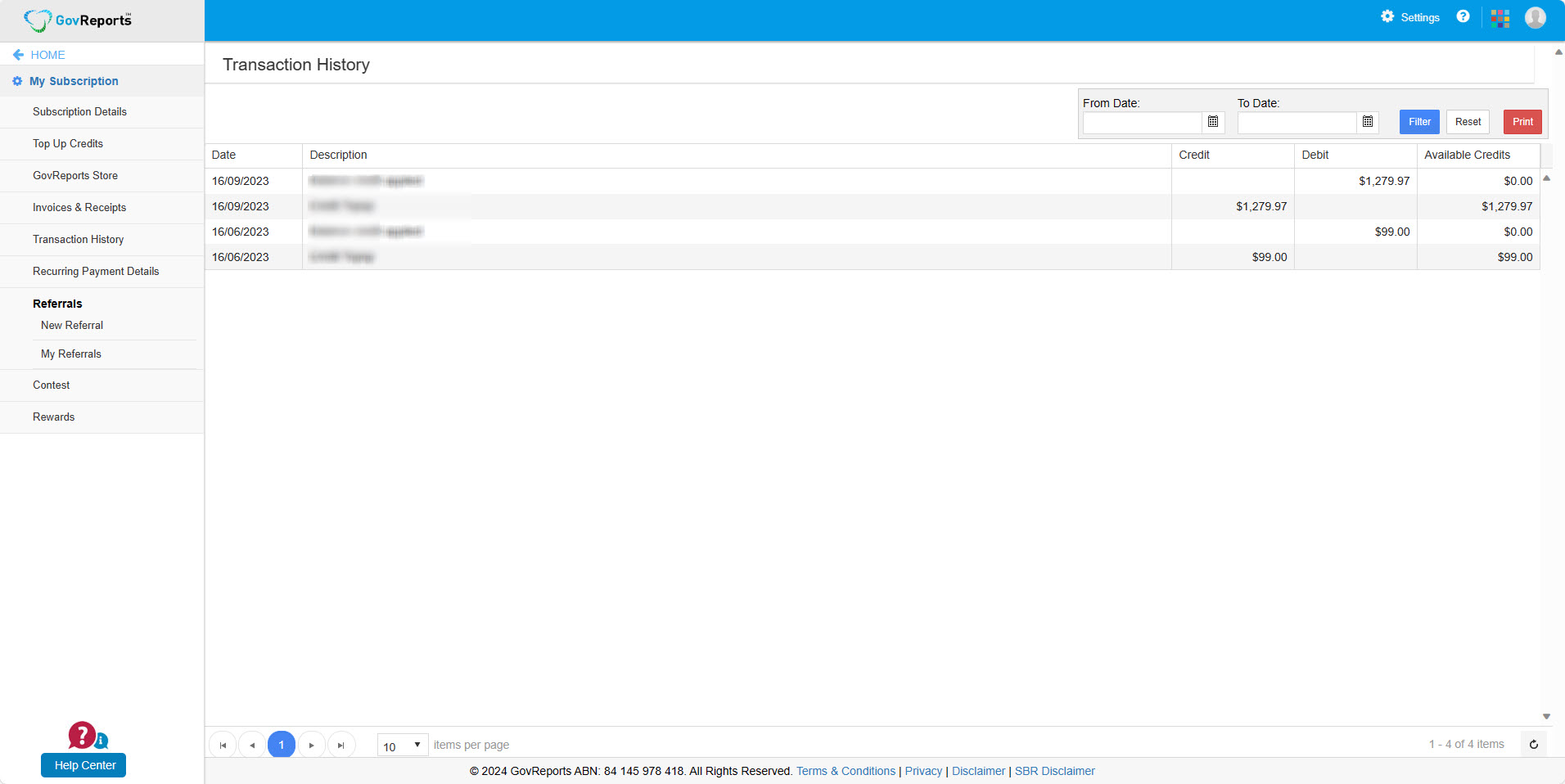

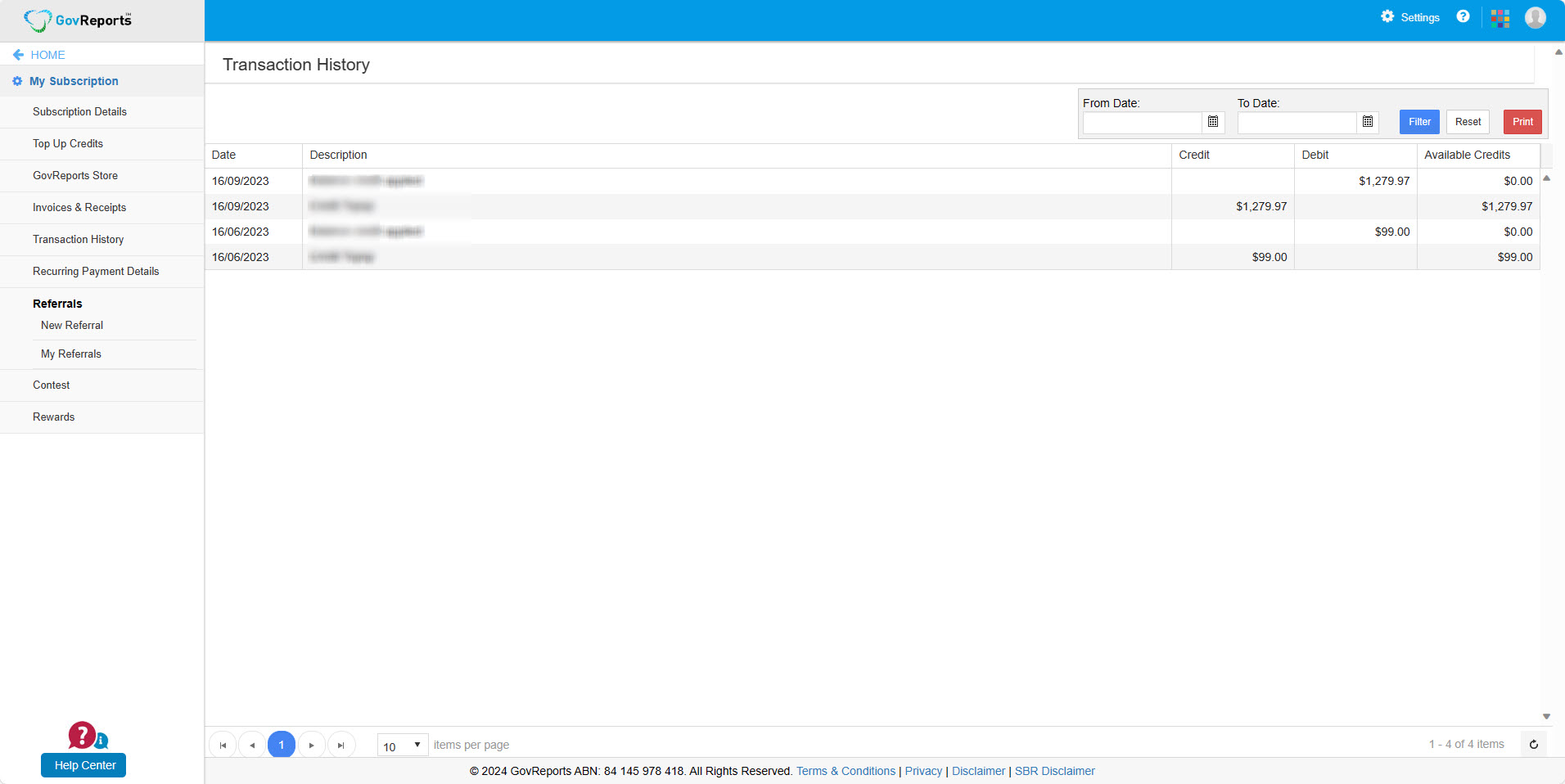

n. Transaction History

View lodgement transactions and history.

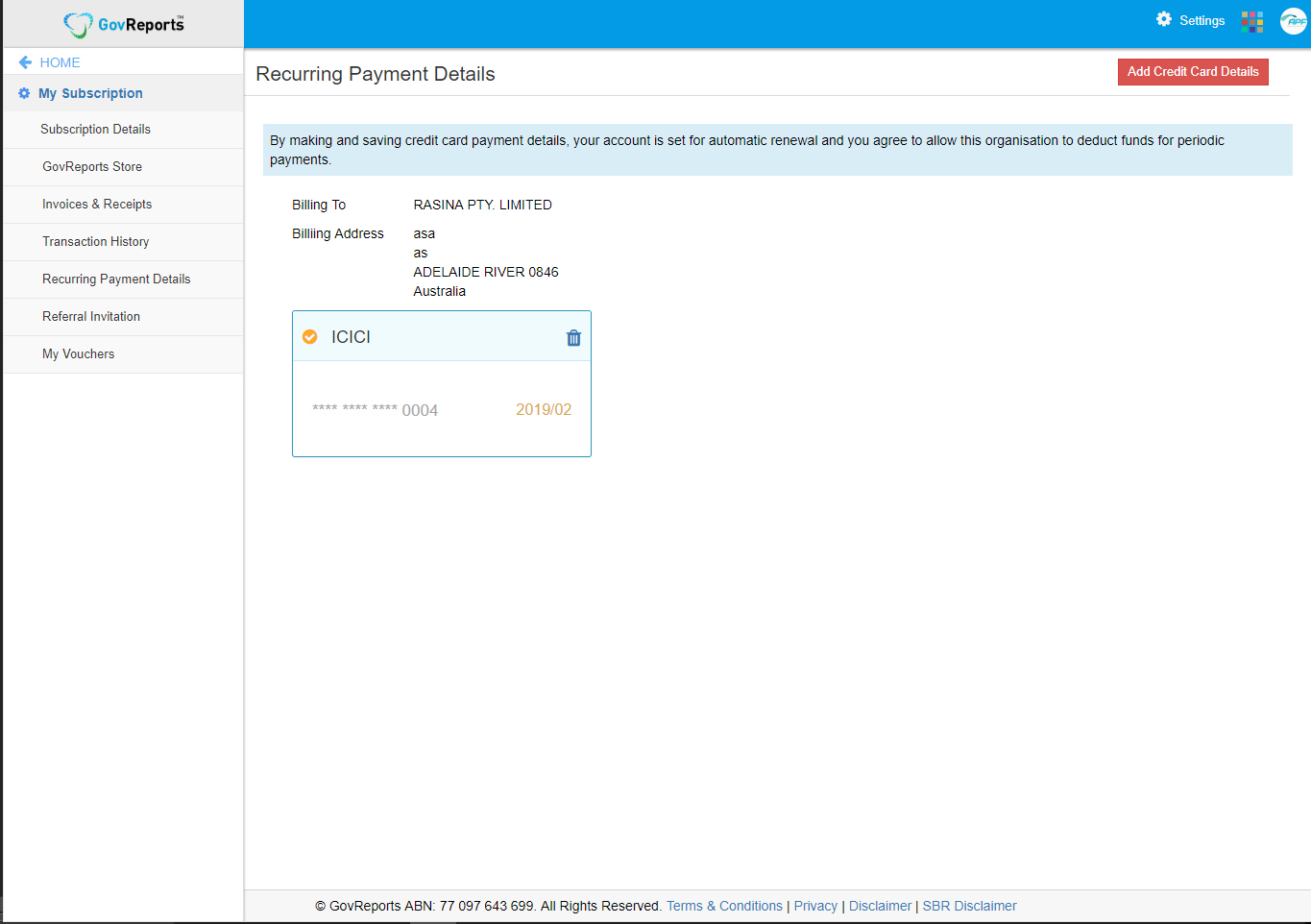

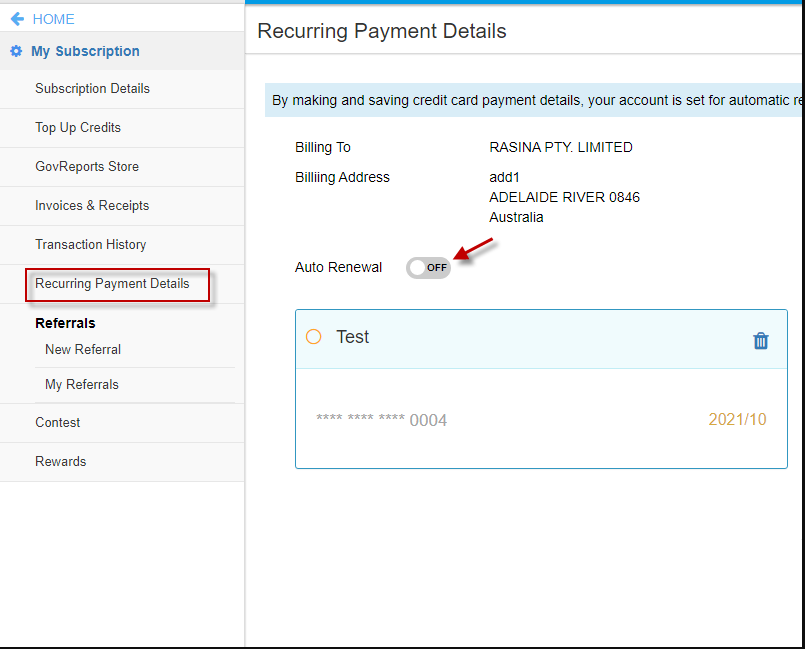

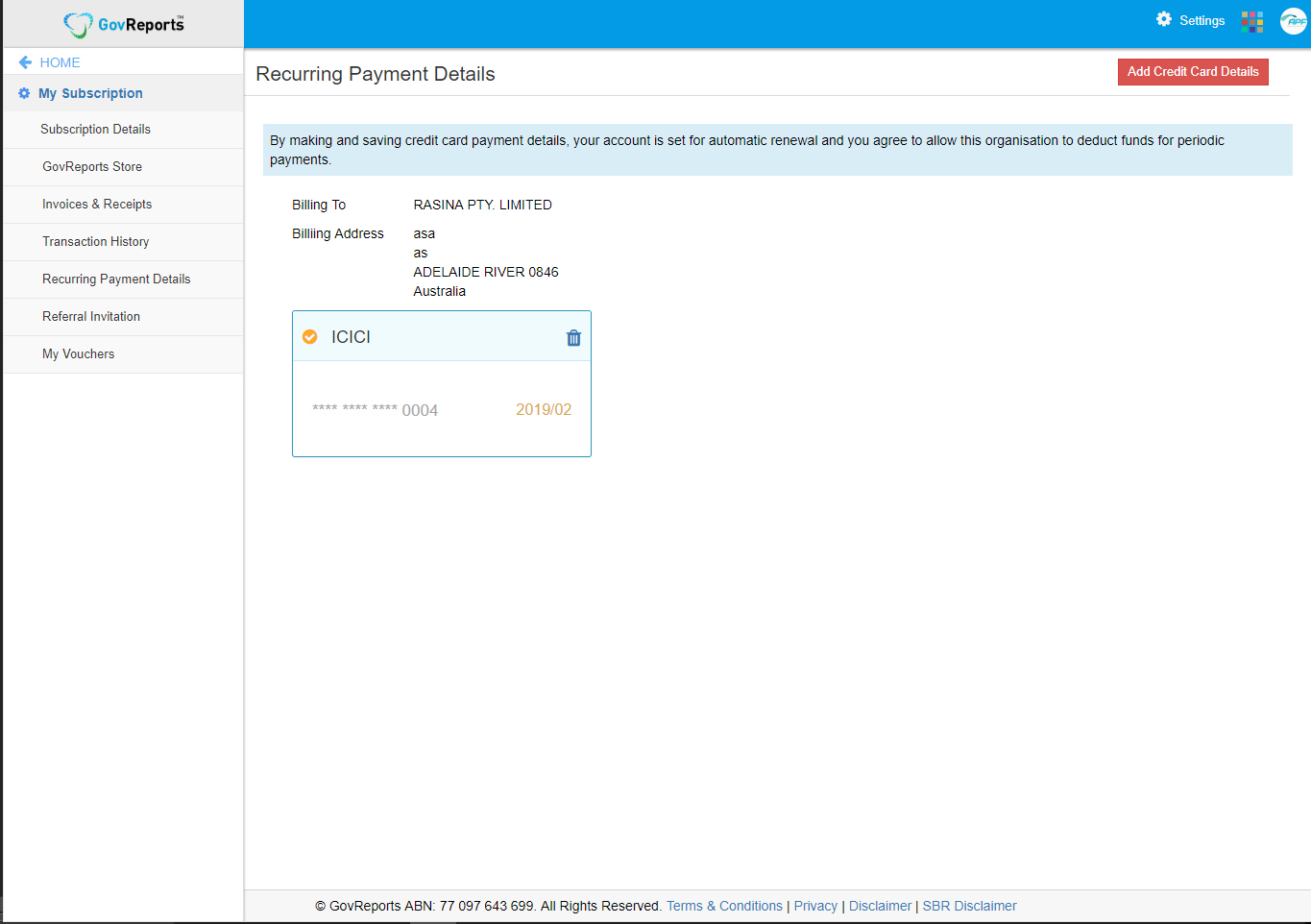

o. Recurring Payment Details

Change credit card details.

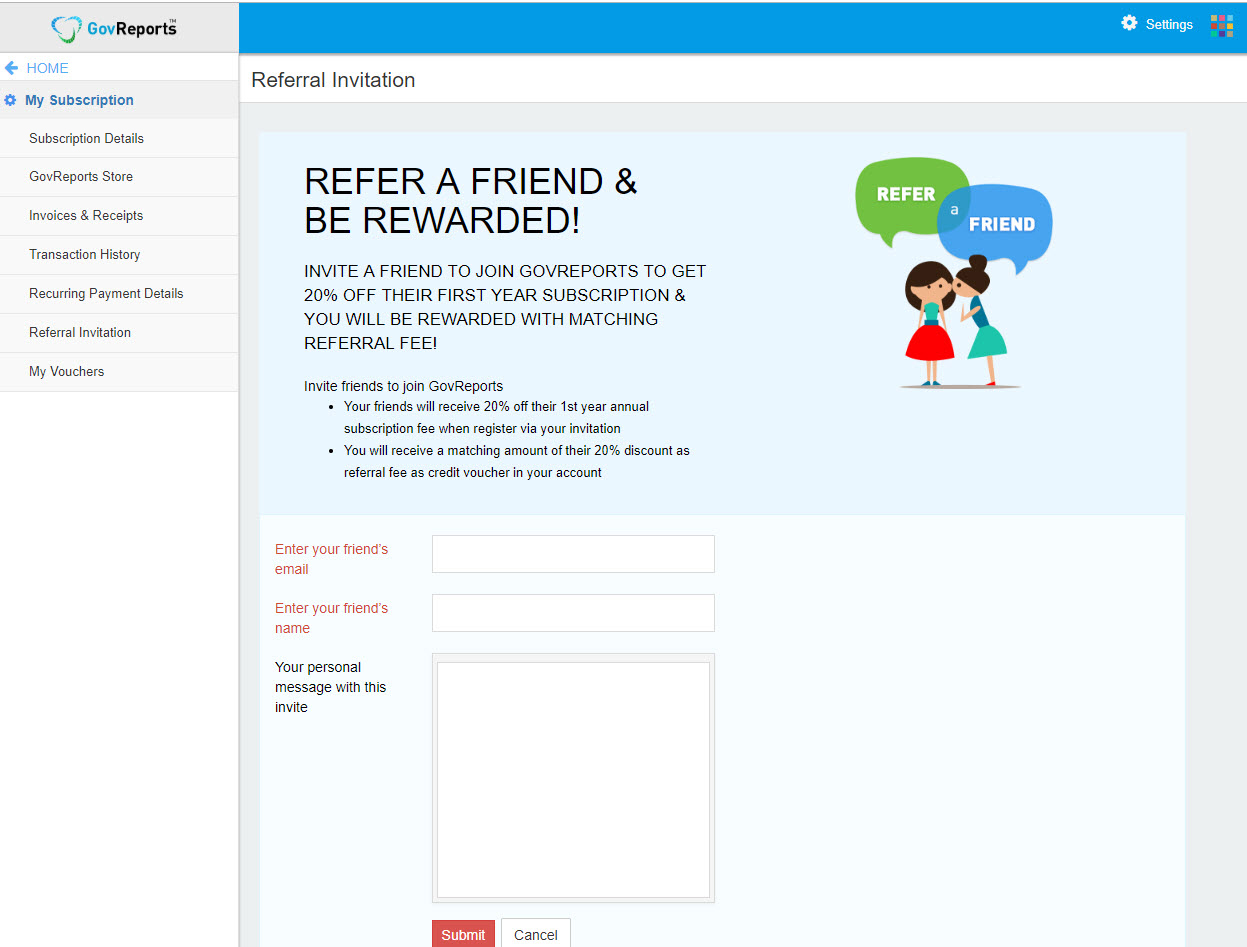

p. Referral Invitation

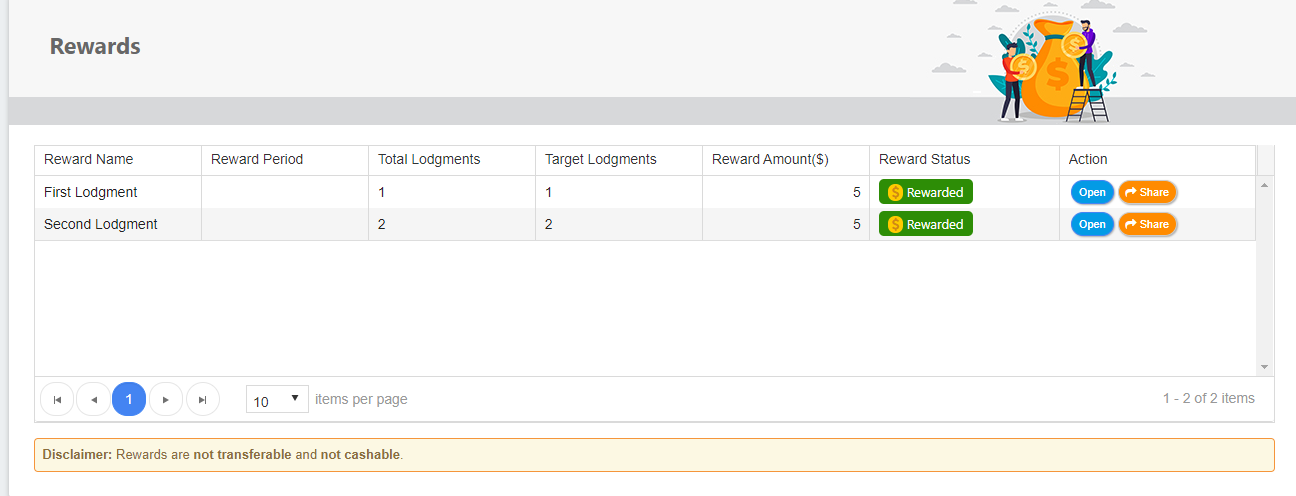

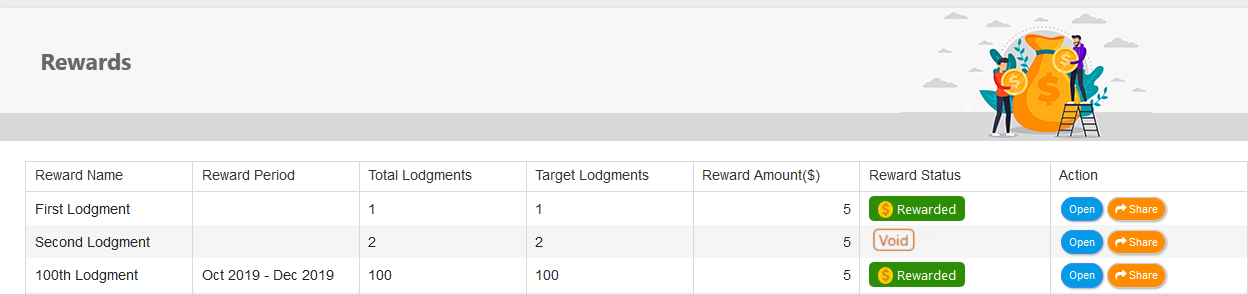

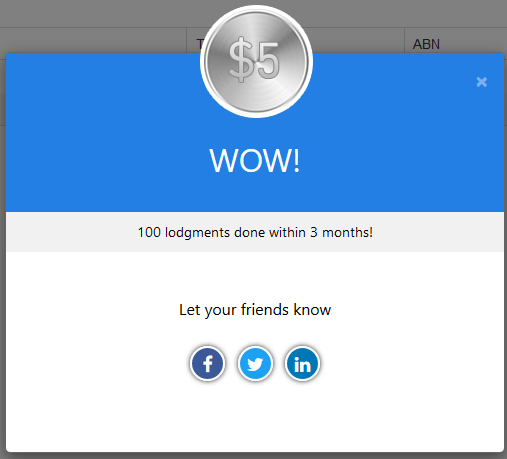

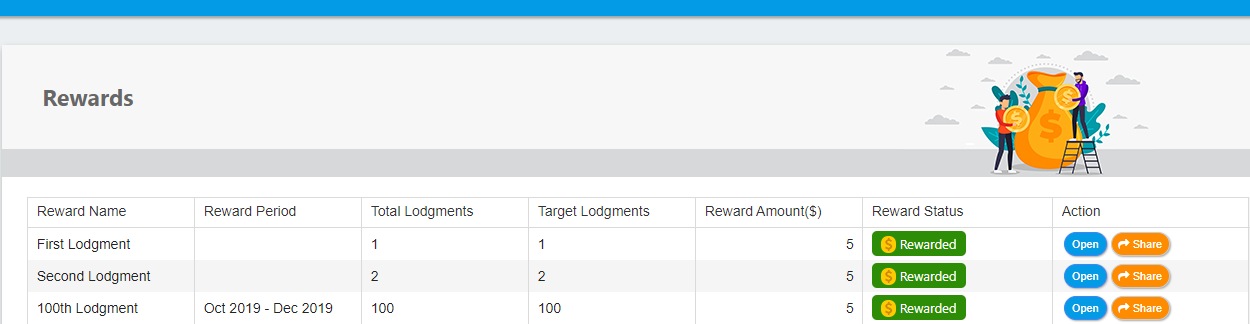

View your referral status.

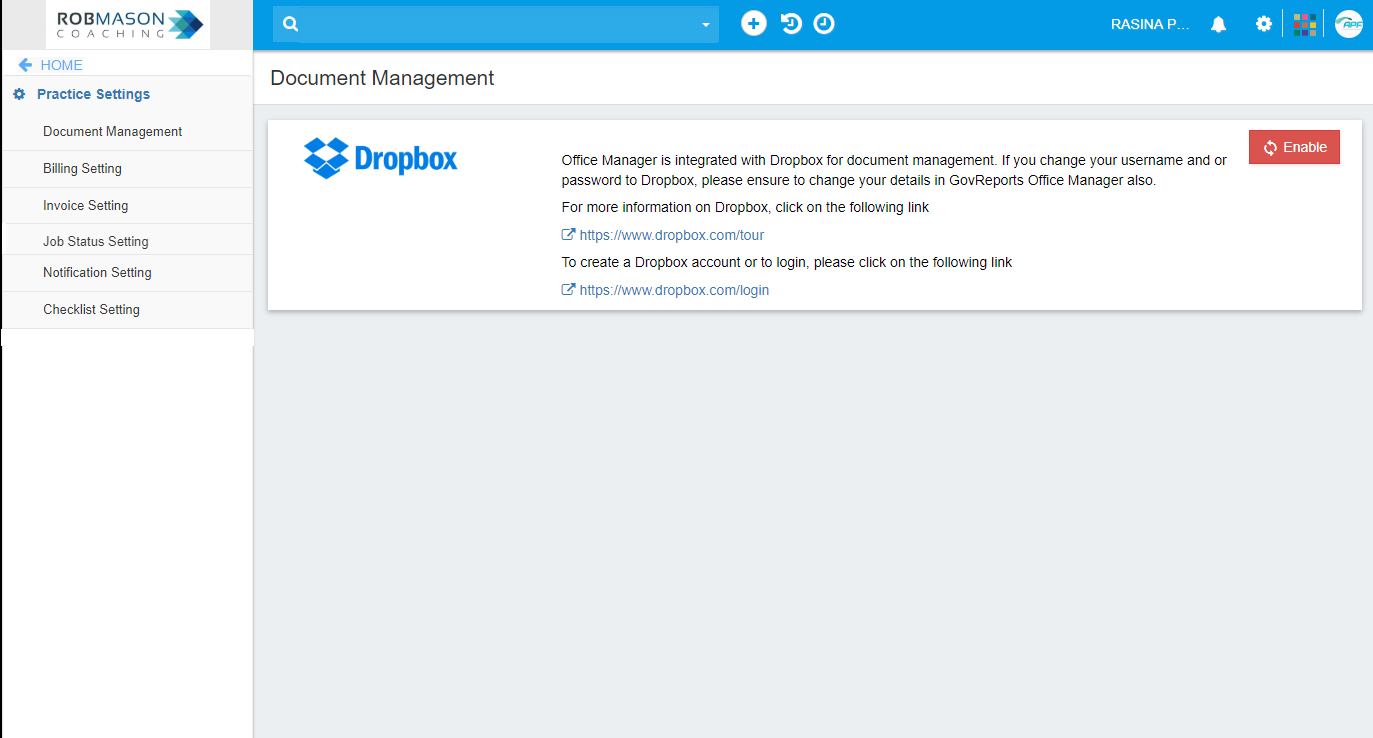

q. Document Management Setting

Configure your GovReports account with Dropbox or Google Drive.

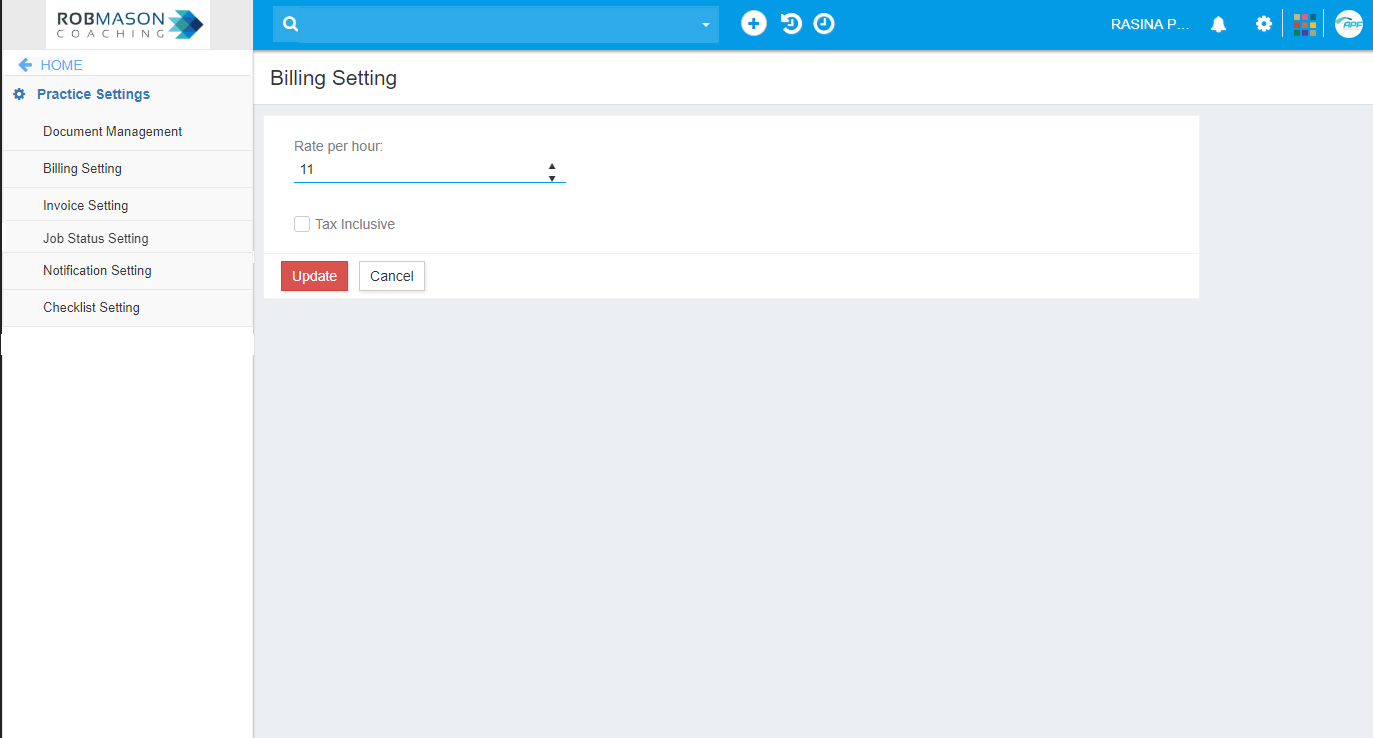

r. Billing Setting

Customise your billing information and hourly payment rate.

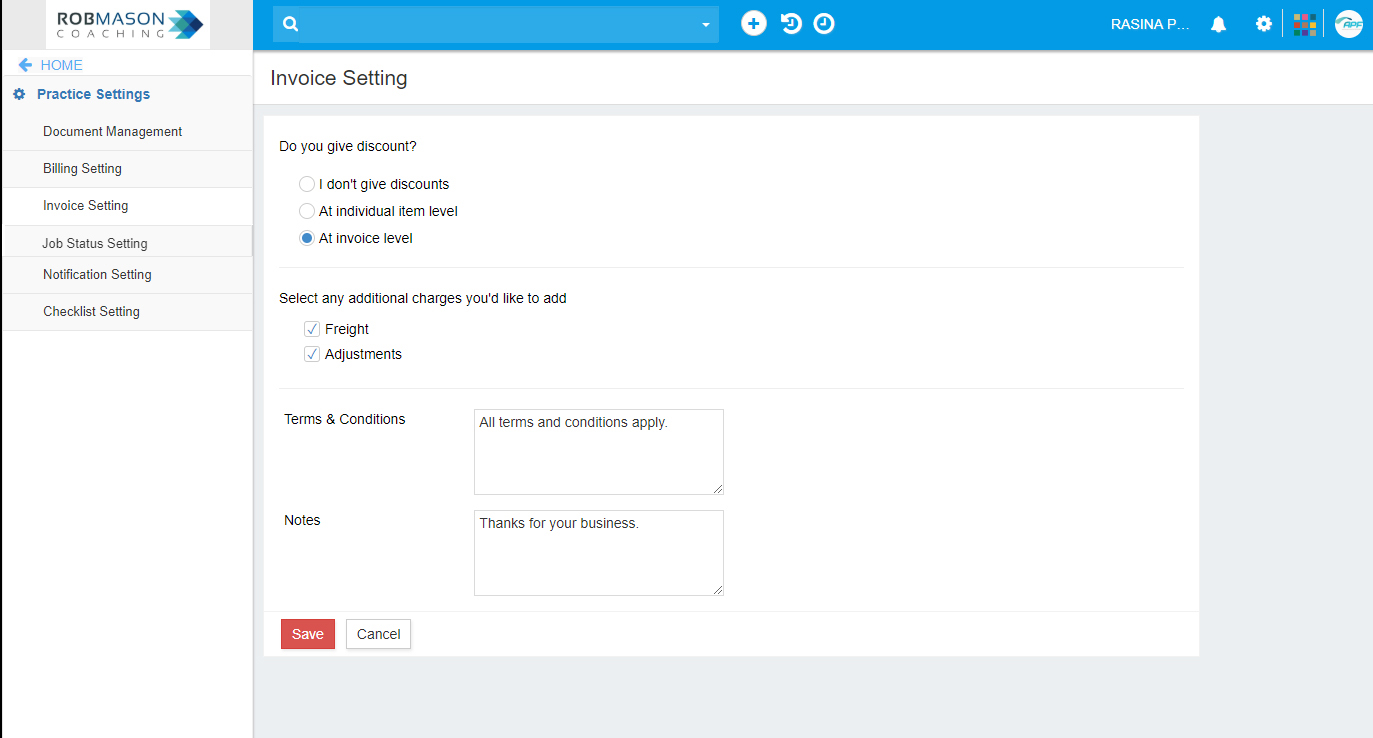

s. Invoice Setting

Customise the invoice appearance you send to customers.

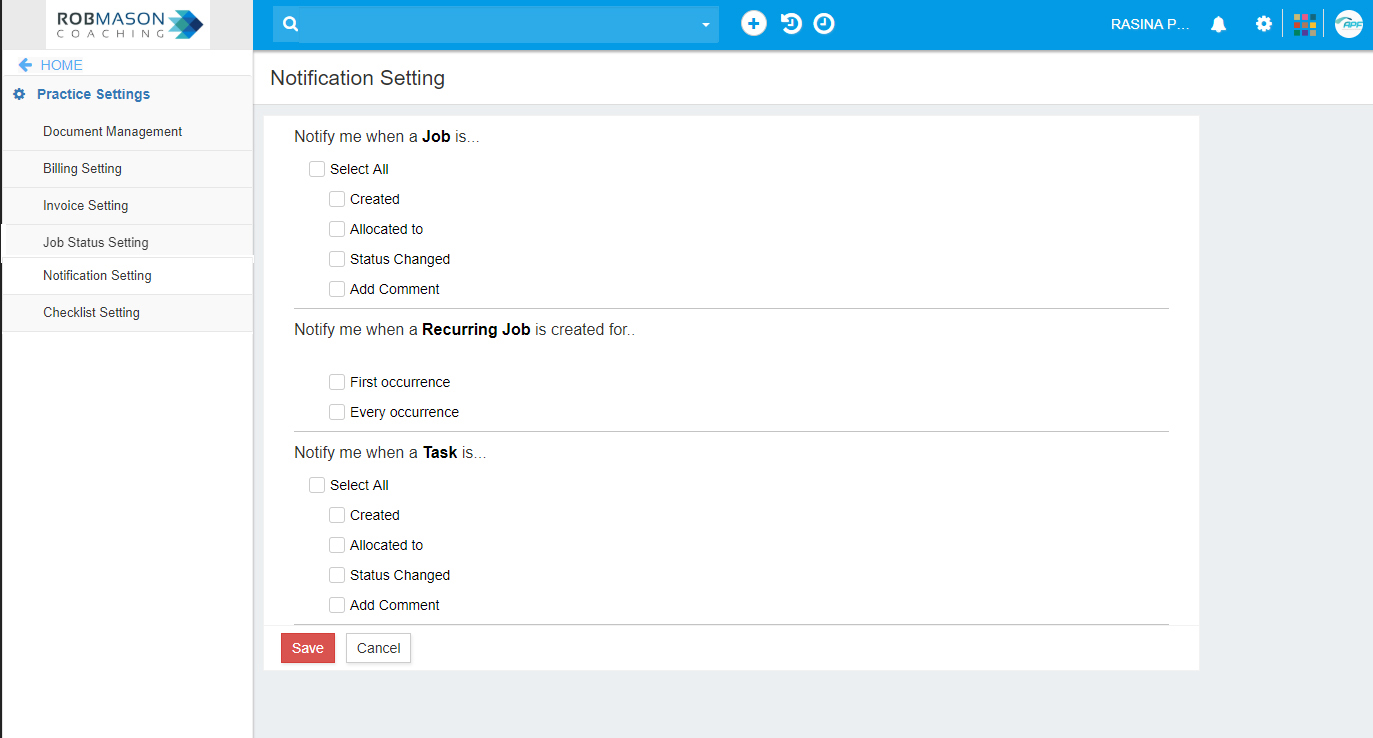

t. Notification Setting

Pick and choose what you want to be notified of from your GovReports Office Practice Management account.

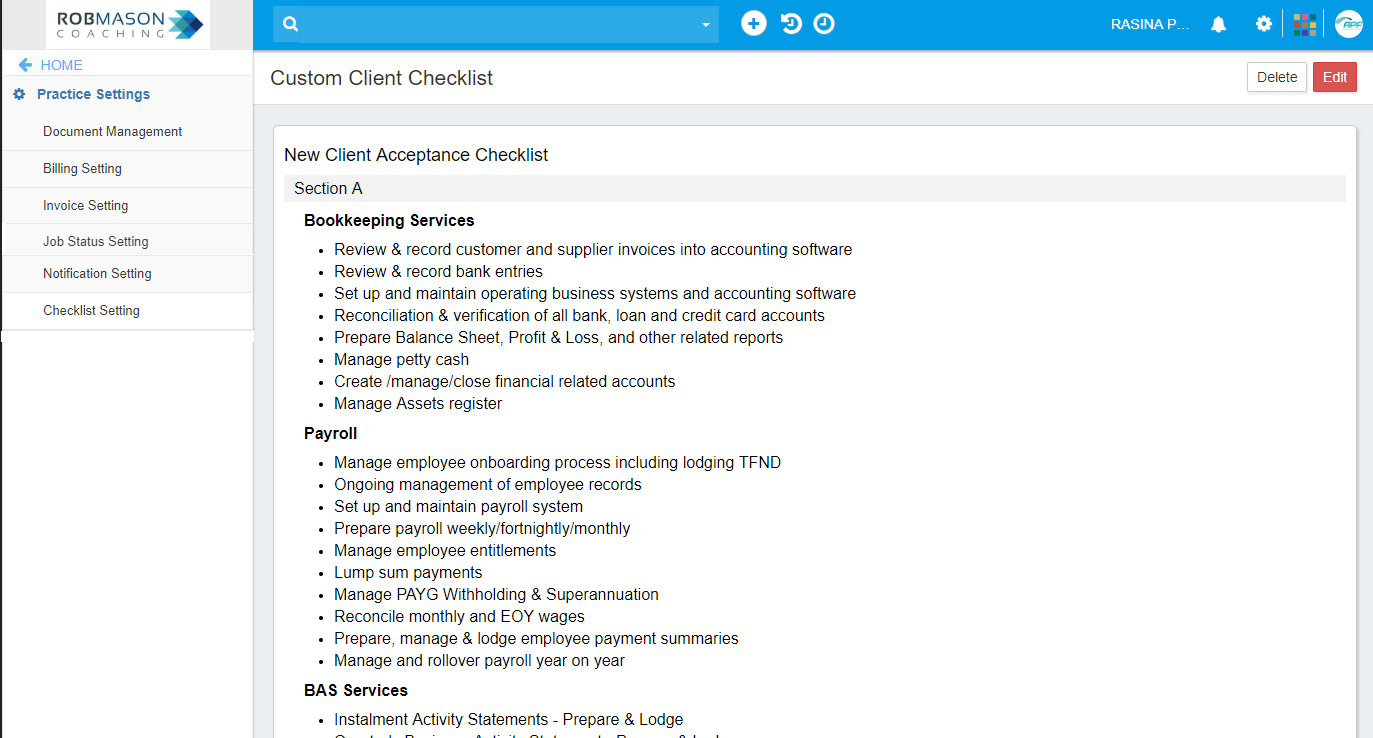

u. Checklist Setting

Custom client checklist with new client acceptance checklist.